Why are gift cards important?

There are dozens of gift cards for many businesses, and members of the Facebook group are big fans!

Gift cards are important in many situations:

- Unlocking welcome bonuses

- Collect many more reward points (like 5 points per dollar at Walmart)

- Using an American Express card almost anywhere

If you prefer the video version, here it is! Otherwise, keep on reading.

We love this strategy because it allows us to accumulate more points! First, check which category you earn the most points in with your credit card.

For example, the TD First Class Travel Visa Infinite Card gives you 6 TD / $1 Rewards points for grocery purchases and 2 TD / $1 Rewards points for other purchases. A $100 purchase at Simons will :

| Number of points accumulated | |

| Purchase with TD First Class Travel Visa Infinite Card directly at Simons ( 2-point Other Purchases category) | 200 points ($100 X 2) |

| $ 100 Simons gift card paid for at the grocery store (6-point grocery category) and paid for with the gift card at Simons | 600 points ($100 x 6) |

Once you’ve used this clever strategy several times throughout the year, you’ll earn points much more quickly. So travel paid for with points or big cash rebates arrive at full speed!

Unlock welcome bonuses with gift cards

The points hunter is generally someone who keeps a close eye on his budget and is able to forecast his spending over the coming months, mainly on his credit cards. It’s all part of their strategy.

In this case, gift cards are valuable allies for quickly unlocking credit card bonuses.

Here, for example, is a typical budget for one month:

| Type | Example gift cards | Amount |

| Gas | Esso, Petro-Canada, Shell… | $150 |

| Grocery | Metro, Super C, IGA, Provigo, Walmart… | $500 |

| Alcohol | SAQ, LCBO | card |

| Drugstores | Jean Coutu, Pharmaprix, Familiprix… | card |

| Monthly subscriptions | Netflix, Apple, Google Play… | $75 |

| Online shopping | Amazon | $200 |

| Shopping | Gap / Old Navy / Banana Republic, La Vie en Rose, Sail, Simons, Sports Experts, lululemon, Reitmans… | $150 |

| Home Improvement | Home Depot, Canadian Tire, Home Hardware… | card |

| Everyday life | Starbuck’s, Tim Hortons, McDonald’s, St Hubert, Keg, | $50 |

| Culture | Renaud-Bray, Archambault, Cineplex | $75 |

| TOTAL | $1,500 | |

Thus, by planning expenses over the next 2-3 months – and having the cash to “advance funds” via gift cards – it is possible to unlock credit card bonuses more easily.

It can also be handy a few weeks before the deadline to unlock the bonus if you see that the 3 months won’t be enough!

Earn more reward points with Christmas gift cards

In addition to earning welcome bonuses, it’s best to learn when to use the right credit card at the right place in order to earn more reward points or cash back!

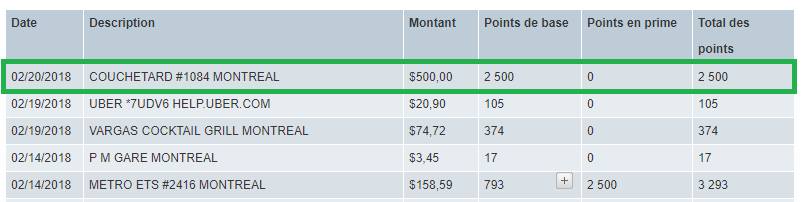

For example, instead of using your American Express Cobalt® Card directly at an SAQ branch(1 point per dollar), you could buy SAQ gift cards at your Metro / Super C grocery store or Couche-Tard/Circle K convenience store (5 points per dollar)!

Thus, your purchase at SAQ with a gift card will have earned you 5 points per dollar instead of 1!

This applies to a wide range of retailers; in fact, all those for which you can find a gift card in your grocery store, gas station, convenience store or pharmacy:

- Walmart

- Netflix

- Shell

- Home Depot

- Hudson’s Bay

- Canadian Tire

- and much more!

Below you’ll find out which credit card to use where to get more reward points!

Use an American Express card almost anywhere with gift cards

American Express cards are increasingly accepted, especially by small businesses.

Some stores continue not to accept them, such as large grocery chains (Maxi, some IGAs, etc.). At this point, something exists: Rakuten.

