New from Chexy: Cash Back on recurring bill payments

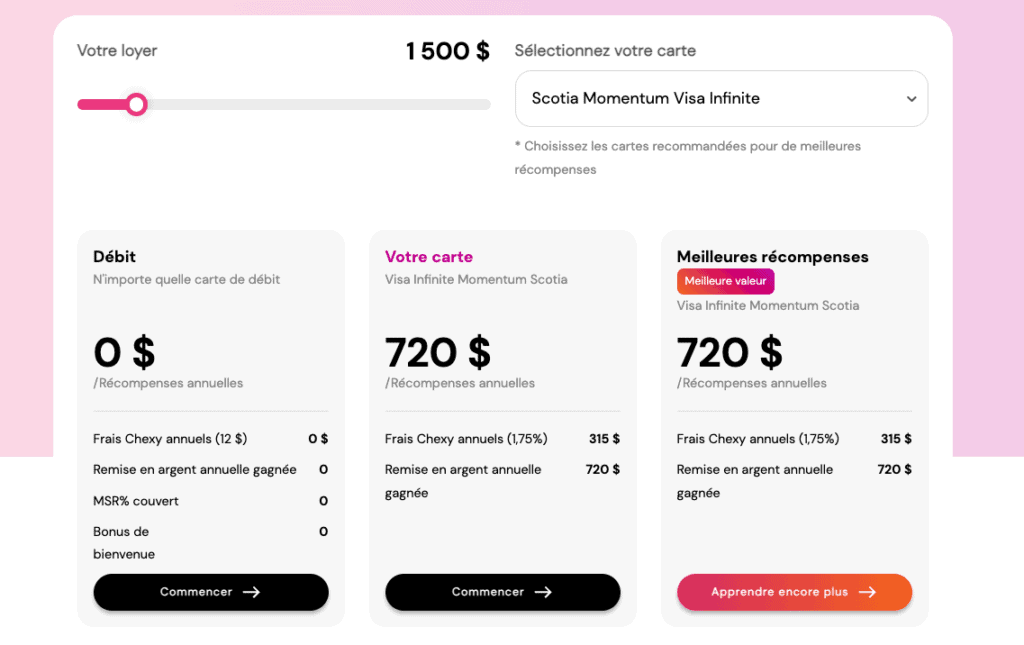

From November 16, 2023, rental payments made via Chexy will be categorized as “recurring bill payments” by credit card issuers. To make the most of it, we recommend the Scotia Momentum® Visa Infinite* Card, which offers 4% cash back on this category, and therefore your rent payments with Chexy.

For example, if your rent is $1,500 a month, you could earn $720 a year in cash back. Deducting the 1.75% fee, that’s a net return of 2.25% on your rent (or $405 on a $1,500 rent), excluding the welcome offer!

The Scotia Momentum® VISA Infinite* card is recognized year after year as one of the best cash-back credit cards in Canada.

Currently, there is no annual fee in the first year, including on additional cards. And you can earn 10% cash back on all purchases for the first three months (up to $2,000 in total purchases).

With the Scotia Momentum® VISA Infinite* card, you get:

- 4% on groceries and recurring payments

- 2% on gas and daily transit

- 1% on all other purchases

For example, if you spend $1,000 per month on groceries and/or recurring payments, you’ll earn $40 cash back per month, or $480 cash back per year with this card for this category of purchases! And that’s not counting the other purchases you’ll make with this card and the advantages it offers (particularly in terms of insurance).

The Scotia Momentum® VISA Infinite* card is an excellent Visa credit card for cash back.

And its insurance benefits are excellent!

What is Chexy?

Chexy is a Canadian company that offers several options for paying your rent in order to earn rewards or increase your credit rating.

