How to save even more with an electric vehicle

With the popularity of electric vehicles, financial institutions have started to offer an incentive to their credit card customers.

I got my first electric car in 2014. Since then, I’ve seen many changes in this wonderful universe. In addition, bonus cash back or extra points for the category of electric vehicle charging have been introduced.

In fact, I’ve done an in-depth analysis of the accumulation category on purchases of charges at electric charging stations.

Example of savings on electrical charging

Cash back with a CIBC Dividend Card

Since spring 2023, CIBC has led the electric vehicle charging category. Actually, CIBC credit cards are among the most generous when it comes to paying for electric vehicle recharging!

For example, the CIBC Dividend® Visa Infinite* Card offers 4% cash back on eligible electric vehicle charging costs.

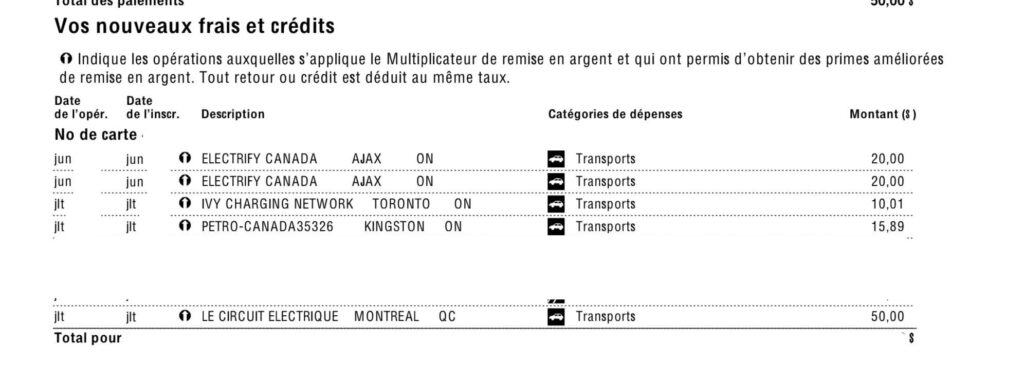

Lately, I’ve been using different networks of charging stations and the cost has been :

| Network | Cost |

| Circuit Electrique | $ 50.00 |

| IVY (OnRoute in Ontario) | $ 10.01 |

| Petro-Canada | $ 15.89 |

| Electrify Canada | $ 40.00 |

| Total | $ 115.90 |

So, with the CIBC Dividend® Visa Infinite* Card‘s 4% cash back, I earned $4.64. This rebate is the equivalent of having charged my car on the Circuit Électrique network for :

- 7 minutes at a 100kW fast-charge station, at the highest wattage (at a rate of $36.87/h X 7 minutes)

- 10 minutes at a 50kW fast-charge station (rate of $25.52/h X 10 minutes)

Plus, there’s a Digital Exclusive Offer† to get even more with the CIBC Dividend® Visa Infinite* Card:

CIBC Dividend® Visa Infinite* Card

The CIBC Dividend® Visa Infinite* Card is one of the best Visa credit cards with cash back in Canada.

Right now, with our exclusive welcome offer, get a 10% welcome bonus in the form of up to $250 cash back (period covered by your first 4 statements). And you’ll get a first-year annual fee rebate†!

With this CIBC Cash Back Credit Card, you get:

- 4% cash back on gas, EV charging, and grocery purchases†

- 2% cash back on eligible transportation, dining purchases and recurring payments†

- 1% cash back on all other purchases†

For example, if you spend $1,000 per month on groceries and/or gas and/or electric vehicle charging, you’ll earn $40 cash back per month or $480 cash back per year with this card for this category of purchases!

And that’s not counting the other purchases you’ll make with this card and the advantages it offers (particularly in terms of insurance).

And this CIBC Cash Back Credit Card offers many insurance coverages:

- Auto Rental Collision/Loss Damage Insurance

- $500,000 Common Carrier Accident Insurance

- Out-of-Province Emergency Travel Medical Insurance

- Purchase Security and Extended Protection Insurance

More points with a CIBC Aventura Card

Using the same example as above, a CIBC Aventura® Visa Infinite* Card gives 1.5 points for every dollar spent at eligible electric charging stations.

