How to get US credit cards?

In this article, you will find out more about my own experience that started in July-August 2017. In January 2024, I’ll be on my 7th U.S. credit card, and my U.S. credit score is 780.

Some processes have changed since then (notably the need for an SSN or ITIN when applying for an American Express credit card through Nova Credit), but the main rules are still there.

Before you start

How does credit work in the United States?

Whether in Canada or the United States, your credit history is generally linked to your Social Insurance Number (SIN in Canada, SSN in the United States), as well as other information such as your first and last name, residential addresses or past and present employment.

SIN and SSN both have nine digits. But a very important reminder: don’ t use your Canadian Social Insurance Number (SIN) instead of the U.S. Social Security Number (SSN) when applying for credit cards.

Indeed, if your SIN were to match an existing SSN of an American resident, you would be committing identity theft here, which can be dramatic for the person from whom you are “borrowing” the SSN!

If you don’t have an SSN for your US credit cards applications, you may need an ITIN: the Individual Taxpayer Identification Number as we will see below. This will allow you to apply for credit cards from other institutions outside of American Express and can greatly facilitate your application process.

Hold at least one American Express card in Canada

The key to starting credit cards applications in the United States is to have held an American Express card in Canada for at least 90 days.

If not, check out this page to find the best American Express Credit Card that can meet your needs.

The main rules to know in the United States

Choose your first U.S. credit cards wisely. Remember that you will be starting from scratch on your credit report.

Therefore, it will be advisable to start with a credit card that you will keep for many years to improve your credit history. While the natural choice might be to go for a credit card with no annual fee, you’ll see further down the road that it’s also possible to start differently.

Also, be aware that one issuer monitors the number of credit cards on your credit report: Chase. A rule has been established: 5/24. This means that you will not be able to get credit cards from Chase if you have opened more than 5 credit cards in the last 24 months from any one issuer.

One way to avoid this: corporate credit cards. Most of these cards are not on your credit report and therefore do not fall under the 5/24 rule.

An address in the United States

Before you begin your first U.S. credit card application, you will need to have a U.S. mailing address.

Two solutions:

- A home in the United States (your own or from friends or family)

- A mail forwarding service

A home in the United States

This is by far the simplest and safest solution. Having a home in the United States (as Snowbirds often do).

Alternatively, if your friends or family agree, use their mailing address as your U.S. address.

Even better: ask them to add you to their electricity account in order to have a document that “proves” you live there!

Your credit cards envelopes will arrive directly at this address and you can ask them to send them to you in Canada (while asking them to take pictures of the cards so that you can use them immediately on the Internet or through Apple Pay).

This is the solution I chose with friends in San Francisco after experimenting with mail forwarding services for a while.

Mail forwarding service

In 2017, there were several mail forwarding services such as Mymallbox. But since then, most of these services have been excluded by the credit cards companies and reported as “Commercial Mail Receiving Agency” to the USPS.

The only solution that always seems to work is 24/7 Parcel.

This company is located in Niagara Falls and charges an annual fee of US$90 to rent a mailbox. And you will pay a reasonable fee of $2 to $3 to get every piece of mail forwarded to Canada.

A bank account in the United States

You also need a bank account in the United States in US Dollars.

The top 3 banks providing cross-border services are RBC, CIBC and TD. Desjardins also offers to open an account at a Florida branch of Desjardins Bank. But the process is only done in a branch (in Canada or Florida) and the costs are significant.

Having most of my accounts at TD, it made sense for me to deal through TD. Please note that you do not need to be an existing TD customer in Canada to open an account with TD Bank USA (but it will make the process much easier).

