Since I spend almost half of the year abroad, it was important for me to find a way to reduce the costs of foreign currency withdrawals. I carefully considered all my options: using my traditional credit cards, changing currency in Canada before I left, using my regular debit card, and others.

The WISE Visa debit card was an easy option for me and compatible with the most ATMs around the world, as well as having minimal fees on my foreign currency withdrawals. Find out how to use it and its advantages for foreign currency withdrawals.

Formerly known as Transferwise,

WISE

is a reliable, easy to use and very competitive international money transfer service. I have been using it for several years and have always been very satisfied with this platform.

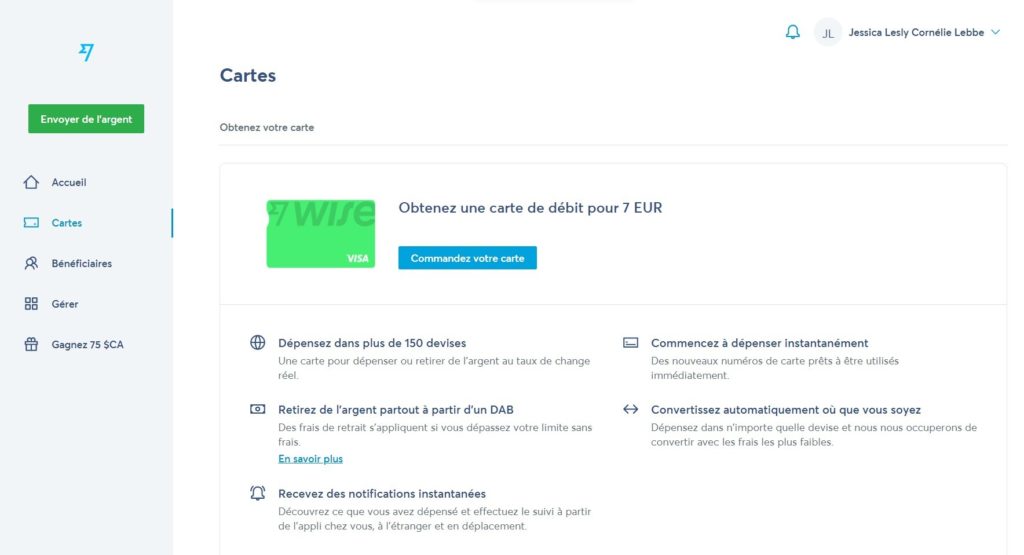

Get the WISE card

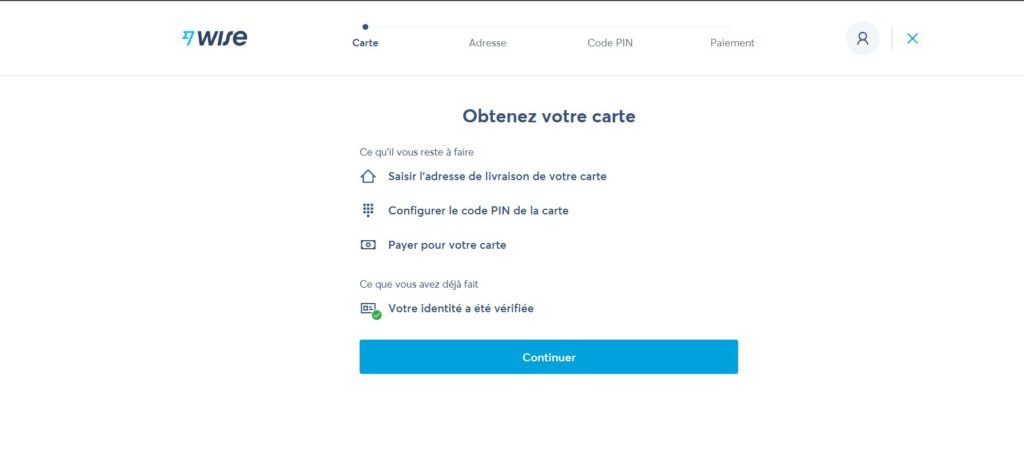

Once you have created your WISE account, you can simply go to the “Cards” tab on the left hand menu and follow the instructions to order your WISE debit card. You will have to pay a one-time fee of 7 euros to obtain the card.

With WISE, everything is done online. Once your application is complete, you will be able to use your digital card by adding it to your digital wallet (Apple Wallet or other). All the details of the map are in the application. You will then receive your physical card in the usual time frame by mail, to be used at ATMs around the world.

