Overview of Mint, the ultimate free credit card management tool

Some information about Mint.com:

- Credit card management tool (and more generally for managing your assets)

- Free

- Owned by Intuit, a recognized company

- In English only

When you are a mileage hoarder, you find yourself having more than 5 credit cards open at the same time. Personally, my wife and I have about 15 active ones right now – featured at the milesopedia birthday party.

15-20 credit cards, each with a payment due date (and a fee), becomes rather complicated to manage without a management tool! That’s where Mint. com comes in.

Simplified credit card management

The Mint.com tool supports most Canadian (and US) banks and credit companies.

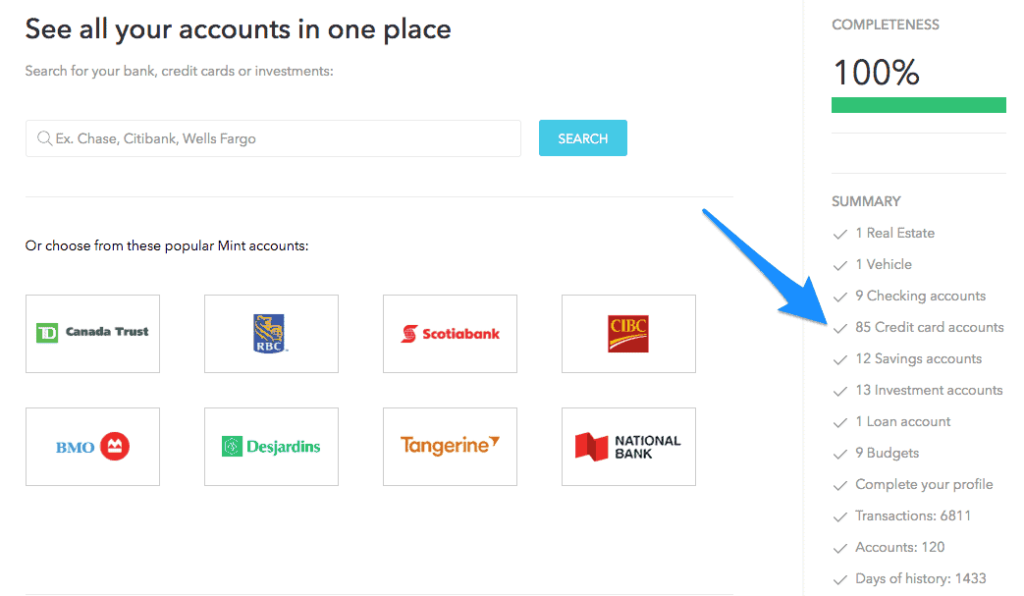

As you can see, we use Mint. com intensively: for 1433 days (about 4 years), we have entered :

- 85 credit card accounts (about 20 per year)

- 13 investment accounts (RRSP, TFSA…)

- 12 savings accounts

- 6,811 transactions listed

- 1 mortgage

- 1 condo

- and 1 car

This allows us to have a complete view of our heritage, and in particular of our activity ashoarder” of miles. Thanks to Mint.com, we haven’t missed any credit card bill payments – which can drastically lower your credit score – and have been notified when bank fees – or dues – have been charged.

