In general, it is always best to pay for your expenses abroad with a credit card since you get the best exchange rate (the daily rate), and you can earn rewards points on top of it.

However, most credit cards will add a 2.5% surcharge to the exchange rate; the conversion fee. To remedy this inconvenience, arm yourself with a credit card that has no conversion fees!

However, in many countries where “cash is king”, it is not always possible to rely solely on our credit cards; it becomes unavoidable to carry cash and exchange your currency.

Additionally, in some places, the merchant is within his or her rights to impose additional fees when paying by credit card; for example, in Australia.

How to determine the best exchange rate?

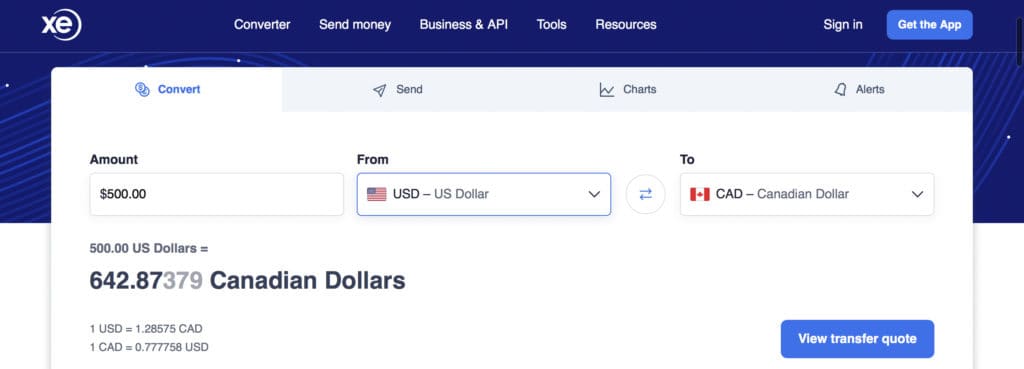

We hear the term “best exchange rate“a lot. This rate is the one that is the most economical and therefore the one that is closest to the rate indicated on comparative sites like Xe.com.

Then, you have to understand that there is an exchange rate when buying the currency and a different price when selling it. This is why you often see two exchange rate values in a bank or exchange office.

Finally, the Mastercard and Visa networks also have their rates for purchases. These rates are posted on their site. Plus, it is possible to find previous rates and indicate if your card charges a conversion fee.

Dynamic conversion reminder: pay in local currency!

Before we look at the different types of withdrawals you can make to get currency, let’s take a look at dynamic conversion.

When you pay at a merchant with your credit card, the payment terminal may offer you to pay in local or Canadian currency.

ALWAYS choose to pay in local currency: in this case, the conversion to Canadian currency will be done at the best daily Mastercard, Visa or American Express rate. Plus a 2.5% conversion fee (unless your card is one of those that do not charge a conversion fee).

If you choose to pay in Canadian currency, the merchant’s exchange rate will apply PLUS any other fees normally charged by your credit card.

Here’s an example of payment in Europe with the Scotiabank Passport™ Visa Infinite* Card. For a purchase of 283.80 euros, the merchant’s payment terminal offers to convert the amount into Canadian dollars at 384.55 CAD, including a 3% conversion fee:

On the transaction date of July 31, 2022, the Visa currency converter indicates that the transaction was for $372.99. Thus, you will have paid the merchant a conversion fee of $11.56!

Should I pay in local currency or Canadian dollars?

When you have a choice between the local currency and your currency, it is always better to pay in the local currency. Thus, you will get a better exchange rate for your purchase or withdrawal at the counter or exchange office.

What is a cash advance when withdrawing money from a credit card?

Unlike purchases of goods and services, when you withdraw money from an ATM, the issuer advances you the money. Interest on the cash advance is charged immediately, unlike purchases you make on your credit card.

Ways to save money and get the best exchange rate when travelling

There are several ways to access money in local currency. These methods each have their advantages and disadvantages.

| ATM Withdrawal | Currency exchange |

| debit card | bank order |

| credit card | order at the post office |

| prepaid card | exchange office |

Debit card travel withdrawals

The easiest way is to withdraw money with a debit card; you will get the best exchange rate (daily rate), but it will be increased by a conversion fee of 2.5%.

Typically, all Canadian banks are connected to major international networks such as Interact, Plus, Maestro, and Cirrus. These logos can be found on the back of your card.

- Very accessible worldwide

- No need to worry about paying interest

- No residual balance on the card to manage

- Daily exchange rate

- 2.5% payable conversion fee

- Withdrawal fee from your bank (if applicable)

- ATM withdrawal fee payable (if applicable)

- Risk of account blocking (without prior travel notification)

What is a currency conversion fee?

