We have written a detailed article on the best point hunting techniques for finding cheap flights. As part of this strategy, we are only interested in programs that offer travel points that can be applied directly to your flights.

Goal: Save on Flights

Here, your goal is to be able to:

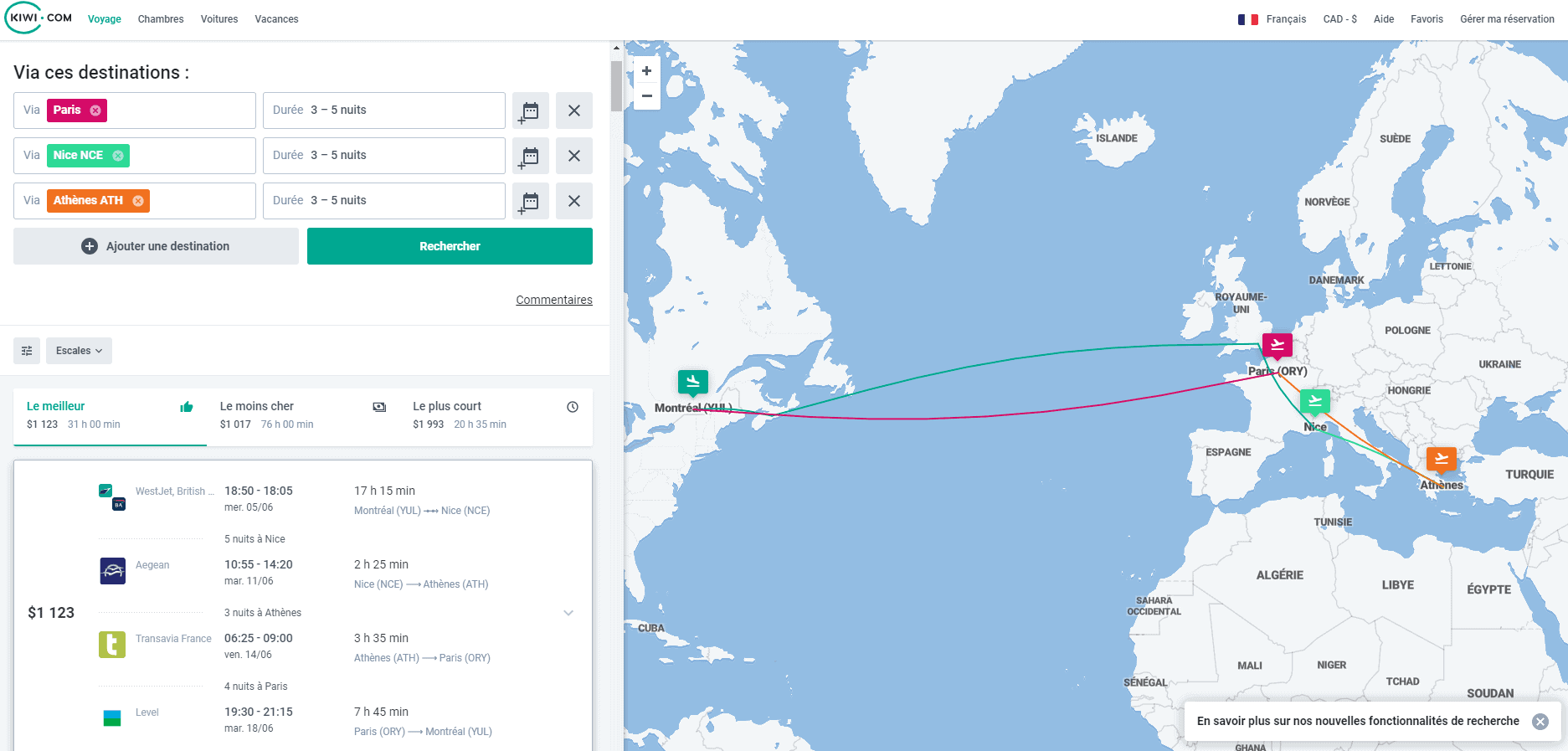

- book on the website that suits you best(Air France, Kiwi.com, Skyscanner, Momondo…).

- travel on the dates that suit you

- Take the itinerary of your choice

- Use the airlines that are right for you

- etc.

So you want more freedom than the one you could have with Aeroplan or AIR MILES. You should always hold a credit card with travel points: it will offer you some flexibility!

Sometimes, we use credit cards with hotel points to get free hotel nights, while on other occasions, we redeem travel points to pay for flights!

Reward Programs to save on flights

To save on flights, you will need to use travel points.

