Foreign currency transaction examples

To pay abroad, several solutions exist:

- Currency exchange

- Cash withdrawals

- Payments

Proceed directly to the list of the four best credit cards with no foreign currency conversion fees.

Exchanging Canadian dollars for the currency of the country you are visiting

To be sure to be able to pay for your purchases abroad, exchanging Canadian dollars before departure is a simple solution. But it is not the most optimal for several reasons.

1- Foreign exchange transaction fees

Whether in Canada or upon arrival in the country you are visiting, you will have to exchange your Canadian dollars for the local currency, which will result in a fee.

“Currency exchange/currency conversion fees“: the exchange office “sells” you foreign currency in exchange for your Canadian dollars at the rate it wants.

This rate will include the exchange rate (which will therefore be “hidden”).

By comparing it with the market rate, you can guess how much this transaction will cost.

For example, the market rate for US$1 is CA$ 1.30. If your exchange office sells you that same US$1 to 1.35 CA$, it charges you a 3.8% fee.

For a US$1,000 transaction, you will have to pay $1,350. The exchange fee here is about $50.

2- Refusing your cash

Want to rent a car? Are you staying in a hotel?

In many cases, a credit card is unavoidable because it is a guarantee for the merchant.

It will be very rare for a car rental agency or hotel to accept cash for this.

3- The risk with a wallet full of cash

If your wallet is stolen, no recourse will be possible, unlike credit cards!

Around the world, we are increasingly moving towards digital payment solutions. In some countries, cash is no longer accepted for services as basic as taxis!

However, it is always helpful to have some “local” money when visiting a foreign country.

Money withdrawals abroad

Two ways to withdraw money:

- with a debit card

- with a credit card

Go directly to the list of the 3 best credit cards with no foreign currency conversion fees.

Withdraw money abroad with a Canadian debit card

With a debit card, you have direct access to the funds available in your checking or savings accounts.

Beware, however, of several aspects:

- Your card’s network (Visa/Mastercard): Some ATMs may refuse one of these networks.

- Preset limits: Your card issuer limits the amount you can withdraw per withdrawal and/or per week. Find out before you leave, and change your withdrawal limits accordingly!

- Fees: There will be several fees depending on your card:

- foreign exchange/currency conversion fees: a rate decided by your card issuer

- Withdrawal fee: a fixed or variable fee per withdrawal depending on the amount withdrawn

- ATM fees: a fixed fee charged by the ATM operator

Some debit cards are more advantageous than others for withdrawals abroad.

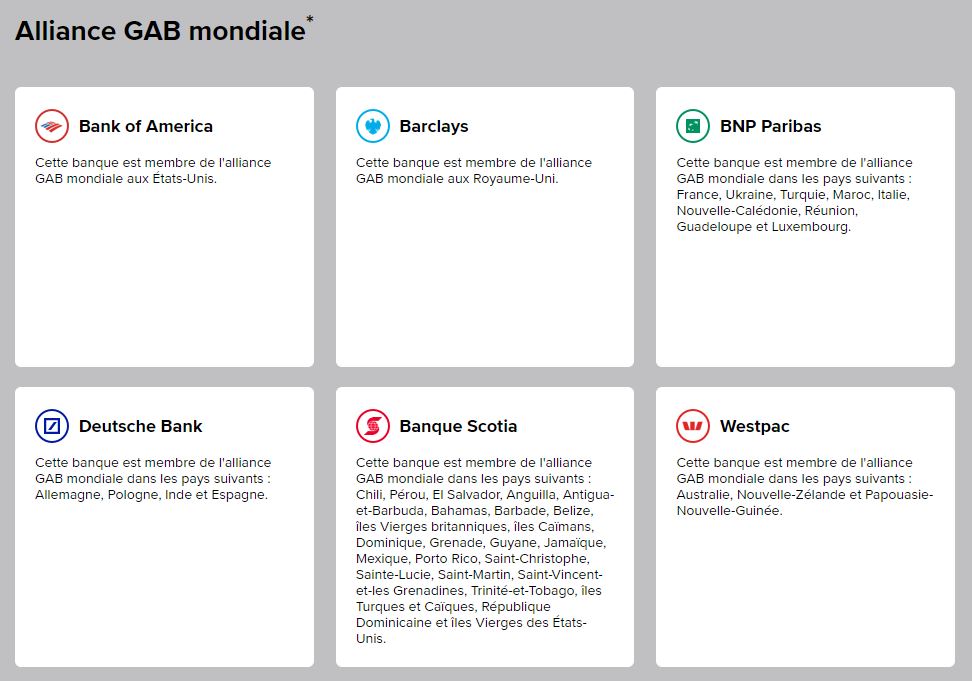

For example, Scotia/Tangerine are members of the Global Alliance, a group of banks allowing their customers to withdraw money free of charge from ATMs of the Global Alliance network. However, you will pay the rate dictated by the bank and will not be able to save on foreign currency conversion charges.