How the WISE card works

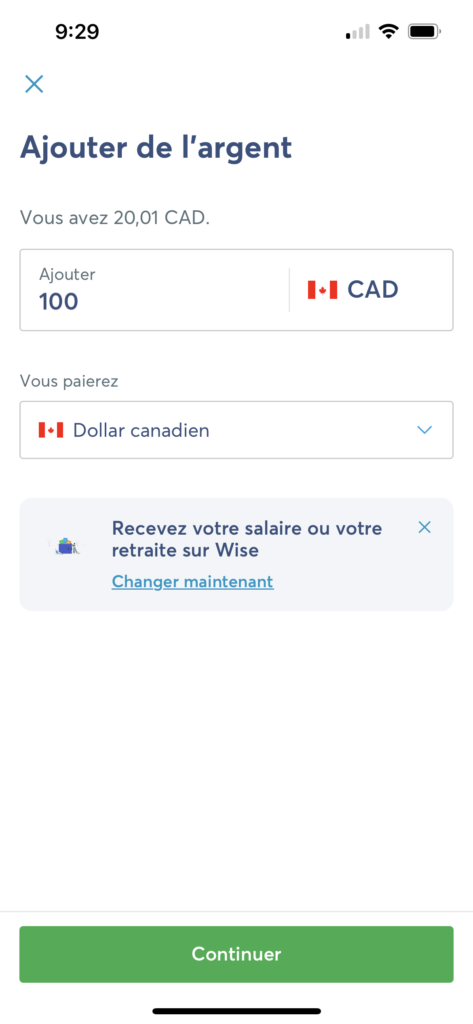

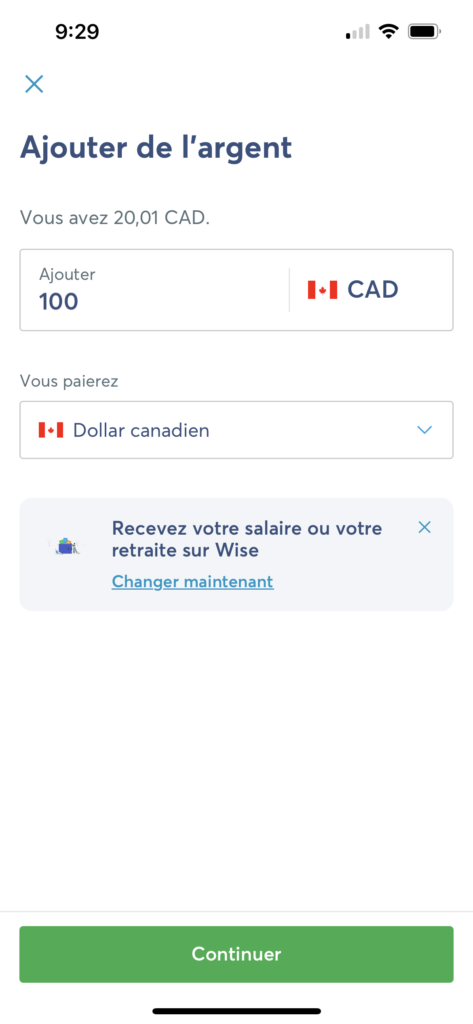

Once the physical card is received and activated, all you have to do is add money to your WISE account, a really quick process when you link your bank account directly to your WISE account. Please note that you can simply add the money to your account in Canadian dollars, this will not prevent you from withdrawing in the currency of the country you are in.

