Welcome offers

MBNA Rewards World Elite® Mastercard®

With the MBNA Rewards World Elite® Mastercard®, you can earn 5 points per dollar of purchases for:

- Dining purchases

- Grocery purchases

- Digital media purchases (Netflix, Spotify, etc.)

- Memberships

- Household utility purchases (electricity, etc.)

Everywhere else, you will get 1 point per dollar.

Enough to make the MBNA Rewards World Elite® Mastercard® the best MBNA credit card for restaurants, groceries, digital media, subscriptions and household utilities.

Knowing that Mastercard recognizes Walmart Supercenters as grocery stores, this is the best credit card for Walmart customers!

Plus, depending on your province of residence, you’ll get a welcome bonus of between 20,000 and 30,000 points, a value of $200 to $300!

And each year, you will receive Birthday Bonus Points equal to 10% of the total number of Points the Account earned in the 12 months before the month of your birthday, to a maximum Birthday Bonus each year of 15,000 Points.

MBNA Rewards Platinum Plus® Mastercard®

The MBNA Rewards Platinum Plus® Mastercard® is one of Canada’s best no-annual-fee credit cards.

With this card, you can earn 2 points per dollar on:

- Dining purchases

- Grocery purchases

- Digital media purchases (Netflix, Spotify, etc.)

- Memberships

- Household utility purchases (electricity, etc.)

And 1 point per dollar everywhere else. This is the best MBNA credit card with no annual fee.

For a limited time, you can get 10,000 welcome bonus points, a $100 value on travel purchases charged to your Card.

MBNA Rewards - Earn MBNA Rewards Points

With the MBNA Rewards World Elite® Mastercard®, you can earn :

- 5 points per dollar spent on groceries, restaurants, digital media, subscriptions and utilities, to a maximum spend of $50,000 (1 point per dollar thereafter)

- 1 point per dollar on the other purchases

While with the MBNA Rewards Platinum Plus® Mastercard®, you can get:

- 2 points per dollar spent on groceries, restaurants, digital media, subscriptions and utilities, to a maximum spend of $10,000 (1 point per dollar thereafter)

- 1 point per dollar on the other purchases

Here are examples of businesses to earn rewards points at grocery stores, lunchbox memberships and restaurants:

- April, Adonis, Bulk Barn, Giant Tiger, IGA, Maxi, Metro, Provigo, Super C, Walmart

- FlashFood and Hello Fresh

- Instacart, Kim Phat, PA Supermarket

And since these credit cards offer between 2 and 5 points per dollar for digital media and utility subscriptions, it’s perfect if you are a subscriber to:

- Netflix, Crave, Disney+

- Apple Music, Spotify, Amazon Prime, Google Play, YouTube Premium

- Videotron, Fido Mobile, Fizz, Koodo, SiriusXM

- Énergie Cardio fitness centers and others

Between 2 and 5 points per dollar at Walmart

At Walmart supercentres, you can buy groceries and earn:

- 5 points per dollar with the MBNA Rewards World Elite® Mastercard®.

- 2 points per dollar with the MBNA Rewards Platinum Plus® Mastercard®

Unlike Visa and American Express credit cards, Mastercard credit cards treat Walmart supercentres like grocery stores!

1 point per dollar at Costco

The MBNA Rewards World Elite® Mastercard® and the MBNA Rewards Platinum Plus® Mastercard® are Mastercard network credit cards.

This means that they will be accepted for purchases made at Costco and you will be able to earn 1 point per dollar.

MBNA Rewards 10% Birthday Bonus Points

Each year, you’ll receive Birthday Bonus Points from MBNA Rewards, equal to 10% of the total number of Points the account earned in the 12 months before the month of the primary cardholder’s birthday, to a maximum Birthday Bonus each year of 15,000 Points.

This mathematically increases your return in MBNA Rewards points on all your purchases.

With the MBNA Rewards World Elite® Mastercard®, you can earn with this 10% anniversary bonus:

- 5.5 points per dollar spent on groceries, restaurants, digital media, subscriptions and utilities

- 1.1 points per dollar on the rest

While have the MBNA Rewards Platinum Plus® Mastercard®, you can get through this 10% birthday bonus :

- 2.2 points per dollar spent on groceries, restaurants, digital media, subscriptions and utilities

- 1.1 points per dollar on the rest

MBNA Rewards - Redeeming MBNA Rewards Points

Redeem MBNA Rewards Points For Cash Back

You can redeem your MBNA Rewards points to earn cash back through credit card statement credit.

The rate at which MBNA Rewards points are used will vary depending on your MBNA credit card:

| MBNA Credit Card | Redemption rate | Value per point |

| MBNA Rewards World Elite® Mastercard® | 120 points = $1 | 0.83 cents |

| MBNA Rewards Platinum Plus® Mastercard® | 200 points = $2 | 0.5 cents |

So when you earn 5 points per dollar at the grocery store with the MBNA Rewards World Elite® Mastercard®, and redeem your MBNA Rewards points for cash back, it’s like earning 4.15% cash back.

Not to mention the 10% anniversary bonus on all points earned in the previous 12 months (up to a maximum of 15,000 points). That brings your cash-back rate at the grocery store up to 4.56%!

