This publication is sponsored by Amex Bank of Canada. However, the opinions and views expressed on this blog are only mines.

With The Platinum Card®, we get a lot of perks for our travels, especially during our 5-month family trip around the world.

In this article, I’ll put each of these advantages into practice.

New Platinum Card offer

In this article, we’ll look at all the travel benefits associated with the Platinum Card®. But first, here’s the new Platinum Card® welcome offer!

New welcome bonus

If you’d like to find out what the Platinum Card® has to offer in terms of benefits, American Express is offering you, as a new cardholder, up to 110,000 bonus Membership Rewards points.

- 90,000 Membership Rewards points by charging $6,000 in purchases to your Card in the first three months of membership

- 10 points per dollar on travel purchases in the first six months (up to 20,000 Membership Rewards points)

That’s enough points for a $1,100 statement credit toward eligible travel purchases charged to the Card. And since you get a $200 Annual Travel Credit, it’s like getting the first year annual fee cleared thanks to this offer!

So you can fully enjoy all the benefits offered by The Platinum Card®.

Access to airport lounges

Definitely the most sought-after perk for people who apply for The Platinum Card®: access to airport lounges.

Access to airport lounges offered by The Platinum Card®

The Platinum Cardmembers enjoy complimentary access to over 1,200 airport lounges across 130 countries and counting.

This benefit applies not only to the Cardmember of The Platinum Card® but also to one guest. In some lounges, it is even possible to enter with up to 2 children under the age of 21. Please note that guest access conditions vary from lounge to lounge.

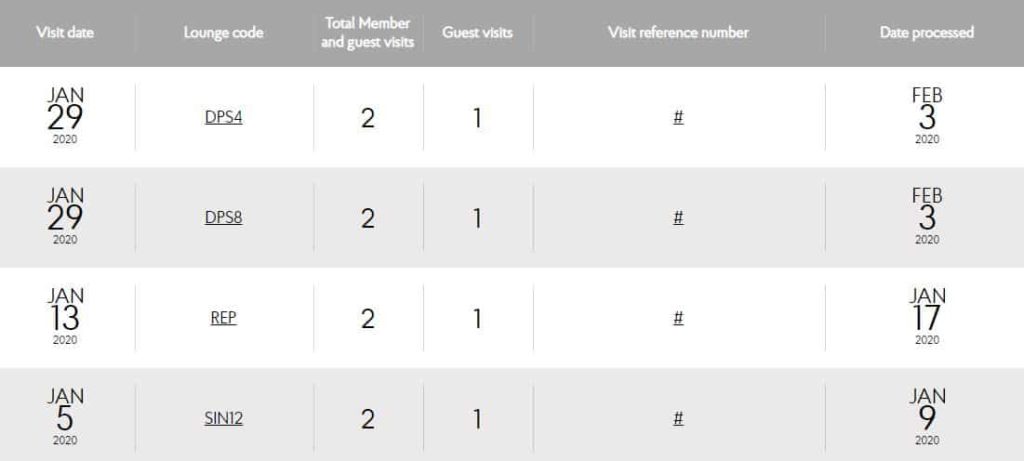

Our use of this airport lounges benefit

We are big fans of airport lounges! We frequently travel with our two children, so this benefit has saved us a lot of money in recent years, especially as part of our trip around the world!

Here we are, for example, at the Bidvest Sky Lounge at Johannesburg Airport, thanks to The Platinum Card®.

And many of the lounges are of high quality, especially in Asia like here in the only one available at Siem Reap Airport in Cambodia:

You can find below a list of all the free access we got in only two months with The Platinum Card®: to lounges in Zurich, Johannesburg, Cape Town, Singapore, Siem Reap and Bali:

Hotel Elite Statuses

The Platinum Cardmembers are fast-tracked to the higher tiers of leading hotel loyalty programs around the world. The benefits are different depending on each program and can range from a room upgrade to complimentary breakfasts, the most sought-after advantage!

The hotel status offered by The Platinum Card®

The Platinum Cardmembers get a higher status level with:

- Marriott Bonvoy: Elite Gold

- Radisson Rewards: Gold

- Hilton Honors: Gold

- Shangri-La Golden Circle: Jade

Our use of the Hotel Status Benefit

Thanks to Hilton Honors Gold and Shangri-La Golden Circle Jade status , we get free breakfasts for every stay at both groups’ hotels! A significant advantage, especially during our world tour when Marriott Bonvoy hotels (our main loyalty program) are not present!