When you make a transaction, your issuer will use an exchange rate to convert your foreign currency purchase into Canadian dollars.

Then, most institutions will add a conversion fee of 2.5% to this exchange rate.

To get the best exchange rate, you should avoid these conversion fees.

Is it worth it to avoid conversion fees on exchange rates?

The exchange rate conversion fee is 2.5% on most cards, so for every $1,000 spent, you will pay a $25 fee.

For small amounts, the fee is negligible.

Travel withdrawals with the prepaid card without conversion fees

The way to save money on foreign withdrawals is with a prepaid card. Some cards will even allow you to load the card and then make a withdrawal in foreign currency without having to pay the conversion fee (or a lesser fee).

The CIBC AC Conversion Prepaid Visa* Card is one example; you can avoid conversion fees on the 10 currencies supported by the card.

Like the debit card, this is one of the best exchange rates when travelling (daily rate). It is in fact the preferred way because you will avoid the conversion fees.

- Very accessible worldwide

- No need to worry about paying interest

- No conversion fee

- Daily exchange rate

- Some currencies are inaccessible

- Residual balance on the card to be managed

- ATM withdrawal fee payable (if applicable)

Then there’s the Visa-affiliated Wise debit card, a reliable solution for making withdrawals in currencies other than your local currency. Formerly known as Transferwise, Wise is an international money transfer platform that stands out for its low fees on foreign currency withdrawals. Once you have created your Wise account and obtained your debit card, you can load your account with Canadian dollars and withdraw money in the currency of the country where you are located. Conversion costs are generally much lower than for conventional credit cards. In France, for example, the fee is 0.53%, while in Morocco it is 1.53%.

Finally, another option is with Wealthsimple Cash is an integrated financial ecosystem that brings together a current account, a high-yield savings account and a reloadable Mastercard. For frequent travelers, this card represents an interesting alternative for avoiding the conversion charges associated with foreign currency transactions. The Wealthsimple Cash Mastercard does not charge fees for ATM withdrawals globally, although some ATMs may apply their own fees.

Withdrawals while traveling with your credit card

The use of credit cards is tricky for over-the-counter withdrawals, as they are considered cash advances. So, you have to be very organized to make this profitable; you should not aim to have the best exchange rate when you have to pay other fees in return!

For purchases, you have a grace period where you don’t have to pay interest; you generally have up to 21 days after the statement closes to pay your balance without incurring interest.

For cash advances, interest is charged immediately after the transaction. So, to save money on travel withdrawals, your balance must be positive (i.e. you don’t owe the bank any money).

It is also important to know that when you pay back the money on your credit card, that money is first paying for your purchases. So, if you want to make a withdrawal and you have purchases to make as well, you’ll need to consider them.

Here is an example of how to avoid paying interest charges when withdrawing money with a credit card:

| Date | Transaction | Balance |

| June 13 | – $500 | |

| June 14 | + $1,000 | |

| June 15 | – $100 (purchase) | |

| June 16 | – $400 (withdrawal) | |

| Interest payable | $0 | |

It is indeed a bigger headache to use a credit card, so why do it? The main advantage is avoiding the 2.5% conversion fee. For larger amounts, the difference is significant as you avoid these conversion fees and get the best exchange rate when travelling.

- Very accessible worldwide

- No conversion fee

- No residual balance on the card to manage

- Daily exchange rate

- Need to worry about interest on cash advances

- Withdrawal fee from your bank (if applicable)

- ATM withdrawal fee payable (if applicable)

Order from your bank

Of course, your bank can sell you foreign currency. In fact, you can place an order from your online profile.

However, this is not always the best exchange rate when compared to Mastercard and Visa rates. Then you have the option of picking up your money at the branch or having it delivered to your home for a fee. The amount will simply be deducted from your account.

- No need to move (with delivery charges)

- No residual balance to manage

- No need to worry about the interest on cash advances

- Need to travel (no charge)

- Premium exchange rate

- Withdrawal limit according to your bank’s rules

- Transaction fees by your bank (if applicable)

- Withdrawal fee from your bank (if applicable)

- ATM withdrawal fee payable (if applicable)

