While you may be able to book an All-Inclusive vacation for less than $1,000 with last-minute deals with Air Canada Vacations or with less luxurious resorts, it is possible to use credit card points to bring the cost of your dream vacation down to an affordable price!

All-Inclusive Holiday for less than $1,000 - Credit Card Sign-up bonuses

The best types of points to bring the cost of an All-Inclusive Holiday down are ones you can use to earn a statement credit on any travel purchase. The most popular programs are:

- CIBC Aventura

- TD Reward Points

- National Bank Rewards Points

- American Express Membership Rewards

- Cashback

Therefore, you can book wherever you want, either by yourself online or with a travel agent and request the statement credit afterwards. You’re free to shop and find whichever resort suits you and use points to ultimately go on an All-Inclusive Holiday for less than $1,000.

The programs mentioned above are known to offer generous welcome bonuses, which means you can obtain a boatload of points as a new customer.

The CIBC Aventura® Gold Visa* Card and CIBC Aventura® Visa Infinite* Card are great options!

You can redeem 50% fewer Aventura Points with CIBC Aventura when you employ your credit card to pay for any type of travel, including all-inclusive travel, through March 31, 2024.

If you have applied for our links, you can receive a 40,000-point welcome bonus on the CIBC Aventura® Gold Visa* Card and CIBC Aventura® Visa Infinite* Card. Then, you can use that $500 worth of points to get an All-Inclusive Holiday for less than $1,000.

Additionally, you can get $1,000 off if you sign up for both credit cards during the offer period and combine your points.

Not bad for credit cards, with four complimentary visits to airport lounges and no annual fees for the first year! Indeed, you will be able to enjoy the various lounges available in Sun destinations.

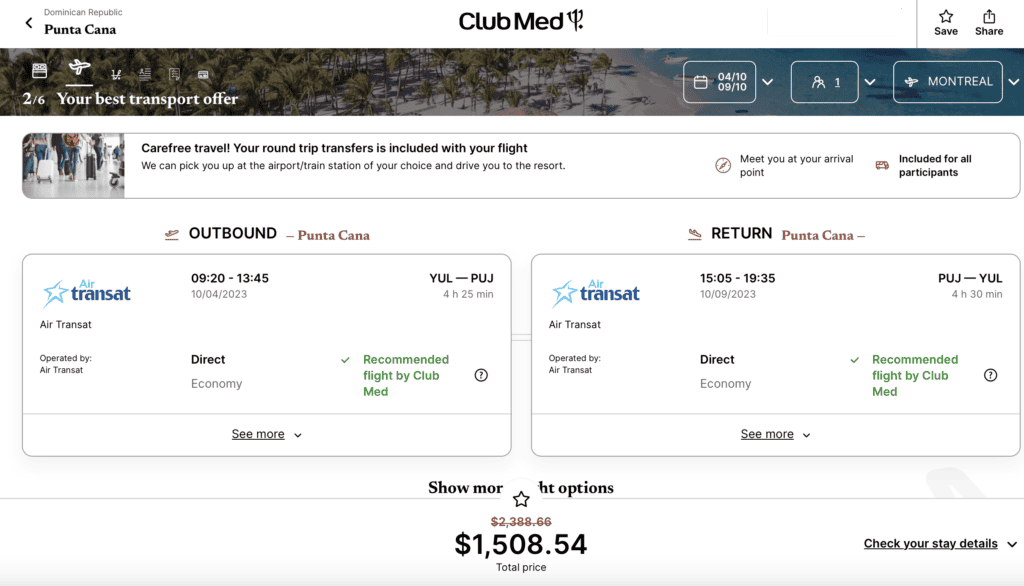

For example, I found this great Club Med deal in Punta Cana, and with your points, you can bring the cost down to your target budget (or near it)!

All-Inclusive Holiday for less than $1,000 - Maximizing rewards on your day-to-day spending

While it’s not everyone who’s keen to constantly signing up for new credit cards each year to go on All-Inclusive Holiday for less than $1,000, you can achieve this goal organically as well by maximizing the rewards you can reap on your day-to-day spending.

The types of points you should aim for are the same as the ones mentioned in the previous section. While some cards give considerable bonuses, others give you a generous accumulation rate on your main expense categories, such as groceries, restaurants, gas, etc.

You can earn 5 Membership Rewards with the American Express Cobalt® Card on anything coded as groceries or restaurant. To get the most return, you should also buy gift cards in grocery stores to pay for gas and other shopping, such as Amazon, SAQ, Netflix, etc., to earn 5 points per dollar on those non-grocery expenses.

Indeed, if you typically spend $800 per month on food (groceries and restaurants) and $200 in gas station gift cards to refuel your car, it translates to 5,000 Membership Rewards per month or 60,000 each year. There you go with your annual discount to go on All-Inclusive Holiday for less than $1,000 as you can use those points for a $600 statement credit!

I am suggesting the American Express Cobalt® Card mainly because it requires no minimum income, so it’s accessible to everybody.

However, you can employ the same strategy on your travel purchases with the World Elite Mastercard from National Bank, which also gives 5X the points (valued similarly to Membership Rewards when used as cashback) and is a Mastercard, so it’s accepted everywhere. But, as a World Elite product, you need a personal income of $80,000 to be eligible.

How about fees hindering your points return as compared to no-fee cashback credit cards?

Well, there are plenty of American Express Promotional offers that bring the cost down, and the World Elite Mastercard from National Bank comes with a recurring $150 travel credit to offset the fees. In addition, the World Elite Mastercard from National Bank has excellent travel insurance and will give you unlimited access to the National Bank Lounge at the Montreal airport.

Conclusion

A sustainable way to get an All-Inclusive Holiday for less than $1,000 every year is to either aim to unlock signup bonuses, maximize the return on your daily spending or a mixture of both!

There is a surge in the price of travel, but it can still be made affordable without cutting on the quality of your vacation with a less desirable resort or trying to score last-minute bargains to no avail.