RBC Avion Visa Infinite Card - Welcome Offer

With this exceptional offer for the RBC Avion Visa Infinite Card, you can earn up to 55,000 Avion points:

- 35,000 Avion points on approval

- 20,000 Avion bonus points when you spend $5,000 in your first 6 months

You can use your Avion Rewards points for travel or redeem them with other loyalty programs such as :

- American Airlines AAdvantage

- British Airways Executive Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

For example, with the current welcome offer, you can get 55,000 British Airways Avios Points or 550 WestJet Dollars.

With the RBC Avion Visa Infinite Card, you earn 1 point per dollar and 1.25 points for travel purchases.

And you’ll benefit from a wide range of insurance coverage: Trip Cancellation and Interruption Insurance, Out-of-Province/Country Emergency Medical Insurance, Rental Vehicle Collision/Loss Damage Insurance, Mobile Device Insurance.

RBC Avion Visa Infinite Card - Earning RBC Avion Rewards points

With this card, you earn RBC Avion Points based on your spending habits.

1.25 RBC Avion points per dollar for travel purchases

For all your travel purchases:

- flights

- Hotels

- car rentals

- and more!

You’ll earn 25% more RBC Avion points. This corresponds to 1.25 RBC Avion points per dollar of purchases.

1 RBC Avion point per dollar everywhere else

You’ll earn 1 RBC Avion point per dollar for all other purchases.

RBC Avion Visa Infinite Card - Redeeming RBC Avion points

With this RBC Avion credit card, you can:

- Transfer points to British Airways Executive Club, Asia Miles, American AAdvantage, WestJet Rewards or Hudson’s Bay Rewards (between 0.5 and 3 cents per point)

- Redeem points for flights with RBC flight chart (2 cents per point)

- Redeem points for any travel purchase on RBC Avion Rewards (1 cent per point)

- Redeem points for gift cards or products (between 0.5 and 1 cent per point)

- Pay with your points for any purchase (0.58 cents per point)

RBC Avion Rewards Fixed Reward Chart

This is where you’ll get the most out of your RBC Avion Rewards points.

RBC offers a fixed reward chart divided into six levels depending on the type of flight :

| Type of flight | RBC Avion Points required | Maximum ticket price excluding taxes |

| Short getaways Any flight within a province, territory or U.S. state, or to a contiguous province, territory or U.S. state |

15 000 | $350 |

| Discover North America Any flight anywhere in Canada or the United States, except Hawaii or Alaska. |

35 000 | $750 |

| Holiday Destinations Western Canada or U.S. to Mexico, Hawaii or Alaska, Eastern Canada to Bermuda, Central America or the Caribbean |

45 000 | $900 |

| Go on holiday Eastern Canada or United States to Mexico, Hawaii or Alaska, Western Canada to Bermuda, Central America or the Caribbean |

55 000 | $1,100 |

| Visit Europe Any flight from a major point of departure in Canada or the United States to destinations in Europe |

65 000 | $1,300 |

| The World Any flight from a major point of departure in Canada or the United States to destinations in Asia, Australia, New Zealand, the South Pacific, the Middle East, Africa or South America. |

100 000 | $2,000 |

What is most interesting, is when the fare of the flight you want to book is close to the maximum amount (excluding taxes and surcharge ).

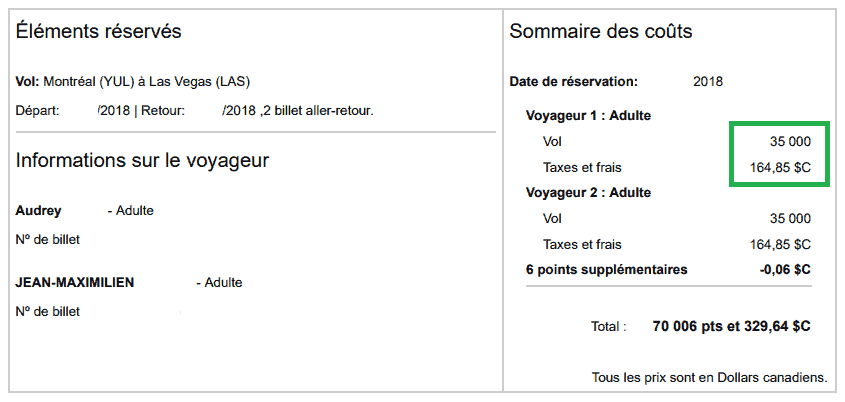

Here’s an example of a flight I booked to redeem 70,000 RBC Avion points I had earned.

This is a flight from Montreal to Las Vegas for a weekend. The fare was 35,000 Avion points (“Discover North America” level in the table above) and $164.85 in taxes.

Flights were direct, operated by Air Canada Rouge (but sold by United).

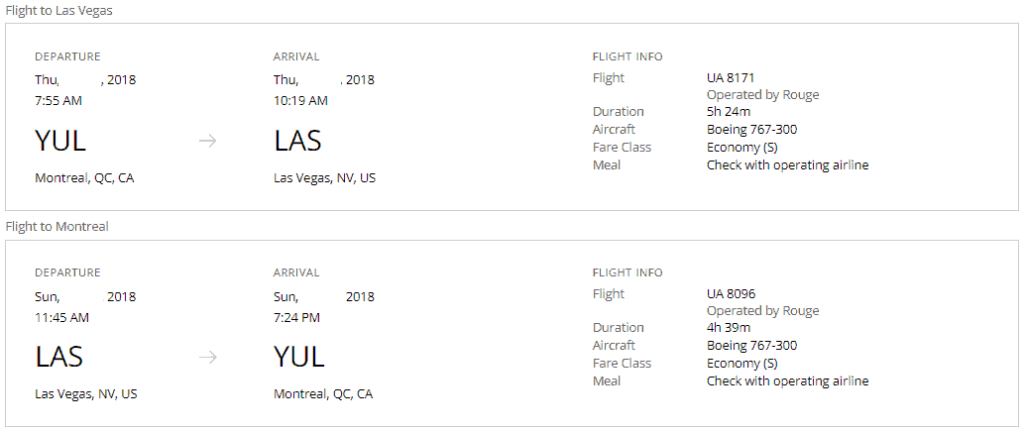

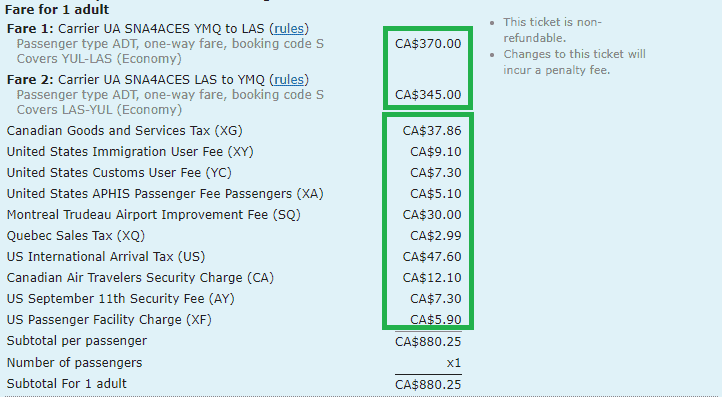

When looking at the details of the fare on ITA Matrix (to get the ticket price + taxes applied), we see that the ticket price is $370 + $345 = $715 (below the maximum allowed by RBC of $750 for 35,000 point tickets):

The taxes are within a few cents of those charged by RBC (approximately $165).

Here, 35,000 RBC Avion points saved me $715.40. This values my use at 2 cents per RBC Avion point (you can hardly get more than that!).

RBC Avion Rewards flexible Reward Chart

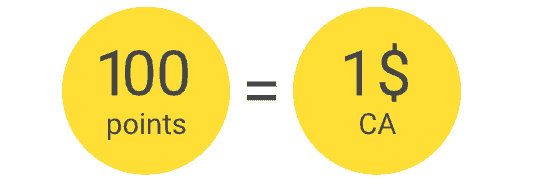

RBC Avion points can also be used via the flexible reward chart. This is the famous “100 points = $1”.

The 55,000 RBC Avion Rewards points earned as a welcome bonus can be used to save $550 on your next travel.

Just use this when you:

- Redeem points for travel rewards without using the Air Travel Rewards Redemption Schedule;

- Redeem points for a hotel stay, car rental, cruise or vacation package;

- Redeem points for one-way, business or first class flight;

- Pay more than the maximum dollar value set for a category;

- Pay all taxes, fees and surcharges.

Converting RBC Avion Rewards points to other loyalty programs

The best use of RBC Avion points earned with the RBC Avion Visa Infinite Card is for transfer to other programs (especially during point redemption promotions such as British Airways Executive Club or Asia Miles). That’s what we did in Australia (and were supposed to do in Japan).

In addition, you can now use your Avios points to travel with Qatar Airways.

Here are the transfer partners and the normal exchange rate.

From time to time, RBC Avion Rewards organizes point conversion promotions, such as +30% to the British Airways Executive Club. Watch for these promotions to redeem your Avion points at the best possible rate! Subscribe to our free newsletter so you don’t miss out.

Purchase gift cards with RBC Avion Rewards points

If buying travel with points isn’t for you, purchasing gift cards is another way to redeem your RBC Avion Rewards points.

We generally do not recommend this method over travel redemptions. However, the RBC Avion Rewards loyalty program regularly offers promotions to redeem Avion points for gift cards!

Here’s an example of an interesting hotels.com gift card promotion. With 18,750 Avion Rewards points, you could get a $250 hotels.com gift card:

RBC Avion Visa Infinite Card - Cardholder benefits

Savings at Petro-Canada

RBC cardholders can link their card to Petro-Canada’s Petro-Points program to earn :

- 3¢ off per litre on fuel and 20% more Petro-Points

- 20% more RBC Rewards points (1.2 RBC Rewards points per dollar spent at Petro-Canada)

Earn more Be Well points at Rexall

By linking your RBC Avion Visa Infinite Card to your Be Well:

- Earn 50 Be Well points for every dollar spent on eligible products at Rexall

- Redeem Be Well points faster for savings in store on eligible purchases where 25,000 Be Well points = $10

12 months of free delivery with DoorDash

Add your RBC Avion Visa Infinite Card to your DoorDash account to:

- Get a free 12-month DashPass subscription – a value of up to $120

- Enjoy unlimited free delivery on orders of $15 or more when you pay with your RBC Avion Visa Infinite Card.

2 for 1 Ski Passes

During the winter season, RBC Avion Visa Infinite Cardholders receive a free lift pass when you buy a Friday lift ticket at participating ski resorts across Canada.

20% discount at Hertz and 3x points

Your RBC Avion Visa Infinite Card gives you a 20% discount on the base rate at Hertz and 3x Avion points.

RBC Avion Visa Infinite Card - Insurance offered by the card

As this card is intended for travellers, it includes the usual “Visa Infinite” level of insurance:

- Out-of-Province / Out-of-Country Medical Emergency Insurance

- Travel accident insurance

- Auto Rental Collision/Loss Damage Insurance

- Trip Cancellation/Trip Interruption Insurance

- Flight delay insurance and purchase of basic necessities

- Hotel or motel burglary insurance

- Purchase Security and Extended Warranty Coverage

- Mobile Device Insurance

Bottom Line

It’s one of the best credit cards in Canada for travellers. Don’t hesitate to take advantage of this exceptional welcome offer!