Introducing Tugo Travel Insurance

The COVID-19 pandemic reminded us that having travel insurance is essential and should be part of the travel budget. While some credit cards have great insurance, dedicated travel insurance may be required.

Far too many travellers think they are safe or covered by provincial healthcare. But as soon as you leave the province’s borders, you will not be able to take advantage of this system! You will then have to arrange for care and pay the expenses that may arise.

Tugo Travel Insurance has 3 types of insurance packages:

- The Non-Medical Package

- The All Inclusive Holiday Package

- The Visitor to Canada Package

You can get some insurance separately, such as:

- Emergency medical insurance

- Hospital/medical insurance (students)

And these packages can be completed with optional coverages:

- Sports

- Baggage

- Rental Car protection

While optional coverage for sports and activities is attractive, baggage or rental car coverages are more worthwhile with some credit cards.

Before you see the different coverages in detail, here is a general overview of the 3 Tugotravel insurance packages.

The 3 Tugo Travel Insurance Packages

Tugo Non-Medical Package

Tugo’s non-medical package includes:

| Insurance | Coverage |

| Trip Cancellation Insurance | up to $10,000 |

| Trip Interruption Insurance | up to $25,000 |

| Accidental Death & Dismemberment | $100,000 |

| Baggage | $500 |

To apply for this insurance, you must be:

- a Canadian resident

- insured under the provincial or territorial health insurance plan of your province or territory of residence, or eligible for its benefits

Tugo All Inclusive Holiday Package

Tugo’s All Inclusive Holiday Package includes:

| Insurance | Coverage |

| Emergency medical insurance (worldwide) | $5,000,000 |

| Trip Cancellation Insurance | up to $10,000 |

| Trip Interruption Insurance | up to $25,000 |

| Accidental Death & Dismemberment | $100,000 |

| Baggage | $500 |

To get this insurance, you must be:

- a Canadian resident

- aged 59 and under

- insured or eligible for benefits offered by your province’s or territory of residence health insurance plan

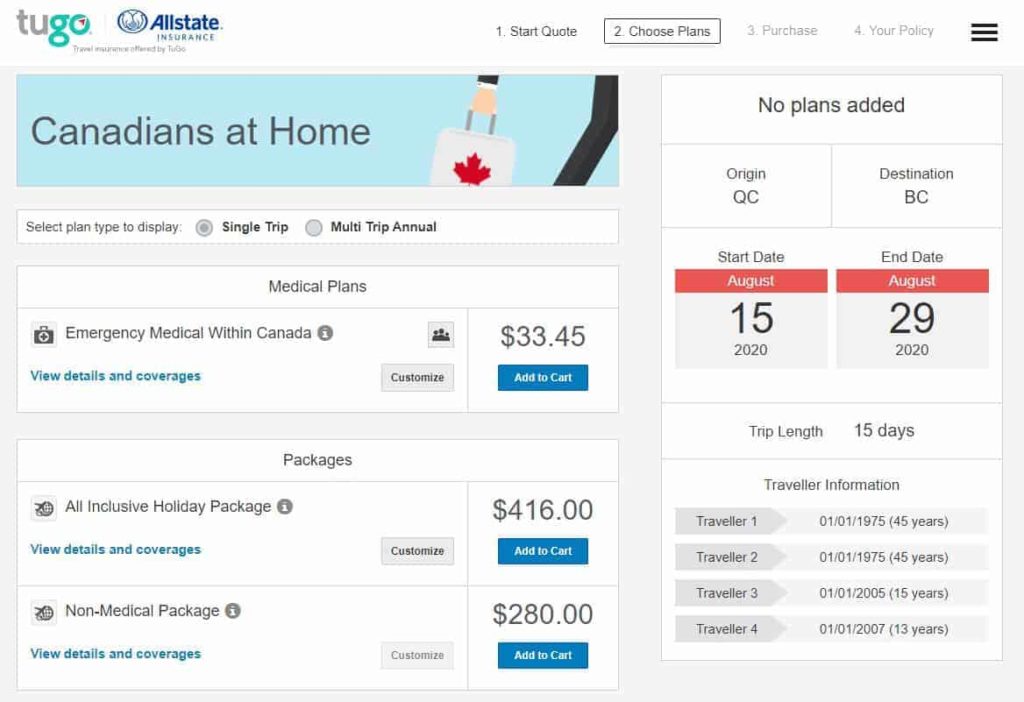

An example for Canadian residents travelling within Canada

Here is the rate for a typical case:

- A couple of travellers with their two children

- Living in Quebec and visiting British Columbia

- For a period of 2 weeks

Several options are then offered:

- Emergency medical insurance for travel within Canada Only: $33.45

- Non-medical package only: $280*

- Canada Vacation Package: $416*

* For these two packages, we indicated $1,000 as the total cost of the trip per traveller (or $4,000 for this family).