For Scotia/Tangerine debit cardholders, for example, it is possible to withdraw with no ATM fees at Bank of America ATMs in the United States or BNP Paribas in France.

However, the currency conversion fee will still apply.

Withdraw money abroad and avoid conversion fees

If you’re a globetrotter or a professional on the move, currency conversion fees can quickly add up when withdrawing abroad. Fortunately, there are ways of minimizing these costs. Two notable options are the Wise card and the Wealthsimple Cash card.

Wise card

The Visa Wise debit card is a reliable option for foreign currency withdrawals. Formerly known as Transferwise, Wise is an international money transfer service offering low fees on foreign currency withdrawals. Once you have your Wise account and debit card, you can add money to your account in Canadian dollars and make withdrawals in the currency of the country where you are located. Conversion fees are often much lower than those of traditional credit cards. In France, for example, the fee is 0.53%, while in Morocco it is 1.53%.

Wealthsimple Cash card

Wealthsimple Cash is an all-in-one financial platform that combines a checking account, a high-interest savings account and a prepaid Mastercard. For travelers, this card is an excellent option for avoiding conversion charges on foreign currency expenses. The Wealthsimple Cash Mastercard does not charge fees for ATM withdrawals worldwide, although the ATMs themselves may charge fees.

Money withdrawal abroad with a Canadian credit card

The same warnings as debit card withdrawals apply to credit cards.

But other much higher fees will be added because the credit card is mainly a PAYMENT method and not a WITHDRAWAL method!

Issuers will then charge:

- a cash advances interest rate (between 20-30%)

- a fixed or variable fee per withdrawal

However, if you find yourself in an emergency and need to withdraw money from your credit card, we advise you to pay your credit card immediately fully.

In fact, interest on cash advances begins to accrue upon withdrawal, as this video from the Financial Consumer Agency of Canada reminds us.

Payments abroad

After withdrawals, let’s take a look at paying with your debit/credit cards abroad.

But first, an important reminder:

Recently, in Greece, I noticed that if I chose to pay in Canadian dollars, the merchant would have charged a 10% conversion fee.

Whereas by choosing to pay in euros with my Scotiabank Passport™ Visa Infinite* Card, this fee was reduced to 0%!

Go directly to the list of the 3 best credit cards with no foreign currency conversion fees.

Payments abroad with a Canadian debit card

As with withdrawals, foreign currency payments with a Canadian debit card will be impacted by preset limits and various fees.

However, this can prevent you from carrying cash with you from Canada, which can reassure some. However, we would prefer this alternative: to pay with a Canadian credit card.

Payments abroad with a Canadian credit card

Most Canadian credit cards will allow you to pay directly to any merchant abroad.

However, different fees will impact each transaction:

| ATM Withdrawal | Payments with the card | |

| Cash advance fees | % of the amount withdrawn and/or fixed fee in $ | – |

| Foreign Exchange Fees | Between 0% and 5% of the amount | Between 0% and 5% of the amount |

| Visa/Mastercard Network Fees | Between 0% and 2% of the amount | Between 0% and 2% of the amount |

| Interest fees on cash advances | Between 20% and 30% per year without grace period | – |

| Interest fees on purchases | – | Between 15% and 30% per year with grace period |

| ATM fees | Between $0 and $10 | – |

Now let’s take the same chart, with a $1,000 purchase or withdrawal with the most common Canadian credit card fees:

| ATM Withdrawal | Payments with the card | |

| Cash advance fees | $7.5 | – |

| Foreign Exchange Fees | 2.5% = $25 | 2.5% = $25 |

| Visa/Mastercard Network Fees | 1% = $10 | 1% = $10 |

| Interest fees on cash advances | 20% = $17 | – |

| Interest fees on purchases | – | – ** |

| ATM fees | $5 | – |

| Total fees for $1,000 | $47.5 – $64.5 | 35$ |

Interest charges on cash advances apply from the grace-free withdrawal: to avoid them, pay your credit card immediately!

We assume that you pay your credit card balance on time to avoid interest charges on purchases.

