RBC Rewards is now called Avion Rewards.

One of the benefits of this is that it simplifies the range of RBC credit cards: some were part of the Avion program, such as the most popular, the RBC Avion Visa Infinite Cardwhile some others were part of the RBC Rewards program.

Now they are all part of the same Avion Rewards program. But there are different levels of Avion members!

Avion Premium and Avion Elite membership levels

In order to distinguish the different Avion credit cards, there are two levels in the Avion Rewards program:

- Avion Premium

- Avion Elite

Here is the breakdown of the credit cards between Avion Premium and Avion Elite:

All Avion members, whether they are Avion Distinction or Avion Elite, benefit from cash back offers, RBC online offers, and can pay with points or redeem them for gift cards or products.

Note that you can become a Avion Premium member not only with certain credit cards, but also with other eligible RBC products: RBC Personal Deposit Accounts, Personal RBC investment products, RBC installment loans, lines of credit and home equity financing.

However, as was previously the case, only Avion Elite members – those with an Avion credit card – will be able to access the Air Travel Redemption Schedule and the Avion Collection experiences.

Also, Avion Elite members get exclusive Elite level offers to earn or redeem points.

Here are the differences in the use of points between Avion Premium and Avion Elite:

| Redemption | Avion Premium | Avion Elite |

| Redeeming points for statement credit | √ | √ |

| Redeem points for gift cards | √ | √ |

| Redeem points for travel (100 points = $1) | √ | √ |

| Converting points to WestJet Rewards | √ | √ |

| Booking a flight with the air travel redemption schedule | × | √ |

| Convert points to AAdvantage, British Airways Executive Club, Asia Miles | × | √ |

Therefore, if you wish full flexibility in using your Avion points, it will be necessary to have an Avion credit card such as the RBC Avion Visa Infinite Card.

You can then convert your points to airline partners like American AAdvantage, British Airways Executive Club, or Asia Miles.

Avion Rewards online shopping portal

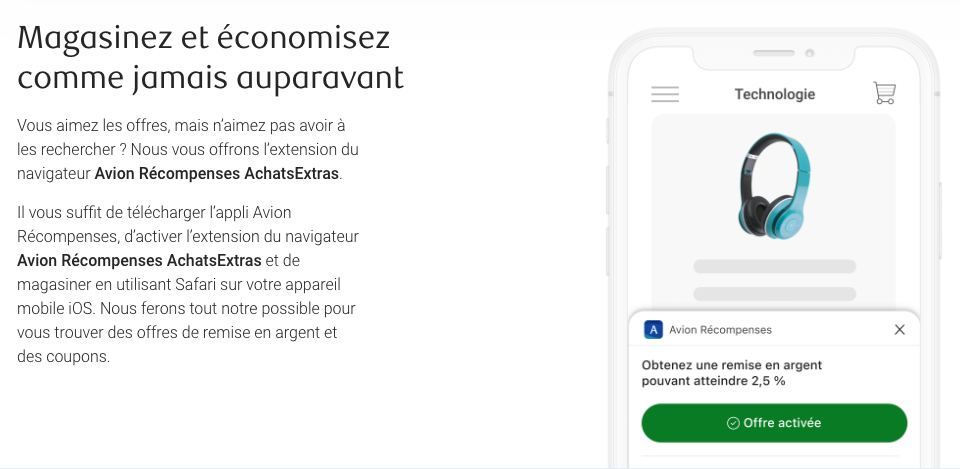

RBC launched of a browser extension called Avion Rewards ShopPlus, providing offers on more than 1,900 brands. However, you need to download the mobile application, which means you can only use the extension on Safari and from your mobile device.

It’s the closest thing to online shopping portals such as AIR MILES (airmilesshops), Aeroplan (eStore) or Rakuten.

Current Avion Rewards Offer

RBC Avion Visa Infinite Card

With this offer for RBC Avion Visa Infinite Card, you can earn up to 55,000 Avion points:

- 35,000 Avion points on approval

- 20,000 additional Avion points when you spend $5,000 in the first 6 months

You can use your Avion Rewards points for travel or convert them to other loyalty programs such as:

- American Airlines AAdvantage

- The British Airways Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

The current welcome offer, for example, gives you the equivalent of 55,000 British Airways Avios or 550 WestJet Dollars.

With the RBC Avion Visa Infinite Card, you earn 1 point per dollar and 1.25 points for travel purchases.

What’s more, you’ll benefit from a wide range of insurances: trip cancellation and interruption insurance, out-of-province or out-of-country emergency medical care insurance, collision and damage insurance for rental vehicles, and mobile device insurance.

-

Transfer your points to airline partners

-

Premium Insurance

-

Visa Infinite Benefits

RBC® Avion® Visa Infinite Privilege* Card

With this exceptional offer for the RBC Avion Visa Infinite Privilege Card, you can earn up to 70,000 Avion points:

- 35,000 Avion points on approval

- 20,000 Avion bonus points when you spend $5,000 in your first 6 months

- 15,000 Avion points as a one-time anniversary bonus 12 months after account opening

You can use your Avion Rewards points for travel or convert them to other loyalty programs such as:

- American Airlines AAdvantage

- British Airways Executive Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

The current welcome offer, for example, gives you the equivalent of 70,000 British Airways Aviosor 700 WestJet Dollars.

With the RBC Avion Visa Infinite Privilege Card, you earn 1.25 points per dollar.

What’s more, you’ll benefit from a wide range of insurances: trip cancellation and interruption insurance, out-of-province or out-of-country emergency medical care insurance, collision and damage insurance for rental vehicles, and mobile device insurance.

Finally, you get six free airport passes for lounge worldwide, and fast track through security checkpoints at selected Canadian airports.

-

Transfer your points to airline partners

-

Premium Insurance

-

Access to VIP Lounges

Bottom Line

RBC states that there will be no further changes:

- The value of your points will remain the same

- Points will not expire

- Point earning ratios will not change

Frequently asked questions about Avion Rewards

If I was already a member of the RBC Rewards program, do I need to enroll in the Avion Rewards program?

No, you will be automatically enrolled. Simply visit the Avion Rewards website or access the Avion Rewards app to discover the benefits of Avion Rewards.

What is the difference between RBC Rewards points and Avion points?

No, you are automatically enrolled. You can simply sign into the Avion Rewards website or the Avion Rewards app to discover what Avion Rewards has to offer.

From now on, your points will be called Avion points (formerly RBC Rewards points).

Will my RBC Rewards points expire under Avion Rewards?

No, your RBC Rewards points will not expire, but since August 25, 2022, they have been renamed Avion points.

Your points are yours to use as long as your account remains open and in good standing.

Has the way I earn Avion Rewards points changed?

No. You will continue to earn points on:

- Eligible purchases made through your credit card accounts, banking rewards accounts, or eligible personal deposit accounts enrolled in the Value Program

- IAdditional / bonus points earning opportunities and/or offers available from merchants, retailers or service providers from time to time

What happens to the value of my RBC Rewards points now that the program has become Avion Rewards?

The value of your existing points will not change.

Who is eligible to participate in the Avion Rewards program?

Customers who own one of the following products are eligible for Avion Premium membership:

RBC Personal Deposit Accounts

- RBC Advantage Banking, RBC Day to Day Banking, RBC No Limit Banking, RBC No Limit Banking for Students, RBC Signature No Limit Banking, RBC Student Banking, RBC VIP Banking, U.S. Personal and RateLink Essential.

RBC Personal Credit Cards

- RBC Rewards+ Visa, RBC Rewards Visa Gold, Signature RBC Rewards Visa, RBC Rewards Visa Preferred, RBC Cash Back Mastercard, RBC Visa Cash Back, RBC Cash Back Preferred World Elite Mastercard, RBC Visa Classic Low Rate Option, RBC RateAdvantage Visa, RBC Visa Platinum, RBC U.S Dollar Visa Gold.

RBC Business Credit Cards

- RBC Visa CreditLine for Small Business

RBC Personal Investment Products

- Life Income Fund (LIF), Registered Disability Savings Plan (RDSP), Registered Education Savings Plan (RESP), Registered Retirement Income Fund (RRIF), Registered Retirement Savings Plan (RSP), Canadian Market-Linked GIC, Income Builder GIC, Non-Redeemable GIC, One-Year Cashable GIC, Prime-Linked Cashable GIC, RateAdvantage GIC, RBC Canadian Banking MarketSmart GIC, RBC Canadian Utilities MarketSmart GIC, RBC ESG Market-Linked GIC, RBC North American MarketSmart GIC, RBC US MarketSmart GIC, Redeemable GIC, US Dollar Term Deposit.

RBC Installment Loans, Lines of Credit and Home Equity Financing

- Government Sponsored Student Loan, Personal Instalment Loans, RBC Employee Student Loan, RBC Energy Saver Loan, RSP Loan, Royal Credit Line, Royal Credit Line for General Program, Royal Credit line for Professional in Medical & Dental Studies, Royal Credit Line for Professional Studies (i.e. MBA/EMA, Law, Masters of Accounting, Master of Finance, Master of Science in Business Mgmt), Royal Credit Line for Special Programs, Royal Credit Line for Students – Students Studying Abroad, Adjustable Rate Mortage (ARM), Construction Mortgage, Fixed Rate Mortgage, Investment Properties Mortgage, Low Down Payment Mortgage, Manufactured Home Construction Mortgages, Ratecapper Mortgage, RBC Homeline Plan, Reverse Mortgage, Variable Rate Mortage, where the product is not tied to a business banking profile

Clients with one of the following products are eligible to participate as an Avion Elite Member:

- RBC Avion Visa Platinum

- RBC Avion Visa Infinite

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Privilege for Private Banking

- RBC Avion Visa Business

- RBC Avion Visa Infinite Business card