The rules of the game change when it comes to travel insurance provided by our credit cards, on the medical side, when we reach our mid-sixties. I was recently reminded of this by a bank with which I have a credit card.

This article reviews travel coverage for people 65 y.o. and older, which remains the same except for medical insurance.

So,

- for those who still want to travel after 65,

- for several more years and…

- for more than three days at a time.

The need for insurance

Most Quebecers who travel outside the province know that to be well protected in terms of health, we must make sure we are covered, even when we travel within Canada.

This is because the costs of care from one province or country to another are not the same, and if we require care that exceeds the amount provided by our provincial health insurance plan, we will have to pay the extra. You might as well have insurance that will cover this excess. And this, at any age.

The travel insurance offered by most good credit cards addresses this need.

A reminder of what good travel insurance includes

Credit cards travel insurance has several components. Only the first one is subject to change as we age. We are first covered on 60 days, then on 30, then on 15, 10 and 3. Damn!

1. Travel medical insurance

Travel Medical Insurance covers medical care in the event of injury or illness outside the province for the cardholder, their spouse and dependents for the duration of the trip. This is where the problem lies. The other clauses do not vary by age.

2. Travel accident insurance

Travel accident insurance is the one you wish you never have to use.

It acts more like life insurance in the event of serious bodily injury (loss of sight, hand, foot, etc.) sustained on a common carrier. The fare must have been paid in whole or in part with the credit card.

3. Trip interruption/cancellation insurance

This insurance also requires that we have paid for all or part of the trip with our credit card: plane ticket, car rental, vacation package for example.

It covers the non-refundable portion of unused services, as well as transportation if the trip is interrupted or delayed for a reason covered by the insurance plan.

And the reasons must be serious and justified. Illness, death in the family, loss of employment to name a few.

4. Flight delay insurance

Depending on the credit cards, the delay must bo from four to six hours for it to take effect.

You will probably have to eat, sometimes even stay in a hotel and get stuff to spend the night if the next flight doesn’t leave until the next day. These situations occur, for example, during bad weather or mechanical breakdown of the aircraft.

These expenses are covered as long as you purchased the ticket in whole or in part, depending on the financial institution, with the credit card. Keep your invoices for claims purposes.

5. Insurance for lost, stolen or delayed luggage

For lost, stolen or delayed luggage, be aware that credit cards have clauses that cover purchases to replace necessary items such as during flight delays. In the event of loss or theft, the offers vary from one card to another.

6. Vehicle rental insurance

It has been withdrawn by some financial institutions but when present, this insurance covers damage caused by accident, fire, theft or vandalism to a rented vehicle.

Credit cards that offer medical insurance for those over 65

Over the past few years, financial institutions have gradually withdrawn substantially from providing travel medical insurance to credit cards holders aged 65 and over. I say substantial because we agree that 3 days is a short time, and we can’t go very far.

This was the case with the BMO World Elite Mastercard, which ended its partnership with Global Allianz for this age group. You must now rely directly on this company, which offers coverage for a maximum of 23 days for those over 65, with a base amount ranging from $270 to $350. This is before you have completed the form declaring your medication, pre-existing conditions, their stability and exclusions.

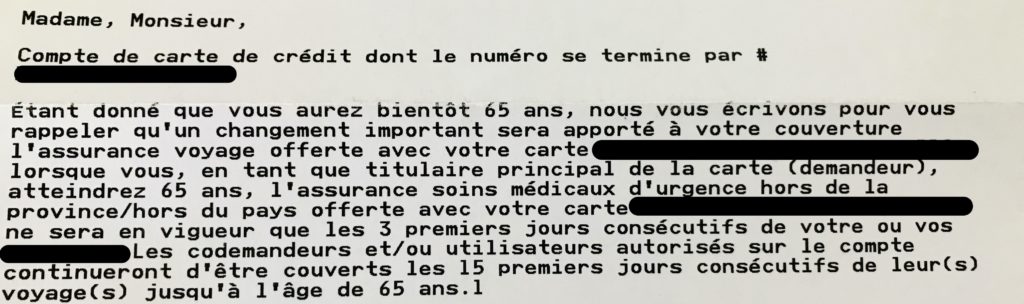

The same is true at Scotia, which has reduced its coverage from 10 days to 3 days as of July 1, 2021 on cards like the Scotiabank Passport Visa Infinite Card.

