It is often said that the best use of Reward Points is in travel. However, if you play your cards right, an RRSP or FHSA contribution can easily beat travel rewards redemptions.

RRSP and FHSA

First of all, the RRSP is defined as a savings vehicle for retirement or to finance the purchase of a first property.

The main advantages are :

- Returns grow tax-free

- RRSP contributions can reduce taxable income (generating tax refunds, family allowances, various credits, etc.).

The FHSA is a new type of account designed to help you save for your first home.

Its advantages are :

- Combine TFSA and RRSP for a down payment.

- Contributions reduce taxable income in the same way as RRSPs, with the same range of tax benefits.

- Earnings are not taxed like a TFSA.

- No obligation to repay money withdrawn from the FHSA, unlike an RRSP.

- Up to $8,000 per year, $40,000 total contribution limit.

When we talk about a tax refund, we are talking about a tax savings. In fact, when RRSP or FHSA contribution deductions are used, the tax payable is recalculated at a lower rate, since the income is lower.

Since the tax deducted from each paycheck does not take these deductions into account, we get a tax return (refund).

Investing in an RRSP or FHSA with credit card points

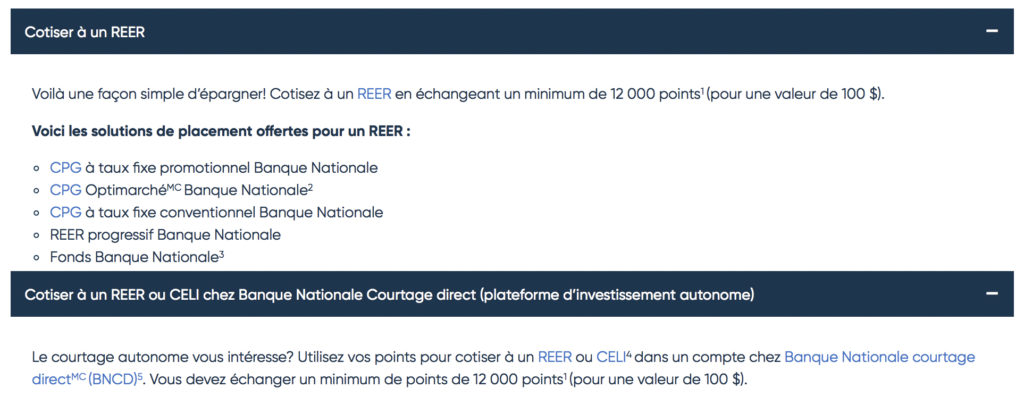

Many institutions offer the possibility of using your reward points to invest directly in your RRSP or FHSA.

Using Reward Points to Maximize Tax Returns

Getting a tax refund with credit card points

Let’s take the example of the National Bank of Canada rate to calculate the real return when we use our points to contribute to an RRSP and invest with the points.

With 60,000 NBC reward points, you can redeem them for a $500 RRSP contribution.

| Employment income | $30,000 |

| Marginal tax rate | 27,53 % |

| Tax savings | $137,65 |

So with 60,000 points, you can get $637.65, which is a better value than 60,000 points for $600 in travel credit!

The higher your income, the higher your marginal tax rate and the higher your return.

Then, by putting the $137.65 tax savings into a child’s RESP (Registered Education Savings Plan), you can take advantage of an additional 30% grant or $41.30.

That means your 60,000 Reward Points can equal $678.95 in value if you contribute to an RESP!

Get a return with points

Your new $500 RRSP contribution will start to grow depending on the product you choose.

For example, I bought $500 worth of Air Canada shares on February 9, 2021, and have had a 15.30% gain since purchase. My RRSP account shows $576.50 on February 9, 2022.

So, with 60,000 NBC Reward Points, I was able to get $714.15 ($500 contribution + $137.65 tax return + $76.50 return) on top of the RESP grants.

Get more disposable income with points

Another magical aspect of RRSP or FHSA deductions is that they can be used for tax optimization purposes.

Many tax credits and government assistance are determined by taxable income. So, if you take out RRSPs or the FHSA to reduce your taxable income, you’ll be “poorer” in the eyes of the government (even though you’ve increased your savings), and financial assistance will be more generous!

There are different tax optimization strategies or sweetspots, depending on the situation.

Contribute to an RRSP or FHSA with a low-tax income

We often hear that you should not contribute to an RRSP if you have a low income. This is not entirely true. While it’s best to maximize the TFSA before adding to the RRSP in these situations, it may be worthwhile to turn to the RRSP when purchasing a home.

Also, it is possible to defer the deduction of the RRSP contribution. You won’t get the tax refund right away, but you can earn tax-sheltered returns right away.

The same applies to the FHSA, which allows you to grow your money and withdraw it without being taxed on the return! However, with the FHSA, we have to contribute for 5 years in a row when we start, so it may be better to wait for the right moment when we can plan on saving $8,000 a year to maximize the product.

For example, an 18-year-old student has saved $7,500 with his summer jobs since 15. Depending on his contribution room, he can maximize his TFSA to $6,000 and use the excess to contribute to his RRSPs. Then he can wait until he returns to work to maximize his tax refund.

How can I easily earn points to invest in my RRSP or FHSA?

The various institutions listed at the beginning of this article offer reward points as a welcome bonus. So, it is possible to get points for an RRSP contribution almost for free with these credit cards!

To follow up on the examples in this article, let’s look at what National Bank is currently offering as a welcome bonus.

National Bank’s three flagship products earn NBC reward points. That’s money for RRSP contributions!

These cards also give you between 1 and 5 points per dollar on all your purchases, depending on the card and the purchase category, even at Costco! This can add up to 5% back to your next RRSP contribution.

Students and low-income earners can earn these points with the National Bank Platinum Mastercard®.

Then, for those who qualify for the National Bank World Elite Mastercard®, you can enjoy many other benefits like access to the NBC lounge and up to $150 in travel credit!

Bottom Line

Credit card rewards points are incredibly flexible. They allow us to save money on everyday life, travel better, travel more and get richer!