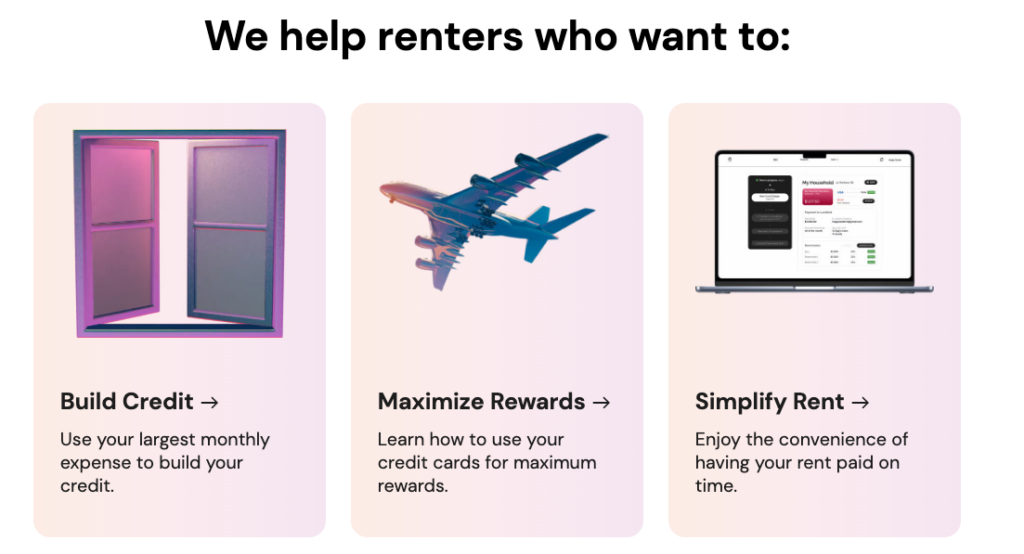

The services of Chexy services are aimed primarily at renters who want to :

- Earn rewards points by paying their rent with a credit card

- Maximize their rewards by earning cash back from multiple retailers

- Build their credit score with Credit Builder

- Automate the rent payment process

Chexy - Earn reward points

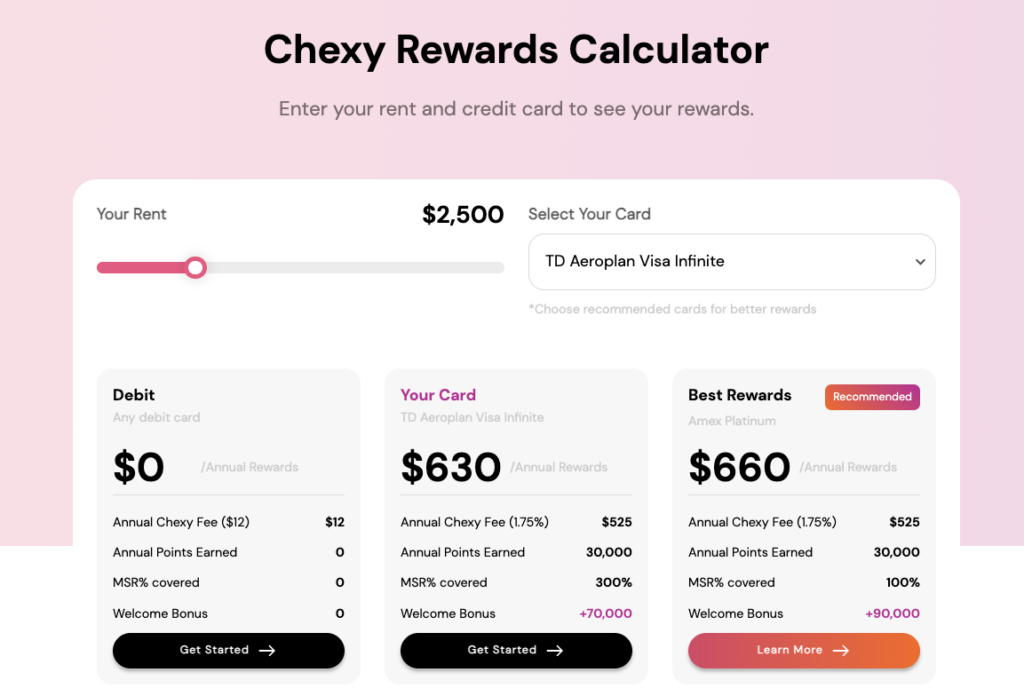

It’s easy to see that, although debit card fees are lower, this payment method doesn’t earn rewards, unlike credit cards.

You can also take advantage of this calculator to explore various credit card options recommended by Chexy for use with their services.

Chexy - Automated rent payments

How do I use Chexy as a renter?

To use Chexy to pay your rent, follow the steps below.

Go to the Chexy website, then enter your details to create an account, or log in from your Google account.

