Earn points

Bank of Montreal (BMO ) offers five credit cards for the BMO Rewards program.

BMO eclipse Visa Infinite* Card

When you sign up for our exclusive offer on the BMO eclipse Visa Infinite* Card, you can earn up to 70,000 BMO Rewards points as well as a $120 annual fee waiver for the first year:

- 40,000 points after $3,000 in purchases in the first three months

- 2,500 points each month after $2,000 in purchases, from month 4 to month 15 (for a total of 30,000 points)

Moreover, you’ll receive a $50 anniversary credit to use as you wish!

With the BMO eclipse Visa Infinite* Card, you can earn 5 BMO Rewards points per dollar spent on:

- Groceries

- restaurants, bars

- Food delivery

- Gas

- local transport

And 1 BMO Rewards point for every $1 spent on everything else. Plus, if you add an authorized user to your account, you’ll earn 10% more points.

You can use BMO Rewards points for all travel purchases made through theagency or website of your choice (airline tickets, hotels, car rentals, all-inclusives, Airbnb, etc.) or for rewards and gift cards on the BMO Rewards platform.

-

5X points on groceries, gas, dining and transit

-

$50 Annual Credit

-

Visa Infinite Benefits

The New BMO eclipse Visa Infinite Privilege* Card

The BMO eclipse Visa Infinite Privilege* Card is a premium metal card! With this card, you can earn up to 120,000 BMO Rewards points:

- 50,000 points when you spend $6,000 in the first 3 months

- 30,000 points after $30,000 in card purchases in the first six months

- 40,000 points at annual card renewal if you have made $75,000 in card purchases in the first 12 months

Plus, you’ll receivea $200 anniversary credit to use as you wish!

As well as a Visa Airport Companion membership with 6 complimentary airport lounge visits per year.

With this Card, you earn 5 BMO Rewards points per dollar of purchases for:

- Groceries

- Gas

- Drugstores

- travel purchases

- Dining

- Food delivery

And 1 BMO Rewards point for every $1 spent on everything else.

You can use BMO Rewards points for all travel purchases made through the agency or website of your choice (flights, hotels, car rentals, all-inclusive resorts, Airbnb, etc.) or for rewards and gift cards on the BMO Rewards platform.

-

5X points on groceries, gas, pharmacy, dining and transit

-

$200 Anniversary Credit

-

Access to VIP Lounges

BMO eclipse rise Visa* Card

The new BMO eclipse rise Visa* Card is a no-annual-fee credit card with travel points, requiring no minimum income.

With this offer, you can earn up to 25,000 points as a welcome bonus:

- 20,000 points after $1,500 in purchases in the first 3 months

- 2,500 points when you redeem 12,000 points with the Pay with Points option over a 12-month period

- 2,500 points when you pay the balance on time for 12 months

What’s more, you can benefit from an interest rate of 0.99% on balance transfers for nine months (a 2% balance transfer fee applies).

With the new BMO eclipse rise Visa* Card, you earn :

- 5 points for every two dollars spent on recurring bill payments

- 5 points for every two dollars spent at the grocery store

- 5 points for every two dollars spent at restaurant and for takeaway

- 1 point per two dollars of purchases for all other purchase categories

You can use BMO Rewards points for all travel purchases made through theagency or website of your choice (airline tickets, hotels, car rentals, all-inclusives, Airbnb, etc.) or for rewards and gift cards on the BMO Rewards platform.

The new BMO eclipse rise Visa* Card also offers:

- Mobile Device Insurance

- Purchase Protection

- Extended warranty insurance

-

No annual fee

-

Purchase Insurance

-

Mobile Device Insurance

BMO Ascend World Elite Mastercard

The BMO Ascend World Elite Mastercard is one of the best World Elite Mastercard credit cards with travel points in Canada. With our exclusive offer, you can get up to 100,000 bonus points:

- 55,000 points after $4,500 in Card purchases in the first 3 months

- 3,750 points per month after $2,500 in monthly purchases from the 4th to the 15th month (up to 45,000 points)

Plus, the annual fee is waived in the first year for both the primary cardholder and authorized users.

