The days when traditional banks were the only ones offering credit solutions are long gone. Nowadays, many fintech companies are competing for a slice of the credit market. In France, one company has stood out: Younited Credit. This platform, which offers online credit, has quickly become a major player in the credit sector. But can we really trust it? A review of Younited Credit.

Younited

Formerly known as Prêt d’Union, the crowdfunding platform became Younited Credit in 2016, just five years after the company was founded, when it began to expand internationally.

The young French fintech has opened its first foreign office in Italy, in Rome to be precise. Today, more than six years later, the Younited team consists of more than 600 employees in France, Germany, Italy, Spain and Portugal.

Younited Credit is not a subsidiary of any bank, although it has raised funds from a number of investors, including Crédit Mutuel Arkea and Bpifrance, to support its growth and expansion. And although it is authorized by the ACPR (Banque de France), Younited Credit does not follow the classic model of traditional banks or credit organizations.

Like Cashbee, its approach is based on an investment fund. In practice, this means raising funds from professional investors such as foundations, corporations, and individuals. These funds are then used to lend to borrowers seeking to make purchases. Personal credits can be offered at some of the most competitive rates on the market using this funding method.

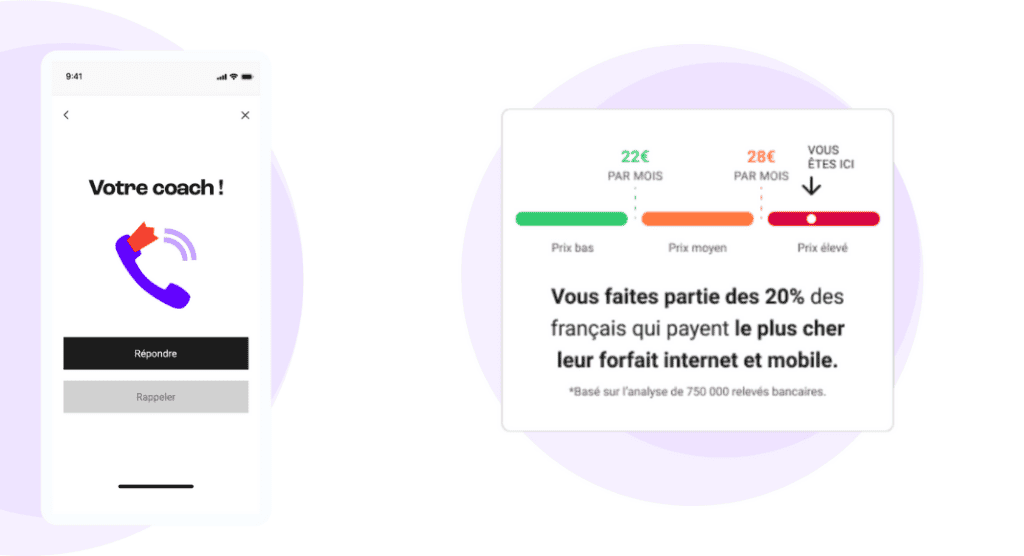

Younited Credit, Younited Pay & Younited Coach

The credit institution has developed three distinct divisions in order to better organize its activities:

- Younited Credit: The start-up offers instant personal credit of up to €50,000, repayable over 84 months.

- Younited Pay: The company offers online or physical purchases with instant credit from 300 to 50,000 euros.

- Younited Credit: It also offers a free budgeting service that can save users hundreds of dollars a month through personalized recommendations.

Available Credit Offers

Younited Crédit propose exclusivement des prêts personnels à taux fixe, une caractéristique qui présente plusieurs avantages pour les emprunteurs. Dès la conclusion du contrat, ces derniers ont en effet la garantie de connaître précisément le montant total de leur prêt, facilitant grandement la gestion de leur budget.

La gamme de crédits à la consommation fournie par Younited Crédit se divise en deux catégories distinctes : les crédits aux particuliers et les crédits aux professionnels. Chacune de ces catégories répond à des besoins spécifiques en matière de financement.

| Crédits pour particuliers | Crédits pour entreprises |

| Crédit voiture | Crédit de trésorerie |

| Crédit voyage | Crédit professionnel |

| Crédit travaux | |

| Crédit mariage | |

| Crédit naissance | |

| Crédit informatique | |

| Crédit immobilier | |

| Rachat de crédit |

Perosonal Credit

Chez Younited Crédit, les contrats de prêt personnel, tout comme les autres formes de crédit à la consommation, sont soumis à certaines limites légales. La durée maximale de remboursement pour un prêt personnel est de sept ans, tandis que le montant maximal empruntable est fixé à 50 000 euros. En revanche, pour un crédit immobilier, il n’y a pas de seuil de montant, bien que la période de remboursement soit généralement plafonnée à 35 ans, sauf en cas d’exceptions spécifiques.

