Welcome offer

For a limited time, when you apply for the Scotiabank®* Platinum American Express® Card, you can earn up to 60,000 points. That’s a $600 value for travel purchases including Airbnb.

With the Scotiabank®* Platinum American Express® Card, you earn 2 points per dollar on all purchases. You can redeem your points on travel purchases (flights, hotels, all-inclusive and even Airbnb). And you can also use them for other rewards in the Scene+ program, such as cash back rewards.

Plus, with this card, you will not pay 2.5% foreign transaction fees on any foreign currency purchases, and you get ten complimentary visits to airport VIP lounges with the Priority Pass and Premium Plaza networks.

And you get excellent insurance for your travels or purchases, concierge service, and exclusive American Express Offers (American Express Invites Program).

A Scene+ card

The Scene+ program is the loyalty program of Scotiabank, Cineplex theatres and, soon, IGA, Sobeys, etc.

The other major cards in the Scene+ program are the Scotiabank Passport™ Visa Infinite* Card and the Scotiabank Gold American Express® Card. This allows you to have another source of Scene+ points earning: having a single Scene+ account regrouping your different credit cards is possible.

A great way to earn points, both through welcome bonuses and great earning rates on specific spending categories with the Scotiabank Gold American Express® Card, for example!

2 points / dollar

With the Scotiabank Platinum American Express® Card, you can earn 2 points per dollar on all purchases. It is one of the only credit cards in Canada to offer this earning rate on any purchase.

And there is no annual limit to the number of Scene+ points you can earn!

Using Scene+ points

You can apply your Scene+ points directly to your travel purchases (flights, hotels, Airbnb, car rentals, etc.) charged to the card: 10,000 Scene+ points = $100.

So 60,000 Scene+ points are worth $600!

This is one of the cards we recommend in these strategies:

You must redeem at least 5,000 points or $50 (after this threshold, the redemption ratio is 100 points = $1).

By redeeming your Scene+ points on your travel expenses, you are guaranteed a 2% return on your card purchases.

Benefits of the card

No Foreign Transaction Fee

With this card, as of July 1, 2022, you don’t pay any conversion fees on foreign currency transactions. This is a unique benefit for credit cards in Canada.

This means you will save 2.5% on every foreign currency transaction!

10 annual visits to VIP airport lounges

With this card, you get a Priority Pass membership as well as complimentary access to VIP airport lounges (including Plaza Premium lounges):

- 10 complimentary visits for the primary cardholder

- 4 complimentary visits for the additional cardholder

For example, at the National Bank Lounge at Montreal-Trudeau International Airport.

Reliable concierge service

If you need help with your restaurant reservations or finding tickets for a show, the concierge service – provided by American Express – is available 24 hours a day, seven days a week.

I have used it several times to get a table in “sold-out” restaurants. Or to make me a list of things to do/see in a city I was planning to visit (Seoul, South Korea).

An American Express card

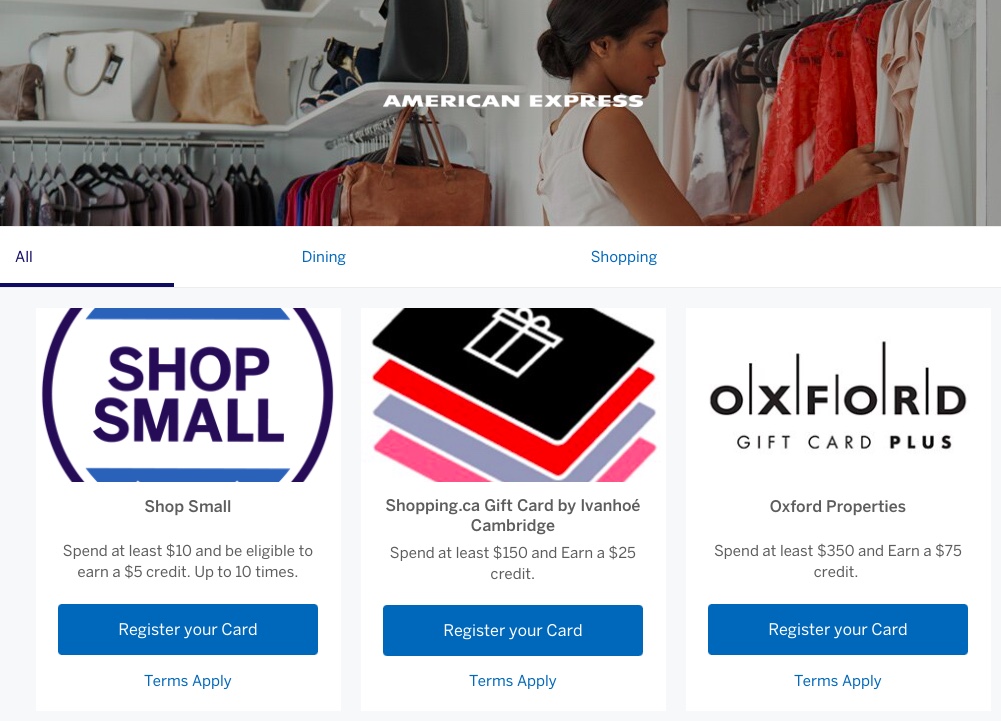

As this card is part of the American Express network, you will access the American Express online offers, including Shop Small.

It’s handy if you don’t have (or no longer have) American Express cards from American Express Canada!

Simply register your card on this page.

Access to American Express Invites

As it is an American Express card, you also have some benefits offered to cardmembers such as “American Express Invites”.

You can get to the Front of the Line for many experiences: concerts, theatres, restaurants, cinema, fashion and shopping.

To sign up for the service once you have your Scotiabank Platinum American Express® Card, go here!

Card insurance

The Scotiabank Platinum American Express® Card provides a number of travel insurance benefits:

Travel Emergency Medical Insurance

Coverage is provided:

- for eligible persons under age 65 for up to 31 consecutive days

- for eligible persons age 65 and older for up to 10 consecutive days.

Trip Cancellation / Trip Interruption Insurance

Charge at least 75% of your trip costs to your Card and get trip interruption insurance at no extra cost.

You, your spouse and your dependent children are eligible for

- up to $2,500 per person for travel expenses (maximum $10,000 per trip) for trip cancellation benefits

- up to $5,000 per person for travel expenses (maximum $25,000 per trip) for trip interruption

Flight delay insurance

Charge at least 75% of the full ticket cost to your Scotiabank American Express Platinum Card and you’ll be eligible for reimbursement of necessary expenses such as hotel accommodations, meals and other emergency items.

You may be reimbursed for eligible necessary and reasonable living expenses incurred during the period of a delayed flight or missed connection which lasts four hours or a missed connection resulting in a waiting period of at least four (4) hours, up to $1,000 per insured person part of the same trip.

Delayed and Lost Baggage Insurance

Charge the full cost of your airplane, train, bus or cruise ship tickets to your Card. If your checked luggage is delayed or lost – you’re covered.

The lost luggage benefit is limited to the lesser of the value of the covered luggage or the actual replacement cost of the lost or stolen covered luggage, to a combined maximum of $1,000.

The delayed luggage benefit is limited to $1,000 for all insured persons on the same trip for the cost of replacing eligible essential items if your checked luggage is not delivered within four (4) hours from your time of arrival at your final destination.

Travel Accident Insurance

Charge at least 75% of your ticket cost to your Card and you’re insured against accidental loss of life or dismemberment.

You, your spouse and eligible dependent children will be automatically insured against accidental loss of life, or dismemberment – up to a maximum of $500,000 (to a maximum of $1,000,000 per occurrence).

Rental Car Collision Loss/Damage Insurance

Charge the full cost of your eligible rental car to your Card and you’re automatically insured if your rental is damaged or stolen.

Note that the rental period cannot exceed 48 consecutive days and vehicles costing over $65,000 are not covered.

Hotel/Motel Burglary Insurance

Use your Card to pay for your stay at any hotel or motel in Canada or the U.S.

When you check into any hotel or motel in Canada or the United States and pay the entire bill with your Scotiabank Platinum American Express® CardIn the event of a break-in to your room, you, your spouse and dependent children traveling with you will be eligible for theft of personal property coverage.

Should your claim exceed the amount reimbursable by the hotel, and/or any applicable insurance protection, your coverage picks up the balance, up to a maximum of $1,000.

Mobile Device Insurance

You may be covered by the mobile device insurance for up to $1,000 in the event your cell phone, smartphone or tablet is lost, stolen or accidentally damaged or experiences mechanical failure.

In order to be covered by this insurance, you need to charge the full cost of your new mobile device to your Card or charge all of your wireless bill payments for such device to your Card when you fund such purchase through a plan.

Purchase Security & Extended Warranty Protection

Most items purchased with your Card are insured against loss, theft and damage for 120 days from the date of purchase, and the manufacturer’s warranty is doubled for up to another year. (Maximum lifetime liability of $60,000)

Bottom Line

This is the best card in terms of Scene+ points earning for all purchases.

This Scotiabank Platinum American Express® Card will be very interesting for many profiles:

- Those who do not want to pay a foreign currency conversion fee

- Those who want reliable insurance

- Those who already have one or more Scene+ cards in their wallet

With this great offer, you can earn up to 60,000 points (a $600 value).