Unlock welcome bonuses with these milesopedia reader tips

Frequently, various questions came up in our facebook group:

Can you help me identify expenses to unlock subscription bonuses?

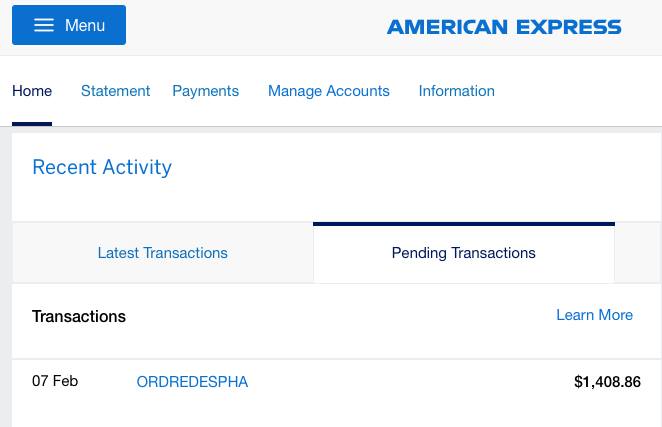

How can you charge $1,500 to an American Express card in 3 months?

Is it possible to pay Hydro Québec with a credit card?

How do I pay my municipal taxes with a credit card?

How can I pay my taxes with a credit card?

How can I pay my rent with a credit card?

Members gave tips and tricks on reaching the welcome bonus trigger levels, which can be as high as $7,000 in 3 months! Here are most of them here, but first, a common-sense reminder:

Buy gift cards for future spending

There are dozens of gift cards for all kinds of businesses, and members of the facebook group are big fans! The trick is knowing how to use them wisely.

A good points and miles hunter is generally someone who keeps a close eye on his budget and is able to forecast his spending over the coming months. In this case, gift cards are a great way to unlock welcome bonuses quickly. What’s more, you can earn lots of points when you buy them!

Here, for example, is a typical budget for the coming month:

| TYPE | EXAMPLES OF GIFT CARDS | AMOUNT |

| Gas | Esso, Petro-Canada, Shell… | $150 |

| Grocery | Metro, Super C, IGA, Provigo… | $500 |

| Alcohol | SAQ/LCBO | $100 |

| Drugstores | Jean Coutu, Pharmaprix, Familiprix… | $100 |

| Monthly subscriptions | Netflix, Apple, Android… | $75 |

| Online shopping | Amazon | $200 |

| Shopping | Gap / Old Navy / Banana Republic, La Vie en Rose, American Eagle, Sail, Simons, Sports Experts… | $150 |

| Home Improvement | Home Depot, Canadian Tire, Home Hardware… | $100 |

| Everyday life | Starbuck’s, Tim Hortons, McDonald’s, St Hubert, Keg, | $50 |

| Culture | Renaud-Bray, Archambault, Cineplex | $75 |

| TOTAL | $1,500 | |

Pay for car and/or home insurance with a credit card in one go

Most insurance companies allow you to pay for car and/or home insurance at once, using a credit card (Mastercard / Visa for the most part).

Of course, you’ll need to have the money available immediately to cover this expense, but if you do, it’s a subscription bonus that’s easy to come by!

And the big advantage: it’s an easily predictable expense, depending on the expiry date of your contracts! You can then sign up for a credit card in advance.

Advance medical expenses (dentists, pharmacies, laboratories, etc.) and get reimbursed by the insurance company!

Do you have group or individual insurance? Does it allow you to pay only the deductible to the medical provider? Charge the entire expense to your credit card.

This way, it’s not the provider (like your dentist) who receives your insurance payment… it’s you! And that will have allowed you to charge the expense to your credit card!

Pre-pay for some services!

If you have money in your account, prepay your monthly expenses for certain services:

- Instead of paying $100 a month for your Fido cell phone plan, pay 3 months in advance with $300 on your account,

- buy a Netflix gift card to pay for the full year’s subscription,

- etc.