- Montant du prêt : 1 000 à 50 000 euros

- Durée du crédit : 6 à 84 mois

- Taux d’appel : De 0,9 % à 21,98 %

- Délai de réponse : Réponse définitive immédiate

- Crédit : Amortissable

- Taux : Fixe

En ce qui concerne la validité d’une offre de prêt chez Younited Crédit, elle est de 30 jours, conformément aux pratiques habituelles des prêteurs.

Car Credit

Younited Credit offers a financing solution for the purchase of a new or used car. With this offer, borrowers can benefit from a car loan of up to 50,000 euros, allowing them to effectively finance the purchase of a vehicle of their choice.

Travel Credit

The travel loan offered by Younited Credit is a consumer loan designed to finance travel in France or abroad. Since the funds borrowed are not earmarked for specific expenses, this personal credit offers flexibility.

Unlike other types of credit, travel credit does not require a specific justification for how the funds will be used. This freedom allows borrowers to use the funds to cover various travel-related expenses, such as airfare, lodging and tourist activities, without having to provide Younited Credit with specific receipts.

Home Renovation Credit

A home renovation credit is a financing option designed specifically for home renovation and improvement projects. This is a special purpose loan where the funds borrowed are used exclusively for work on a property, whether it’s a primary or secondary residence, or even a rental property.

This financing solution is becoming increasingly popular with households looking to renovate or give their home a new lease on life, as it offers an efficient way to complete home improvement projects while maintaining the integrity of the family budget.

Wedding Credit

The wedding credit offers future spouses the opportunity to celebrate their union without compromising their overall financial situation. This loan provides the funds needed to spread the total cost of planning a wedding over a period of time.

This type of loan also offers the flexibility to include additional cash if needed, allowing the couple to manage the costs associated with this important event.

Birth Credit

The arrival of a baby has a significant impact on the family budget, increasing parents’ annual expenses by about 20%, according to studies conducted by INSEE (Institut National de la Statistique et des Études Économiques). In this context, the estimate amount of a birth loan can be between 500 and 2,000 euros, although this range is indicative.

Computer Credit

These days, it’s possible to find laptops and smartphones at very affordable prices, sometimes under 300 euros. Mid-range models typically cost between 400 and 500 euros, while high-performance laptops like the MacBook Pro and smartphones like the iPhone often exceed 1,000 euros.

Mortgage Loan

Real estate credit is often used to purchase primary residences or for rental investments with the goal of renting out one or more properties.

A mortgage differs from a personal loan, which is used to finance everyday consumer items such as a car, construction, furniture or services. Before signing up for a home loan, it’s imperative to take the time to think things through and do a thorough analysis, because signing this type of contract commits the borrower to making repayments until the end of the agreed period.

Credit Buyback

Credit buyback, also known as credit consolidation, is a financial solution offered by various credit organizations and banks, including Younited Credit. The primary goal of loan buybacks is to reduce monthly payments and make financial management easier and clearer for borrowers. The benefits of this operation are many:

- Lower Interest Rates: Borrowers can benefit from lower interest rates on all their loans, resulting in potential interest savings.

- Consolidation of Monthly Payments: Instead of juggling several monthly payments, a loan buyback allows you to consolidate them into a single monthly payment, making it easier to manage your finances.

- Debt Prevention: This process can help avoid excessive debt or over-indebtedness by reorganizing loans in a more manageable way.

- Simplified Procedures: With a loan buyback, borrowers have only one financial contact, which simplifies administrative procedures.

Business Credit

Business credit is specifically designed to meet the financial needs of businesses and professionals. It is particularly relevant for entrepreneurs seeking start-up capital, companies looking to expand their operations, or business buyers.

The funds obtained from the bank can be used for a variety of purposes, including the acquisition of tangible assets such as vehicles or machinery, the financing of intangible items such as capital increases or the acquisition of shares, or real estate investments.

The term of the business loan can vary from 2 to 15 years, i.e. from 24 to 180 months, and it can be either fixed or variable/revocable, offering flexibility tailored to the needs of each company.

Request and Simulation

Pour obtenir un prêt auprès de Younited Crédit, le processus est simple :

- Simulation de crédit : Tout commence par une simulation de crédit. Cette étape cruciale permet de calculer rapidement le montant du prêt dont vous avez besoin, ainsi que les mensualités correspondantes. Cette simulation s’effectue par le biais d’un formulaire en ligne sécurisé, où vous indiquez vos contraintes financières, votre salaire mensuel et vos coordonnées.

- Réponse de principe immédiate : Une fois votre demande soumise, vous recevez une réponse de principe immédiate. Cela signifie que vous saurez aussitôt si votre demande est susceptible d’être acceptée, vous offrant ainsi une clarté instantanée sur votre projet de financement.

