We always tell you in the facebook group “Travel for free (or almost…!) with your points & miles – milesopedia” to have a game plan to start your points & miles hunt! I took the time to write and share with you today what our game plan will be for 2019!

Our goals to date with points & miles

Those who know me personally, know that “I love… what makes me dream and make my family enjoy it”!

Indeed, in my hunt for points & miles, I have always sought to travel:

- if possible in business class (and with my children!)

- or even in First Class (without the children!),

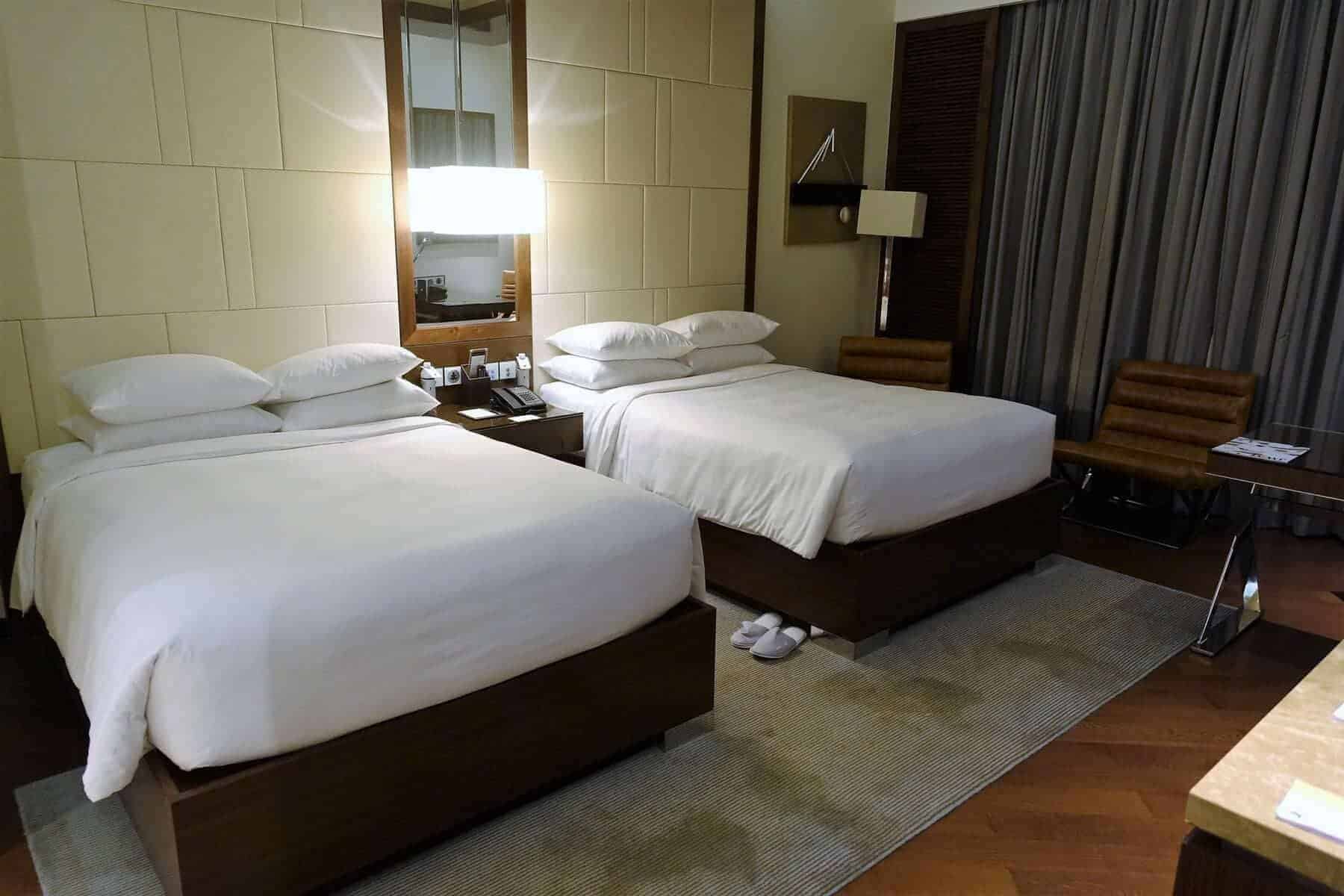

- while staying in palaces (or big hotels with a nice view)!

In fact, I’m looking to use my points & miles to buy things that I couldn’t necessarily afford with my own money!

To achieve this:

- American Express Membership Rewards points, combined with Aeroplan,

- and the Marriott Bonvoy program – linked to the two Marriott Bonvoy credit cards

…have been my true allies until today!