You see, for $1,000, if you withdraw at a counter you will pay between $45 and $65 in fees! If you make a transaction, it is a $35 fee.

The best way to save money on foreign currency transactions

Three credit cards issued by Canadian banks are the only ones that do not charge any conversion fees for your foreign currency transactions:

Scotiabank Passport™ Visa Infinite* Card

With this welcome offer for the Scotiabank Passport™ Visa Infinite* Card, you earn up to 40,000 welcome bonus points (a $400 value) as well as a first-year annual fee waiver (a $150 value):

- 30,000 points after just $1,000 in purchases

- 10,000 points after $40,000 in annual purchases in the first year

Then, each year, if you make at least $40,000 in purchases on the card, you’ll earn an annual bonus of 10,000 points, a value of $100.

With the Scotiabank Passport™ Visa Infinite* Card, you earn 3 points per dollar spent at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op.

Also, you earn 2 points per dollar for:

- grocery purchases

- dining purchases

- Entertainment

- Transportation

The Scotiabank Passport™ Visa Infinite* Card is an excellent Visa credit card for this type of purchase.

You can redeem your points for any travel purchases (flights, hotels, all-inclusive and even Airbnb). You can also use your points as cash back rewards with Scene+.

The Scotiabank Passport™ Visa Infinite* Card also offers:

- no foreign transaction fee

- 6 complimentary passes to airport VIP lounges

- Premium insurance for your travels or purchases

- Concierge services

We voted this credit card the Best No-FX Fee Credit Card of 2024. Knowing that the annual fee is waived in the first year, there’s never been a better time to get this credit card for your international travels over the next year!

Scotiabank Gold American Express® Card

The Scotiabank Gold American Express® Card only requires a $12,000 minimum income, making it accessible to as many people as possible.

For a limited time, you can earn up to 40,000 points in the first year, which is a $400 value on travel purchases, including Airbnb.

With the Scotiabank Gold American Express® Card, you earn 6 points per dollar spent at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op.

Also, you earn 5 points per dollar for:

- grocery stores

- Restaurants

- Entertainment

And 3 points per dollar on gas, transit and streaming services purchases.

You can redeem your points on travel purchases (flights, hotels, all-inclusive and even Airbnb). You can also use your points as cash back rewards with Scene+.

The Scotiabank Gold American Express® Card also offers no foreign currency transaction fees, excellent travel and purchase insurance, concierge service and exclusive American Express benefits (Front of the Line Program).

Scotiabank Platinum American Express® Card

For a limited time, when you apply for the Scotiabank®* Platinum American Express® Card, you can earn up to 60,000 points. That’s a $600 value for travel purchases including Airbnb.

With the Scotiabank®* Platinum American Express® Card, you earn 2 points per dollar on all purchases. You can redeem your points on travel purchases (flights, hotels, all-inclusive and even Airbnb). And you can also use them for other rewards in the Scene+ program, such as cash back rewards.

Plus, with this card, you will not pay 2.5% foreign transaction fees on any foreign currency purchases, and you get ten complimentary visits to airport VIP lounges with the Priority Pass and Premium Plaza networks.

And you get excellent insurance for your travels or purchases, concierge service, and exclusive American Express Offers (American Express Invites Program).

Conversion fee: 0% !

With this benefit, for each transaction, you save a 2.5% fee.

The exchange rate obtained will most of the time be very close to the interbank exchange rate. In any case, it will be much more advantageous than the one from exchange agencies.

No transport of foreign currency

One of the traveller’s fear: to have his money stolen!

We mentioned it above: in the event of cash theft, you will have absolutely no recourse.

But with a credit card, you take away that risk!

Fraud insurance

Your credit card has been compromised and money has been taken from your account?

No problem: you’re not responsible!

Upon review, your credit card issuer will refund money improperly taken from your account.

Higher limits

The DEBIT card often limits you to both withdrawals and payments you can make.

This is not the case with the credit card: the limit will be the one set (5,000 – 10,000 CA$…).

Earning reward points

Last but not least, a very important aspect for rewards point hunters: every transaction on your credit card will earn you rewards points!

For the Scotiabank Gold American Express® Card, all foreign purchases earn 1 point/dollar. On the other hand, the buying categories in Canada are more interesting: up to 5 points per dollar.

Points that you can easily apply as a statement credit to your travel purchases!

Bottom Line

You can see it: you need to plan your money needs when going abroad!

Paying with a credit card that does not charge any foreign currency conversion fees is ideal. But don’t put aside other options, for all the reasons mentioned above.