Every credit card issuers have travel points programs:

Some will offer you the possibility:

- to book with any travel agency or airline

- while others will have their own online agency, often offering the same prices

Of course, we will prefer programs that offer more flexibility, but we should not disregard the others!

Here are the top 4 travel reward programs to save money on flights:

American Express Membership Rewards Points (flexible option)

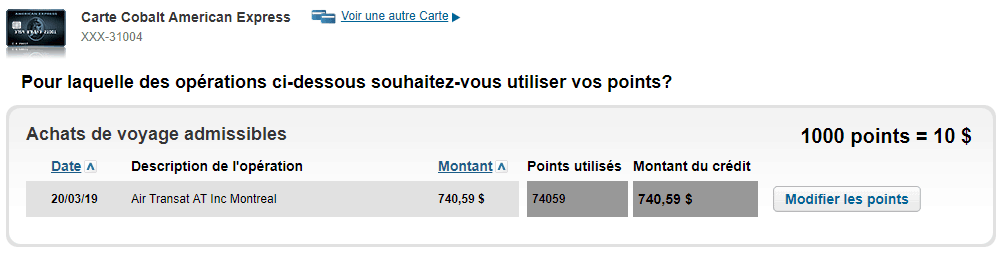

With the Membership Rewards program, you can apply points to any flight purchase charged to one of the six Membership Rewards Cards.

You can apply 1,000 points for a $10 credit or 10,000 points = $100. Below, an Air Transat flight booked with an American Express Card:

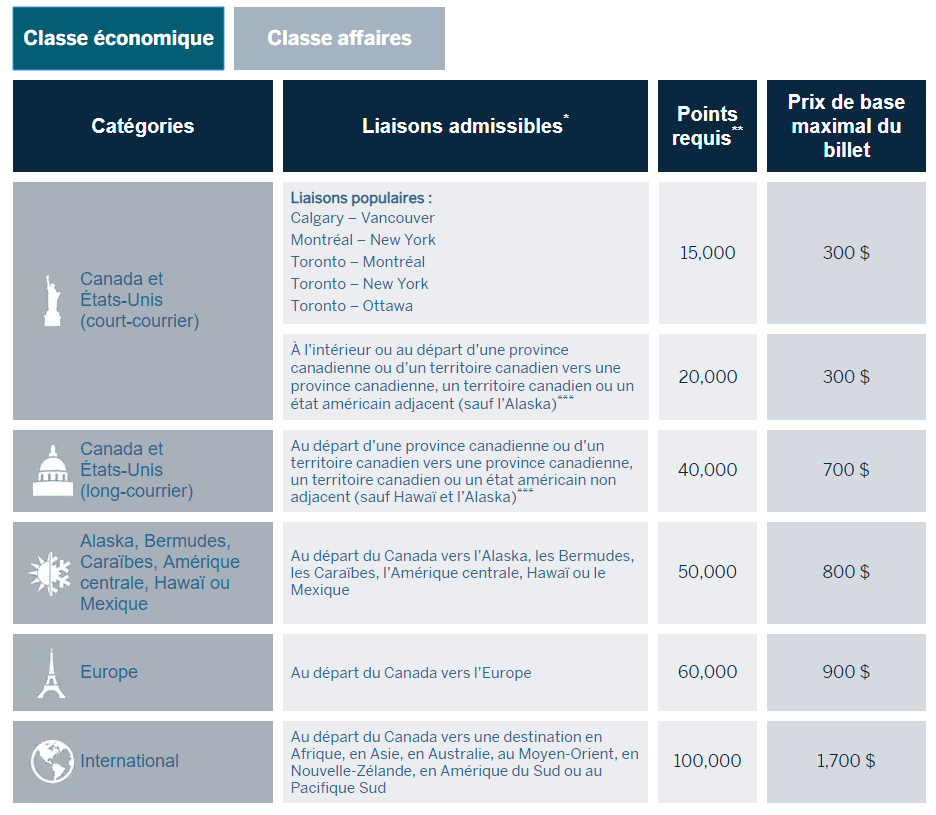

American Express Membership Rewards Points (fixed option)

For some flights, American Express has assigned a fixed chart: you will be able to use a predetermined number of points based on the cost of your flight.

Scene+ Scotiabank

The Scotiabank SCENE+ program works the same way: you can apply your points directly to the purchase of your flight charged to one of the cards from the program.

This means that 5,000 points can be used for a $50 credit, or 10,000 points = $100.

