Finom, an innovative start-up, offers a range of integrated tools for corporate financial management. These tools cover everything from accounting and billing to banking. Notable benefits include a French IBAN for business accounts, a multi-bank platform for centralized financial management, and the ability to obtain Mastercard virtual debit cards quickly. This solution offers entrepreneurs a simplified option for efficiently managing their business finances. But is it reliable? Milesopedia reviews Finom today.

Finom

A direct competitor to Revolut Business, bunq Business and Qonto, Finom is a neobank headquartered in Amsterdam, the Netherlands. Founded in 2019 by four entrepreneurs behind Modulbank, one of Russia’s most significant B2B online banks, the startup offers professional banking solutions, focusing on SMEs and the self-employed.

With 50,000 customers today, the young neobank aims for one million business customers in Europe by 2025. To date, it is present in the following countries:

- Germany

- Belgium

- Spain

- France

- Italy

- Netherlands

- Poland

Its investors include Target Global, the largest venture capital fund based in Berlin, FJ Labs, General Catalyst and Avala Capital.

Treezor, a subsidiary of Société Générale, provides banking services and payment card issuing. Finom has also partnered with Onfido for online identity control, Salt Edge for open banking solutions, SumUp for mobile payments and Iubenda for digital compliance services dedicated to SMEs.

Finom pro accounts

Anyone wishing to set up their own business must respect the obligation to create a business bank account. This is a crucial stage in setting up a company, as it involves depositing the necessary capital. This deposit involves placing money in a specially blocked account, held by a bank, a notary, or the Caisse des dépôts et consignations (CDC), to guarantee solvency to business partners. A capital deposit certificate is issued once the capital deposit has been made. This document is essential for registering the company with the Registre du Commerce et des Sociétés.

If you’re thinking of setting up a micro-business, it’s important to note that you’ll need to open a separate account from your account. Although a business account is not an absolute requirement, it does offer a number of advantages in terms of tax management and cash flow.

Whether you are a business creator, a freelancer or an SME, Finom offers different pro accounts to meet your needs:

| Accounts | Solo | Start | Premium | Corporate |

| Independent | 0/month | €14/month | €34/month | €119/month |

| Small Business Cards | – | €14/month | €34/month | €119/month |

Pro accounts for the self-employed

The self-employed pro account is designed for freelancers, consultants and self-employed people. Monthly fees and benefits vary according to the formula selected. Here is a summary of the available options:

| Solo | Start | Premium | Corporate | |

| Number of users | 1 | 2 | 5 | 10 |

| Monthly fee per additional user | €4 | €2 | €1 | €1 |

| Cashback | 0% | 2% | 3% | 3% |

| Complimentary cards | MasterCard debit card + Virtual Card | MasterCard debit card + Virtual Card | MasterCard debit card + Virtual Card | MasterCard debit card + Virtual Card |

| Card payment limit | 20 000 € | 40 000 € | €50 000 | 60 000 € |

| Foreign currency payments | 3 % | 2 % | 1 % | 1 % |

| Fees for euro ATM withdrawals | €2 for each withdrawal | €2 after 5 withdrawals | €2 after 10 withdrawals | €2 after 20 withdrawals |

| Accounting access | – | Yes | Yes | Yes |

| Credit notes and invoice status monitoring | – | Yes | Yes | Yes |

| Scheduled and recurring payments | – | Yes | Yes | Yes |

| Processing bulk payments | – | – | Yes | Yes |

Pro accounts for SMEs

The pro account for small and medium-sized enterprises (SMEs) is aimed at any company with at least two employees. Three turnkey formulas are available:

| Start | Premium | Corporate | |

| Number of users | 2 | 5 | 10 |

| Monthly fee per additional user | €2 | €1 | €1 |

| Cashback | 2% | 3% | 3% |

| Complimentary cards | MasterCard debit card + Virtual Card | MasterCard debit card + Virtual Card | MasterCard debit card + Virtual Card |

| Card payment limit | €40 000 50 000 | €60 000 | € |

| Foreign currency payments | 2 % | 1 % | 1 % |

| Fees for euro ATM withdrawals | €2 after 5 withdrawals | €2 after 10 withdrawals | €2 after 20 withdrawals |

| Accounting access | Yes | Yes | Yes |

| Credit notes and invoice status monitoring | Yes | Yes | Yes |

| Scheduled and recurring payments | Yes | Yes | Yes |

| Processing bulk payments | – | Yes | Yes |

Advantages of Finom accounts

Finom offers a range of benefits for its business accounts tailored to the specific needs of entrepreneurs. Here are the main benefits when choosing a pro account with this fintech.

Quick and Easy Opening of Accounts

Opening a business account with Finom is entirely online and can be done in less than 15 minutes if you have all the necessary information.

Capital deposit

When you open an account with Finom, the capital deposit starts at 214 euros for the first year. This is done in four simple steps:

- Provide your company information.

- Transfer a capital deposit.

- Check your identity.

- Obtain a certificate of capital deposit.

Once the funds have been transferred to your Finom account, they are protected by the legal guarantee of up to 100,000 euros. As all data transfers are end-to-end encrypted via TLS-encrypted channels, Finom has no access to online credentials. These are encrypted at least twice, using RSA and 256-bit AES, and can only be accessed with one-time passwords.

European IBAN

Finom ‘s professional accounts are linked to a French IBAN, facilitating transactions in Europe and abroad. You can automate your tax and contribution payments to European public institutions. The IBAN is obtained within just 72 hours of opening an account.

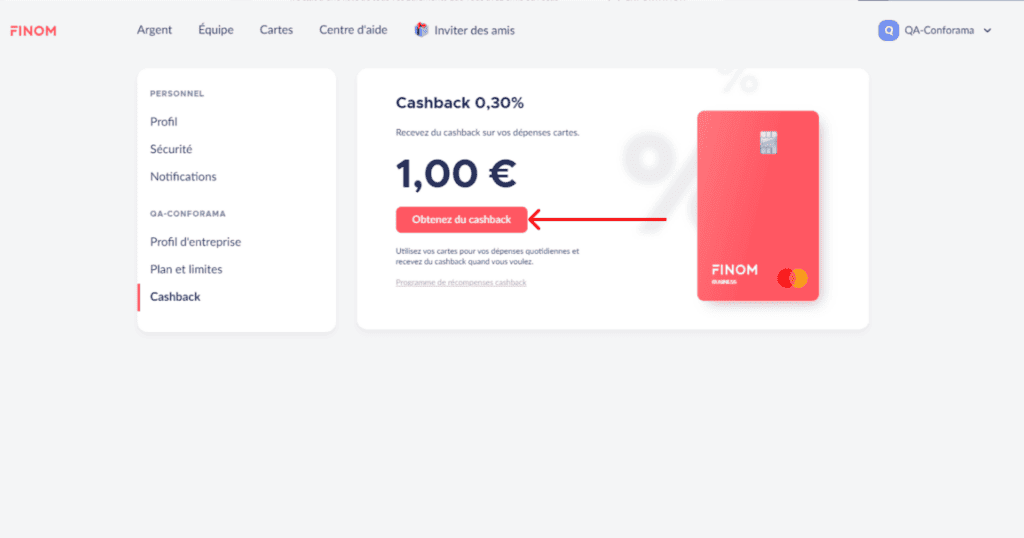

Cashback

Cashback ranges from 15 to 100 euros depending on the type of subscription. Beyond this amount, cashback will not be accumulated. On the other hand, there are a few transactions for which you won’t be rewarded, such as withdrawals and transfers between accounts.

| Subscription | Cashback | Monthly maximum |

| Start | 2 % | €15 |

| Premium | 3 % | €30 |

| Corporate | 3 % | €100 |

Physical and virtual cards

Finom offers all its cardholders a Mastercard debit card and a virtual card, which can be connected to your smartphone via Apple Pay and Google Pay. Limits are customizable to give you greater control over spending, and cards can be frozen or blocked in the blink of an eye via your smartphone or computer.

Depending on the subscription chosen, you can make between 5 and 20 monthly withdrawals.