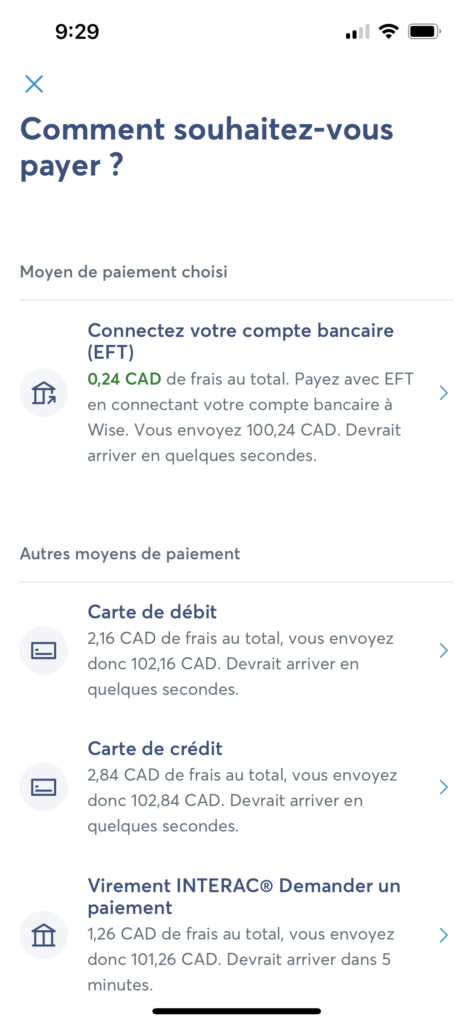

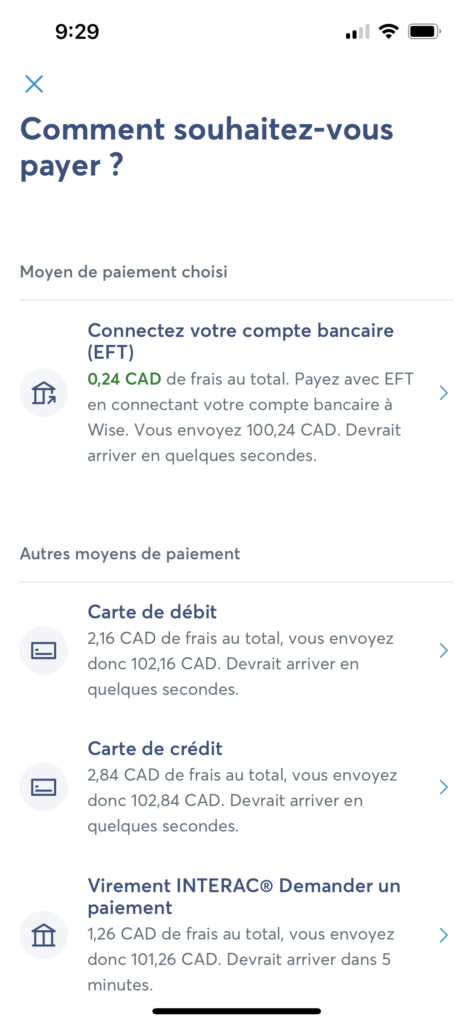

WISE clearly shows you the transfer feesaccording to the method you choose. Generally, the EFT (electronic funds transfer) method is still the most economical by far. Here we see that it costs me only 24 cents for a $100 transfer to the account.

Once the process is completed, it’s a matter of seconds before the money is added to your account (again, in my personal experience). I’ve found this process via the app extremely helpful and quick while traveling when I find an ATM on my way in and need to add funds instantly to my WISE card to withdraw them.

ATM withdrawal

When I need to withdraw money abroad, I always favor ATMs directly from the main banks of the country I am in. Most of them accept withdrawals with Visa cards, so it is possible to use your WISE debit card. Isolated ATMs that are not directly associated with a bank, such as those found in convenience stores, restaurants or on the street, are often the most expensive in terms of fees.

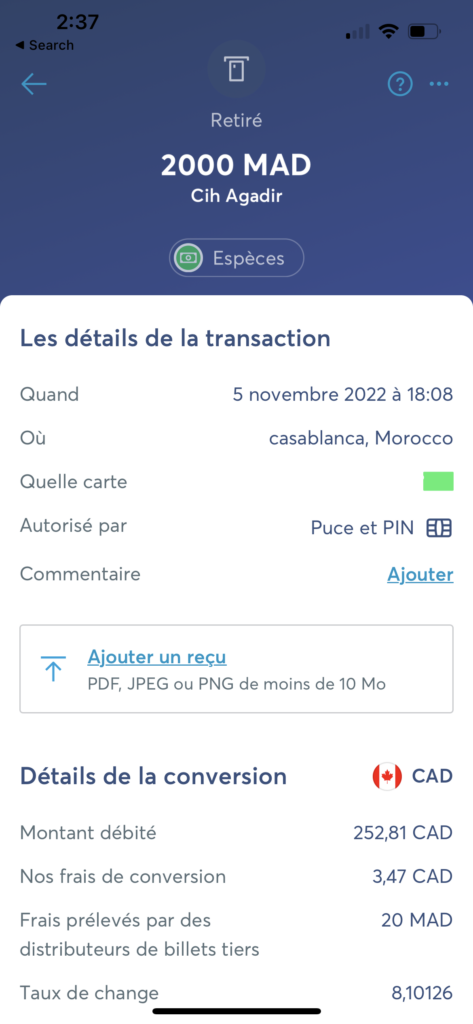

Once you withdraw your money, you will receive a notification of the amount in the currency of your WISE account (CAD for me) of the transaction. You can then click on each individual transaction in the application and access all the details of the charges levied.

The ATMs I used in Europe did not add any fees, and I made sure to choose large banking institutions. In Morocco, the counter told me that there would be a varying fee of 20 dirhams (about $3 CAD); other banks would charge as much as 35 dirhams per transaction.

So you can see in the details of each transaction that the fees are minimal, and in this way I avoid the $5 per withdrawal that my traditional bank would have charged me using my usual debit card.

Travel information

Before you make your withdrawal, you can find out about the WISE bank card conversion fee by going to the “travel information” section on the top right. Simply enter the country in question to find out the conversion fee. Compared to the 2.5% fee on each transaction on traditional credit cards, this fee is often much lower. For example, in France the fee is 0.53% while in Morocco it is 1.53%.

WISE also informs you of the amount you can withdraw without a withdrawal fee. Their app explains each fee very clearly in this section which I recommend you explore to get more tips on saving on foreign currency withdrawals.

Bottom Line

My WISE card came in handy during my two-month trip because I had the peace of mind of knowing that I could withdraw money anywhere at very little cost. In addition, the WISE application makes the process simple, fast and very user-friendly. I also really like the transparency towards fees and the tips that help us better understand foreign currency transactions.

Of course, my first choice was always to use my no-conversion fee credit card to continue earning rewards points while traveling. I mainly used the Scotiabank Passport™ Visa Infinite* Card on this trip. My WISE debit card served as an essential tool when my only option was to pay cash, as was often the case in Morocco.

If you travel regularly, a credit card with no conversion fees will save you a lot of money. Discover them here:

Want to know my other tips for

long term travel at low cost

? I share them with you here!