This was the case in New Zealand, at the Hilton Lake Taupo hotel. We had free breakfasts for us and our children:

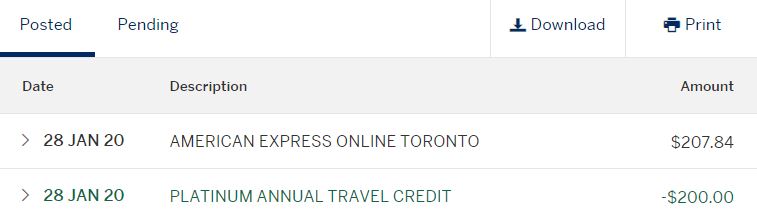

The $200 Annual Travel Credit

Each year, when the annual membership is renewed, The Platinum Cardmembers receive a $200 Annual Travel Credit.

In order to get this benefit, it is necessary to book any travel booking of $200 or more charged to your Platinum Card® through American Express Travel Online or through Platinum Card® Travel Service. It can be, for example, a hotel night or a car rental.

Our use of the Annual Travel Credit

As we travel a lot, we find a use, each year, to this $200 Annual Travel Credit.

This year we booked a hotel room in New Zealand thanks to this credit offered by The Platinum Card®. And like every year, the $200 credit appears in the account at the same time as the expense.

Insurance

The Platinum Card® is one of the best cards in Canada regarding insurances. If fortunately, we have not had to use it so far, it is great to be able to count on it in case of a problem.

Insurance Coverage offered by The Platinum Card®

Examples of insurance coverage offered by The Platinum Card®:

- Out of Province/Country Emergency Medical Insurance

- Trip Cancellation Insurance

- Trip Interruption Insurance

- $500,000 Travel Accident Insurance

- Car Rental Theft and Damage Insurance

- Flight Delay Insurance

- Baggage Delay Insurance

- Lost or Stolen Baggage Insurance

- Hotel/Motel Burglary Insurance

- Travel Emergency Assistance

- StandbyMD Travel Medical Concierge

- Purchase Protection® Plan

- Purchase Protection® Plan

Our use for car rentals

As part of our trip around the world, we found a great utility to the Car Rental Theft and Damage Insurance offered by The Platinum Card®.

You can be covered for theft, loss and damage of your rental car with an MSRP of up to $85,000 for rentals of 48 days or less when you fully charge your rental to your Platinum Card. To take advantage of this protection, simply decline the Collision Damage Waiver (CDW), Loss Damage Waiver (LDW) or similar option offered by the car rental agency.

In some countries, car rental agencies require a large deposit on the credit card.

The Platinum Card® has a significant advantage of being a Charge card.

A Charge card has No Pre-Set Spending Limit on Purchases, and this is where we have had great use in our round-the-world trip.

For example, in South Africa, the car rental agency required a $5,000 deposit on our card! Without The Platinum Card® in our wallet, it would have complicated our other transactions or pushed us to prepay our credit card.

The Membership Rewards program

American Express Membership Rewards loyalty program is arguably the best program offered by a bank in Canada because of its flexibility.

Membership Rewards points earning

With The Platinum Card®, you can earn:

- 2 points per dollar of eligible meal purchases

- 2 points for every $1 in Card purchases on eligible travel

- 1 point for every $1 in all other Card purchases

We use the American Express Platinum Card® to pay for our trips (like car rentals): 2 Membership Rewards points per dollar is a great return. And we can travel with peace of mind, thanks to the Card insurance we described earlier.

The many possibilities offered by the Membership Rewards program

With American Express Membership Rewards loyalty program, you can enjoy flexible ways to use your points:

- Transfer your points to the frequent flyer program and other loyalty programs (more details below).

- Statement credits for any eligible purchase charged to your Card

- Take advantage of the Fixed Points Travel Program, which allows you to redeem a fixed number of points for eligible flights at americanexpress.ca/travel.

- Take advantage of our flexible points travel program, which lets you redeem your points for any trip including flights, hotels or car rentals. where 1,000 points = $10

- Gift cards from premium retailers like Holt Renfrew

- And more!