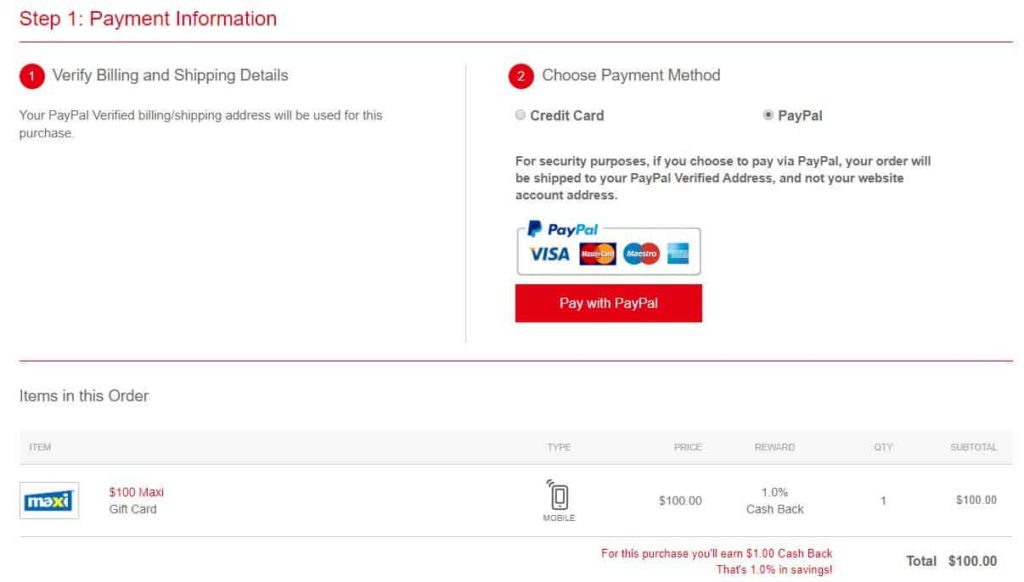

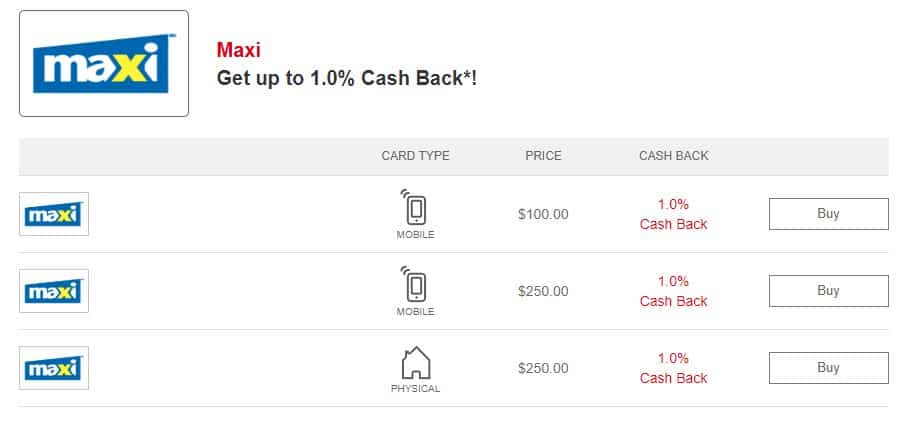

Rakuten allows you to get cash back for your online purchases. But the site also contains a section dedicated to gift cards(not accessible from the mobile application)!

If you are not a member of Rakuten.ca, sign up via our referral link to get a $5 credit after a $25 purchase!

You can then use your American Express card (via Paypal) to get yourself a Maxi gift card for example.

That way, you use your American Express card indirectly at Maxi 😉

List of stores and grocery stores offering gift cards in Canada and Quebec

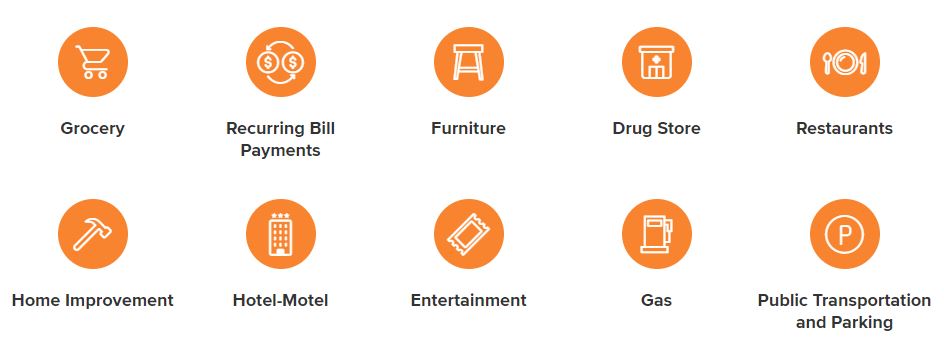

There are different categories of businesses in Canada offering gift cards that can be purchased with credit cards:

- Grocery stores (Metro, Super C, IGA, etc.)

- Gas stations (Esso, Shell, Petro-Canada, etc.)

- Drug stores (Pharmaprix, Jean Coutu, Uniprix, etc.)

- Convenience stores (Couche-Tard)

- Home improvement centers (Home Dépôt, Rona, Home Hardware)

- Office Supply Centres (Staples)

And for each of these categories, there are different credit cards to earn points! We will give you our best credit card choices for each category.

Gift cards available in grocery stores

To purchase grocery store card with a credit card , turn to one of these 5 credit card :

| Credit card | Earning rate |

| American Express Cobalt® Card | 5 points per dollar |

| Scotiabank Gold American Express® Card | 5 points per dollar (6 points per dollar at IGA/Sobeys) |

| National Bank World Elite Mastercard | 5 points per dollar |

| SimplyCash® Preferred Card from American Express | 4% |

| CIBC Dividend® Visa Infinite* Card | 4% |

| Scotia Momentum® VISA Infinite* Card | 4% |

| BMO eclipse Visa Infinite* Card | 5 points per dollar |

The first two American Express card can be used at most Metro, Super C, IGA and Safeway grocery stores.

They will offer 5 points per dollar, a return of approximately 5% on all grocery store gift card purchases.

You can read our detailed comparison on these two credit cards here.

If you shop elsewhere, you’ll want to consider the National Bank’s World Elite Mastercard®, which gives you 5 points per dollar spent on groceries when you purchase gift cards.

Or switch to the CIBC Dividend® Visa Infinite* Card or Scotia Momentum® VISA Infinite* card, which will give you 4% cash back on all gift card purchases at a grocery store.

Finally, you’ll earn 5 points per dollar with the BMO eclipse Visa Infinite* Card, corresponding to a return of approximately 3.5% on travel purchases made with your points.

Gift cards available at gas stations

To purchase gas station card with a credit card , turn to one of these 6 credit card :

| Credit card | Earning rate |

| CIBC Dividend® Visa Infinite* Card | 4% |

| SimplyCash® Preferred Card from American Express | 4% |

| Marriott Bonvoy® Business American Express®* Card | 3 points per dollar |

| Scotiabank Gold American Express® Card | 3 points per dollar |

| American Express Business Edge™ Card | 3 points per dollar |

| American Express Cobalt® Card | 2 points per dollar |

All gas stations accept American Express credit cards. Here, the choice of a card will vary depending on the type of rewards you prefer to have.

If you prefer to earn Marriott Bonvoy points by purchasing your gift cards at gas stations, we recommend you use either:

- American Express Business Edge™ Card (3 points per dollar, equivalent to 3.6 Marriott Bonvoy points)

- the Marriott Bonvoy® Business American Express®* Card (3 points per dollar)

If you prefer to earn travel points by purchasing your gift cards at gas stations, we recommend that you use either:

- Scotiabank Gold American Express® Card: 3 points per dollar

- American Express Cobalt® Card: 2 points per dollar

Finally, if you prefer to earn cash back by purchasing your gift cards at service stations, we recommend that you use either:

- CIBC Dividend® Visa Infinite* Card: 4% per dollar on gas station purchases

- SimplyCash® Preferred Card from American Express Card: 4% per dollar on gas station purchases

Gift cards available at drugstores

To purchase gift cards in drug stores with a credit card, you will turn to one of these 3 credit cards:

| Credit card | Earning rate |

| Tangerine Money-Back Credit Card | 2% |

| American Express® Gold Rewards Card | 2 points per dollar |

Most drugstores accept American Express credit cards.

If you prefer to collect Membership Rewards points when purchasing your gift cards at drugstores, we recommend using the American Express® Gold Rewards Card: 2 points per dollar of purchases.

If you prefer to earn cash back by purchasing your gift cards at pharmacies, we recommend using the Tangerine Money-Back Credit Card or Tangerine World Mastercard.

You can choose the “Drugstores” category among the categories offering 2% cash back.

Gift cards available in convenience stores

To buy gift cards in convenience stores such as Couche-Tard, Macs, Circle K, 7-eleven with a credit card, one will turn to one credit card:

| Credit card | Earning rate |

| American Express Cobalt® Card | 5 points per dollar |

The American Express Cobalt® Card is recognized as one of the best credit cards in Canada.

