Welcome offer

Earn up to 60,000 Membership Rewards points with this welcome offer for the American Express® Gold Rewards Card. That’s a $600 value for travel or any purchase on the Card.

You can also transfer your points to airline partners such as Aeroplan, Avios (British Airways / Qatar Airways), Flying Blue, and hotel partners (Marriott Bonvoy, Hilton Honors).

With this Card, you get many benefits like:

- $100 annual travel credit

- Priority Pass membership and 4 complimentary Plaza Premium visits per year

- $50 NEXUS credit

You earn 2 points per dollar for travel purchases, and at:

- gas stations

- grocery stores

- drugstores

And 1 point per dollar everywhere else.

Like all American Express Canada Cards, there is no minimum income requirement.

Benefits

A new Metal Card with a Rose Gold option

In 2021, American Express Canada has decided to launch this new metal card (like the Platinum CardMD from American Express and the AeroplanMD* Reserve Card from American ExpressMD).

When you sign up for this card, you can choose one of two versions:

- Yellow Gold

- Rose Gold

And remember, this is a new product: if you had the old Gold Card before (and didn’t renew it before Amex changed its features), you could get the latest version of this Card (and the welcome bonus that comes with it)!

$100 annual travel credit

With the American ExpressMD Gold Rewards Card, you get an annual travel credit of $100.

You can use this travel credit directly on the American Express Travel portal to book flights, rental cars or hotels.

Priority Pass membership and 4 complimentary Plaza Premium visits per year

With this Card, you get access to airport lounges around the world.

First, it offers a Priority Pass membership (a value of about US$99 per year). You can then pay $32 US for each visit to one of the 1,200 Priority Pass lounges worldwide.

Secondly, this Card comes with 4 complimentary visits per year to Plaza Premium lounges.

This is good news as most credit cards that offered Priority Pass, or LoungeKey have lost access to the many Plaza Premium lounges in Canada.

For example, you will be able to access the excellent Air France Business Lounge at Montreal-Trudeau.

$50 NEXUS Statement Credit

With the American ExpressMD Gold Rewards Card, you get a NEXUS credit of CA$50 every 4 years.

This is convenient if you regularly travel across borders.

Earning points

With the American ExpressMD Gold Rewards Card, you get:

- 2 points per dollar on travel purchases

- 2 points per dollar on gas purchases

- 2 points per dollar on grocery purchases

- 2 points per dollar on drugstore purchases

- 1 point per dollar on everything else

For groceries, we’ll always recommend using your American Express Cobalt® Card, which offers 5 points per dollar!

Using points

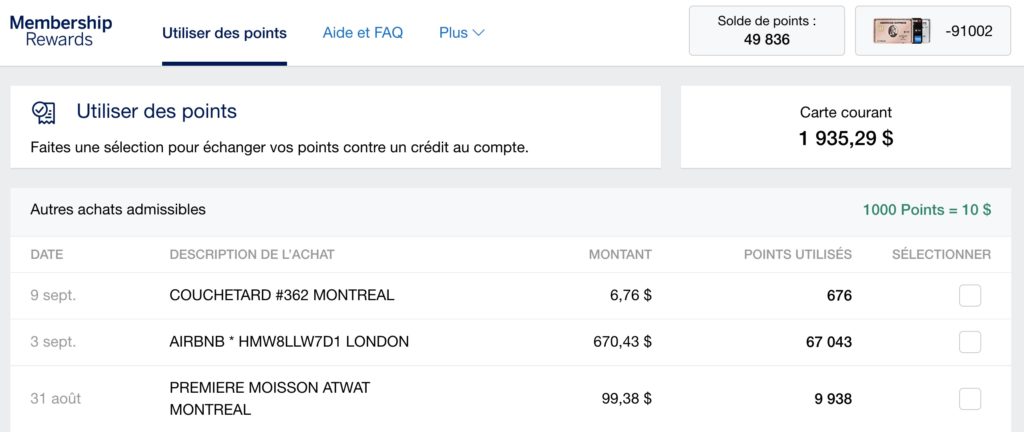

Use Membership Rewards points for any purchase

This is the easiest way to use your points: you apply them to any purchase made on the card (travel or everyday purchases).