So which credit cards should you turn to?

The moment of truth

They are few in number but here they are:

The National Bank World Mastercard and the National Bank World Elite Mastercard accept 15-day travel coverage for 65-74 year olds.

You can charge only a part of the trip to the account to benefit from all the insurances. But if you are going away for more than 15 days, you cannot buy an additional policy to cover the rest of your stay. It is also impossible for those aged 75 and over to be insured.

This means that you will have to take out private insurance for the entire duration of the trip if it exceeds 15 days or if you are at least 75 years old.

The same is true of Desjardin’ Odyssey line of Visa and Mastercard cards.

The difference is that the entire journey must be paid for with the card and that a personalised offer exists, “La Quattra” for 61-80 year olds. With this option, only the medical form needs to be filled out every four years, which ensures that the premium is frozen should health problems arise. But this is not a credit card benefit.

Whether it’s BNC or Desjardins, these credit cards require a personal or family annual income or assets that not everyone has. In terms of income, World Elite cards require $80,000 (personal) or $150,000 (family) while the Visa Infinite Privilege cards requires $200,000 in family income.

All of these cards offer excellent coverage: $5 million for medical insurance over 15 days of travel and $65,000 for car rental insurance. for a maximum of 48 days.

Any other solutions?

Many credit cards offer excellent insurance until age 64. But you’ll have to leave that window of opportunity to be properly insured when traveling if you’re in your mid-60s and:

- you do not have the income required to get the above mentioned cards,

- you travel for more than 15 days,

- you have reached 75 years of age.

What can you do then? There is no way we can leave the province, and I mean province, not country, without proper medical insurance.

For those who are not yet retired or who have recently retired, I invite you to check whether your employer offers a health insurance plan for its retirees. This was my case.

The program I was offered is called Capital Perspective. I pay a monthly premium to supplement the public health and drug insurance plan. In addition, this plan offers:

- trip cancellation insurance of $5,000 per trip, and

- 5 million in travel insurance per 90-day trip.

Private insurance

In addition, there are several private travel insurance comparators on the web. Their agents will be happy to explain the process of rating your premium based on your answers to questions asked about your health status. Many people over the age of 65 are active and in excellent health, which will make it easier to buy insurance.

However, for those of you who have concerns, pre-existing conditions will be discussed and you will be asked to be “stable” for 90 or 180 days depending on your age to ensure this. It wouldn’t stop you from going but you might not be covered for that specific condition. I’ll let you discover the joys of the little exclusion clauses.

I called the Blue Cross out of curiosity and they will extend credit card insurance if it is agreed. The company has not established a maximum number of days for insuring a claimant. It offers an annual package that covers the desired number of trips or one trip at a time. And, oh! It accepts the young at heart up to the age of 85. However, be sure to ask if there are any deductibles to pay.

Conclusion

It is important to have insurance, especially medical insurance, once you leave your home province. Even and especially if you go to the United States for a few days. Most of our credit cards are generous up to age 55, but the benefits get scarce after that.

Two financial institutions stand out: the National Bank and Desjardins, but they are limited to a 15-day coverage. For longer stays, you should look into group insurance for retirees or shop around privately. The latter has some interesting offers that can be paid for… with your credit card . Enough to unlock a welcome bonus, for example!

Finally, we predict the next financial institution that dares to launch an insurance product tailored to the needs of the 65+ with a credit card will benefit from a significant migration of baby boomers towards its services. Whose luck will it be?