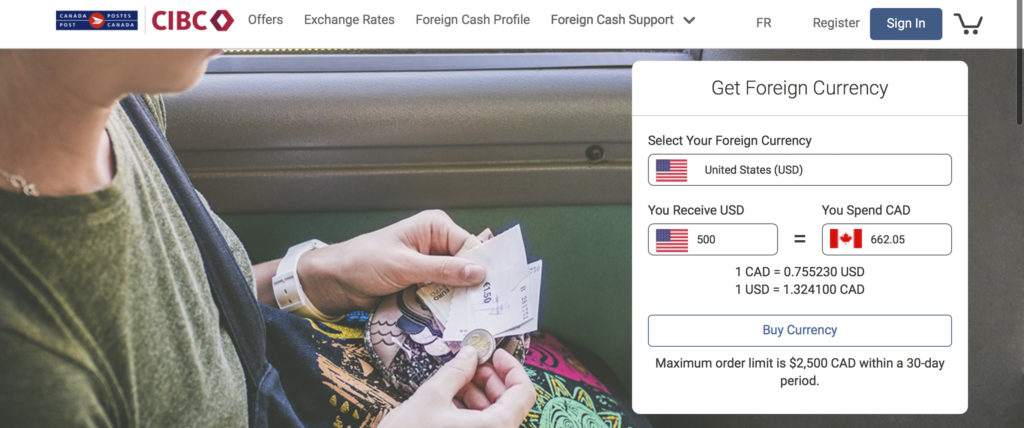

Ordering and delivering currency from Canada Post

Canada Post, in partnership with CIBC, offers a service where you can place an order for foreign currency and have it sent by mail!

The exchange rate is increased by 2% to 5% depending on the currency, but it is quite convenient to receive the money directly to our mailbox!

- No need to travel

- No residual balance to manage

- No withdrawal fees from your bank to pay

- No ATM withdrawal fee to pay

- No need to worry about the interest on cash advances

- Premium exchange rate

- $2,500 withdrawal limit per 30 days

To order foreign currency in this way, you will need to:

- create an account and confirm your identity;

- choose a currency, the amount and your preference of banknote denominations;

- choose between home delivery or delivery to a post office;

- Switch to debit or Interact (credit cards are not accepted);

- show identification upon delivery or pickup.

Exchange offices

Finally, are currency exchange offices a good option? The exchange rates of the offices vary greatly. Some places offer a better exchange rate than your bank or a comparable rate, but you could also find very unfavourable rates.

To get foreign currency with the offices, store around and compare; one place might have a better exchange rate for one currency, but not for another!

Finally, exchange offices located at the airport and in tourist areas should be avoided if you want to get the best exchange rate while travelling.

- No residual balance to manage

- No withdrawal fees from your bank to pay

- No ATM withdrawal fee to pay

- No need to worry about the interest on cash advances

- Need to move

- Need to shop around and compare

- Premium exchange rate

- Sometimes commission is added

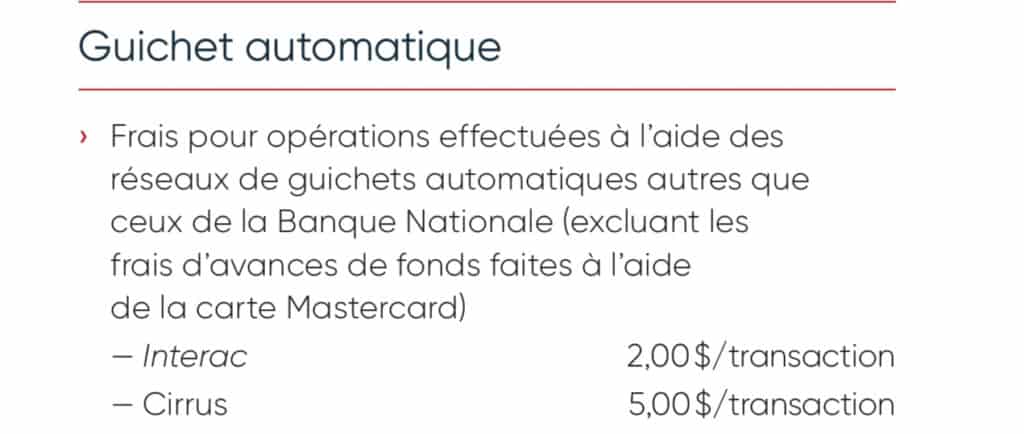

How to avoid or save on travel withdrawal fees?

When you make ATM withdrawals, you usually have to pay:

- fees charged by the bank for the transaction

- fees charged by your banking institution for withdrawals

- conversion fees

When it comes to your bank’s fees, you can sometimes save on withdrawals with certain packages. However, when you are abroad, the ATM you have chosen may also charge you a fee for the withdrawal.

Here is a table of foreign banks we found that do not charge! With a credit card like the Scotiabank Passport™ Visa Infinite* Card or the CIBC AC ConversionTM Prepaid Visa* Card, you’ll get the best exchange rate and the most savings with these banks!

| Country | Bank |

| Bosnia and Herzegovina | Ziraat Bank |

| Croatia | OTP Bank |

| Spain | Unicaja |

| Indonesia | Bank BRI, BNI Bank, MayBank, BC, Mandiri |

| Ireland | All public banks |

| Montenegro | CKB Bank, Universal Capital Bank (Hipotekarna) |

| Portugal | Multibanco |

| Sri Lanka | People’s Bank |

| Turkey | Ziraat Bank, Seker Bank |

For Tangerine customers, you can save on withdrawal fees at banks in the Global ATM Alliance network. Withdrawal fees are even waived at several banks: Bank of America, Barclays, BNP Paribas, Deutsche Bank, Scotiabank, and Westpac.

Finally, the withdrawal fees at Tangerine are very competitive when compared to other banks.

To open an account at Tangerine, our orange key to receive $50 is: 39634222S1

Get the best exchange rate: comparison table

So, what method should you choose to get the best exchange rate while travelling and save on withdrawal fees?

It depends! Each method has its pros and cons. It’s up to you to decide what’s best for your situation. To help you visualize the numbers for each option, here are some examples.

Need $500 in US dollars

| Debit withdrawal (other) | Flow withdrawal (Tangerine) | Credit withdrawal (Scotia Passport) | Prepaid withdrawal | Bank order | Mail order | Office Exchange | |

| Conversion fee | 2,5 % | 2,5 % | 0 % | 0 % | ≈ 3% | ≈ 3% | ≈ 3% |

| Withdrawal Fees | $5 | $3 | $0 | $0 | ≈ $1.5 | $0 | $0 |

| Counter fees | $3 | $3 | $3 | $3 | – | – | $0 |

| Commission | – | – | – | – | – | – | ≈ $3 |

| Cost of obtaining | $674.71 | $672.71 | $643.70 | $643.70 | $662.25 | $662.05 | $663.00 |

In this example, you get the best exchange rate with an over-the-counter withdrawal with a no-conversion fee credit card or a prepaid card.

Need $50 in US dollars

| Debit withdrawal (other) | Flow withdrawal (Tangerine) | Credit withdrawal (Scotia Passport) | Prepaid withdrawal | Bank order | Mail order | Office Exchange | |

| Conversion fee | 2,5 % | 2,5 % | 0 % | 0 % | ≈ 3% | ≈ 3% | ≈ 3% |

| Withdrawal Fees | $5 | $0 | $0 | $0 | ≈ $1.5 | $0 | $0 |

| Counter fees | $3 | $0 | $3 | $3 | – | – | $0 |

| Commission | – | – | – | – | – | – | ≈ $3 |

| Cost of obtaining | $72.67 | $65.67 | $67.07 | $67.07 | $67.60 | $66.21 | $68.00 |

In this example, you get the best exchange rate by withdrawing at the counter with a Tangerine customer debit card.

We can see that the savings are much greater when the amount is higher with a better exchange rate despite transaction fees. Tangerine allows you to save money at partner locations as well.

So, as always, do your math and assess your preferences!

Frequently Asked Questions (FAQ) about the best exchange rates

Where to get the best exchange rate for travel?

By paying for your purchases with a credit card without conversion fees, you will get the best exchange rate for your trip.

Where to withdraw foreign currency at the best exchange rate?

With a prepaid credit card, you can minimize transaction fees and get cash at the best exchange rate.

Where is the best place to exchange our money?

For currency exchanges, exchange rates are similar from one institution to another. You will need to shop around for a currency exchange that has a difference in rates and does not charge a commission.

When is the best time to exchange currency?

When your trip is booked, do a little research on the rate trends. If the trends show that the rate is falling against the Canadian dollar, go for it! Otherwise, wait until closer to your trip.

How much cash should I have when I travel?

To avoid theft and loss, it is suggested that you have no more than $300 in cash. This way, you can maximize your credit card purchases without conversion fees and only use cash when the credit card is not accepted.

What are the fees when withdrawing money abroad?

There are conversion and transaction fees from your bank and ATM withdrawal fees when travelling.

Should we exchange our money before leaving on a trip or while there?

It will depend on the amount, but generally, the exchange rates are similar. However, less common currencies are generally exchanged at a better rate locally than in Canada.

The common currencies are the US dollar, the euro, the British pound, the yen, and the yuan.

Should we use our credit card or debit card to withdraw money while travelling?

In general, a withdrawal with a prepaid credit card with no conversion fee will give you the best exchange rate when travelling.

How can I save on travel withdrawal fees?

With a credit card without conversion fees, you can get the best exchange rate on your purchases. Then, a prepaid credit card or a banking package with minimal transaction fees will be the winning combination for withdrawing money while travelling.