EQ Bank - History

EQ Bank is an entity of Equitable Bank, a financial institution with over 50 years of experience.

EQ Bank has no physical headquarters, and its financial activities are conducted online. This saving on rental fees allows EQ Bank to offer different financial products with excellent interest rates to all Canadians, including Quebec!

EQ Bank offers top-notch collateral, and all deposit products are eligible for CDIC deposit insurance.

The EQ Bank mobile application is available on the App Store and Google Play.

EQ Bank - Products

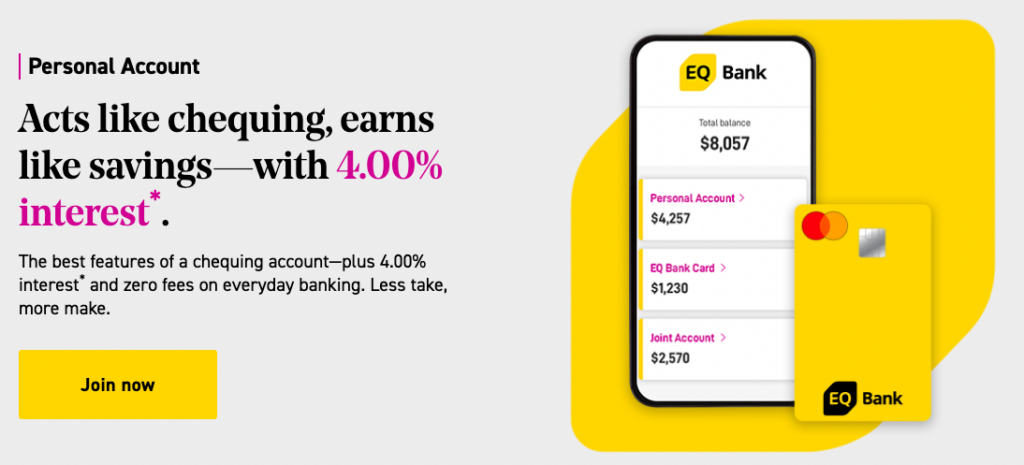

EQ Bank - Personal account

The EQ Bank Personal Account (formerly known as the Savings Plus Account) is a no-fee account that offers a generous 4.00%* interest rate to all customers on everyday banking services:

- 2.50% interest on everyday banking services

- Plus 1.50% bonus interest* when you direct deposit your pay

This account also offers several free features, such as:

- Interac e-Transfers®

- Everyday banking operations

- Bill payments

- Deposits and withdrawals

Finally, there is no minimum balance required for this type of account.

Banque EQ - Joint account

The EQ Bank Joint Account offers its customers an interest rate of 4%*. The advantages of this financial product are the same as those of the savings account, while many free financial services are offered to customers:

- Interac e-Transfers®

- Everyday banking operations

- Bill payments

- Deposits and withdrawals

It’s also important to specify that you need to meet a few criteria to benefit from the advantages of this account for your daily transactions. These are the criteria:

- Canadian Resident

- Age of majority in the province

- Have a social insurance number

You can add up to 3 people to your EQ Bank Joint Account.

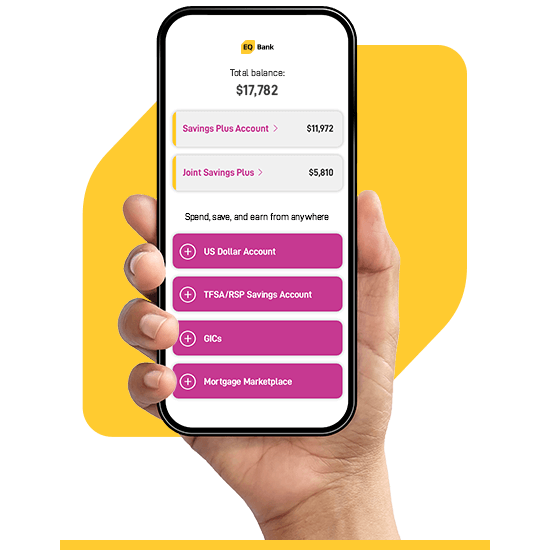

EQ Bank - TFSA Savings Account

The EQ Bank TFSA Savings Account offers an interest rate of 3.00%*. There are no management fees.

The free features are the same as the two previous accounts.

Remember that there are annual contribution limits for the TFSA ($6,000 in 2022, and $6,500 in 2023).

It is also possible to purchase GICs (Guaranteed Investment Certificates) for your TFSA.

Guaranteed investment certificates are safe, low-risk investments with stable returns. It should be noted, however, that once the money is deposited in this account, it is advisable to keep it there until the end of the GIC, otherwise you will be subject to penalties.

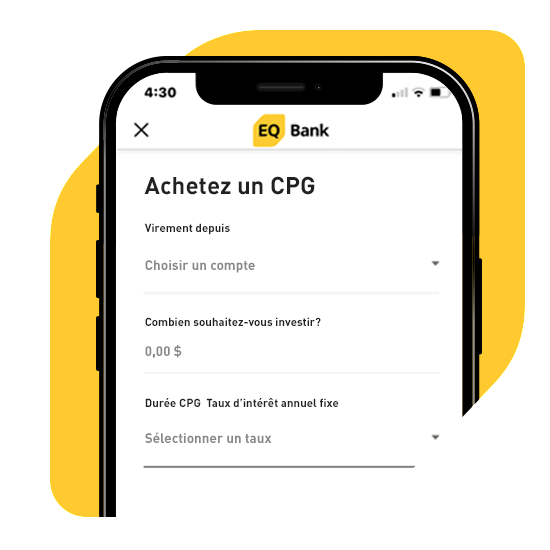

EQ Bank - GICs / Guaranteed Investment Certificates

EQ Bank offers a wide range of Guaranteed Investment Certificates (GICs).

Investing cash in registered (TFSA in Quebec and TFSA/RRSP elsewhere in Canada) and non-registered accounts is possible.

The terms of this financial vehicle are very flexible, as EQ Bank offers no less than 13 different options. The interest rates offered are also attractive.

Right now, you could get 5.35%* for a 1-year TFSA GIC.

Note that a minimum deposit of $100 is required to purchase GICs. Finally, it is important to note that users will benefit from Canada Deposit Insurance Corporation protection when purchasing guaranteed investment certificates with EQ.

EQ Bank - Mastercard

EQ Bank also offers a prepaid card: the EQ Bank Card.

With the EQ Bank Card, you get:

- A prepaid Mastercard (usable at Costco)

- Free ATM withdrawals in Canada

- 0.5% cash back on all expenses

- No Foreign Transaction Fee

It stands out with its advantageous interest rate of 4%, the same as on the Personal Account, which is applied to the card balance until it is spent.

EQ Bank - Products not available in Quebec

It should be noted that EQ Bank does not currently offer the following products in Quebec:

- US Dollar Account

- International money transfer

- RRSP Savings Account

- RRSP GIC

- The transfer function between EQ accounts

Bottom Line - Review

The arrival of EQ Bank for Quebec residents is great news! This adds competition to our banking market by offering attractive products with no monthly fees, along with its digital banking services. Both to use your money and to save it.

Do you want to open an account with EQ Bank? It’s easy, click on one of the links below and open your account in a few clicks:

Legal notice:

*Interest is calculated daily on the total closing balance and paid monthly. Rates are per annum and subject to change without notice.

◊ Based on research conducted by Equitable Bank comparing interest rates of base savings accounts offered by Canada’s ‘Big 5’ banks. Rates were compared using a ratio analysis. Research is based on savings account interest rates taken from public websites as at October 3, 2022. Promotions and Rate Premiums are excluded.

®Registered trademark of Interac Corp, used under license.

How can I get an EQ Bank card?

The EQ Bank credit card is the EQ Bank Card.

You can see all its features and how its cashback works on this page.

What is the EQ Bank?

The EQ Bank credit card is the EQ Bank Card.

You can see all its features and how its cashback works on this page.

How can I reach EQ Bank Customer Service?

By phone, toll-free in North America: 1-844-437-2265

Or if you’re outside North America: 1-416-551-3449

The address of the EQ Bank is :

EQ Bank – Digital banking

30, avenue St. St. Clair West, Suite 700,

Toronto, Ontario M4V 3A1

What's the difference between the EQ Bank and the Equitable Bank?

Equitable Bank, with its lending services and investment solutions, owns EQ Bank, a digital bank in Canada.