- You buy something with your American ExpressMD Gold Rewards Card.

- You redeem your points on this purchase: 1,000 points = $10

60,000 Membership Rewards points are worth $600 here.

You can see it on the screenshot below: whether it is Airbnb (Travel), Couche-Tard or Première Moisson, the exchange rate is the same.

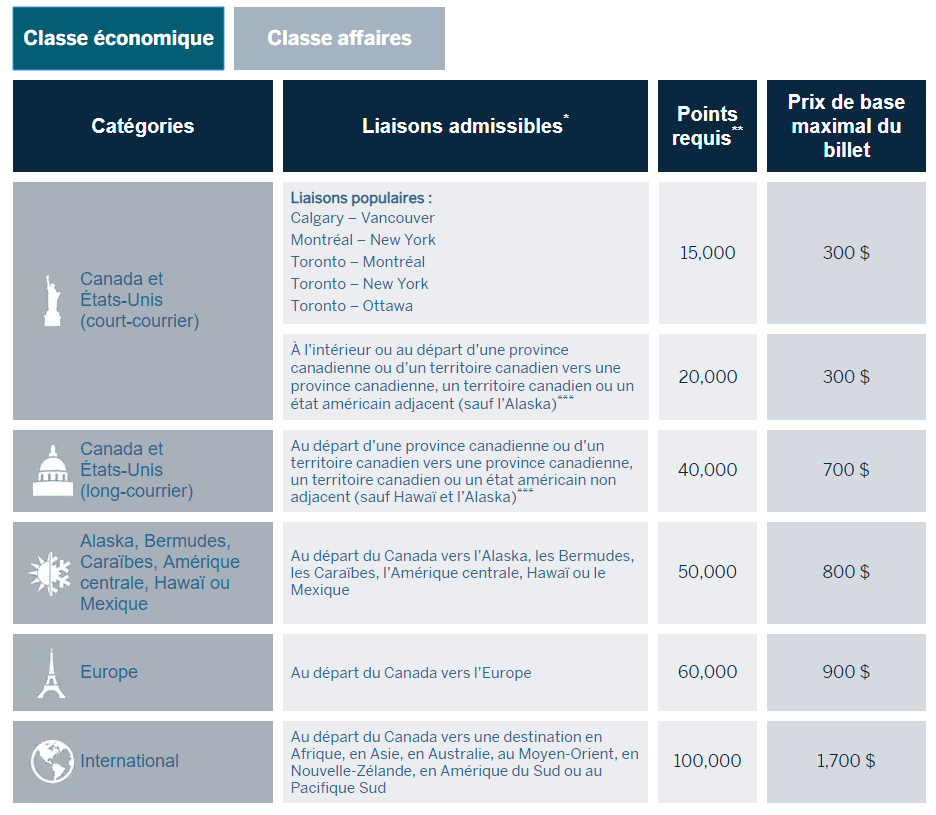

Redeeming Membership Rewards points via American Express Fixed Travel Point Chart

Here, it’s simply THE best use of American ExpressMD Gold Rewards Card Membership Rewards points:

- You browse American Express travel portal

- You book some flights at fixed-points pricing: 15,000 points = $300!

60,000 Membership Rewards points are worth $1,200 here.

But this only applies to specific flights:

Membership Rewards Transfer Partners

Here are all the transfer partners for American Express Membership Rewards program:

| Partners | Conversion rate |

|

60,000 Membership Rewards points = 60,000 Aeroplan points |

|

60,000 Membership Rewards points = 45,000 miles |

|

60,000 Membership Rewards points = 45,000 miles |

| 60,000 Membership Rewards points = 60,000 Avios points |

|

| 60,000 Membership Rewards points = 45,000 miles |

|

| 60,000 Membership Rewards points = 45,000 miles |

|

|

60,000 Membership Rewards points = 60,000 Hilton Honors points |

|

60,000 Membership Rewards points = 72,000 Marriott Bonvoy points |

Insurance

With the American ExpressMD Gold Rewards Card, you benefit from a number of attractive insurances.