Redeem MBNA Rewards Points For Travel

The best way to redeem MBNA Rewards points is to purchase travel.

You’ll be able to redeem your MBNA Rewards points at a rate of 1,000 points = $10, or 1 cent per point.

Redeem MBNA Rewards Points For Gift Cards

The second best way to redeem MBNA Rewards points is for gift cards.

Via the MBNA Rewards platform, you can redeem your MBNA Rewards points to get two types of gift cards:

- Electronic gift cards

- Physical gift cards

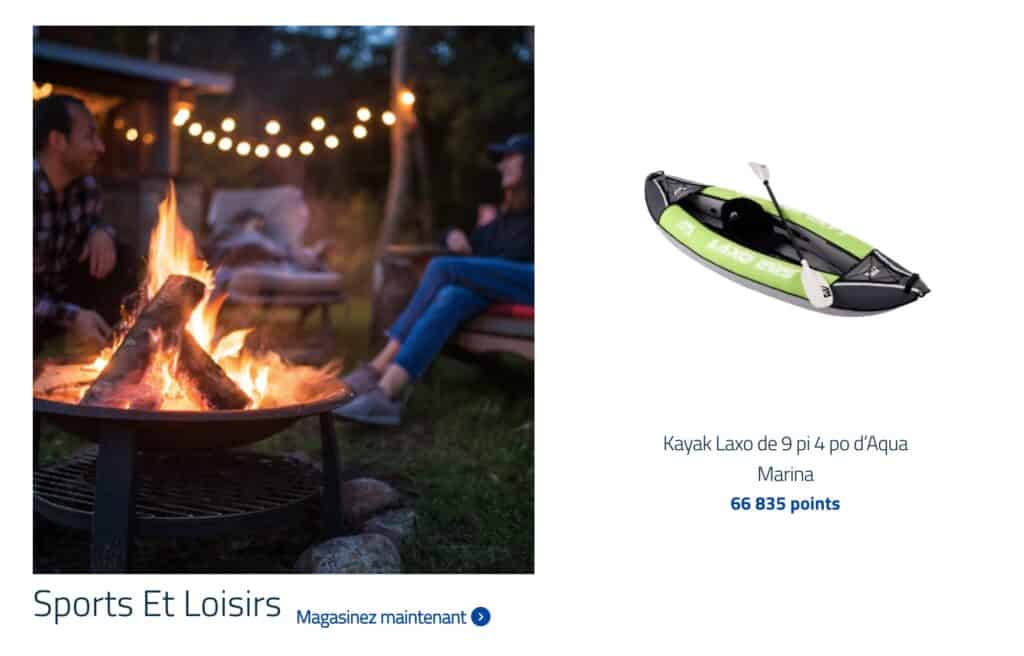

Redeem MBNA Rewards Points For Products

The third best way to redeem MBNA Rewards points is to get products through the MBNA Rewards platform.

From what we’ve seen, the rate at which your MBNA Rewards points are used to get products will be approximately 0.85 cents per point.

MBNA Rewards - MBNA Insurance

These MBNA Rewards credit cards offer several insurance coverages.

Mobile Device Insurance

In terms of Mobile Device Insurance, the MBNA Rewards World Elite® Mastercard® and the MBNA Rewards Platinum Plus® Mastercard® both offer this coverage.

Coverage of up to $1,000 in the event of loss, theft, accidental damage or mechanical failure of your eligible mobile device.

To benefit from this protection, you must use one of these MBNA Rewards Mastercard credit cards to:

- Pay all your monthly cell phone bills and any upfront costs

- OR pay for at least 75% of your mobile device when you pay the full cost of its purchase up front

Travel insurance

The MBNA Rewards World Elite® Mastercard® offers insurance coverage for your travels:

| Insurance | Details |

| Travel Medical Insurance | Up to $2 million for the first 21 days of travel (65 and under) |

| Delayed or lost luggage insurance | Up to $1,000 per person, if more than 4 hours late |

| Flight and travel delay insurance | Up to $500 per person if the flight or trip is delayed more than 4 hours |

Purchase Assurance and Extended Warranty Insurance

The MBNA Rewards World Elite® Mastercard® and the MBNA Rewards Platinum Plus® Mastercard® offer 90 days’ purchase insurance. In addition, they both provide an attractive extended warranty. The extended warranty doubles the manufacturer’s written warranty on most new purchases made with this card.

The MBNA Rewards World Elite® Mastercard® stands out by offering a Price Protection service for 60 days following the date of purchase. This refers to an eligible item paid for with your card where you find it at a lower price in Canada after purchase.

Bottom Line

The choice is yours!

The MBNA Rewards World Elite® Mastercard® is for people with incomes over $80,000 who want a fast accumulation of rewards points at grocery stores, restaurants and monthly memberships. Also, it offers travel insurance with an annual fee of $120. Its welcome bonus will give you up to $165 in reward points.

While the MBNA Rewards Platinum Plus® Mastercard® has no annual fee and no minimum income requirement. This credit card does not have travel insurance but does offer an attractive extended warranty. Its welcome bonus will give you up to $50 in reward points.