With the BMO Ascend World Elite Mastercard, a premium credit card from BMO, you get:

- 5 points per dollar on travel purchases

- 3 points per dollar on dining purchases

- 3 points per dollar for entertainment purchases

- 3 points per dollar on recurring bill payments

And 1 point for every $1 spent everywhere else, including at Costco. You can use BMO Rewards points for all travel purchases made through the agency or website of your choice (flights, hotels, car rentals, all-inclusive resorts, Airbnb, etc.) or for rewards and gift cards on the BMO Rewards platform.

The BMO Ascend World Elite Mastercard also offers:

- Four annual complimentary passes to airport VIP lounges

- Excellent Premium insurance for your travels or purchases

- a premium concierge service

-

5X points on travel purchases

-

Access to VIP Lounges

-

Accepted at Costco

BMO Rewards® World Elite®* Business Mastercard®*

The BMO Ascend World Elite Business Mastercard is one of the best travel points-based Business Mastercard® credit cards in Canada. You can earn up to 100,000 points as a welcome bonus:

- 20,000 points on your first purchase within 75 days of account opening;

- 8,000 points per month when you spend at least $3,000 per monthly period, from the 3rd to the 12th month following account opening (for a total of 80,000 points).

Plus, there’s no annual fee for the first year! And you get 2 free annual visits to DragonPass airport lounges.

You can also benefit from a welcome interest rate of 0% on balance transfers for nine months (a 3% transfer fee applies).

With the BMO Ascend World Elite®* Business Mastercard, you earn 4 points for every dollar spent on:

- gas purchases

- office supplies

- cell phone/internet payments

And 1.5 points for every dollar you spend, including at Costco or for significant purchases at home improvement stores.

You can use BMO Rewards points for all travel purchases made through theagency or website of your choice (airline tickets, hotels, car rentals, all-inclusives, Airbnb, etc.) or for rewards and gift cards on the BMO Rewards platform.

You can also combine the points you earn with the other two BMO Rewards cards to save even more on your travels.

With the BMO Rewards® World Elite®* Business Mastercard® for Business, you benefit from various travel protections:

- Collision Damage Waiver

- Car Rental Personal Effects & Business Property

- Car Rental Accidental Death & Dismemberment

- Baggage & Personal Effects

- Baggage insurance in case of delay

- Flight Cancellation

- Trip Interruption/Trip Delay

- Flight delay

- Common Carrier Insurance

And for your purchases :

- Extended Warranty

- Purchase Protection

-

4X points on gas, office supplies, cell phone and Internet bills

-

Access to VIP Lounges

-

Accepted at Costco

Great cards for Costco!

Both BMO Mastercard credit cards are accepted for all your Costco purchases, so you can earn BMO Rewards points!

Redeem points

Redeem your BMO Rewards Points for travel

The most significant advantage of BMO Rewards points: there are no blackout periods.

You can redeem your BMO Rewards points anytime.

Unlike a loyalty program like Aeroplan or AIR MILES, you can redeem anytime for flights, hotels, cruises and vacation packages.

BMO Rewards points can be used for various types of travel booked with your BMO credit card at the travel agency or website of your choice:

- flights

- Hotels

- Car rentals

- Cruises

- Vacation packages

- Airbnb

- etc.

To redeem your BMO Rewards points, you’ll need to use the BMO Rewards website.

In all of these cases, the value of your BMO Rewards points will be 15,000 points = $100 (or 0.67¢/point). And that’s the most value you can get out of them !

BMO Rewards Price Guarantee

You can call BMO Rewards if you can’t find what you want on the online portal.

But it is also possible to claim a price match guarantee!

Several rules are governing this price guarantee. BMO will match the price for most Canadian travel providers:

- Vacation Packages:Sunquest Vacations, ALBATours, TransatVacations, Nolitours, Signature Vacations, Air Canada Vacations, Sunwing and WestJet Vacations

- Airfare:Air Canada or WestJet

Redeem BMO Rewards points for investments/statement credit

After travel, the second-best BMO Rewards points redemption is through a BMO investment account. Not yet a BMO banking customer? Get a welcome offer with one of these BMO Banking Packages.

Here, 15,000 points = $100 (or $0.67/point).

On the other hand, we will totally advise you not to use your points as a statement credit: the rate is far from advantageous: 15,000 points = $50 (or $0.33 /point).

Redeem BMO Rewards points for Gift cards

Another option to redeem your BMO Rewards points is for gift cards.