The same principle applies to other subscriptions such as Netflix, Youtube Premium, Apple Music… by buying gift cards!

This tip is especially useful when you see that you’re running out of time (usually 3 months) and you’re “only” a few hundred dollars short of your bonus!

Unlock bonuses with your rent payments

An innovative way to unlock a welcome bonus is to use the Chexy service to pay your rent.

Chexy is a Canadian company that allows tenants to pay their rent with a credit card. By using this service, not only can you automate your rent payments, but you can also earn reward points or cash back on your credit card.

Chexy charges the rent to your credit card each month and then transfers the money to the landlord via Interac transfer. The service benefits those seeking to maximize reward points or boost their credit score.

One of the biggest challenges in unlocking a welcome bonus is reaching the required spending threshold. For example, some high-end credit cards may require you to spend up to $7,000 in three months to unlock the bonus, or even several hundred dollars a month for 12 months (as with the National Bank World Elite Mastercard or the American Express Cobalt® Card).

Using Chexy to pay your rent, you can quickly increase your monthly expenses without adding extra costs to your budget. What’s more, Chexy’s service fees are generally offset by the value of the points or cash back you earn.

Finally, Chexy has recently been recognized as a recurring payment service by most credit card issuers. For example, with the Scotia Momentum® Visa Infinite* Card, you get 4% cash back when you pay your rent via Chexy!

Unlock bonuses with your car

Car accident/vehicle damage: pay instead of your insurance!

We wouldn’t wish it on anyone, but unfortunately… it happens! Does your car need to be serviced after an accident? Is your windshield broken?

Instead of letting the insurance company pay the body shop or garage, pay the repairs in advance on your credit card!

Plan the maintenance of your car!

Owning a car is expensive: but usually, maintenance can be scheduled a few weeks in advance.

If you do it right, it’s a way to help you unlock a new sign-up bonus!

Unlock bonuses with friends and family

Pay their bills with your credit card!

Does your mother, your brother, your best friend pay his bills with his bank account or by check? Tell them to stop!

Invite him to read this article…. or offer to take care if their bill and have them reimburse you with an Interac payment! You can always thank her with an SAQ or grocery gift card (purchased with your American Express Cobalt® Card)!

The next time you invite your parents over for dinner, identify the expenses they regularly incur!

Make group reservations and payments!

Are you planning a group trip involving the purchase of numerous plane tickets and hotel nights?

Having a birthday party at a restaurant with a group of friends? Are you giving a joint gift to a colleague or friend?

Offer to pay in advance on your credit card and be reimbursed by Interac!

Become director of your union council!

For small condominiums, managed by the various co-owners, one or two people will often take care of certain expenses, such as the purchase of a barbecue or parasols for the communal terrace…

Charge this expense to your credit card! For example, a friend of mine managed to charge the complete renovation of his building’s communal terrace to various American Express cards, and easily collected several hundred thousand points! (Tip from a friend).

Annual subscriptions... a windfall for bonuses!

Are you a member of the Ordre des Pharmaciens? Each year, you must pay a membership fee of approximately $1,500. And since this Order takes Paypal, it’s easy to get the bonus from a card like the Marriott Bonvoy® American Express®* Card.

Many professional organizations accept payment by credit card: instead of sending a check, pay by credit card!

The same applies to all memberships: theatre, soccer club, gym, etc.

And if your credit card isn’t accepted, you can fall back on a service like Plastiq to send a check for you.

Put your business expenses on your credit card!

Do you work for a small business? Often, it’s possible to set up an expense account and charge your various purchases to your credit card: flights, hotels, multiple subscriptions, and so on.

In some companies that advertise on Facebook or Google, it is also possible to request that expenses be charged via your credit card.

Some interesting cards for bonuses!

Here is a list of some cards that are perfect for picking up different bonuses:

Bottom Line

There are many other tips for unlocking bonuses… which are discussed in the milesopedia facebook group or at our events!

But with all the ones mentioned above, you should be able to unlock many bonuses! To find out when you’ll receive your bonus, click here!