BMO Rewards

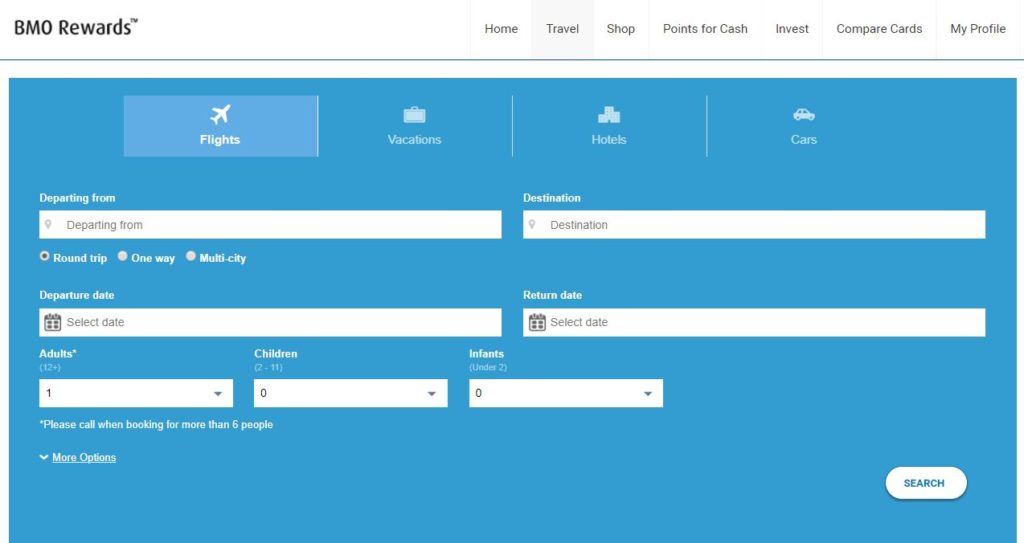

The BMO Rewards program works differently: points earned with any of the cards in the program can be used on the BMO travel booking portal. Alternatively, you can book your flight on your chosen site at the same redemption rate (a new feature of the BMO Rewards program).

The redemption rate will always be the same when using points for travel, in this case to save on flights: 10,000 points = $71

HSBC Rewards

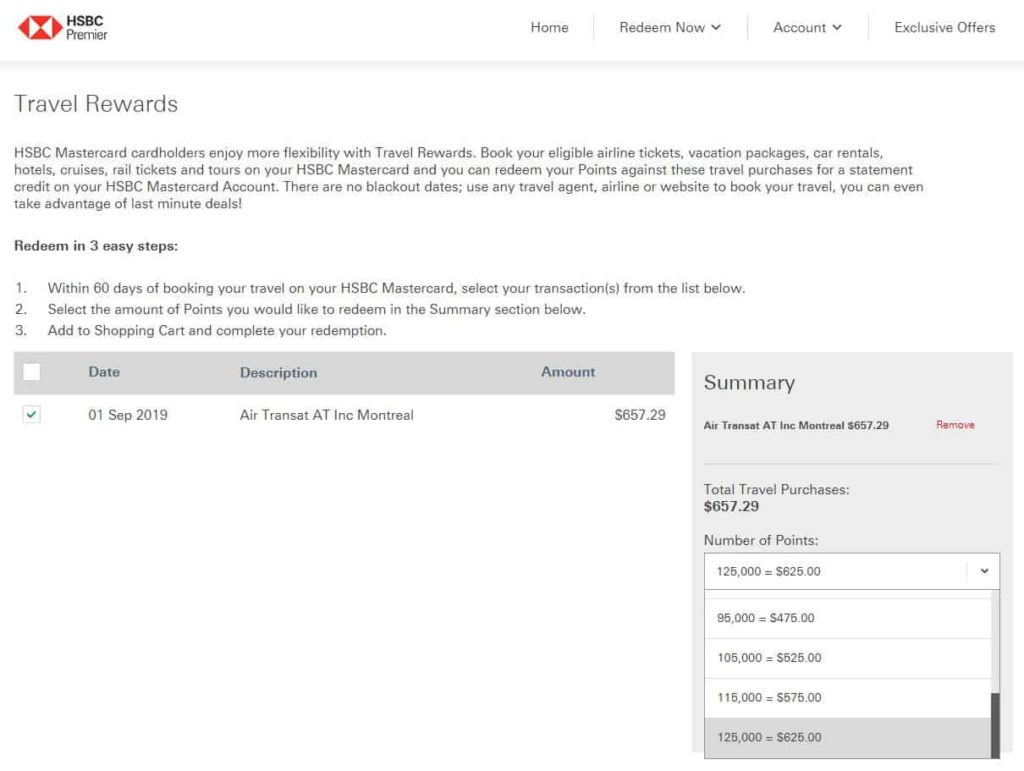

To use your HSBC Rewards points, charge any travel purchase to your HSBC World Elite® Mastercard® (and earn 6 points per dollar for this type of purchase).