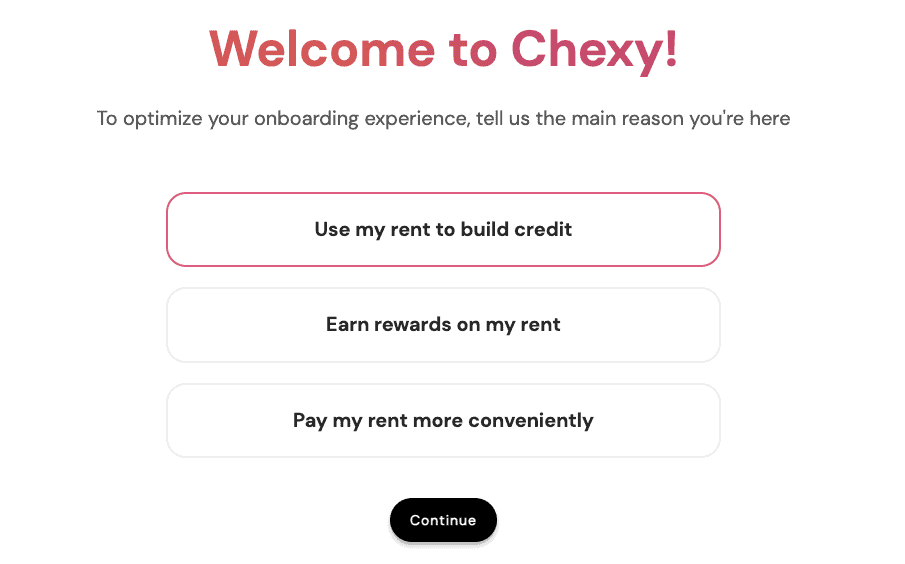

Next, indicate your main purpose for using Chexy, such as earning rewards on your rent, for example.

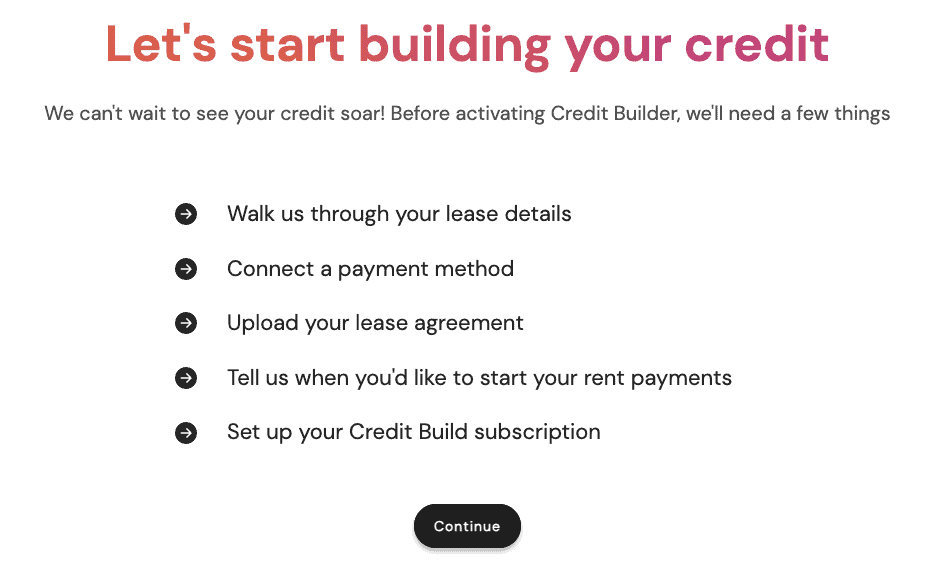

To complete this process, make sure you have :

- Information about your lease

- Your payment method (credit or debit card)

- Your digital lease agreement

- Your landlord’s information, including the e-mail address used to send the Interac transfer

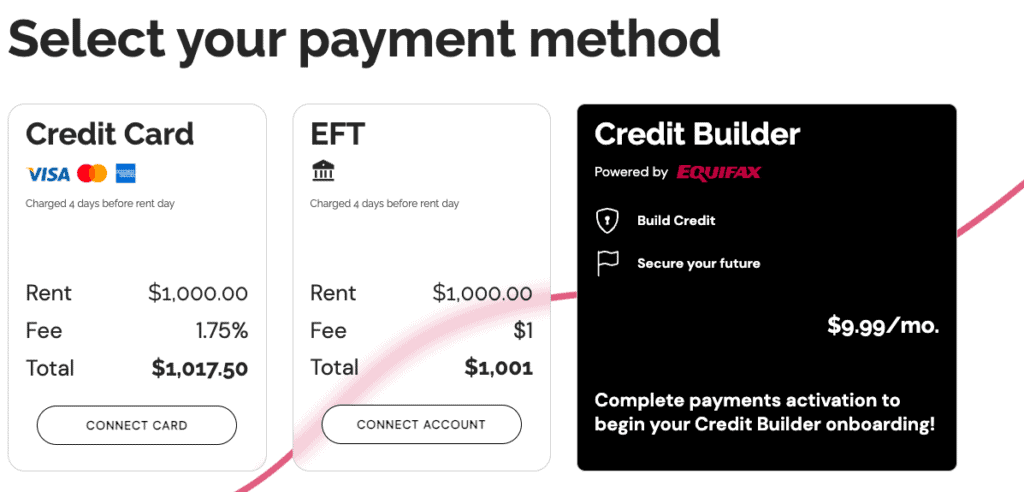

Once you have added your information, you will need to select your payment method:

- by credit card to earn rewards,

- by automatic transfer (debit card),

- or by adding the Credit Builder option ($9.99 per month).

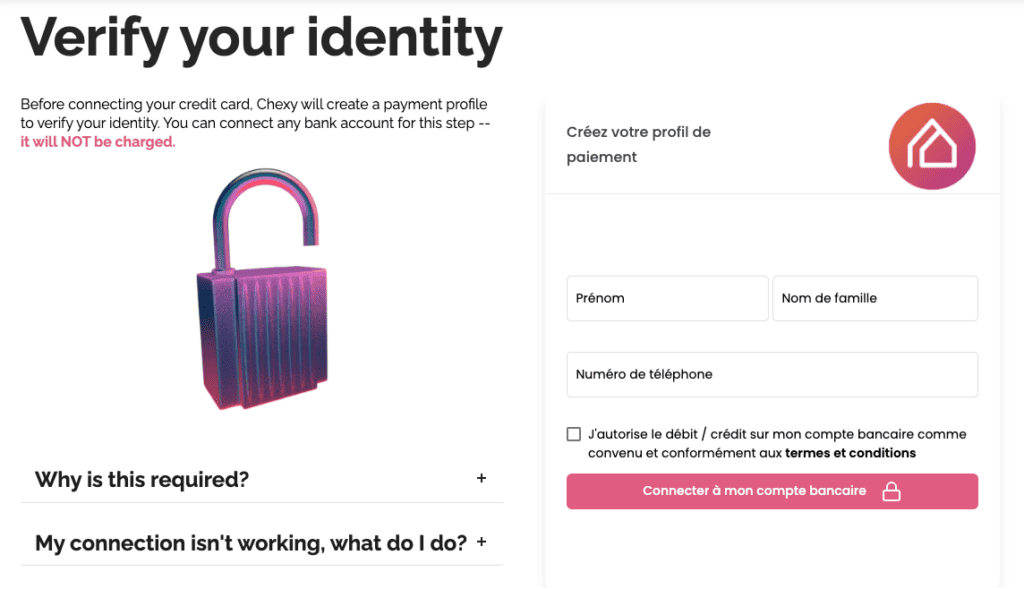

As a security measure, Chexy must verify your identity. All you need to do is connect to an online bank account.

How to use Chexy as a landlord?

While it once seemed impossible for a landlord to bill rent by credit card, it’s now possible with Chexy.

On its website, Chexy has a section dedicated to landlords. From autumn 2023, they will be able to invite their tenants to pay with Chexy so that they can take advantage of the benefits and rewards on offer.

In addition to automating payments, Chexy offers other benefits that will enable landlords to track activity.

Other Chexy services

Chexy - Cashback

By signing up for Chexy‘s rent payment service, you can earn cashback on your online shopping. The principle is the same as using the eBoutique of Aeroplan, Rakuten, Boomerang or any other online shopping platform.

The cashback you earn will then be deducted from what Chexy charges to your credit card, so it can help cover service fees.

Chexy - Credit Builder

This service, available for a fee of $9.99 per month, can help anyone trying to raise their credit score, whether they’re newcomers, students, or anyone with a specific goal in mind (buying a home, for example). So it’s a good way to keep your credit data up to date and active by showing positive use.

With a better credit score, you can get a better rate when you apply for a mortgage, and save a lot of money over the years. Or be approved for better American Express, Mastercard or Visa credit cards.

Our review of Chexy

If you can use Chexy to pay your rent, it’s a great way to earn points every month and unlock welcome bonuses that stretch over several months.

These include the American Express Cobalt® Card, the Platinum CardMD from American Express, and many high-end cards that require you to reach a certain high annual spending threshold to unlock bonus points.

Also, these cards generally offer points whose value is greater than the fees charged by Chexy. For example, we estimate the value of an Aeroplan point at 2 cents.

Here are some of them:

In addition, some credit cards offer cash back, so you’ll also come out ahead when you pay your rent through Chexy. One example is the SimplyCash® Preferred Card from American Express, which offers 2% cash back (plus a hefty welcome bonus):

If you’re a renter looking to unlock a credit card welcome bonus with high spending requirements, using Chexy ‘s services can help you achieve your goals.