When you buy your gift cards in convenience stores with this credit card, you will get 5 points per dollar:

Walmart gift card can be purchased at Couche-Tard convenience stores! A sneaky way to get 5 points per dollar for Walmart with the American Express Cobalt® Card.

Including for medications at Walmart pharmacies!

Gift cards available at renovation centers

To purchase gift cards at home improvement centres with a credit card, two credit cards shou;d be used:

| Credit card | Earning rate |

| Tangerine Money-Back Credit Card | 2% |

| Tangerine World Mastercard | 2% |

You can earn cash back when you purchase your gift cards at home improvement centers using the Tangerine Money-Back Credit Card or Tangerine World Mastercard.

You can choose the “Renovations” category among the categories offering 2% cash back.

Gift cards available in office supply stores

To purchase gift cards at office supply stores with a credit card, two credit cards should be used:

| Credit card | Earning rate |

| American Express Business Edge™ Card | 3 points per dollar |

| BMO Rewards® World Elite®* Business Mastercard®* | 4 points per dollar |

You can earn travel points by purchasing your gift cards at office supply stores using:

- American Express Business Edge™ Card: 3 points per dollar (or the equivalent of 3.6 Marriott Bonvoy points)

- BMO Rewards® World Elite®* Business Mastercard®*: 4 points per dollar (or the equivalent of 2.68% in travel points)

Bottom Line

Now you know which credit card to use in the right place to buy gift cards. Now, don’t forget your gift cards when you go shopping!

Frequently asked questions about gift cards

What are gift cards?

Gift cards are prepaid instruments that allow the holder to purchase goods or services up to the monetary value printed or loaded on the card. They are often given as gifts for various occasions.

How do I know if there's money left on a gift card?

On the back of your gift card, go to the Internet address indicated. On this site, you’ll find a section that looks like “Check my gift card balance”. Enter your card information.

Sometimes, there is also the option of calling a customer service department, which will provide the balance. Or go directly to the store and find out the amount at the checkout.

How can gift cards help me earn points on my credit card?

When you purchase gift cards using your credit card, it generally counts as a regular transaction. So, if your credit card offers points or rewards for every purchase, you’ll earn these benefits by purchasing gift cards.

Where should I buy gift cards to maximize my credit card points?

To maximize your points, it’s a good idea to buy gift cards at stores where your credit card offers bonus points or higher reward rates. Such as a grocery store, gas station, convenience store or drugstore.

Where can you buy gift cards like Amazon, St-Hubert, Sports Expert, Apple, Home Depot, Canadian Tire, etc.?

You can buy gift cards at many stores, including grocery stores, gas stations, convenience stores, Dollarama stores and drugstores.

What gift cards are available?

There are hundreds of gift cards for a wide range of retailers, including Amazon, Walmart, Ikea, Shell, Esso and SAQ.

How can I get gift cards?

To obtain gift cards, you can go to any major supermarkets or chains selling them. These cards are often available at checkouts or in special displays. In addition, many websites also offer the option of buying gift cards online, which you will receive either in physical form by post or electronically by e-mail.

Where can I buy a gift card online?

There are several online gift card sites. This is the case of Rakuten, for example.

Where can I buy a Walmart gift card?

It is possible to purchase a Walmart gift card at a Couche-Tard/Circle K convenience store. In this case, it’s best to use the American Express Cobalt® Card to earn 5 points per dollar.

Where can I buy an IKEA gift card?

IKEA gift cards can be purchased at Couche-Tard/Circle K convenience stores and IGA. In this case, it’s best to use the American Express Cobalt® Card to earn 5 points per dollar.

How do I check the balance of a gift card?

The most common way to check a gift card balance is to visit the card issuer’s website. Most of these sites have a dedicated section where you can enter the card number and, if necessary, an associated PIN code. By providing this information, the site will usually show you the remaining balance on the card. If you can’t access the website or prefer a different method, you can also often check the balance by calling a customer service number indicated on the card or by asking directly in-store.

Are there any risks associated with buying gift cards with a credit card?

As with any transaction, it’s essential to ensure that you buy gift cards from reputable suppliers. There’s also a risk of over-consumption, as it can be tempting to buy lots of gift cards to earn points, but this could result in a high balance on your credit card.

Do gift cards expire?

In Canada, most gift cards have no expiry date. However, it’s always a good idea to check the specific terms of the gift card when making a purchase.

How to write gift card in the plural?

Gift Card is written Gift cards in the plural.