Then you can go to the HSBC Rewards portal to apply your points on your travel purchases and get a statement credit.

Here’s an example of the purchase of an Air Transat ticket on my HSBC World Elite Mastercard:

Credit cards

With the goal and programs set, we can now look at credit cards that earn points to save money on airfares.

American Express Membership Rewards offers

Here are the 7 Cards of the American Express Membership Rewards Program, whose points can save you money on your flights.

The Best Membership Rewards Offer from American Express

The American Express Cobalt® Card is the best credit card from American Express, whether you want points for travel or cash back.

The welcome bonus is distributed monthly for the first 12 months. You’ll earn 1,250 Membership Rewards points for every $750 in purchases charged to your card during the month (whether in the 1X, 2X, 3X or 5X category). That’s up to 15,000 Membership Rewards points.

You can easily use these points as statement credits for everyday or travel purchases. The value is the same for both: 1,000 points = $10.

Or you can transfer them into Aeroplan points, Avios (British Airways/Qatar Airways), Flying Blue, Marriott Bonvoy or Hilton Honors.

With the American Express Cobalt® Card, you can earn between 1 and 5 points per dollar:

| Category | Points per dollar |

| Grocery stores (Metro, IGA, Sobeys, Super C, etc.) | 5 |

| Food delivery | 5 |

| Restaurants and bars | 5 |

| Convenience stores | 5 |

| Streaming subscriptions | 3 |

| Gas station | 2 |

| Transportation | 2 |

| Travel | 2 |

| Other | 1 |

This is a 1 to 5% return on all these purchases.

For example, if you spend $1,000 per month on groceries and/or restaurants and/or food delivery, you’ll earn $50 cash back per month, or $600 cash back per year with this card for this category of purchases!

And if you decide to transfer your points to other programs like Aeroplan, you could get even more value!

In addition, this card provides excellent insurance coverage: rental car theft and damage, baggage delay, lost or stolen baggage, flight delay, $250,000 travel accident, hotel or motel burglary, Mobile Device Insurance, Purchase Security, Purchase Protection Insurance.

Like all American Express Canada Cards, there is no minimum income requirement.

Scotia Scene+ Offers

Here are the five best credit cards in the Scotia SCENE+ program.

The most interesting in our opinion are:

- Scotiabank PassportMD Visa Infinite* Card: one of the only cards in Canada to charge no foreign currency conversion fees AND to offer 6 free airport lounge accesses. See detailed presentation here.

- Scotiabank Gold American Express® Card: this card charges no foreign currency conversion fees. This credit card is exciting thanks to its accelerated points earning and excellent insurance coverage. See its presentation here.

BMO Rewards Offers

There are several cards in the BMO Rewards program:

The BMO Ascend World Elite Mastercard is one of the best World Elite Mastercard credit cards with travel points in Canada. With our exclusive offer, you can get up to 100,000 bonus points:

- 55,000 points after $4,500 in Card purchases in the first 3 months

- 3,750 points per month after $2,500 in monthly purchases from the 4th to the 15th month (up to 45,000 points)

Plus, the annual fee is waived in the first year for both the primary cardholder and authorized users.

With the BMO Ascend World Elite Mastercard, a premium credit card from BMO, you get:

- 5 points per dollar on travel purchases

- 3 points per dollar on dining purchases

- 3 points per dollar for entertainment purchases

- 3 points per dollar on recurring bill payments

And 1 point for every $1 spent everywhere else, including at Costco. You can use BMO Rewards points for all travel purchases made through the agency or website of your choice (flights, hotels, car rentals, all-inclusive resorts, Airbnb, etc.) or for rewards and gift cards on the BMO Rewards platform.

The BMO Ascend World Elite Mastercard also offers:

- Four annual complimentary passes to airport VIP lounges

- Excellent Premium insurance for your travels or purchases

- a premium concierge service

Bottom Line

To apply this strategy to save on airline tickets with Reward Points, you could only focus on one program. Or you can get into multiple programs, which is ideal for a couple: each of you applying for a different card.

The three best cards in our eyes are:

- American Express Cobalt® Card

- Scotiabank Passport™ Visa Infinite* Card

- BMO Ascend World Elite Mastercard

Also, as you can see, these cards sometimes require a high income ($60,000 – $80,000/year), while others require lower income ($12,000 with the Scotiabank Gold American Express® Card) or even no minimum income at all (American Express Cobalt® Card).

So everyone can benefit from travel points to save on flights!