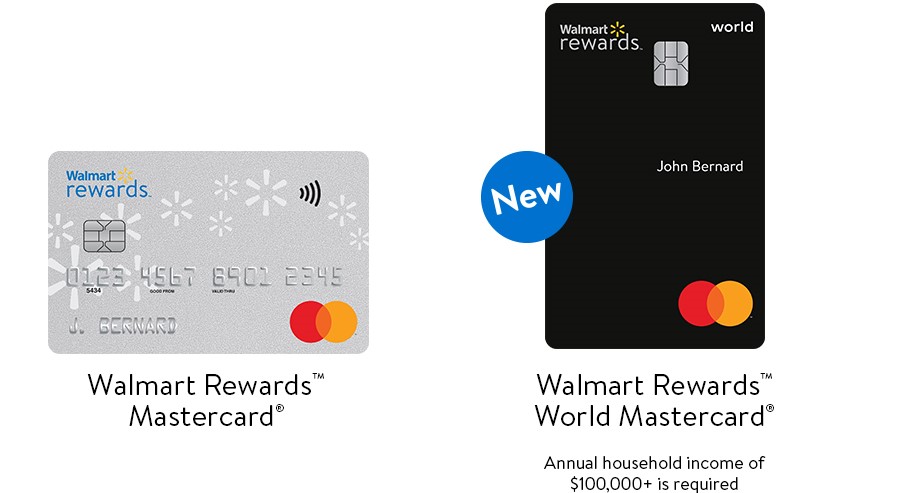

Walmart Canada Credit cards

Walmart Canada offers two credit cards issued by Fairstone Bank of Canada:

Here are the main features of these two Walmart credit cards:

| Walmart Rewards Mastercard | Walmart Rewards World Mastercard | |

| Household income required | $0 | $100,000+ |

| Annual fee | $0 | $0 |

| Online at walmart.ca | 1,25 % | 3 % |

| At any Walmart store in Canada | 1,25 % | 1,25 % |

| At any gas station | 1 % | 1,25 % |

| Everywhere else | 1 % | 1 % |

Both Walmart Canada credit cards are attractive, with no annual fee. With the World version, you get 3% cash back on your online purchases at Walmart.ca, which is hard to beat.

Other Credit Cards for shopping at Walmart Canada

In Canada, several credit cards are interesting for shopping at Walmart, but also elsewhere. Here’s our selection of credit cards with no annual fee from 5 issuers:

Rogers Mastercard®

The Rogers Mastercard® is one of Canada’s best no-annual-fee credit cards, especially for Rogers, Fido or Shaw customers.

Right now, you can earn 10% cash back for the first 3 months, up to a maximum of $100.

With the Rogers Mastercard®, and if you are actively subscribed to only one eligible service with Rogers, Fido or Shaw, you can earn 2% unlimited cash back on all your purchases. Eligible services include :

- Rogers Mobile

- Fido Mobile

- Rogers, Fido, or Shaw Home (Internet, TV, home phone, home monitoring, or satellite)

So this card is now also available to Quebec residents with a mobile service with Rogers or Fido!

Plus, you get 1.5x redemption bonus on Rogers, Fido and Shaw purchases – that’s a 3% cash back value. Plus, as a Rogers Mastercard® credit cardholder, you’ll get five Roam Like Home days at no cost every year for Rogers mobile plans (up to $75 value).

If you’re not a Rogers, Fido or Shaw customer, you’ll earn 2% cash back on U.S. dollar purchases and 1% unlimited cash back on all other purchases.

MBNA Smart Cash Platinum Plus® Mastercard®

The MBNA Smart Cash Platinum Plus® Mastercard® is one of the best cash back credit cards with no annual fee in Canada.

With this card, you can get 2% on:

- gas purchases

- grocery purchases

Until the total gas and grocery purchases in the applicable month reaches $500. And 0.5% everywhere else.

For a limited time, you can earn 5% cash back for the first six months, a $150 value. This is the best no-fee MBNA credit card with cash back.

Tangerine Money-Back Credit Card

The Tangerine Money-Back Credit Card has no annual fee and offers cash back.

With this limited-time welcome offer, you can earn an additional 10% cash back (up to $100) when you spend up to $1,000 on everyday purchases during the first 2 months.

You can choose two to three categories that interest you (groceries, gas, furniture, home improvement, recurring bills, pharmacy, etc.) to earn 2% cash back! And there is no annual cash back limit. It is one of the best credit cards for renovations.

In addition, the Tangerine Mastercard offers several insurance coverages for your purchases :

- 90 days purchase insurance

- One year extended warranty

Finally, during your first 30 days, transfer balances and pay only 1.95% interest on the transferred balance for the first 6 months.

Tangerine World Mastercard

If you have an individual income of $60,000 or a family income of $100,000, you may want to consider the World Mastercard Tangerine.

This credit card has no annual fee and offers cashback. With this limited-time welcome offer, you can earn an additional 10% cash back (up to $100) when you spend up to $1,000 on everyday purchases during the first 2 months.

You can choose two to three categories that interest you (groceries, gas, furniture, home improvement, recurring bills, pharmacy, etc.) to earn 2% cash back! And there is no annual cash back limit.

In addition, the Tangerine World Mastercard comes with several insurance coverages for your purchases and travel :

- 90 days purchase insurance

- One year extended warranty

- Mobile Device Insurance

- Rental Car Collision/Loss Damage Insurance

Finally, during your first 30 days, transfer balances and pay only 1.95% interest on the transferred balance for the first 6 months.

BMO® CashBack® Mastercard®*

The BMO CashBack Mastercard is a no-annual-fee, cash-back credit card. With the BMO CashBack Mastercard, you can earn 5% cash back for the first three months. It’s a maximum welcome bonus of $100.

Then you get:

- 3% cash back on grocery purchases, including at Walmart Supercenters

- 1% cash back on recurring bill payments

Finally, you can also get a 0.99% introductory rate on balance transfers for nine months.

SimplyCash® Card from American Express

Do you want a cash back credit card with no annual fee and a great earning rate for everyday purchases? Here’s an option for you: the SimplyCash® Card from American Express.

With this no-annual-fee credit card, you earn:

- 2% cash back on gas purchases

- 2% cash back on grocery purchases

- 1.25% cash back on all other purchases

And with this welcome offer, you can earn a $10 statement credit for each monthly billing period in which you spend $300 in purchases on your Card in the first 10 months ( up to $100 in statement credits).

And you benefit from several coverages: $100,000 travel accident, Purchase Protection, and Buyer’s Assurance® Protection Plan.

Like all American Express Canada Cards, there is no minimum income requirement.

MBNA Rewards Platinum Plus® Mastercard®

The MBNA Rewards Platinum Plus® Mastercard® is one of Canada’s best no-annual-fee credit cards.

With this card, you can earn 2 points per dollar on:

- Dining purchases

- Grocery purchases

- Digital media purchases (Netflix, Spotify, etc.)

- Memberships

- Household utility purchases (electricity, etc.)

And 1 point per dollar everywhere else. This is the best MBNA credit card with no annual fee.

For a limited time, you can get 10,000 welcome bonus points, a $100 value on travel purchases charged to your Card.

Bottom Line

As you can see, you’re not limited to the two Walmart Canada credit cards issued by Fairstone Bank. Other options that are just as or even more appealing are available to you in Canada!

Check out our other credit card rankings :