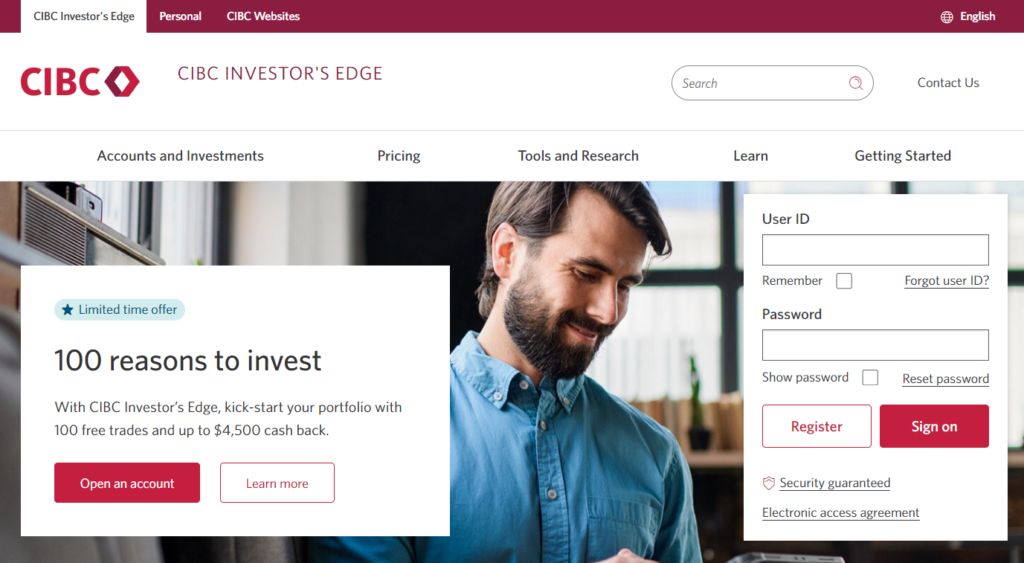

CIBC’s online brokerage service is called CIBC Investor’s Edge. It’s a trading platform that lets youinvest in the stock market and manage your own investment portfolio. Services are available via the online trading platform or the mobile application.

Whether you’re a new self-directed investor or an advanced trader, the CIBC Investor’s Edge brokerage platform offers a variety of tools and resources to help you build and manage your investment portfolio. If you’re under 25, you can even negotiate for free under certain conditions.

What services does the CIBC online brokerage platform offer?

CIBC’s online brokerage service is called CIBC Investor’s Edge. This brokerage platform allows you to invest in stocks and exchange-traded funds (ETFs) on your own, as an independent investor. It can also be used to invest in fixed-income securities and mutual funds. Several types of investment accounts are available, including registered accounts, tax-free savings accounts and margin accounts. Finally, CIBC Investor’s Edge offers a wide range of tools and resources to help you build and manage your investment portfolio. All these services are available from Investor’s Edge’s online and mobile trading platform.

Investment account types

The CIBC Investor’s Edge brokerage platform allows you to invest in the following types of investment accounts:

- Unregistered accounts (cash and margin accounts)

- Tax-Free Savings Account (TFSA)

- First Home Savings Account (FHSA)

- Registered Education Savings Plan (RESP)

- Registered Retirement Savings Plan (RRSP)

- Registered Retirement Income Fund (RRIF)

- Locked-in retirement account (LIRA)

- Life Income Fund (LIF)

Investment products

The CIBC Investor’s Edge brokerage platform allows you to trade the following investment products yourself:

- Stocks

- Exchange Traded Funds (ETFs)

- Options

- Mutual Funds

- Canadian Depository Receipts (CDRs)

- Guaranteed Investment Certificates (GICs)

- Government and corporate bonds

- Precious metals

- Initial public offering (IPO)

- Structured bills

Tools and resources

The CIBC Investor’s Edge brokerage platform helps you enhance your knowledge and optimize your investment strategy with state-of-the-art tools and resources.

More specifically, it provides you with the following tools:

- Selection tools and experts’ research

- Watch lists

- Customized alerts

- Investment tutorials

- Reliable news sources

- Technical analysis resources

- Trading on a desktop or mobile device

- A wide range of investment choices

- Various common and advanced order types

- Periodic Investment Plan (PPP) to contribute at the desired frequency and benefit from fixed-sum periodic purchases

- In-depth overview of major indexes, equities, ETFs and mutual funds

What are the fees for using the CIBC Investor's Edge brokerage platform?

To use the CIBC Investor’s Edge brokerage platform as an independent investor, there is an annual account fee (administration fee) and a trading fee (transaction fee).

Annual account fee

The CIBC brokerage platform’s annual account fees are relatively straightforward.

- If your unregistered account balance is less than $10,000, the annual account fee is $100.

- If the balance in your registered account (RRSP, RRIF, LIRA or LIF) is less than $25,000, the annual account fee is $100.

- In other cases and other account types (TFSA, FHSA, RESP), there is no annual account fee.