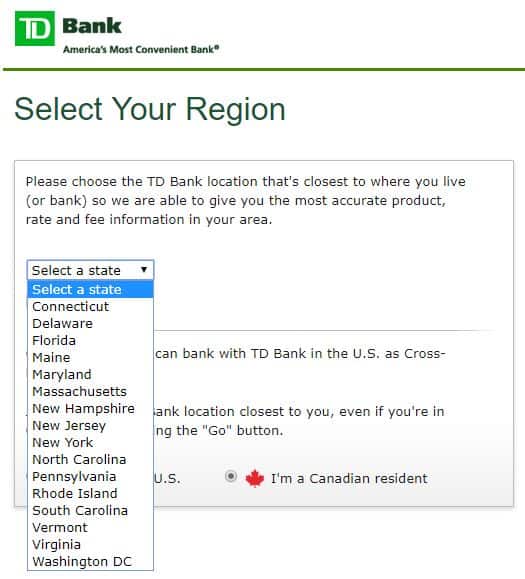

The account will be opened directly with TD Bank U.S.A. via this link. You will then be presented with a page asking you in which state you wish to open your account and your status (US or Canadian resident).

I personally chose to open my account in Burlington, Vermont. Please note that you will not have to take any local steps: everything will be done online, by mail or by phone.

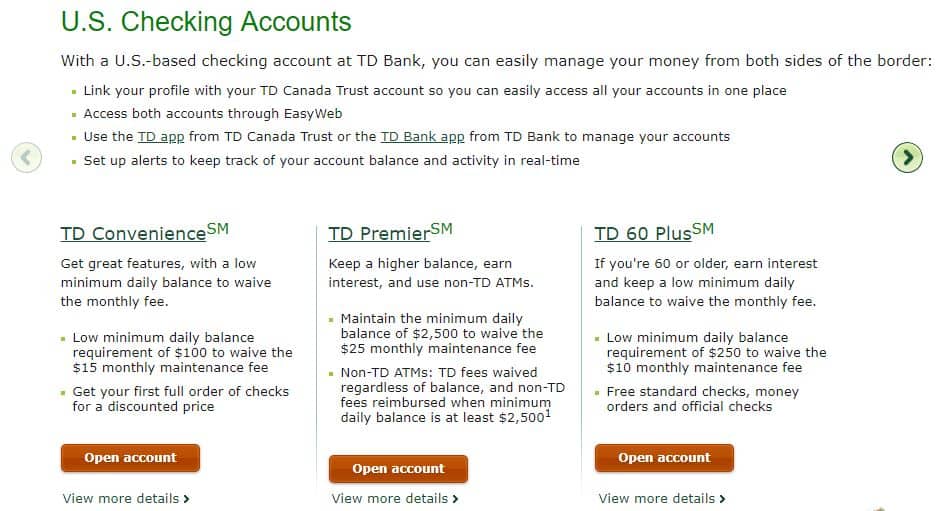

Once you have defined the state and city, you will need to choose the type of account. I chose the “TD Convenience” basic account: as long as you keep $100 US on it, there are no fees!

You then follow the different steps to get your account. At the end of the process, write down your account information so that you can make an initial deposit of US$100 to avoid any fees!

A currency transfer service from Canada to the United States

In order to pay your credit cards bills, you will need to go through your new U.S. bank account.

You may very well choose to use your Canadian bank account to fund this U.S. bank account. But generally the (transfer and conversion) fees will be much less advantageous than those provided by other providers (as you will see below).

After looking at the different services and rates/fees, I chose Wise. Moreover, when we talk about it on the Facebook group, many readers also trust this service.

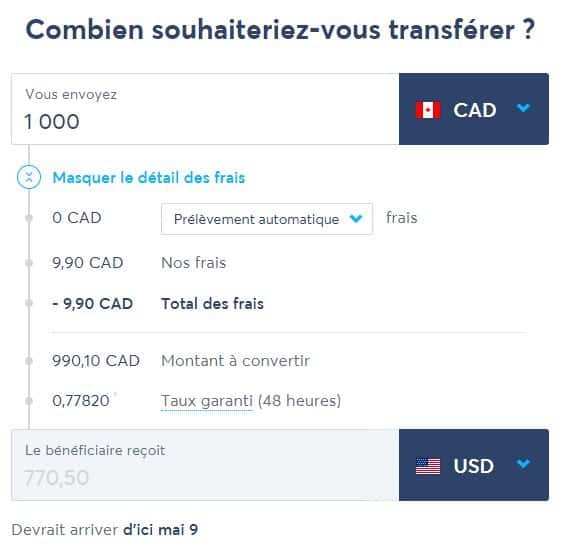

Take a look at the example of a transfer of CA$1,000. After deducting Wise’s fees (CA$9.90 for this transfer amount), you’ll receive US$770.50. Note that this rate is locked for 48 hours!

