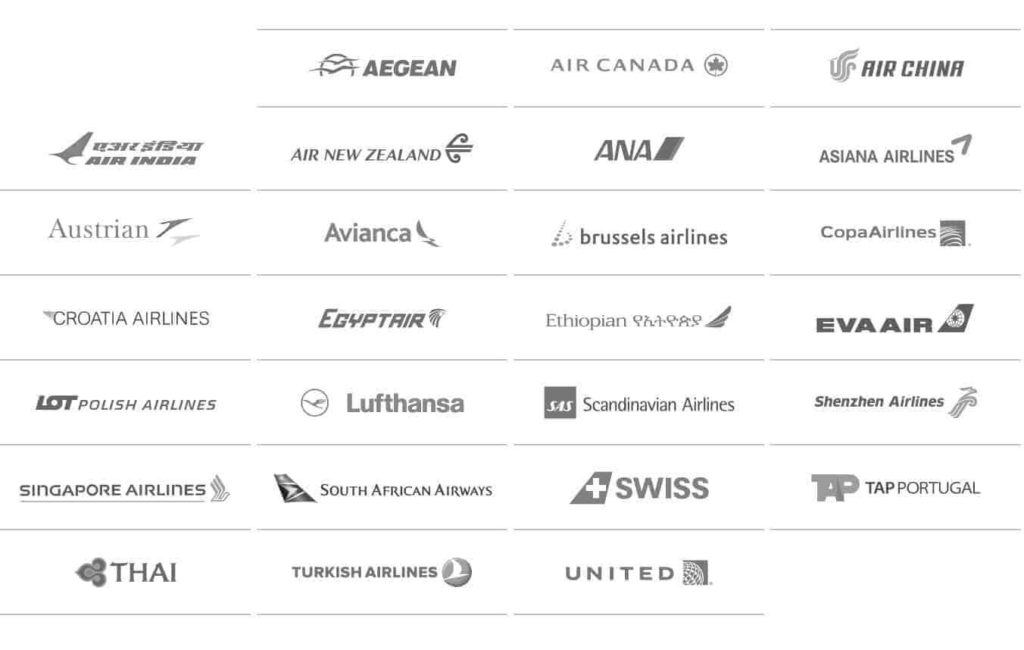

Star Alliance is an alliance of 26 airlines, which includes Air Canada, Swiss, TAP Air Portugal and United Airlines. The alliance is now launching its first Star Alliance credit card, which will be in partnership with HSBC’s Australian branch.

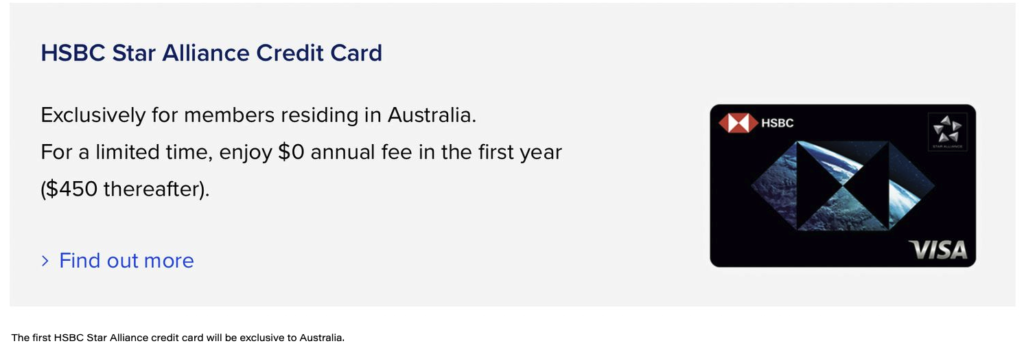

It will be called the HSBC Star Alliance Credit Card.

Australians will be the first lucky ones to get their hands on it. But what is interesting is that if this Star Alliance credit card is successful, there are rumours that other countries could have this type of card. Like France, for example (which has no Star Alliance carrier).

In Canada, knowing that there are many Aeroplan/Air Canada co-branded credit cards, it seems complicated to imagine the arrival of this type of card. Although there are rumours to the contrary.