Finally, special pricing is available for two types of investor. The $100 annual fee on registered accounts is waived for the following investors:

- Young investor: Young investors under the age of 25 with a CIBC SmartStart chequing account.

- Student Investor : Student investors with a CIBC SmartSteps for Students chequing account.

Trading fees

Trading fees vary depending on the investment product and the type of investor you are:

| Investor | Active investor | Young investor | Student investor | |

| Stocks | $6,95 | $4,95 | $0 | $5,95 |

| Exchange Traded Funds (ETFs) | $6,95 | $4,95 | $0 | $5,95 |

| Options | 6.95 + $1.25 per contract | 4.95 + $1.25 per contract | 6.95 + $1.25 per contract | 5.95 + $1.25 per contract |

| Money market mutual funds | $0 | $0 | $0 | $0 |

| Other mutual funds | $6,95 | $6,95 | $6,95 | $6,95 |

For more information on pricing or investor types, visit the CIBC Investor’s Edge website.

How do I open an account with CIBC Investor's Edge?

To open a brokerage account with CIBC Investor’s Edge, you can do it yourself on their website or by phone. The account opening process takes just a few minutes, and it’s even faster if you’re a CIBC online banking customer.

In short, you can start investing in three quick and easy steps:

- Open an account

- Create your user code and password

- Fund your account (from a CIBC bank account, another financial institution or another brokerage platform)

CIBC Investor's Edge Customer Service

To reach CIBC Investor’s Edge customer service, you have several options, including :

- Telephone: 1-800-567-3343

- Asian language services: 1-888-366-6888

- Chat (for online account holders)

- Mailing address: 161 Bay Street, 4th Floor, Toronto, Ontario M5J 2S8

Advantages and disadvantages of Questrade

Here are the advantages and disadvantages of CIBC Investor’s Edge.

Advantages:

- No minimum balance

- No account fees for FHSAs, TFSAs and RESPs

- Reasonable trading fees (compared to online brokers at other major Canadian banks)

- Wide selection of tools and resources

- Asian language services

- Offer for young and student investors

Disadvantages :

- Trading fees for equities and ETFs (compared to some online brokers who offer no-trading fees)

- No fractional shares

- No share lending

Bottom Line

In short, the CIBC Investor’s Edge brokerage platform lets you invest in the stock market on your own, at attractive rates. Whether you’re a new self-directed investor or an advanced trader, the CIBC Investor’s Edge brokerage platform offers a variety of tools and resources to meet your financial needs and goals.

| Features | CIBC Investor’s Edge |

| Investment account types |

|

| Investment products |

|

| Trading fees |

|

| Annual account fee |

|

| Minimum balance | $0 |

| Special rates |

|

For more information, visit the CIBC Investor’s Edge website or contact customer service at investorsedge.cibc.com.

Frequently Asked Questions

Here are answers to the most frequently asked questions about the CIBC Investor’s Edge brokerage platform.

How do I open an account with CIBC Investor's Edge?

Opening a CIBC Investor’s Edge account is quick and easy. You can open an account yourself on their website or by telephone. The three steps are: open an account, create your user ID and password, and fund your account (from a bank account or other brokerage platform).

How can I invest in the stock market with CIBC?

Investing with CIBC is simple. First, you need to open an account with the CIBC Investor’s Edge brokerage platform. Next, you need to select the type(s) of investment account(s), such as a TFSA or an RRSP. Once your account is funded, you can invest in the stock market on your own as an independent investor in stocks, exchange-traded funds (ETFs) or options.

Is the CIBC Investor's Edge brokerage platform secure?

CIBC Investor’s Edge is a division of CIBC Investor Services Inc. a subsidiary of CIBC (Canadian Imperial Bank of Commerce). CIBC Investor’s Edge is a member of CIPF (“Canadian Investor Protection Fund”) and IIROC (“Investment Industry Regulatory Organization of Canada”). Finally, secure online access is protected by the CIBC Digital Banking Security Guarantee.

What types of accounts are available with CIBC Investor's Edge?

Opening a CIBC Investor’s Edge account is quick and easy. You can open the following accounts online: unregistered accounts (cash and margin accounts), Tax-Free Savings Account (TFSA), First Home Savings Account (FHSA), Registered Retirement Savings Plan (RRSP), Registered Education Savings Plan (RESP). Other registered and locked-in accounts are available, such as Registered Retirement Income Funds (RRIFs), Locked-In Retirement Accounts (LIRAs) and Life Income Funds (LIFs).

What is the profile of investors on the CIBC brokerage platform?

On the CIBC brokerage platform, there are 4 typical investor profiles: investor, active investor, young investor and student investor. Trading fees and annual account fees vary according to these investor profiles.

Are FHSAs and TFSAs available at CIBC Investor's Edge?

Yes, the First Home Savings Account (FHSA) and the Tax-Free Savings Account (TFSA) are available through the CIBC Investor’s Edge brokerage platform. CIBC Investor’s Edge and CIBC Securities also offer Registered Retirement Savings Plans (RRSPs) and Registered Education Savings Plans (RESPs).