Here, BMO Rewards points value is variable:

| Gift-card | Cost in points | Value of 1 point |

| Best Buy = $100 | 19 300 | ¢0.52 |

| Amazon / Costco = $100 | 20 300 | ¢0.49 |

| Indigo = $100 | 18 700 | ¢0.53 |

| Gap = $100 | 17 200 | ¢0.58 |

| Best Western = $100 | 17 500 | ¢0.57 |

On average, here 10,000 points = $54 (or $0.54/point).

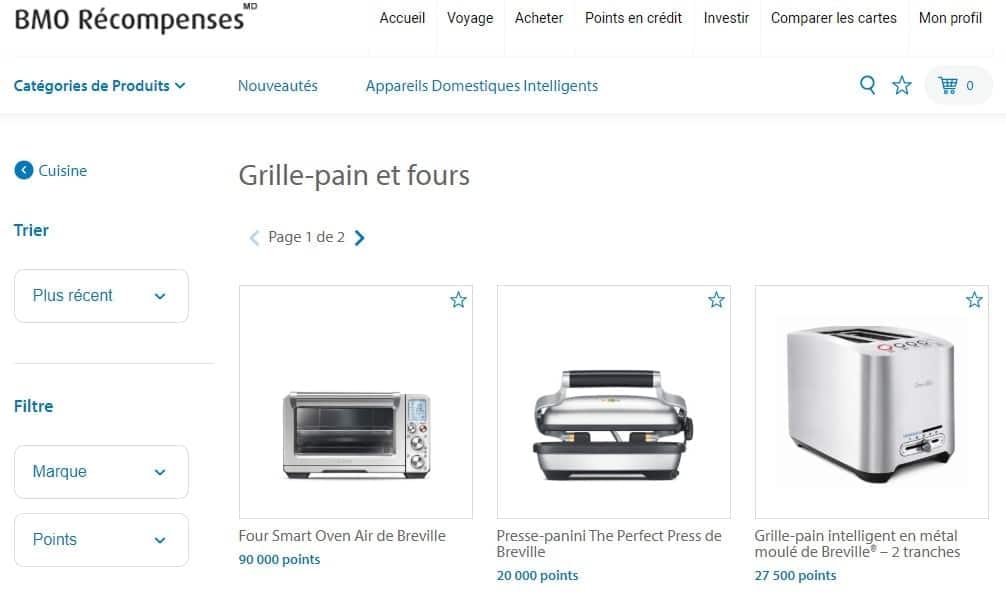

Products with BMO Rewards Points

Like any loyalty program, you can redeem your BMO Rewards points for products.

But, as we say in travel hacking:

You don’t buy a toaster with your points!

Here, we made the comparison on a product, the “Four Smart Oven Air Breville” sold for 90,000 BMO Rewards points.

This same oven costs $599 plus taxes on Best Buy / Amazon, or $688.70 in Quebec. This makes a valuation of 10,000 points = $76.52 (or 0.765 ¢).

Surprisingly, you find more value in buying this item than through travel! The exception confirming the rule?

After several valuation tests, we found that the value varies greatly from product to product (between 0.30 and 0.80 ¢!).

It will be up to you to test for your desired products!

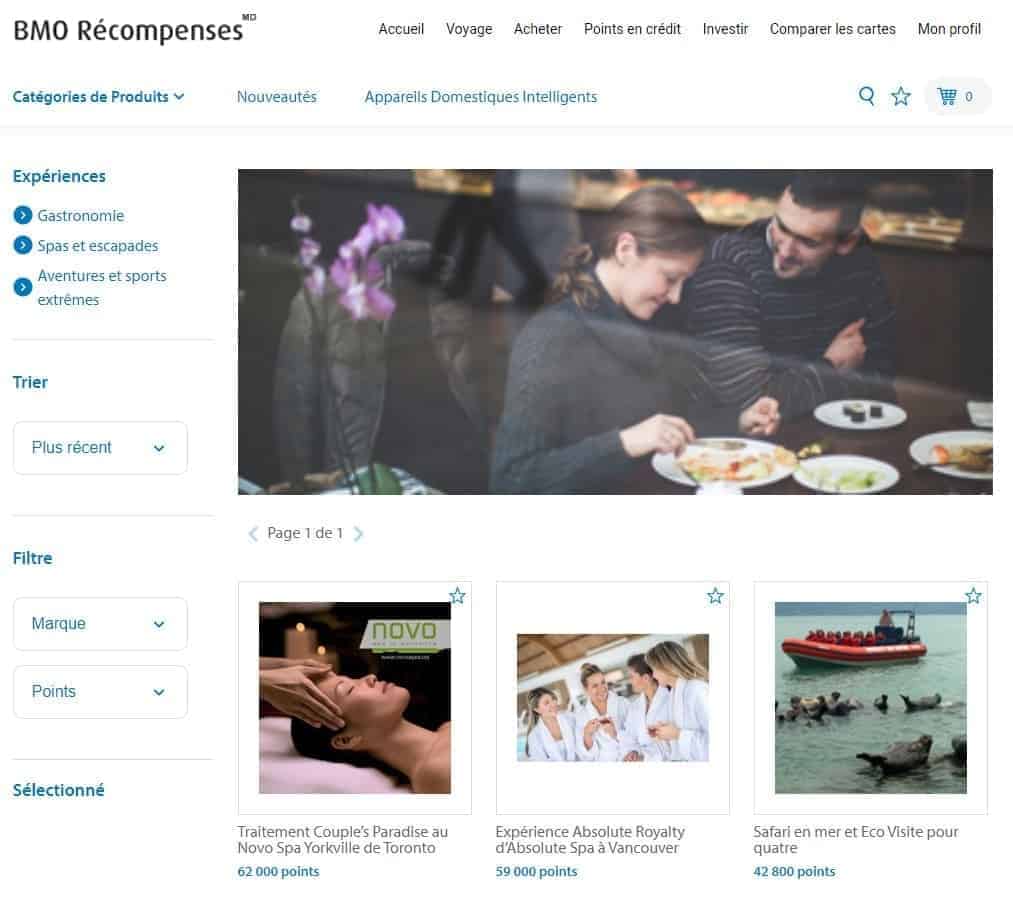

Redeem BMO Rewards Points for experiences

Finally, you can redeem your BMO Rewards points for experiences!

This option applies to only a few cities in Canada. When writing this post, the only one in Quebec is in Mont-Tremblant.

