Avoiding debt

Check if grants are available to increase your home’s energy efficiency and keep track of your renovation budget.

In fact, by joining a contractor’s program, you can also save money on renovations. You don’t even need to have a company!

Purchasing materials

Using a credit card to purchase materials and tools is an option.

The right credit card will be used to optimize spending. This is only valid if your credit card balance is at zero each month. The best ones offer air, hotel, travel or cash back rewards.

In addition, they offer excellent insurance benefits, such as extended warranty and purchase protection.

And don’t forget to check out the Best Price Guarantee on Home Depot, Home Hardware, Rona and Réno Dépôt for building materials, new countertops or a complete basement renovation. There are savings of up to 10% at some businesses.

It’s as if your renovations could finance your next vacation!

Choosing the right credit cards

Here are our suggestions for the best credit cards for home renovation projects. First, there are a few questions to ask:

- Does the business accept American Express, Visa and/or Mastercard?

- Are you looking for points to save on hotels? On airline tickets? Cash back? Or for Disney?

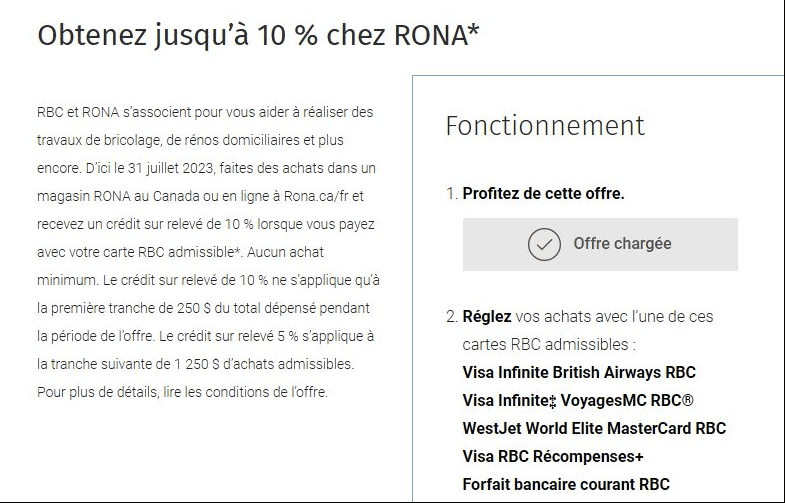

If you have an RBC credit card, check your RBC offers. A few times a year, there are credits of up to 10% on purchases at RONA.

For contractors who do not accept credit cards directly, there is a way to go through Paypal, PaySimply or Plastiq. However, you may incur additional costs with these options.

A credit card with cash back

It’s the best way to avoid the headache with home improvements ! And in our experience, it even works for purchases from garden centers.

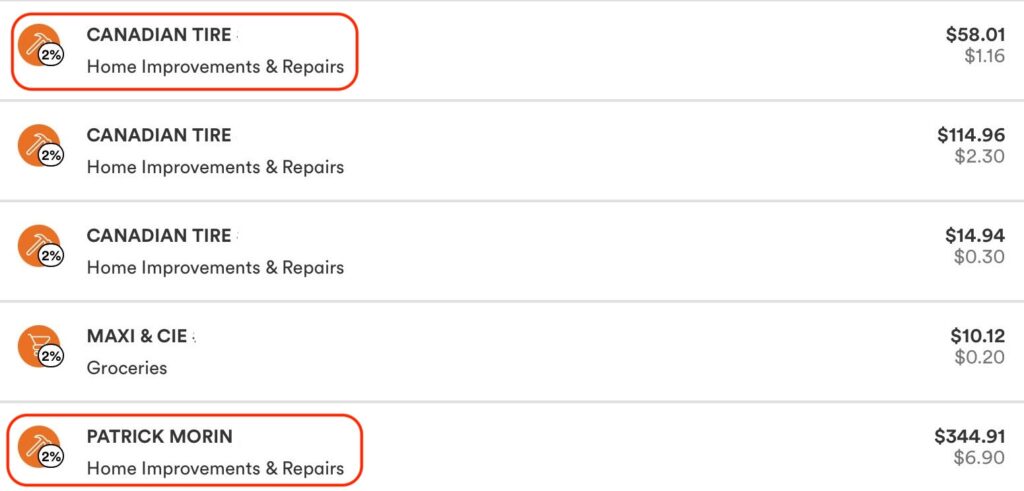

Choose the “Home Improvements” category to get 2% cash back quickly and easily on all purchases at hardware and home improvement stores, such as Canadian Tire and Patrick Morin in this example:

This also applies to :

- RONA

- Reno Depot

- Home Depot

- Home Hardware

- Lowe’s

- For painting: Dulux, Benjamin Moore, Sherwin-Williams

- Blinds to Go

The Tangerine Money-Back Credit Card has no annual fee and offers cash back.

With this limited-time welcome offer, you can earn an additional 10% cash back (up to $100) when you spend up to $1,000 on everyday purchases during the first 2 months.

You can choose two to three categories that interest you (groceries, gas, furniture, home improvement, recurring bills, pharmacy, etc.) to earn 2% cash back! And there is no annual cash back limit. It is one of the best credit cards for renovations.

In addition, the Tangerine Mastercard offers several insurance coverages for your purchases :

- 90 days purchase insurance

- One year extended warranty

Finally, during your first 30 days, transfer balances and pay only 1.95% interest on the transferred balance for the first 6 months.

A credit card with points for travel

The National Bank World Elite Mastercard® is NBC’s best Mastercard credit card.

Right now, with our exclusive welcome offer:

- Get up to 35,000 reward points

- Save on annual fees for the first year

- Get a chance to win $2,000 in travel credits courtesy of Transat

It’s the best time of year to apply for the National Bank World Elite Mastercard®!

With this card, you earn up to 5 points per dollar on your purchases:

- 5 points per dollar on grocery and restaurant purchases

- 2 points per dollar on gas and electric recharge purchases

- 2 points per dollar on recurring bills

- 2 points per dollar on À la carte Travel

- 1 point per dollar on all other purchases

And since it’s a National Bank Mastercard credit card, you can use it at Costco.

With this card, you have access to a $150 annual travel credit that you can use in any of these categories:

- Airport parking

- Baggage fees

- Seat selection

- Access to airport lounges

- Flight upgrades

In addition, you can enjoy access to DragonPass airport lounges and free Wi-Fi with Boingo. And unlimited access to the National Bank Lounge at Montreal-Trudeau.

Finally, Milesopedia voted the National Bank World Elite Mastercard® the Best Travel Credit Card and the Best Credit Card for Insurance in 2023 and 2024.

A credit card with points for free hotel nights

The Marriott Bonvoy® American Express®* Card is the best credit card for free hotel nights.

With this exceptional limited-time welcome offer, you can earn up to 80,000 Marriott Bonvoy points:

- 65,000 Welcome Bonus points after you spend $3,000 on your Card in your first 3 months of Cardmembership

- Plus, earn an additional 3 points for a total of 5 points on every $1 spent on eligible travel and gas purchases in your first 6 months (up to 15,000 points)

It’s the best time of year to get the Marriott Bonvoy® American Express®* Card. Don’t wait, this offer ends on May 6, 2024!

It’s a Card we recommend keeping because each year at renewal, you get an Annual Free Night Award (for up to 35,000 points at hotels worldwide) and 15 Elite Night Credits per year, counting towards your Marriott Bonvoy Elite status.

With this Card, you earn 5 points per dollar on all purchases at Marriott Bonvoy properties and 2 points per dollar on all other purchases.

Finally, this Card comes with comprehensive insurance: baggage delay, lost or stolen baggage, $500,000 travel accident, flight delay, hotel or motel burglary, rental car theft and damage, Purchase Security, Purchase Protection.

Like all American Express Canada Cards, there is no minimum income requirement.

Airline points credit card for airline tickets

With the TD® Aeroplan® Visa Infinite* Card, you can earn up to 50,000 Aeroplan points:

- A welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†

- 20,000 Aeroplan points when you spend $6,000 within 180 days of Account opening†

- Plus, earn a one-time anniversary bonus of 20,000 Aeroplan points when you spend $10,000 within 12 months of Account opening†

- $100 NEXUS fee rebate†

- Up to eight passengers travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lb) when your travel originates on an Air Canada flight†

It’s the best TD credit card for occasional Air Canada travellers.

With the TD® Aeroplan® Visa Infinite* Card, you earn 1.5 points† per dollar of eligible purchases for:

- Grocery stores

- Gas stations

- Air Canada purchases, including Air Canada Vacations

Home improvement store gift cards

You can earn more points or cash back by purchasing home improvement store gift cards at multiplier stores!

For example, you could use the American Express Cobalt CardMC to earn 5 points per dollar on grocery and convenience store gift cards. Points accumulate much faster this way, because otherwise you’ll only earn 1 point per dollar if you buy directly from the hardware store.

The following gift cards are available in grocery stores:

- Home Depot, Canadian Tire and IKEA (Super C, IGA, Maxi, Adonis, etc.);

- Home Hardware (Maxi only) ;

- Amazon (everywhere!)

However, there are no Canac, RONA, BMR, Patrick Morin or Réno-Dépôt gift cards in grocery stores.

By buying them there at the same time as your grocery basket, it’s as if you were also earning 5 points per dollar for your home improvement purchases .

For example, if you buy $500 worth of Home Depot gift cards at IGA with this Cobalt Card from American Express :

- 5 points/dollar x $500 gift cards = 2,500 Membership Rewards points

This 2,500 Membership Rewards points can be :

- Transferred into 2,500 Aeroplan points for a future dream trip or under the sun ;

- Transferred into 3,000 Marriott Bonvoy points for future free nights at their hotels;

- Rebate on $25 credit card balance for travel, everyday purchases or home renovations.

Or, you could use the American ExpressMD Gold Rewards Card to earn 2 points per dollar when buying gift cards at drugstores, grocery stores or gas stations.

For more information on this tip, check out this article.

Think of the welcome bonuses!

Renovations are a major expense in the life of a household. It is also a time when these expenses happen over a few months (between 1 and 6 months generally).

You need to leverage this great expense by unlocking welcome bonuses. Especially for cards that you would not have targeted first due to the high level of spending required!

For example, if you have $5,000 to $10,000 to spend at a home improvement or hardware store, you could rack up points as fast as a pneumatic nail gun:

- 100,000 TD Rewards points after $5,000 in purchases ;

- 60,000 Aeroplan points after $7,500 in purchases ;

- $ 280 cash back after $10,000 in purchases.

One example is all those business credit cards that require you to spend several thousand dollars in 3 months. And even individuals can apply for them.

Here are the payment cards accepted at various home improvement, garden center and hardware stores:

- Visa, Mastercard and American Express: Home Depot, RONA, Réno-Dépôt, Canadian Tire, Patrick Morin, Potvin Bouchard, BMR (online and some stores), Home Hardware, Pépinière Locas, Jardins Zeillinger.

- Visa and Mastercard: Canac, Jardin Dion.

With the TD First Class Travel® Visa Infinite* Card, you can earn up to 100,000 TD Points† and a first year annual fee rebate:

- Welcome Bonus of 20,000 TD Points when you make your first Purchase with your Card†

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- A Birthday Bonus of up to 10,000 TD Rewards Points†

Get an Annual Fee Rebate for the first year†.

With the TD First Class Travel® Visa Infinite* Card, you get:

- 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD

- 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants

- 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account

- 2 TD Rewards Points† For every $1 you spend on other Purchases

This TD credit card is one of the best TD travel rewards cards.

Bottom Line

There are several ways to take advantage of this important expense! Again, we remind you to pay your credit card in full each month. Otherwise, the interest paid will wipe out any points earned.

How can I save money on renovations?

First of all, avoid the “While we’re at it… “to avoid extra costs!

- Do some small manual jobs according to your ability (painting, demolition, etc.);

- Use your credit card rewards points to amortize costs (see article above);

- Find out about government subsidies such as Rénoclimat ;

- Get 2 to 3 contractor quotes;

- Store around for material prices at local hardware stores;

- Allow yourself to wait and watch the sales period (late spring, late summer…);

- Set a budget, stick to it and add 10% for unpleasant surprises.