Our use with British Airways Executive Club

For us, the best use of American Express Membership Rewards program is through the transfer of points to frequent flyer programs such as Marriott Bonvoy, Aeroplan or British Airways Executive Club.

Transferring membership rewards in Avios miles from British Airways Executive Club saved us a lot of money, especially in Australia!

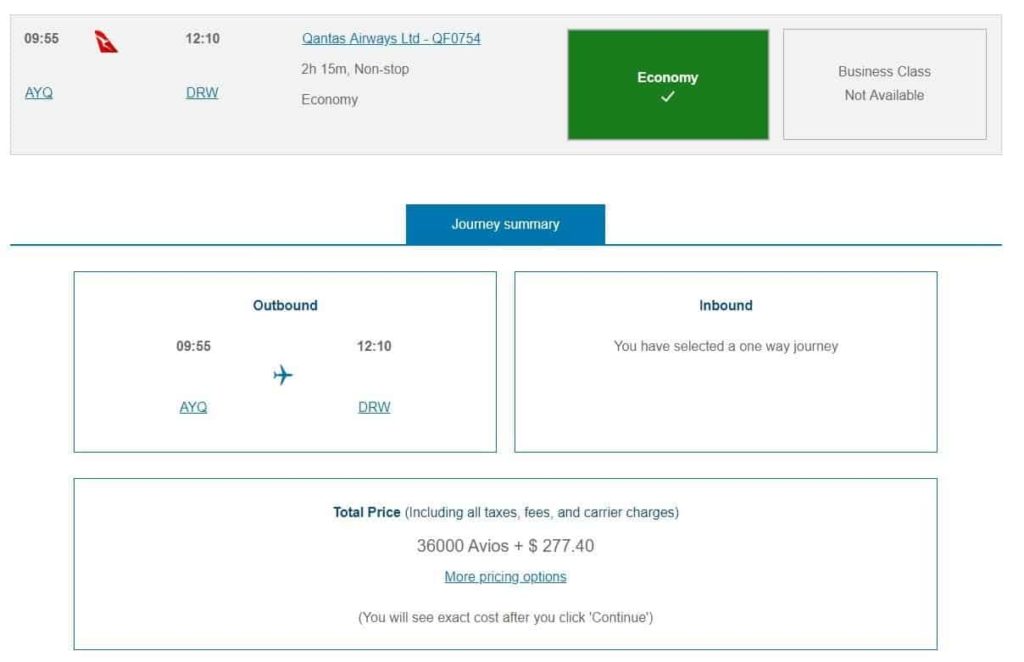

With British Airways Executive Club, you can redeem Avios miles to get airline tickets from partner airlines such as Qantas, the Australian airline.

For example, to get a flight for four people between Uluru (AYQ) and Darwin (DRW), we converted 36,000 Membership Rewards Points into 36,000 Avios miles.

That same plane ticket would have cost us no less than $1,300:

Suffice to say that 36,000 Membership Rewards Points saved us almost $1,000 in this case!

American Express online offers

American Express regularly has promotional offers, directly accessible in your online account.

American Express Platinum Cardmembers® are eligible for these offers.

Our use for booking a trip online

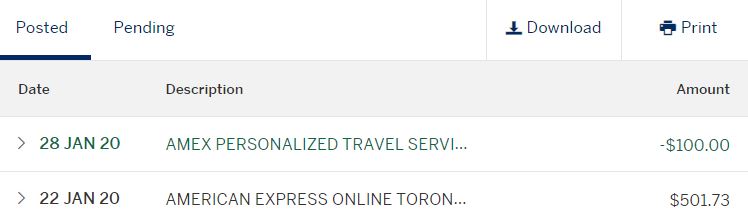

For example, we were lucky enough to take advantage of the latest offer for one of our trips:

Spend at least $450 and get a $100 credit

We used this offer to book a 10-day prepaid car rental in Bali worth $500.

The $100 was credited only a few days after the expense appeared on our account!

Bottom Line

The Platinum Card® is a card we particularly appreciate as frequent travellers, and even more during our family trip around-the-world. We consider its annual fee to be a full-fledged travel expense as it brings us significant benefits!