Out of Province/Country Emergency Medical Insurance

Can provide coverage of up to a maximum of $5,000,000 for eligible emergency medical expenses incurred by an insured person under age 65 while travelling outside your Canadian province or territory of residence for the first 15 consecutive days of a covered trip.

Trip Cancellation Insurance

You can be reimbursed for the non-refundable and non-transferable portion of your travel arrangements when charged to your Card before your departure date should you cancel your trip for a covered reason.

Trip Interruption Insurance

When you charge your travel arrangements to your Card, this insurance can cover the non-refundable and non-transferable unused portion of your travel arrangements purchased before your departure date should your trip be interrupted or delayed for a covered reason.

You can be covered for up to $1,500 per insured person, per trip, up to a maximum of $6,000 for all insured persons combined.

Car Rental Theft and Damage Insurance

Save when you travel with the flight and damage Insurance for rental cars included with your Card This insurance provides compensation for theft, loss and damage up to the market value of the rental car with a maximum MSRP of $85,000 depending on the year of the model.

To take advantage of this benefit, you simply need to refuse loss or damage protection or any other similar option offered by the rental company and bring the entire rental to your Card. There’s no additional charge for this coverage, and you save yourself the daily insurance fee (usually $16 to $23 per day) charged by the car rental company.

Baggage delay insurance

Having booked your flight with your Card you can receive up to $500 (maximum in combination with Flight Delay Insurance) for any necessary and reasonable routine purchases of clothing and minor items deemed essential that you make in a four-day periodfor essential clothing and sundry items when your baggage on your outbound trip is delayed by six hours after arrival at destination of your departure flight.

Lost or Stolen Baggage Insurance

If you carry the full amount of your airfare to your Card you are insured in case of loss or damage of your personal belongings, carry-on baggage or checked baggage while travelling up to $500 per trip for all insured people.

Flight Delay Insurance

Charge your airline tickets to your Card and get up to $500 (maximum in combination with Misdirected Baggage Insurance) for all necessary and reasonable expenses incurred within 48 hours at a hotel, motel or restaurant, or for small items, if your flight is delayed or you are denied boarding for four hours or more without providing alternative transportation.

$500,000 Travel Accident Insurance

Travel accident insurance gives you automatic coverage of up to $500,000 for accidental death and dismemberment for you, your spouse and your dependent children under age 23 when you travel on a common carrier (plane, train, boat or bus) and you charge the full price of all tickets to your Card. Supplementary card holders, their spouses and dependent children under the age of 23 are also covered.

Hotel or motel burglary insurance

Simply pay for your hotel or motel room with your card and you will receive coverage of up to $500 in case of loss of most personal belongings in the event of a burglary at your hotel or motel room.

Purchase Protection® Plan

Eligible items purchased on your card may be insured for a period of 90 days from the date of purchase against accidental property damage and theft up to a maximum of $1,000 per claim (all items purchased combined).

Buyer’s Assurance® Protection Plan

Your coverage can automatically extend the manufacturer’s initial warranty up to an additional year when you carry all eligible items to your Card.

If you need to consult the insurance booklet, it can be found at this link.

Bottom Line

The American ExpressMD Gold Rewards Card is a highly attractive Membership Rewards Card.

Take advantage of the current limited-time welcome offer to apply for it right now!

This article was not sponsored. The views and opinions expressed in this article are purely my own.

American Express is not responsible for maintaining or controlling the accuracy of the information published on this website. For full and up-to-date product information, click on the Subscription link. Terms and conditions apply.