But here’s the thing: many credit card offers keep shrinking and we’re still waiting to see what will come out of Aeroplan after the purchase by Air Canada, CIBC, TD and Visa is finalized soon.

AIR MILES seems to be doing well. So I decided to tackle it knowing that I am also diversifying my points & miles portfolio to meet my new reality as a “family man”.

Diversification of our points & miles portfolio

I am now looking to diversify our points & miles portfolio. I say “our” because I manage mine… and Audrey’s, my wife.

Indeed, as the children become “grown up”, they must now each have an airline ticket in their name, whereas until their 2nd birthday, only an extra $50 to $100 was required for Aeroplan air rewards: the beautiful bargain will end soon, our youngest arriving on his 2 years.

So I have to diversify our points & miles portfolio to keep up with this new reality!

Earning Marriott Bonvoy points

I continue to be a strong supporter of Marriott Bonvoy (the late Marriott Bonvoy / Marriott Bonvoy).

After all, American Express still distributes

credit cards linked to this program

and the bonuses – while not as generous as in the past – still allow for “free” nights at many hotels around the world!

And there is an argument that struck a chord in my ear among the comments in the facebook group “Travel free (or almost…!) with your points & miles – milesopedia”:

A hotel room can be shared by 4 people… but an airplane seat cannot! Thus, accumulating 200,000 Marriott points to afford 10-20 nights in hotels for 2 adults and 2 children… will be much more lucrative than accumulating the equivalent amount of miles at Aeroplan… to afford only one plane ticket!

And since the last few months, the points bonuses have been decreasing on the Membership Rewards/Aeroplan side, so it’s getting harder to accumulate points!

After all, there will always be a number of credit cards that allow you to earn points to offset the cost of your airfare (in economy) such as the Scotiabank Passport™ Visa Infinite* Card or the BMO Ascend World Elite Mastercard.

Audrey and I are actively (re-)launching the direct accumulation of Marriott Bonvoy points with the sign-up bonuses of the two credit cards.

In addition, we continue to earn American Express Cobaltᵐᶜ Select Card Membership Rewards points, which we transfer to our Marriott Bonvoy account as needed.

5 Select Membership Rewards points / dollar spent in grocery stores – convenience stores (read: gift cards) – restaurants, that allows to accumulate 6 Marriott points / dollar!

Earning Best Western Rewards points

We have also decided to earn Best Western Rewards points via the Best Western Rewards MasterCard. The bonus is very easy to get since it only takes one spend on the card. And the card is free, what more could you ask for?

In addition, points can be combined into one account by simply calling Best Western Rewards.

|

|

| Name / Card | The Mastercard credit card Best Western Rewards |

| Annual fee | No annual fee |

| Bonus | 20,000 Best Western points |

| How to earn eUpgrade Credits | after the first purchase |

| application | [button color=”blue” size=”medium” link=”https://milesopedia.com/go/mbna-bestwestern” icon=”fa fa-credit-card-alt” target=”false”]Subscribe[/button] |

Collecting AIR MILES miles

Of course, I saved “the juicy part” for last: our planned AIR MILES mileage accumulation for 2019!

There are two types of AIR MILES collectors:

- The one who swears by AIR MILES DREAM miles like Serge

- The one who swears by AIR MILES MONEY miles like Chantal

You can’t say that one is more right than the other: they are both equally good!

Still, their AIR MILES mileage accumulation statistics are simply incredible: around 20,000 AIR MILES miles per year for a couple.

Reported in SILVER miles, we are talking about a value of over $2,000. In DREAM miles, this can be worth anywhere from $2,000 to $4,000 (or even more) depending on how you use it!

But… how do they do it?

Via shopping offers

AIR MILES regularly conducts shopping offers to collect many bonus miles such as the Neighborhood Spin where you can easily earn 2,000 AIR MILES miles, or the Mega Miles offer.

Our DREAM miles collector was telling us he gets around 2,500 miles a year. While our SILVER mile fan (who uses several of his children’s AIR MILES cards) is racking up bonuses during these shopping sprees!

Via credit card offers

And of course, the best source for earning AIR MILES miles is through AIR MILES credit card offers. And we’re in for a real treat right now, with AIR MILES trying to attract Aeroplan’s disappointed customers (and not lose ground to the new Optimum program)!

As many readers have pointed out in the facebook group “Travel free (or almost free…!) with your points & miles – milesopedia”, it is possible for spouses to sign up for an AIR MILES credit card by indicating a “common” AIR MILES account number. This makes it much easier to accumulate miles in one account… so you can use them easily!

Our couple’s strategy for earning points in 2019

So here is OUR couple strategy for credit card underwriting for 2019.

January 2019: the first wave of credit card subscriptions for Mrs.

| FIRST CARD SUBSCRIBED | |

| Card |  |

| Page | The BMO AIR MILESMD MasterCardMD World EliteMD |

| Bonus | |

| Fee | |

| application | [button color=”blue” size=”medium” link=”https://milesopedia.com/go/bmo-airmiles-world-elite” icon=”fa fa-credit-card-alt” target=”false”]Subscribe[/button] |

| SECOND CARD SUBSCRIBED | |

| Card |  |

| Page | American Express® AIR MILES®* Platinum Credit Card |

| Bonus | 2,000 miles |

| Fee | 65$ |

| application | [button color=”blue” size=”medium” link=”https://milesopedia.com/go/amex-airmiles-platine” icon=”fa fa-credit-card-alt” target=”false”]Subscribe[/button] |

| THIRD CARD SUBSCRIBED |

|

| Card |  |

| Page | The BMO® AIR MILES® Mastercard®* card |

| Bonus | Promo 800 miles |

| Fee | $0 |

| application | [button color=”blue” size=”medium” link=”https://milesopedia.com/go/bmo-airmiles” icon=”fa fa-credit-card-alt” target=”false”]Subscribe[/button] |

| Total miles earned | 5,800 AIR MILES miles |

| Accumulated contributions | 65$ |

January 2019: the first wave of credit card subscriptions for Mr.

| FIRST CARD SUBSCRIBED | |

| Card |  |

| Page | The BMO AIR MILESMD MasterCardMD World EliteMD |

| Bonus | |

| Fee | |

| application | [button color=”blue” size=”medium” link=”https://milesopedia.com/go/bmo-airmiles-world-elite” icon=”fa fa-credit-card-alt” target=”false”]Subscribe[/button] |

| SECOND CARD SUBSCRIBED | |

| Card |  |

| Page | American Express® AIR MILES®* Platinum Credit Card |

| Bonus | 2,000 miles |

| Fee | 65$ |

| application | [button color=”blue” size=”medium” link=”https://milesopedia.com/go/amex-airmiles-platine” icon=”fa fa-credit-card-alt” target=”false”]Subscribe[/button] |

| THIRD CARD SUBSCRIBED |

|

| Card |  |

| Page | The BMO AIR MILESMD Corporate MastercardMD |

| Bonus | |

| Fee | |

| application | [button color=”blue” size=”medium” link=”https://milesopedia.com/go/bmo-airmiles-entreprise” icon=”fa fa-credit-card-alt” target=”false”]Subscribe[/button] |

| Total miles earned | 8,000 AIR MILES miles |

| Accumulated contributions | 65$ |

Assessment of the first wave of couple subscriptions

So all in all, by the end of March 2019, we should have accumulated through credit card bonuses just over 13,800 AIR MILES miles…for a derisory cost of $130! If we add the miles obtained via the expenses necessary to trigger the bonuses we will be around 15,000 miles.

Via credit cards and shopping offers, we will easily reach 20,000 AIR MILES miles in 2019.

Our future use of these AIR MILES miles

As we regularly tell you, you need to have a game plan for using your points & miles.

Children growing up, our goal is to be able to save money on travel-related activities (e.g., admission to theme parks such as Disney World) or on short-haul flights for extended weekends in the Maritimes, for example (by taking advantage of the companion ticket of each of our BMO AIR MILES World Elite Mastercard).

So we’re going to focus on the DREAM version of AIR MILES.

I think I will be able to withdraw around 20 cents / AIR MILES mile, which should save me around $4,000 on AIR MILES travel / DREAM products.

4,000 obtained for a “low” financial investment on our part ($130 in credit card fees) and an average investment in time (finding the right AIR MILES offers during shopping campaigns).

In this respect, the solidarity on the facebook group “Travel for free (or almost…!) with your points & miles – milesopedia” will be very useful!

2019 in milesopedia family What does this look like?

So, 2019 should be all about: AIR MILES + Marriott Bonvoy + Best Western Rewards. Of course, if bonuses from Membership Rewards, Aeroplan or other sources were to come out, we would be ready to get them!

If you’ve read the article this far, you should have a little idea of my 2019 game plan numbers!

|

|

|

|

| Points | 20,000 miles | 240,000 points | 80,000 points |

| Estimated valuation | 4 000$ | 2 400$ | 600$ |

| Cumulative contributions | 130$ | 540$ | $0 |

| Approx. net valuation | 3 870$ | 1960$ | 600$ |

| Total | 6 430$ | ||

Bottom Line

I still continue to accumulate American Express Membership Rewards points – which I believe is one of the best point currencies in the Canadian market and makes it a “safe haven” value.

But I’m going to try to make 2019 about diversification… and optimizing our points & miles portfolio as a “good father “!

What about you, what’s your game plan for 2019? Come and share it in the facebook group “Travel for free (or almost…!) with your points & miles – milesopedia”!