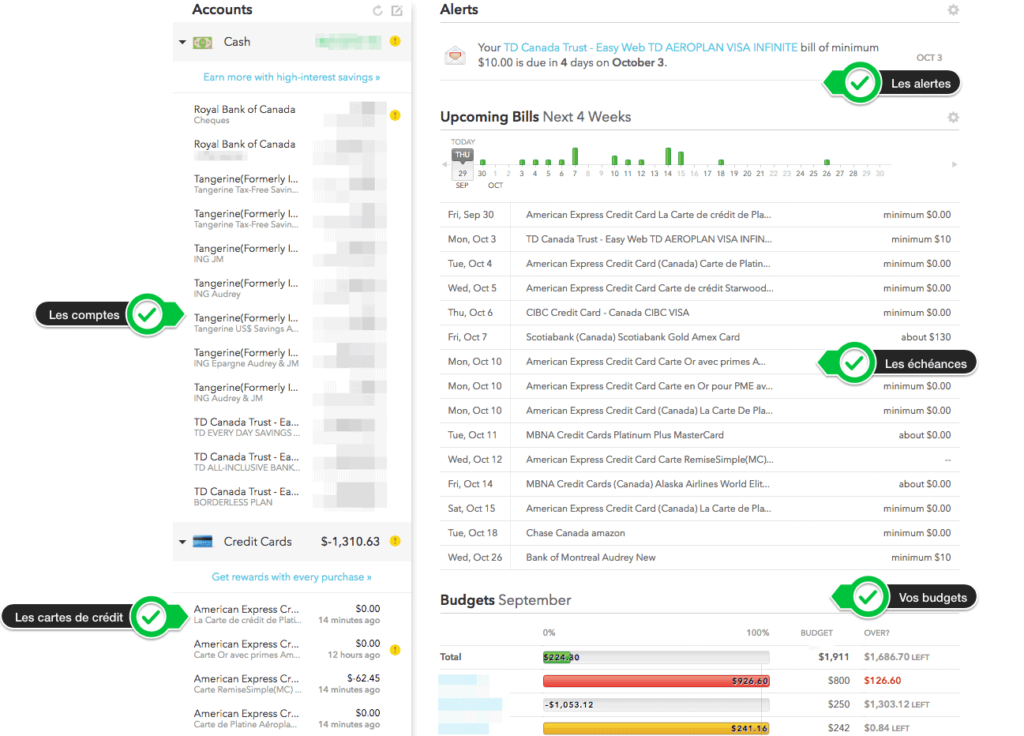

The general view of the Mint.com account

On the home page of your Mint.com account, you have access to an overview of your financial life:

- Bank accounts and credit cards on the left

- Alerts, deadlines and budgets on the right

If a deadline is coming up, it will be placed in the “Alerts” category. You can also set up an email alert.

You can also create budgets by expense category (Rent / Mortgage, Hydro, Groceries, Restaurants….).

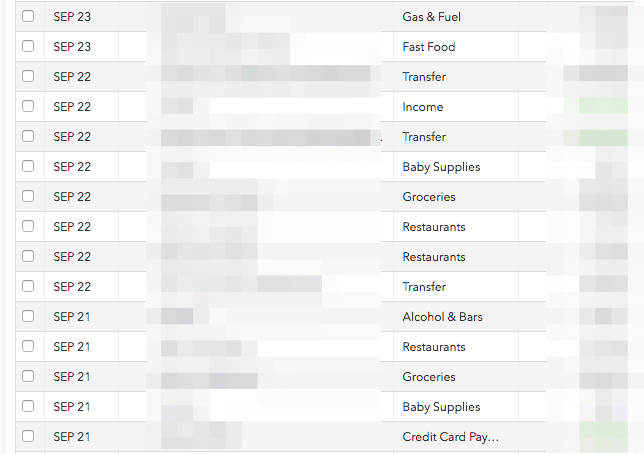

Transactions grouped in Mint.com

One of the strengths of mint.com is that it aggregates all of your account transactions. This is very useful when you have accounts with different banks, which is especially the case when you have several credit cards!

Then, we notice that Mint. com is quite good at classifying expenses in the right categories (Fast Food, Groceries, Gas…). But sometimes there are mistakes and you can of course change the category (or make your own).

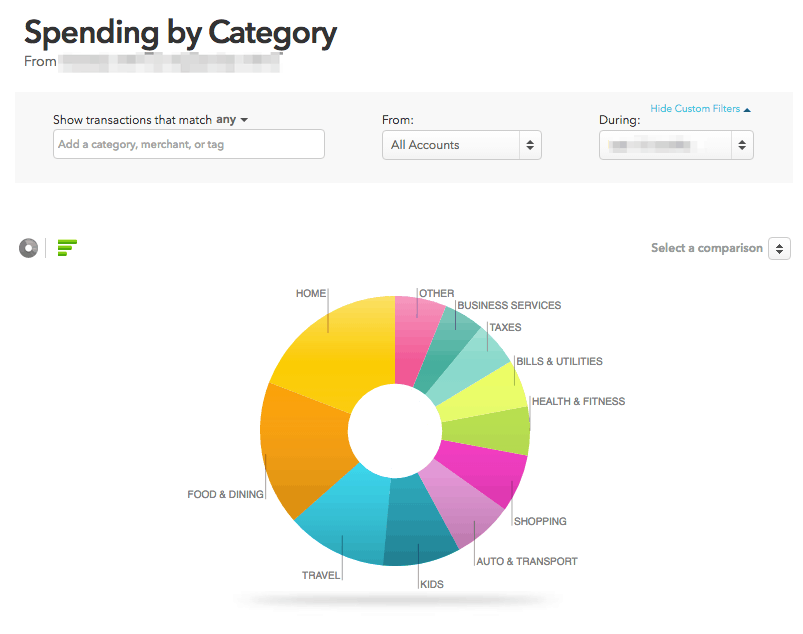

Categories in Mint.com

In addition, Mint. com provides many tools such as the one allowing to visualize the categories of expenses on a defined period of time (week, month, year…)

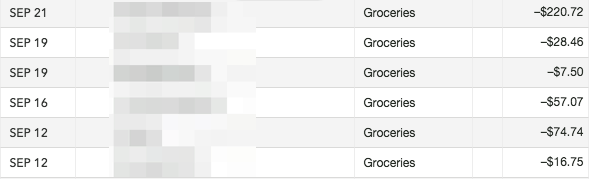

It is then possible to analyze a particular category and see the expenses related to it. For example, in the “Food & Dining” section, I select only “Grocery Stores”.

Conclusion

We let you make mint.com your own. It takes a few days to learn, but you’ll soon be hooked! You should know that it also uses mobile applications allowing you to have a view, at any time, of your accounts!

RegisterRegister

RegisterRegister

RegisterRegister

RegisterRegisterRegisterRegister