Earning points

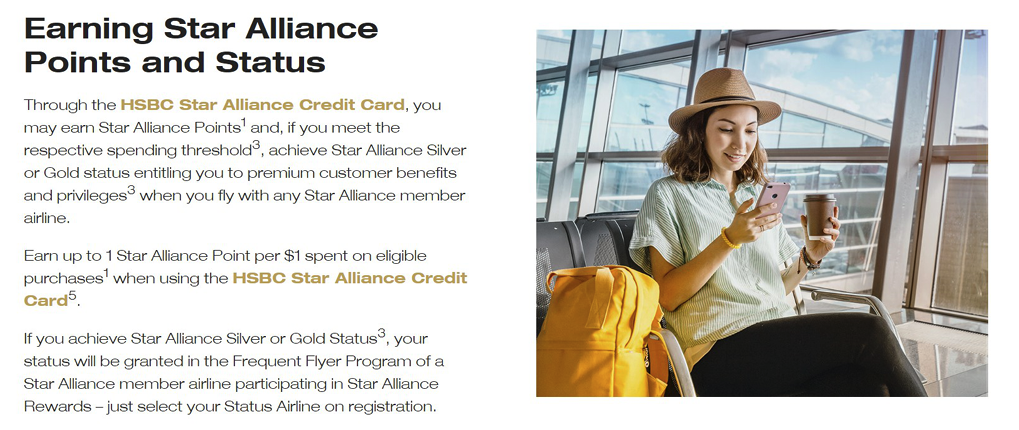

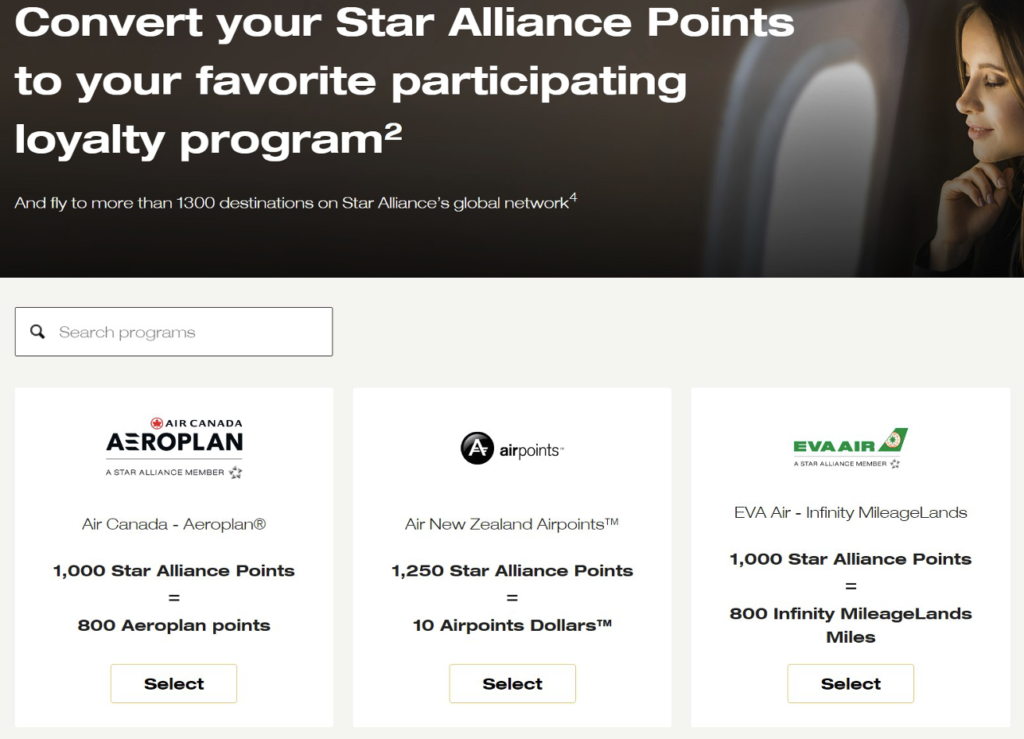

This new HSBC Star Alliance Credit Card is part of the Visa network and earns Star Alliance points. These Star Alliance points can be transferred to the other 26 airline programs of the alliance. For example, 1,000 Star Alliance points are worth 800 Aeroplan points.

The same transfer rate applies for :

- Singapore Airlines KrisFlyer

- United Airlines MileagePlus

For Air New Zealand Airpoints, 1,250 Star Alliance points are worth 10 Airpoints Dollars. Therefore, it can be expected that this rate will vary for different airline programs.

This Star Alliance credit card will have an earning rate of :

- 1 Star Alliance point for every $1 AUD (Australian dollar) up to $3,000 spent per month

- 0.5 Star Alliance points per $1 in monthly spending (no maximum)

Status and other details

The annual fee for the HSBC Star Alliance Credit Card is $450 AUD or approximately $390 CAD with the first year free for the limited-time introductory offer.

This Star Alliance credit card also offers 0% interest for 6 months on airline tickets purchased on Star Alliance airlines.

And finally, Star Alliance Gold status can be earned after reaching $4,000 in spending within the first 3 months of enrollment. This is a significant advantage since this status offers access to the Star Alliance airport lounges (including the Air Canada Maple Leaf Lounges).

However, you will need at least $60,000 in annual spending to maintain this status (or $30,000 AUD to have at least Star Alliance Silver status). Those who already have Star Alliance Gold status will be compensated with 40,000 Star Alliance points.

Then, each time a monthly statement is issued, the points will be transferred to the airline program of our choice such as Aeroplan. What’s interesting is that the Star Alliance credit card holder will be able to change the program to which the points will be credited.

Bottom line

The Star Alliance HSBC Credit Card is not yet open for application, but it is expected that it will be in the next few days.

Star Alliance points will not be held in the account, but rather must be transferred each month to an airline program of your choice.

In addition, the earning rate of this credit card is average compared to our Aeroplan credit cards for example. But that’s because interchange fees are very low in Australia.

Would you be interested in this Star Alliance credit card if it were offered in Canada or France? Discuss it with the Milesopedia community on our Facebook group!

In the meantime, here are some credit card offers available in Canada: