Foreword

Municipal and school taxes represent a significant expense for a homeowner each year. For points users, it’s an opportunity to go and unlock welcome bonuses thanks to these spendings.

As always, only use these methods:

- if you are able to pay your credit card balance in fullby the due date (otherwise the interest charged will eat up all the bonus you earned)

- if you consider the fees generated vs. the rewards collected: if your card only accumulates 1% and offers no welcome bonus, there is no need to pay a 2% or 2.9% fee. In this case, the two solutions proposed below will not bring you any benefit.

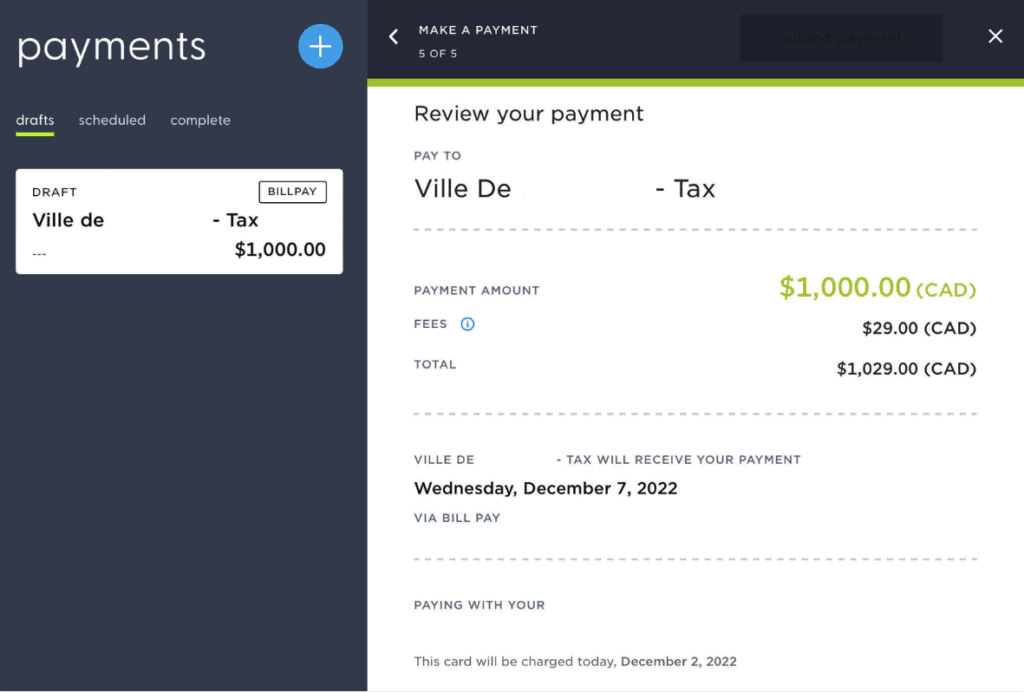

Pay your municipal taxes with Plastiq

Would you like to use a Visa or Mastercard credit card to pay your municipal or school taxes? No problem. Plastiq.com offers you this possibility. By the way, we have written a detailed article on Plastiq.

The fees charged by Plastiq vary depending on the card used. Generally, it is 2.9% for all Visa and Mastercard payments.

Paying your city taxes on Plastiq.com with a Mastercard or Visa card is also a good way to unlock the welcome bonus !

For example, the RBC Avion Visa Infinite Card requires you to spend a certain amount within the first six months to unlock the generous welcome bonus.

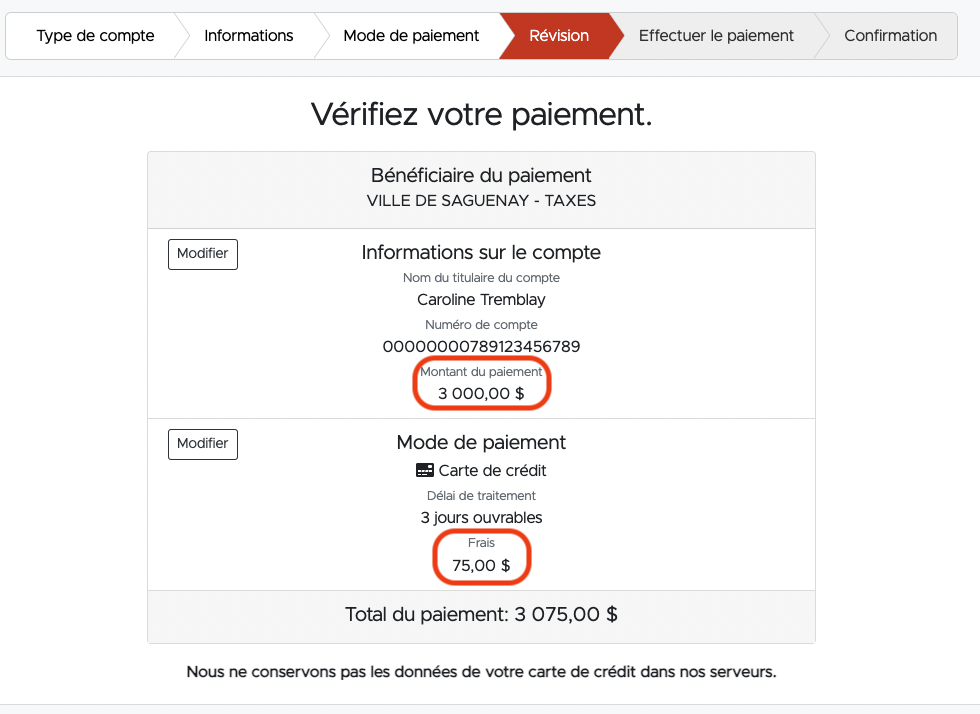

Pay your municipal taxes with PaySimply

We have written an article that describes how PaySimply works.

PaySimply is very secure and has been approved by the Canada Revenue Agency, among others (just like Plastiq). For Visa, Mastercard and American Express credit cards, the fee is 2.5% of the total bill.

For example, the TD First Class Travel® Visa Infinite* Card offers 2 points per dollar on every transaction. Right now, the welcome bonus is 135,000 points if you spend $5,000 within 180 days of opening. What’s more, the card is free for the first year.

So when you sign up for the TD First Class Travel® Visa Infinite* Card and pay $5,000 in municipal taxes via PaySimply with this new card, you’ll get:

- A high welcome bonus

- 10,000 points for spending (a $50 value in travel points)

You’ll receive several hundred dollars net as a “gift”, which puts the 2.5% fee paid via PaySimply for this transaction ($125) into perspective.

Of course, it will always be more profitable to spend this $3,000 in 3 months through other purchases – like at Costco, for example – but if paying municipal taxes can help you, why not?

Here are some other interesting Mastercard and American Express cards to use on PaySimply:

Bottom Line

Why not take advantage of the opportunity to earn points on your municipal tax payments when solutions exist?

Please note that Paysimply or Plastiq purchases charged to a BMO Rewards card do not earn rewards points. For example, with the BMO Ascend® World Elite®*Mastercard®*, you can pay your bill via PaySimply with this card.

However, this expense will not count as an eligible expense for a welcome offer or earn BMO Rewards points.