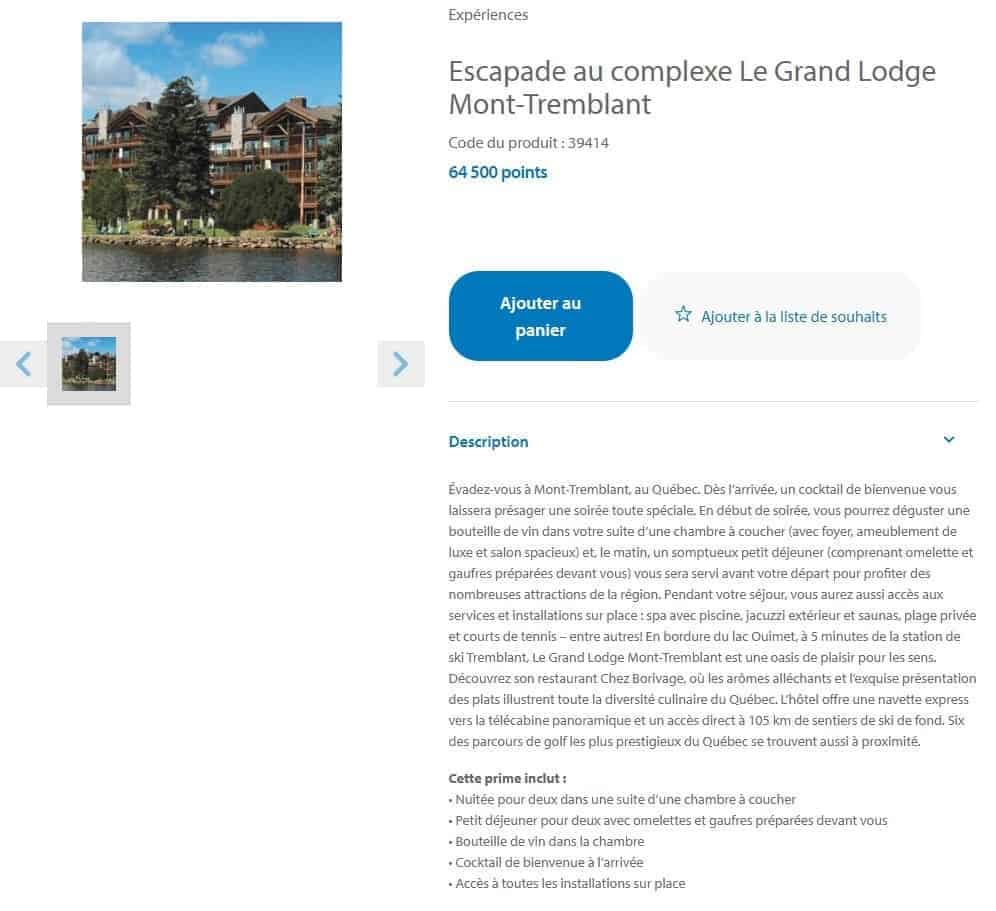

64,500 BMO Rewards points for a getaway for two at Le Grand Lodge Mont-Tremblant:

- One night for 2 in a suite

- Breakfast for 2

- Bottle of wine

- Welcome cocktail

Compared to the rates spotted on the web, this values 10,000 points = $62 (or 0.62 ¢ per point).

Summary

Here is a table of your various options:

| Redemption | 10,000 points | Value of 1 point |

| Travel | $66.7 | ¢0.67 |

| Investment | $66.7 | ¢0.67 |

| Experiences | $62 | ¢0.62 |

| Merchandise | $60 | ¢0.60 |

| Gift cards | $54 | ¢0.54 |

| Statement credit | $33.3 | ¢0.33 |

As you can see, the value of your BMO Rewards points can vary greatly.

One thing is for sure: do not use them for a statement credit; it is the worst possible redemption!

If you don’t redeem your points for travel, use it for investments, experiences or even gift cards.

Video

FAQ

What are BMO Rewards points?

BMO Rewards is Bank of Montreal’s (BMO) loyalty program. Points earned are called BMO Rewards points. These BMO Rewards points can be redeemed for travel, merchandise or gift cards through the BMO Rewards portal.

How do I earn BMO Rewards points?

There are five BMO Rewards Credit Cards, including one business credit card.

According to offers, each one gives you some welcome bonus points. You’ll earn points depending on your purchases charged to the credit card. Depending on your buyer profile, some cards will be more suitable than others.

For example, the BMO eclipse Visa Infinite* Card offers 5 points for every dollar spent on purchases:

- Dining

- Food delivery

- Gas

- Transit

- Groceries

Finally, other BMO Rewards credit cards are Mastercard, so it’s a good idea to use them at Costco. Take the time to read through the benefits of each card to match your needs.

How much is a BMO Rewards point worth?

Each BMO Rewards point is worth approximately 0.7 cents. So if you have 50,000 points, it’s a $350 value.

What are BMO Rewards points used for?

You can redeem BMO Rewards points in 5 different ways:

- Travel

- Investments

- Experiences

- Products

- Gift cards

- Statement credit

However, the best use is for travel. Here’s the approximate value of 10,000 BMO Rewards points based on the type of redemption:

| Redemption | Value |

| Travel | $71.4 |

| Investments | $66.7 |

| Experiences | $62 |

| Products | $60 |

| Gift cards | $54 |

| Statement credit | $33.3 |

Can BMO Rewards points be transferred to another program?

BMO Rewards points cannot be transferred to another program.

Do BMO Rewards points expire?

As long as a BMO Rewards credit card is open, the points are valid. After the account is closed, you have 90 days to use them.

What is the Best Price Guarantee at BMO Rewards?

BMO has a best price guarantee for most Canadian travel suppliers: Vacation Packages: Sunquest Vacations, ALBATours, Transat Holidays, Nolitours, Signature Vacations, Air Canada Vacations, Sunwing Vacations, and WestJet Vacations. And airline tickets: Air Canada or WestJet.

Is there an annual fee for BMO Rewards credit cards?

Some BMO Rewards credit cards have no annual fee, some are waiving the first-year annual fee and some not.

What’s more, there are minimum annual income requirements to apply for some cards(BMO Ascend World Elite Mastercard), while others are available to all, such as the

With select BMO Rewards Credit Cards, you get great insurance for travel or purchases, as well as extended warranties depending on the credit card you choose. You can also get free access to airport VIP lounges.

How do I apply for a BMO Rewards credit card?

As with most Canadian credit cards, Milesopedia is affiliated with Bank of Montreal (BMO). You can filter your search in the Credit Card Comparison Page, or go to the BMO Credit Cards page.