Tugo Visitor to Canada Package

Tugo’s visitor to Canada package includes:

| Insurance | Coverage |

| Emergency Medical insurance for visitors to Canada | up to $150,000 |

| Trip Cancellation Insurance | up to $20,000 |

| Trip Interruption Insurance | up to $25,000 |

| Accidental Death & Dismemberment | $100,000 |

| Baggage | $500 |

To get this insurance, you must be:

- a visitor to Canada

- an immigrant or Canadian returning home waiting for their provincial healthcare to take effect

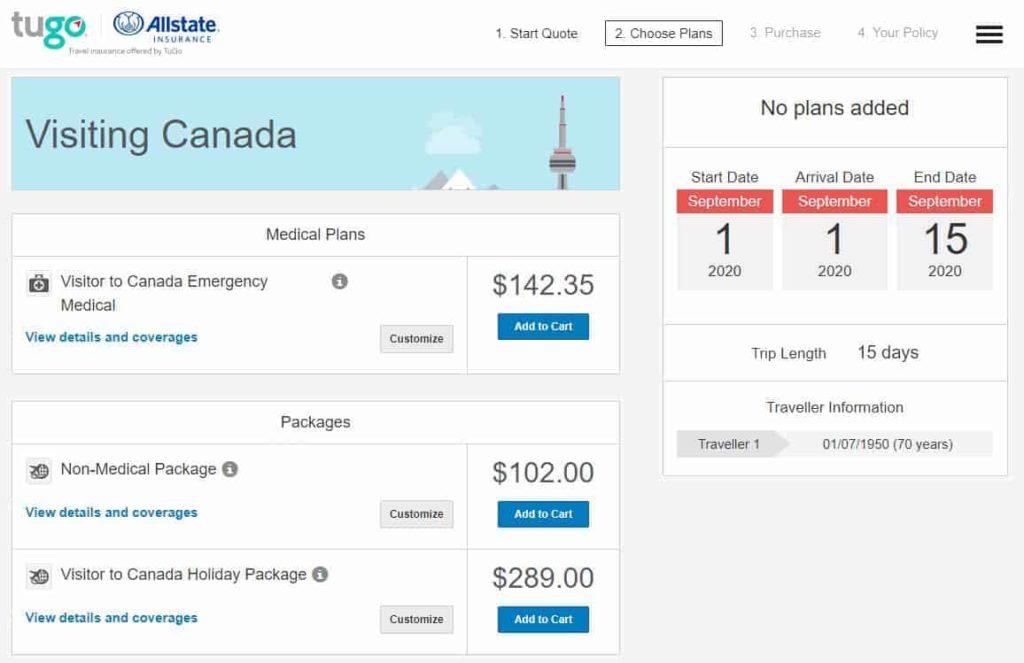

An example of Tugo Visitor to Canada Package

Here is the rate for a typical case known to many UK people living in Canada:

- A 70-year-old English grandmother

- Visiting her children and grandchildren in Canada

- for a period of 2 weeks

- Hosted by the family

Several options are then offered:

- Emergency visitor medical insurance in Canada Only: $142.35

- Non-medical package only: $102*

- Visitor to Canada package: $289*

For these two packages, we indicated $1,200 as the total cost of the trip per traveller (the typical cost of a flight from Europe).

Tugo Travel Insurance Coverage

Tugo's Emergency Medical Insurance

Tugo’s emergency medical insurance includes:

- licensed ambulance

- emergency dental expense

- prescription drug reimbursement

- expenses to bring a family member to your bedside if hospitalized

- board and lodging for you or your travelling companion while confined to a hospital

- escorting home of insured children

- and more.

Tugo Visitor to Canada Medical Insurance

Tugo’s visitor to Canada medical insurance includes:

- medical transport,

- Emergency dental services,

- prescription drug reimbursement

- Additional living expenses for your travel companion while you are hospitalized,

- and more.

Tugo's trip cancellation and trip interruption insurance

Risks covered in Tugo’s trip cancellation and trip interruption insurance are:

- unexpected sickness, injury, and/or death of you, your travelling companion, immediate family or your travelling companion’s immediate family

- natural disaster

- travel advisory

- subpoena

- involuntary job loss,

- missed connection

- the non-issuance of a travel visa

Tugo Accidental Death and Dismemberment Insurance

Purchase this insurance as an annual multiple travel policy or single trip.

The benefit limit is $100,000.

Optional Tugo Travel Insurance Coverage

Tugo's activities and sports insurance

Tugo Travel Insurance is one of the few in Canada to offer optional coverage of sports and activities when you travel.

Here are the three types offered, as well as the excluded activities.

Contact sports coverage

Tugo’s optional coverage is up to $5,000,000 for the following contact sports:

- Australian football

- Boxing

- Football

- Ice Hockey

- Lacrosse

- Rugby

Extreme sports coverage

Tugo’s optional coverage is up to $500,000 for the following extreme activities:

- Base Jumping

- Bull Riding/Bull Fighting

- Scuba Diving or Free Diving over 30m

- Motorized Speed Contests

- Motorized X Game Sports (or those sports in similar type events)

- Mountaineering over 6,000m

- Rodeo

- Running with the Bulls

- Scuba Diving (if not certified by an internationally recognized and accepted program)

- Scuba Diving or Free Diving over 30m

- Ultimate Fighting & Mixed Martial Arts

- Wingsuit Jumping/Wingsuit Flying

Adventure sports coverage

Tugo’s optional coverage is up to $5,000,000 for the following adventure activities:

- Flying as a pilot or passenger in a glider or ultralight

- Backcountry Snowshoeing

- Bobsledding

- Canyoning/Canyoneering

- Downhill Freestyle Skiing/Downhill Snowboarding in Organized Contests

- Downhill Longboarding

- Downhill Mountain Biking

- Downhill Skating

- Endurance Activities over 6 hours

- Hang Gliding

- High Risk Snowmobiling

- Ice Climbing

- Luge/Skeleton

- Mountaineering up to 6,000m

- Non-motorized X Game Sports

- Parachuting/Skydiving/Tandem Skydiving

- Paragliding/Parapenting

- Paramotoring

- Parasailing/Parascending over Land

- Snow Kiting

- Stunt/Aerobatic Flying

Excluded activities

Excluded from the optional coverage of Tugo, activities of Training, Instruction, Participation, or Practice Out-of-bounds:

- skiing

- snowboarding

- snowshoeing

- non-motorized snow-biking

Tugo's baggage insurance

Tugo’s baggage insurance pays for the loss, damage, destruction or theft of your personal effects while:

- in transit

- in any hotel or any other building

- en route anywhere in the world, on water, land or in the air

Tugo rental car protection

This protection covers physical damage to, or loss of, a leased/rented automobile. You must have a valid driver’s license.

Rental car protection benefit limit: $50,000

Credit card payment

You can pay for your Tugo travel insurance with your credit card:

- American Express

- Mastercard

- Visa

It’s a great way to earn points, or even unlock a welcome bonus!

Tugo Travel Insurance FAQs

On the Tugo website, you will find a complete FAQ, including on COVID-19 related issues.

Like most travel insurance, Tugo does not cover travel outside of Canada at this time because:

- COVID-19 pandemic is a known situation for travellers

- The Canadian government has issued a travel warning (avoid non-essential travel outside of Canada)

On the other hand, you are covered for:

- Travel within Canada

- any other medical emergency not related to COVID-19

Conclusion

Tugo offers customizable and comprehensive travel insurance.

If high-end credit cards can cover you for most situations, including travel interruption/cancellation insurance – such as these best credit cards in Canada for travel insurance – they can:

- be inaccessible for people with incomes of less than $80,000

- have limits on the number of days outside the province of residence

- have age limits

- have exclusions for certain blankets

It is then advisable to apply for travel insurance like Tugo’s to be well protected.