Can COVID-19 be a pre-existing condition and therefore a barrier to your travel insurance coverage?

Since the beginning of the pandemic, we have often thought about cancellation clauses if we get sick, new requirements that may suddenly come into play, or what to do if the airline decides to suspend a route.

Several topics regarding travel and COVID-19 have already been discussed.

COVID-19 and the risk of late complications

COVID-19 is a disease caused by the coronavirus – does a diagnosis result in an exclusion from emergency medical services (EMS) emergency medical service?

Several complications can occur after a coronavirus infection:

- dyspnea (shortness of breath)

- pericarditis

- pneumonia

- thrombophlebitis

- pulmonary embolism

- etc.

The risks are very low, especially if you have not been hospitalized, but here is what you need to know about emergency medical insurance when COVID-19 is considered a pre-existing condition.

Credit Card EMS Insurance

First of all, not all credit card insurance policies are equivalent at this level, especially in relation to COVID-19.

To compare, I looked at four credit cards that stand out in terms of travel insurance and pre-existing conditions.

BMO Ascend World Elite Mastercard

For the BMO Ascend World Elite Mastercard and the BMO® AIR MILES® World Elite®* Mastercard®*, it reads:

This insurance does not provide reimbursement for any expenses incurred during the Coverage Period in connection with Continuing Treatment, Recurrence or a medically recognized complication related directly or indirectly to a medical condition for which you […] were diagnosed […] during the six (6) months immediately preceding the start of the Coverage Period.

After speaking to two different agents, they confirmed to me that no coverage will be given if you have had COVID-19 in the last 6 months, as it is a pre-existing condition.

You can find the insurance certificate here.

National Bank's World Elite Mastercard®

Next, with the National Bank’s World Elite Mastercard® and the National Bank’s World Mastercard, the terms and conditions of the contract state:

No benefit is payable if the accident or sickness is directly or indirectly related to any illness, injury or condition (other than a minor ailment) […] during the 3 months prior to the trip

I confirmed this information with CanAssistance, the insurer of National Bank credit card holders. COVID-19 is rightly considered a pre-existing condition and EMS stated that it would not be covered.

However, there is one exception:

Minor ailment: An illness, injury, or medical condition that ended at least 30 days prior to travel and did not require… admission as an inpatient or outpatient to a hospital…

So if you tested positive for COVID-19 and simply recovered at home, you will be covered after 30 days of recovery.

I had to call in a supervisor to get my answers regarding the definition of pre-existing condition because three agents gave me conflicting information.

You can find the National Bank insurance contract here.

Private insurance for EMS

Blue Cross

Blue Cross insurance also considers COVID-19 as a pre-existing condition and a minor ailment. Therefore, EMS insurance applies only 30 days after you’ve recovered and under certain criteria.

Manulife

Manulife phrases the pre-existing condition clause differently:

Pre-Existing Condition: Any health condition that existed prior to the effective date of your insurance.

So, with Manulife, if you are recovered from COVID-19 before you travel, there will be no worries because this “health problem” no longer exists and there are no time limits to meet. I confirmed this information with two different agents.

The Manulife COVID-19 Pandemic Travel Insurance Plan contract can be found here.

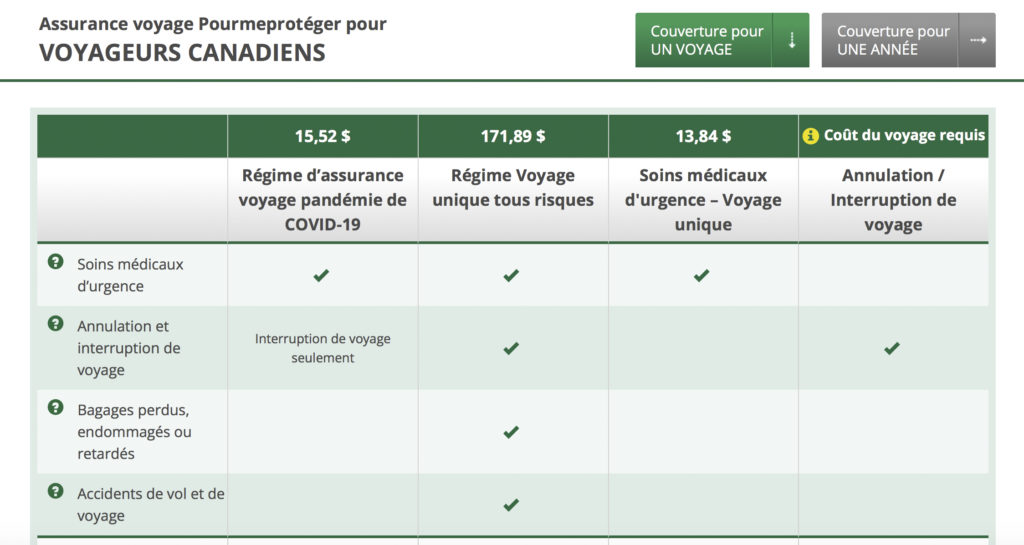

So, if you want to get coverage for COVID-19 quickly after your recovery, Manulife offers very reasonable rates for some peace of mind with EMS.

The following prices are for a weekend in the United States.

Conclusion

What are the chances of getting COVID-19 twice in such a short period of time or developing a very severe complication? Not likely and quite rare!

However, risk management is different for everyone! If the pre-existing condition clause is a concern for you, you now know that there are inexpensive solutions to address it!

Low probability, high consequence!