So I would have earned 174 Aventura points. Knowing that Milesopedia values an Aventura point at 1.2 cents, I got the equivalent of $2.09.

Aventura points can then be used to pay for a hotel room or any other eligible travel expense.

How to pay for a electric charge with a credit card

Payment for electric recharging is made by credit card, via the recharging network’s mobile application. Simply add your credit card number to your profile in the mobile application or on the website.

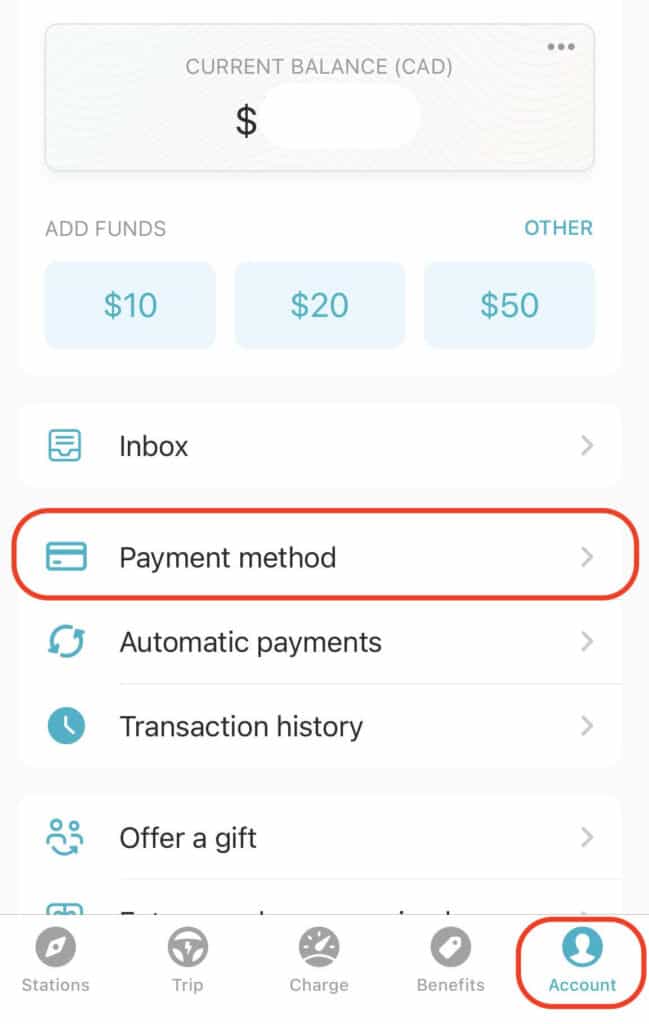

As, for example, in the case of Circuit Electrique:

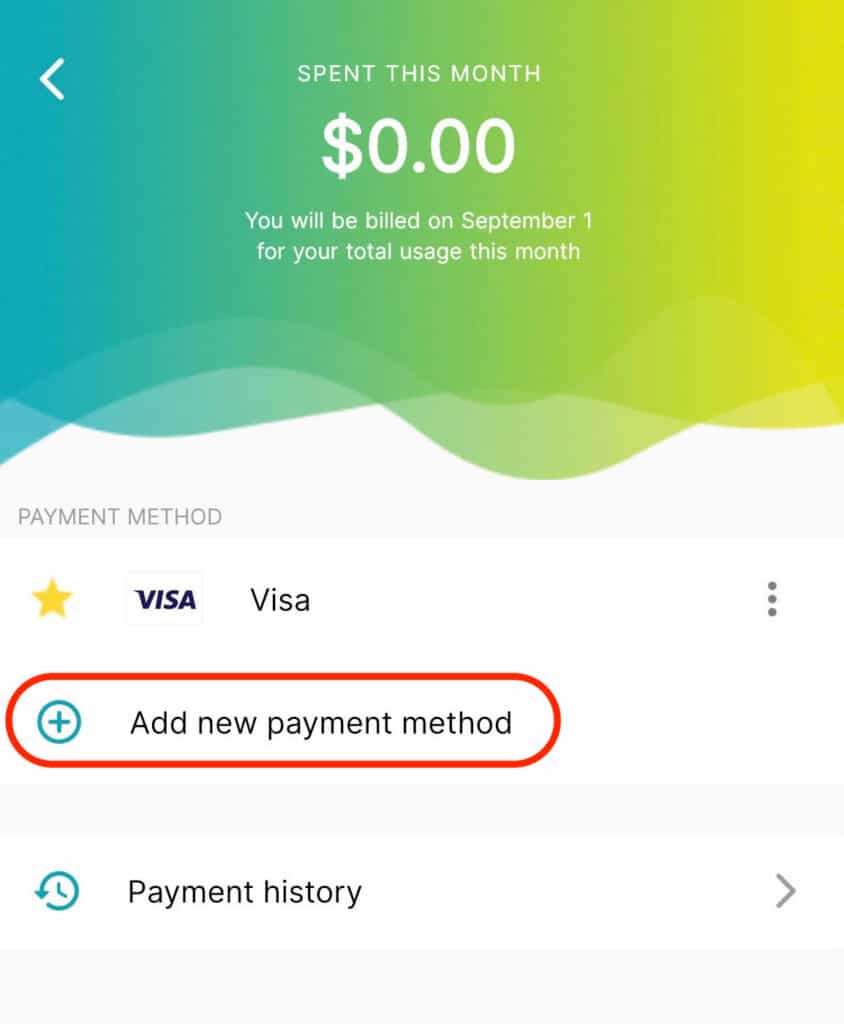

Or the IVY electric charging network:

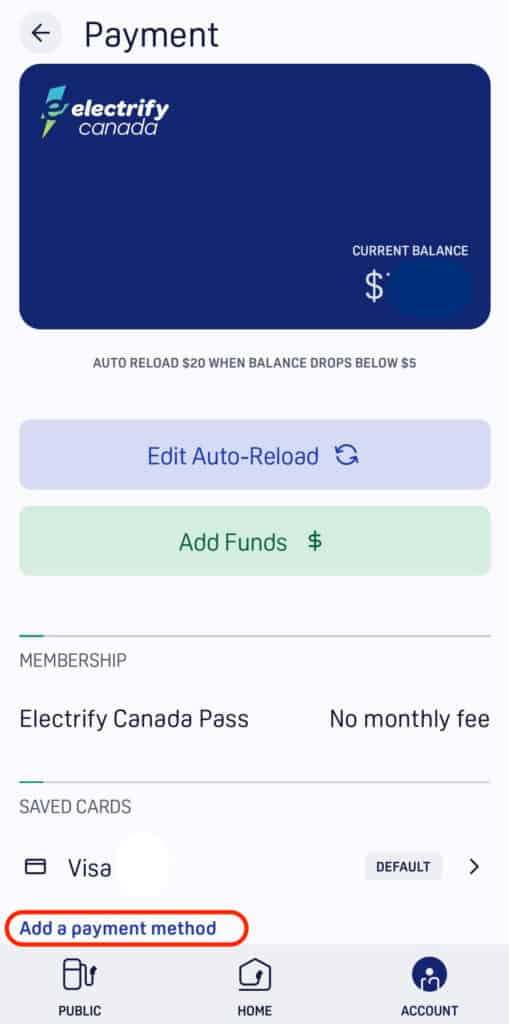

And here’s where to enter your credit card information to pay the cost of a charge with Electrify Canada:

Bottom Line

Of all the credit cards on the market today, CIBC Visa credit cards are among the best for paying for EV charging at public charging stations.

They offer the best return in points or cash back, thanks to their higher earning rate for EV charging.

But the one that gives the most is the CIBC Dividend® Visa Infinite* Card, with its 4% cash back! You can’t beat it.

Above all, it’s very important to pay your credit card balances in full every month. Otherwise, all your savings will be wiped out by interest charges.

The opinions and personal experiences expressed in this article are mine alone and do not represent the views of CIBC.