See what the market rate was at the time of writing this article (consulted on xe.com):

We appreciate Wise’s transparency: the rate displayed is indeed the market rate, and the fees charged for the service rendered are clear!

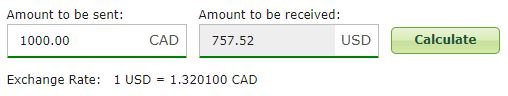

And for the record, what was the rate TD offered for a transfer from my Canadian account?

Please note that here, the rate displayed by TD includes the fee charged by the bank. In the end, compared to Transferwise, you lose about $13 when trading via TD! Imagine for a bigger amount!

The Global Transfer process for the first card

Once you have your mailing address, your bank account and your American Express Canada credit card in hand, you can finally apply for your first credit card in the United States!

With the Global Transferprocedure, you don’t need an SSN or ITIN.

American Express Global Transfer: the process

Details of the American Express Global Transfer can be found on this page or in the capture below.

Note that American Express USA asks for information on:

- Your current (Canadian) American Express card number

- Your address in the United States

- Your U.S. phone number (a Canadian number works)

- Your U.S. bank account

- Your passport, SSN or ITIN

- Your job information

Now you understand why we needed to do all of the above for the U.S. address and U.S. bank account.

American Express USA will verify all information, including banking information (by calling your bank in the United States).

Regarding employment information, just mention that you will be transferred to the United States by your employer.

Personally, I gave my Canadian employment information and had no problems.

The Global Transfer Process

The process is very simple:

- On the American Express USA website, choose the card you want

- You apply for it. In the application process, you mention the American Express card you already hold (in this case, any Canadian American Express card that has at least 3 months of transaction history).

- You complete the application

Once the application is submitted, you might be lucky and have it immediately approved. It could also be put on hold (or worse, rejected), in which case you will have to call the special American Express Global Transfer service at 1-877-621-2639.

Personally, I had to call and the process only took five minutes: it was a verification of information concerning your Canadian credit report, linked to your American Express Canada card.

This process will only be done once: then, once established, it is your credit score in the United States that will allow you to obtain other cards from American Express!

Which credit card should I apply for first?

I advise you to start with a card that will be free of charge from year to year. This will allow you to keep it and build your credit history in the United States with it.

That’s what I did when I signed up for the American Express EveryDay Card. It’s part of the Membership Rewards program. It’s free year after year and offers you a nice little welcome bonus to get you started.

Once you have reached the requested expenses, you will get the bonus on the next statement.

But you can also start with an American Express credit card with an annual fee and after one year make a product change to a card without an annual fee.