Integrated Billing

Invoice management is simplified for all Finom account holders. In fact, the youthful fintech offers its users the possibility of creating and sending invoices in under a minute, particularly in :

- speeding up configuration thanks to automatic field filling;

- invoice your regular customers using fully customizable templates;

- allowing you to send your invoices in a single click by e-mail or courier.

Invoicing is also packed with useful features, such as the ability to make PayPal payments via a link or QR code, invoice translation into English, Italian, German, French, Dutch, Polish and Spanish, and multi-currency invoicing.

Expense Management

The Solo offer does not allow you to customize invoice templates, but Start, Premium and Corporate accounts do. They also enable the integration of accounting software, an expense management solution, document storage in the cloud, and the recording and uploading of receipts.

Finom also offers comprehensive transaction logs with history, real-time customizable notifications, and search engines with filters and sorting. In our opinion, this is one of Finom’s most attractive pro options.

Advanced Technology

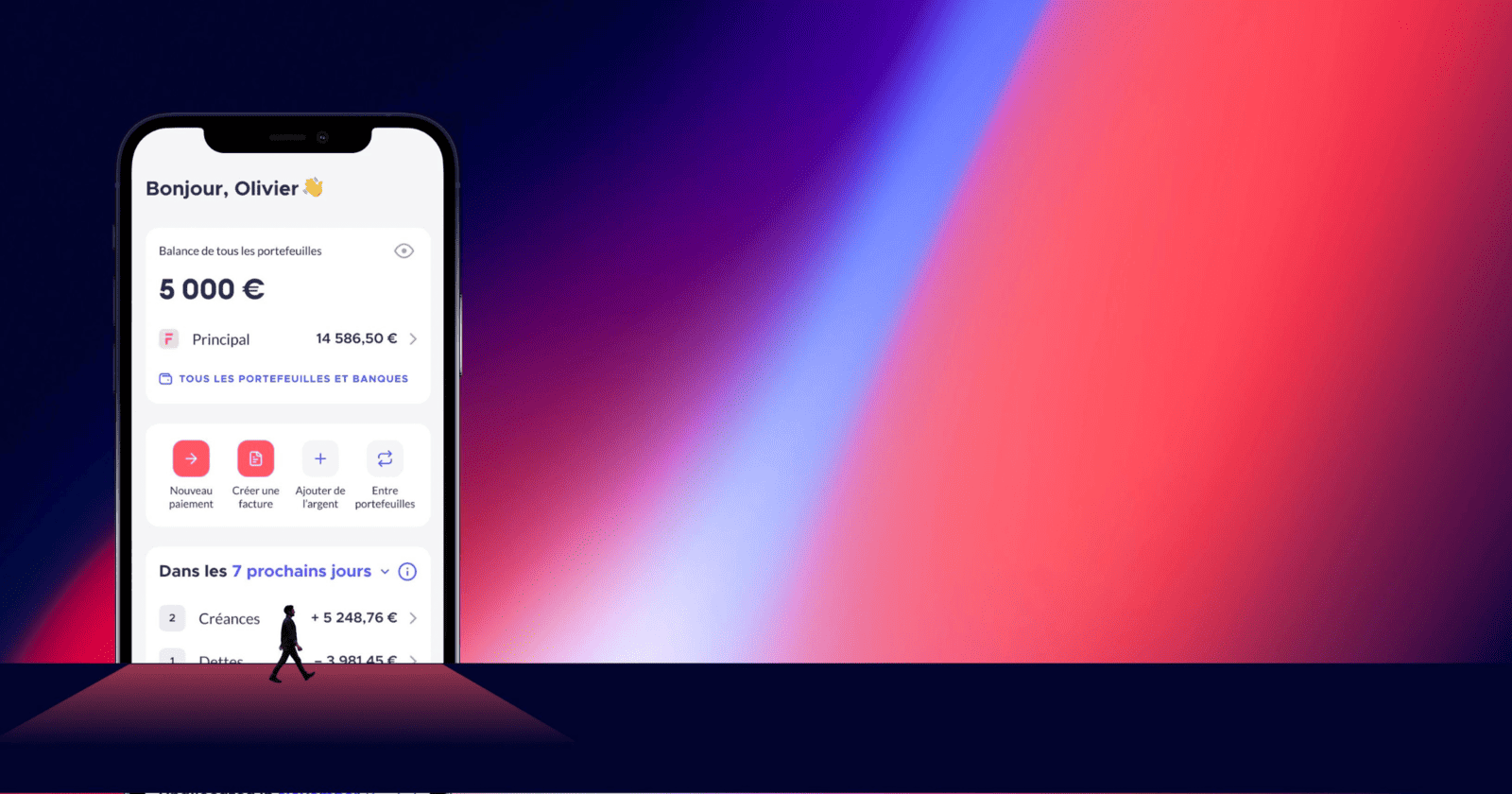

In our Review, Finom offers an intuitive mobile application with a fluid, streamlined user experience. You can carry out all your transactions, manage your accounts and receive real-time notifications.

Opening an Account

The procedure for opening a business account with Finom is entirely online and can be completed in just a few minutes. To get started, all you need to do is bring the necessary documents and follow these simple steps:

- Go to the online banking site, then select “Open an account“.

- Enter an e-mail address and click “Accept and continue” to send the subscription request.

- Enter your first and last name, choose a password and select “Continue” to validate your registration.

- Fill in the requested information about your company: location, current status, and legal form.

- Send the necessary supporting documents.

Contact customer service

Review and testimonial on Finom

Positive review on Finom

We believe that, for professionals, Finom Bank is one of the best pro banks, on a par with Mooncard. We particularly like the simplicity and speed of the account opening process and the ease with which you can gather and submit the documents required to create a business account.

Finom ‘s user-friendly interface is also worth mentioning because of the intuitive nature of the mobile app and website, which simplifies day-to-day banking and financial management.

Negative review on Finom

Some users have reported negative reviews concerning occasional technical problems and slight delays on Finom’s part in processing certain transactions. Moreover, unlike American Express, no insurance is offered to cardholders, which can be a definite disadvantage. In our Review, it could therefore be worthwhile to combine a Finom business account with a personal account and a bank card that comes with insurance, such as the Visa Premier cards from BforBank and Monabanq.

Frequently asked questions about Finom

Is Finom a bank?

Yes, Finom is a bank founded in 2019 in the Netherlands.

Who's behind the Finom bank?

Founded in 2019 in the Netherlands, Finom is a young neobank now present in France thanks to banking institution Treezor, a subsidiary of Société Générale.

What is Treezor?

Founded in 2016 by two French entrepreneurs and acquired in 2019 by the Société Générale Group, Treezor is an Electronic Money Establishment approved by the ACPR, authorized to operate in 25 countries and a principal member of the Mastercard network.

Treezor is a forerunner in Banking as a Service. It integrates technological, regulatory and security aspects into its offering to provide API access to all services in the payments chain for both acquiring and issuing.

Is it possible to open a free account with Finom?

Yes, it is possible to open a free account with Finom. The solo offer, ordinarily available for as little as 5 euros a month, is often offered free of charge, depending on current offers and promotions.

How do I make a bank transfer with Finom?

Making a SEPA transfer from your Finom account couldn’t be easier. Go to your account and press the “New Payment” button. You will then need to select the wallet from which the transfer will be made, enter the recipient’s name and IBAN, the reason or reference for the transfer, and press the “Verify payment” button to review all the details you have entered before completing the transaction.

Once you have ensured all the data is correct and uploaded the necessary supporting documents or invoices, you should press the “Pay now” button. Finally, you must confirm this payment with a code received on the mobile application.

Can I make an instant transfer with Finom?

Only transfers between Finom users are instantaneous.

What are the withdrawal limits with Finom?

The daily limit depends on the subscription chosen: 500 euros for Solo, 1,500 euros for Start, 2,000 euros for Premium, and 2,000 euros for Corporate.

How do I open a Finom account?

In our Review, opening a Finom business account is surprisingly simple, as everything is done entirely online. The process is quick and easy. You must visit the website, provide your information, and send the required documents, such as the SIREN status review or Kbis extract. Once this is done, your professional account is ready for use.

How can I reach Finom?

You can reach Finom by email at hello@finom.com or via WhatsApp at +31 (0)9 70 14 20 37 77.