- Soumission des justificatifs : Après avoir obtenu une réponse de principe favorable, la deuxième étape consiste à transmettre les pièces justificatives nécessaires depuis votre espace personnel. Les trois principaux documents requis sont :

- Pièce d’identité en cours de validité : Cela peut être votre Carte nationale d’identité (CNI) ou votre passeport.

- Relevé d’identité bancaire (RIB) : Il s’agit de votre numéro de compte bancaire.

- Justificatif de domicile récent : Vous devrez fournir une facture d’énergie ou de téléphone datant de moins de 3 mois, attestant de votre adresse actuelle.

- Réponse définitive : Une fois que Younited Crédit a reçu et vérifié vos justificatifs, l’équipe de la plateforme digitale s’engage à vous donner une réponse définitive en 24 heures ouvrées. Si vous choisissez la connexion bancaire, cette réponse peut même être instantanée. Cette étape garantit une efficacité optimale dans le traitement de votre demande.

- Déblocage des fonds : Passé le délai légal de rétractation, les fonds financiers sont transférés rapidement sur votre compte bancaire.

Funding

Once your credit application has been definitively approved, Younited Credit undertakes to transfer the funds to your bank account from the eighth full working day following the signature of the credit agreement.

To give you a concrete example, if your application is accepted on June 12, the funds will be transferred from June 20, provided that this day is a working day.

It is important to note that weekends and holidays are not included in this calculation, so the delivery time may vary depending on the calendar.

Interest Rate

Younited Credit‘s commitment to offering some of the most competitive interest rates on the market definitely stands out. Borrowing rates are fixed and vary from 0.10% to 21.61% depending on various factors.

The borrowing rate is calculated on an annual basis depending on the loan term, the type of loan, the purchase being financed (primary home, secondary home, furniture, services, etc.), the region of residence, and much more.

Acceptance Rate vs. Refusal Rate

Refusal of a credit application is not uncommon. In fact, this type of rejection is quite common, with one out of every two applications being turned down. It’s important to understand that credit is not an absolute right, and financial institutions are not required to provide any justification for their refusal, regardless of the reason for the request.

The main reasons for rejection given by lenders may include:

- The applicant has already signed too many loan contracts in the course of repayment.

- The applicant has a history of late payments or overindebtedness.

- The applicant’s profile is deemed risky by the lender, or the applicant does not meet all the required conditions.

- The applicant appears in a bad payer file.

- The applicant’s budget is deemed insufficient for the amount requested.

In some cases, the applicant’s budget may not be considered strong enough for the amount requested.

Younited Credit Review

What's Good

We believe that Younited Credit has several strong points worth mentioning. First and foremost, the online application process is fast and easy. The startup’s competitive interest rates are also a draw, as is the transparency of associated fees.

The flexibility of the repayment terms, with the possibility of early repayment, is also praised, as is the speed with which applications are processed and funds made available.

These features make Younited Credit an undeniable attraction, especially for those looking for financing solutions.

What's Bad

Younited Credit gets praised for many things, but also gets criticized for some. Some borrowers have expressed concern about the time it takes to process their applications, which can sometimes take longer than expected.

In addition, some Younited Credit users shared an unfavorable review, citing a less-than-satisfactory customer experience, particularly in terms of communication and customer service responsiveness. Frustration was also expressed by some, who pointed to problems with the follow-up of files.

Despite these negative points, Younited Credit remains an attractive financing option for many borrowers.

Frequently Asked Questions about Younited Credit

Is Younited Credit reliable?

Yes, Younited Credit is reliable. Founded in 2011, the financial institution is approved by the ACPR (Banque de France).

Does Younited Crédit lend easily?

Credit applications are frequently turned down. In fact, one out of every two applications can be denied, and financial institutions are not required to provide any justification for their denials.

What Are Younited Crédit's Rates?

Younited Crédit propose exclusivement des prêts personnels à taux fixe. Ils commencent à 0,9 % et atteignent 21,98 %.

Which Bank is Behind Younited Credit?

Younited Credit is not a subsidiary of any bank, although it has raised funds from a number of investors, including Crédit Mutuel Arkea and Bpifrance.

Why Does Younited Credit Ast For Monthly Payments?

To ease the burden on borrowers, the first monthly payment is made on the 4th of the second month following the availability of funds, after a period of 30 to 60 days from the availability of funds. For example, if your funds are deposited on February 1, your first monthly payment will not be withdrawn until March 4.

This flexibility in the first installment can be invaluable when planning your finances, giving you some leeway to adjust to your new financial commitment.

Why Does Younited Credit Ask for Account Statements?

Borrowers must provide the lending institution with their last three bank statements, to give an overview of account management.

How Long Does it Take to Get Credit from Younited Credit?

Younited Credit offers the possibility of obtaining fast credit within 48 hours.

How Can I Contact Younited Credit by Phone?

For all inquiries, please call Younited Credit at +33 1 78 42 53 00.