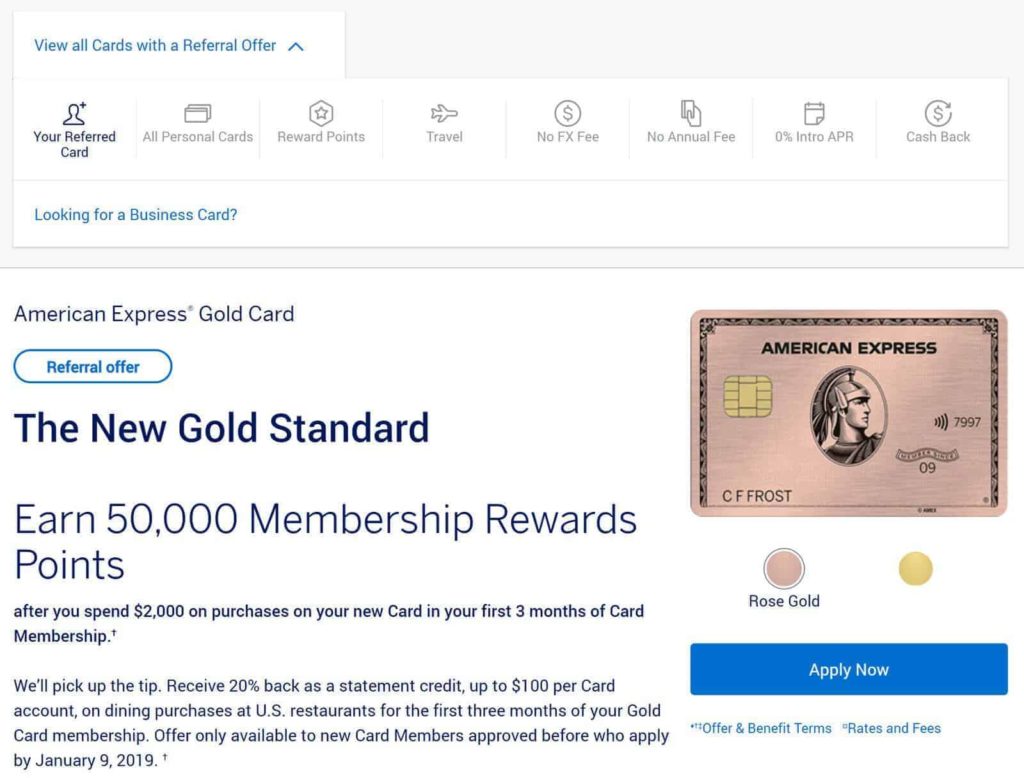

Here are our referral links for various US credit cards:

What second credit card should I apply for?

After a few months, you can apply for other American Express cards. It is important to continue to spend regularly on your American Express Credit cards or you will not be able to apply for new cards!

The choice is vast. Here are the two favourites that I plan to keep even though their costs are high: the benefits provided by Hilton Honors and Marriott Bonvoy more than compensate for them every year.

After clicking on the Apply button, feel free to check the“View All Cards With A Referral Offer” link to see all the referral options available to you.

After 2 to 3 American Express cards, it will be time to switch to cards from other issuers, including Chase (in order not to violate the 5/24 rule mentioned in the introduction).

For this new step, you will need an Individual Taxpayer Identification Number (ITIN).

Get an Individual Taxpayer Identification Number (ITIN)

The Individual Taxpayer Identification Number (ITIN) is a 9-digit number like the Social Security Number (SSN).

It allows the US Internal Revenue Service (IRS) to identify individuals who cannot have a SSN.

Thus, any non-U.S. citizen can still sell products in the U.S. and receive income that will be taxable to the IRS. Hence the need to issue an ITIN for these people.

In order to obtain an ITIN, you can take the steps yourself. Or call in a specialist service.

By yourself

You will need to provide 3 documents to the IRS in order to be issued an ITIN:

- A W-7 Form

- Proof of identity

- A letter signed by a holding agent: this is the intermediary who will validate that you actually need an ITIN to transact through them.

