Travel may be on ice for many, with inflation and rising interest rates persisting.

As a result, reward points balances can be very high.

Did you know that it is possible to use credit card points to invest?

Investing with our credit cards points

Many institutions offer the possibility of using your reward points directly to invest, whether for savings orfinancial independence.

Saving with points

Investing is a great way to take advantage of reward points when there is no travel goal in sight.

Although the redemption rate is still higher when used for travel expenses, remember that points can also be seen as “sleeping money”.

Reward points for financial products

Consider the rate example for National Bank of Canada.

With 60,000 points, they can be redeemed for a $500 contribution to a TFSA account to invest.

When compared to the “best rate” of 55,000 points for a $500 travel discount, at first glance, the points are not optimized. In fact, you “lose” 5,000 points, or a value of ~$45.

On the other hand, if there’s no trip on the horizon, it may be preferable to put that $500 to work, optimize our tax return or pay off debts (mortgage, line of credit, etc.) rather than leave it in the form of points.

According to Goldman Sachs Bank, the average annual return of the S&P 500 has been about 9.2% for the past 140 years.

Redemption rates for investing

To access financial products, you will need to open an account and become a customer of the bank.

Here is the number of points required by each financial institution to invest or reduce your debt.

| Program | Financial products offered | Exchange rate for financial products | Travel Discount Redemption Rates (Comparative) |

| NBC À la carte |

|

12,000 points = $100 |

12,000 points = $100 or 11,000 points = $100 when redeeming over 55,000 points |

| RBC Rewards |

|

12,000 points = $100 |

15,000 points = $150 or 15,000 points = up to $350 for an airline ticket |

| CIBC Aventura |

|

12,000 points = $100 |

10,000 points = $100 or 10,000 points = up to $400 for an airline ticket |

| BMO Rewards |

|

15,000 points = $100 | 15,000 points = $100 |

| Desjardins BONUSDOLLARS |

|

1 BONIDOLLARS = $1 | 1 BONIDOLLARS = $1 |

| HSBC Rewards |

|

25,000 points = $100 (mortgage account 25,000 points = $75 (savings account) |

25,000 points = $125 |

As can be seen, some of the exchange rates are close to what you can redeem against credit to the account on travel expenses.

At the start of the pandemic, I had liquidated the majority of my reward points in order toincrease my savings contributions and invest.

During an 18-month period when I was grounded, my investments grew over 20%.

Since we didn’t know when we could travel again, I found another way to make those points worthwhile despite a slightly disadvantageous exchange rate in the first place.

If you’re facing a significant increase in mortgage payments with skyrocketing rates, you can turn to your points to ease the burden.

Indirect methods for investing with points

However, when there’s a trip on the horizon, it’s really best to redeem reward points for travel discounts. Then, invest the amount saved.

Having the right mindset

It’s just a matter of perception, but there are two ways to look at it:

- our trip costs less, so we have more money available for other purchases

- our trip costs less, so we have more money available to invest or save

The basic rule of travel hacking, let’s remember, is not to create needs.

So, to maximize your points and your budget, you need to use your points and cash back on expenses you would have made anyway.

Money is money

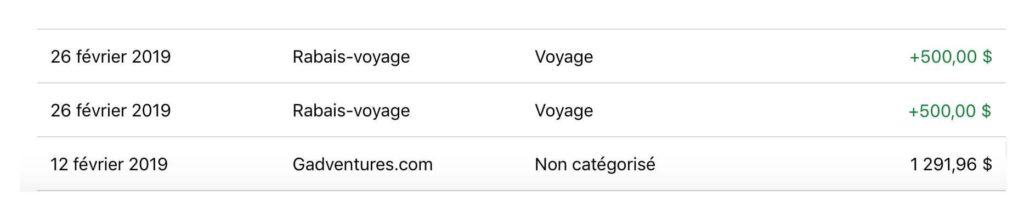

During my trip to Turkey, I had booked a tour package with G Adventures. With them, there are several ranges of service for the same journey.

I carefully chose the one that suited me and then applied my National Bank rewards points to the fees.

Again, I selected the tour that satisfied me and not a more luxurious tour just because I had a “big discount”.

Secondly, would I have gone on the trip even if I didn’t have so many points? In my case, the answer is yes.

So by using my points to reduce the cost of my tour, I saved a $500 that I was going to inject into this trip anyway. So I deposited that same amount into one of my investment accounts.

This thinking applies to all reward point programs, but also to cash back. Credit cards allow me to save money while pursuing my dream trips.

Unlike direct methods, this allows me to invest my savings anywhere : Wealthsimple, Questrade, my bank’s brokerage platform, etc.

This is custom heading element

Bottom Line

More cash thansk to credit cards points? More money to invest to eventually achieve financial independence while enjoying life to the fullest.