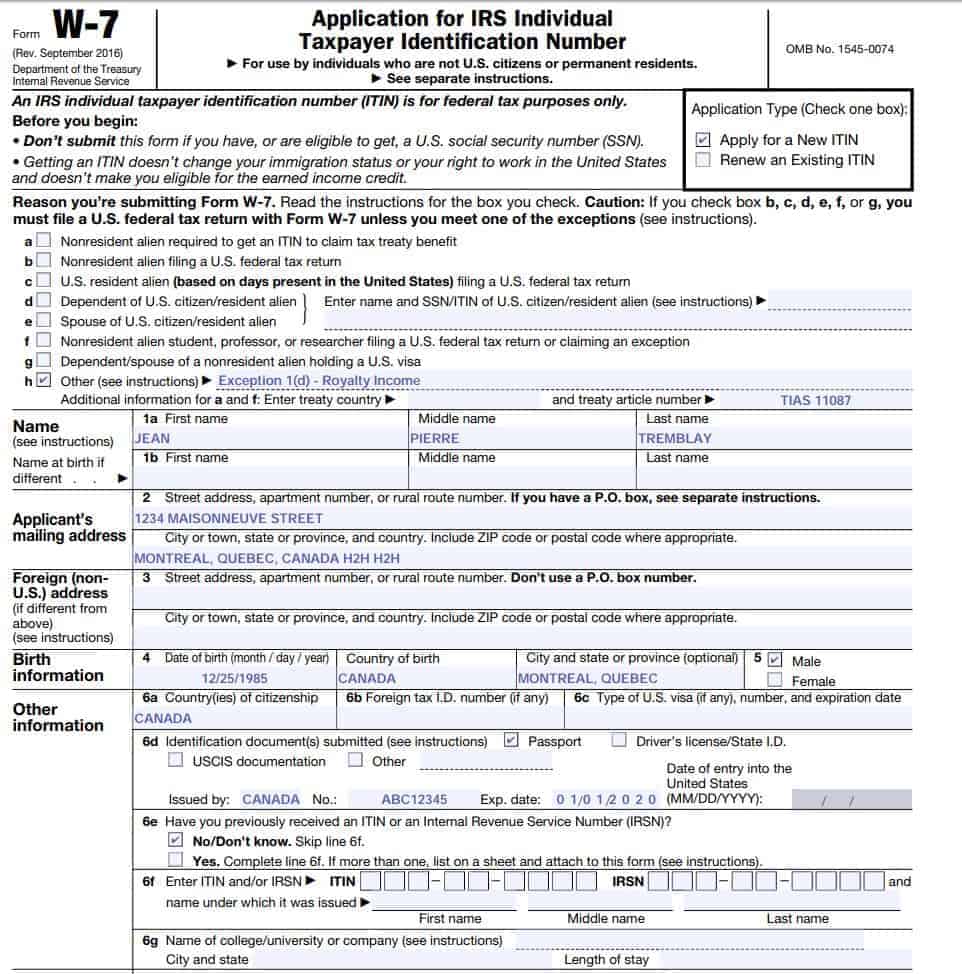

W-7 Form

The W-7 Form will allow you to submit an ITIN claim for the IRS. You can download it from this address.

Here’s how to fill it out:

- Check “Apply for a New ITIN“.

- Check the reason “h” with: Exception 1(d) – Royalty Income

- Enter the treaty: TIA 11087

- Fill in the other personal information

- Then date and sign with your phone number.

- Save it and print it

This is what it looks like:

Proof of identity

There are two ways to do this:

- Send your passport with your W-7 form

- Send a certified copy of your passport

It’s best to choose the certified copy of the passport!

You will have to show up in person at one of Passport Canada’s main offices. A fee of $45 will be charged and your passport will be held for approximately 1 week before it is returned to you along with the certified true copy by registered mail.

Of course, ask for the certification to be done in English!

A signed letter from an intermediary/withholding agent

When I did it in 2017, I went through Smashwords. This method no longer works.

There is another method through Amazon that still seems to work for some members of the milesopedia community. Simply download and fill out the document you will find on this page.

Then attach it to your ITIN application.

But if you’d rather be on the safe side and not waste time on steps that could prove fruitless, you’ll need to choose a paid service to help you obtain an ITIN, such as US Tax Resources.

By a specialized service

Jayce from Pointsnerd recommends the services of US Tax Resources. Although I myself have not needed to try them, I know several people who have received good service from this company.

For $249.99 + taxes, you will get:

- A completed W7 form (without the risk of error that could waste your time with the IRS)

- A tax notice from the United States

- Instructions for all procedures

Transmit the ITIN request to the IRS

Once you have your documents in hand, you will be able to send your ITIN request to the IRS at the following address:

Internal Revenue Service

ITIN Operation

P.O Box 149342

Austin, TX 78714-9342

It should take about 2 months before you receive your ITIN in the mail from the IRS.

Bottom Line

Don’t hesitate to come discuss your efforts to get American credit cards in the Facebook group!

Here are our referral links for various US credit cards: