National Bank World Elite® Mastercard® - Summary

The National Bank World Elite Mastercard® is NBC’s best Mastercard credit card.

Right now, with our exclusive welcome offer:

- Get up to 35,000 reward points

- Save on annual fees for the first year

- Get a chance to win $2,000 in travel credits courtesy of Transat

It’s the best time of year to apply for the National Bank World Elite Mastercard®!

With this card, you earn up to 5 points per dollar on your purchases:

- 5 points per dollar on grocery and restaurant purchases

- 2 points per dollar on gas and electric recharge purchases

- 2 points per dollar on recurring bills

- 2 points per dollar on À la carte Travel

- 1 point per dollar on all other purchases

And since it’s a National Bank Mastercard credit card, you can use it at Costco.

With this card, you have access to a $150 annual travel credit that you can use in any of these categories:

- Airport parking

- Baggage fees

- Seat selection

- Access to airport lounges

- Flight upgrades

In addition, you can enjoy access to DragonPass airport lounges and free Wi-Fi with Boingo. And unlimited access to the National Bank Lounge at Montreal-Trudeau.

Finally, Milesopedia voted the National Bank World Elite Mastercard® the Best Travel Credit Card and the Best Credit Card for Insurance in 2023 and 2024.

National Bank World Elite Mastercard® - Offer details

Until June 15, 2024, with the exclusive offer for Milesopedia readers, you can earn up to 35,000 welcome bonus points with a first-year annual fee rebate!

Several criteria are required to get the full National Bank welcome bonus:

- 10,000 points after $5,000 in purchases in the first three months

- 10,000 points after $10,000 in purchases in the first 6 months

- 15,000 points after $20,000 in purchases in the first 14 months

Moreover, when you sign up for the National Bank World Mastercard® via our link, you’ll automatically be entered in the Transat contest: there are five travel credits courtesy of Transat worth $2,000 to win!

For your information National Bank World® Mastercard® is one of the credit cards we recommend renewing year after year because of its travel and purchase insurance and its $150 annual travel creditand its travel benefits (access to the National Bank lounge, Wi-Fi access, etc.).

National Bank World Elite® Mastercard® - Earning points

With the National Bank World Mastercard®, you can earn up to 5 points per dollar:

| Category | Points |

| Grocery and Restaurant | 5* |

| Gas and electric recharge | 2 |

| Recurring bills | 2 |

| À la carte Travel | 2 |

| Other purchases | 1 |

For the Grocery and Restaurant category, you can earn 5 points per dollar up to $2,500 in total monthly purchases charged to the card.

Once you reach $2,500 in monthly purchases, you will earn 2 points per dollar on the Grocery and Restaurant category. This is still very good compared to other cards that only offer 1 point per dollar after the threshold is reached.

This makes the National Bank World Mastercard® one of the best Mastercard credit cards for grocery and restaurant purchases.

National Bank World Elite® Mastercard® - Use of points

À la carte Rewards

To redeem your NBC Rewards points, you must log on to the dedicated NBC À la carte Rewards Plan portal.

You can book your vacation with your points (plus monetary supplement if required) through the À la carte Travel Agency: 10,000 points for every $100.

It’s simply the best use of your NBC Rewards points!

Statement credit

It’s also possible to redeem your NBC points as a statement credit for any travel expenses you’ve charged to your credit card (redemption must be made within 60 days of the expense being charged to the credit card account).

Eligible purchases are:

- Flights

- Vacation packages

- Car rentals

- Hotel nights

- Cruises

- Condominium or cottage bookings for tourism purposes

- Airbnb

- Excursions

- Camping

- And more!

However, for this type of redemption, the rate is different (see table below).

You can also redeem your points for a product in the À La Carte Rewards catalogue.

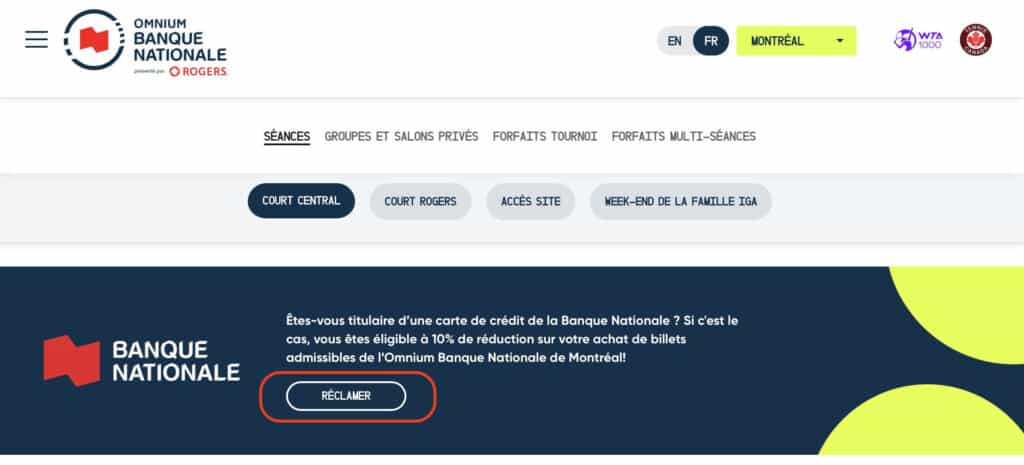

10% discount on National Bank Open tickets

To see your favourite tennis players on the courts for less, simply use your National Bank World Mastercard®!

At the very beginning of the ticket purchase process, click on Claim to get your 10% discount on National Bank Open tickets.

NBC Rewards Chart

You’ll see from this chart that the best use of NBC Rewards points is to book your trip with NBC’s À la carte Travel online travel agency: you get $100 for 10,000 points.

| Rewards | Points for $100 |

| Exchange with the dedicated NBC à la carte travel agency | 10 000 |

| Flexible travel rebates (from 55,000 points redeemed) |

11 000 |

| Flexible travel rebates | 12 000 |

| Extras À La Carte RRSP or TFSA contribution Reimbursement of your all-in-one line of credit or mortgage loan |

12 000 |

| Gift-card | 12,000 – 13,500 |

| Statement credit | 25 000 |

In addition, the A la carte Rewards store also allows you to redeem your points for merchandise and gift cards.

If you have a promotional code, you can use it at checkout.

National Bank World Elite® Mastercard® - Benefits

$150 travel credit per calendar year

Through NBC’s Smart Travelers program, National Bank World Mastercard® credit cardholders have a total of $150 available each calendar year to apply to certain travel-related expenses:

- Airport parking

- Baggage fees

- Seat selection

- Access to airport lounges

- Flight upgrades

This is a great perk for those who use an airport parking lot (note that Park & Fly also works with this benefit) or who have to pay baggage or seat selection fees.

These credits are valid per calendar year. This means that if you sign up for the National Bank World Mastercard® in 2024, you will benefit from these credits until December 31, 2024, and will receive them again on January 01, 2025.

However, if you don’t use your 2024 travel credits, they will be lost.

Unlimited access to the National Bank Lounge at Montreal-Trudeau

With the National Bank World Mastercard®, you have unlimited complimentary access to the National Bank Lounge at Montreal-Trudeau (YUL).

This benefit is valid for the main cardholder as well as an additional traveller. And up to two children.

Note that holders of an additional National Bank World Elite® Mastercard® are also entitled to unlimited access to the National Bank Lounge with an additional guest!

Access to DragonPass Lounges

The National Bank World Mastercard® offers access to over 1,300 airport lounges worldwide in the DragonPass network.

For each visit, you will have to pay an entrance fee of 32 US$ per person.

Since 2023, World Elite cardholders can be reimbursed for these airport lounge visits. This is an eligible travel expense, up to a maximum of $150 per year.

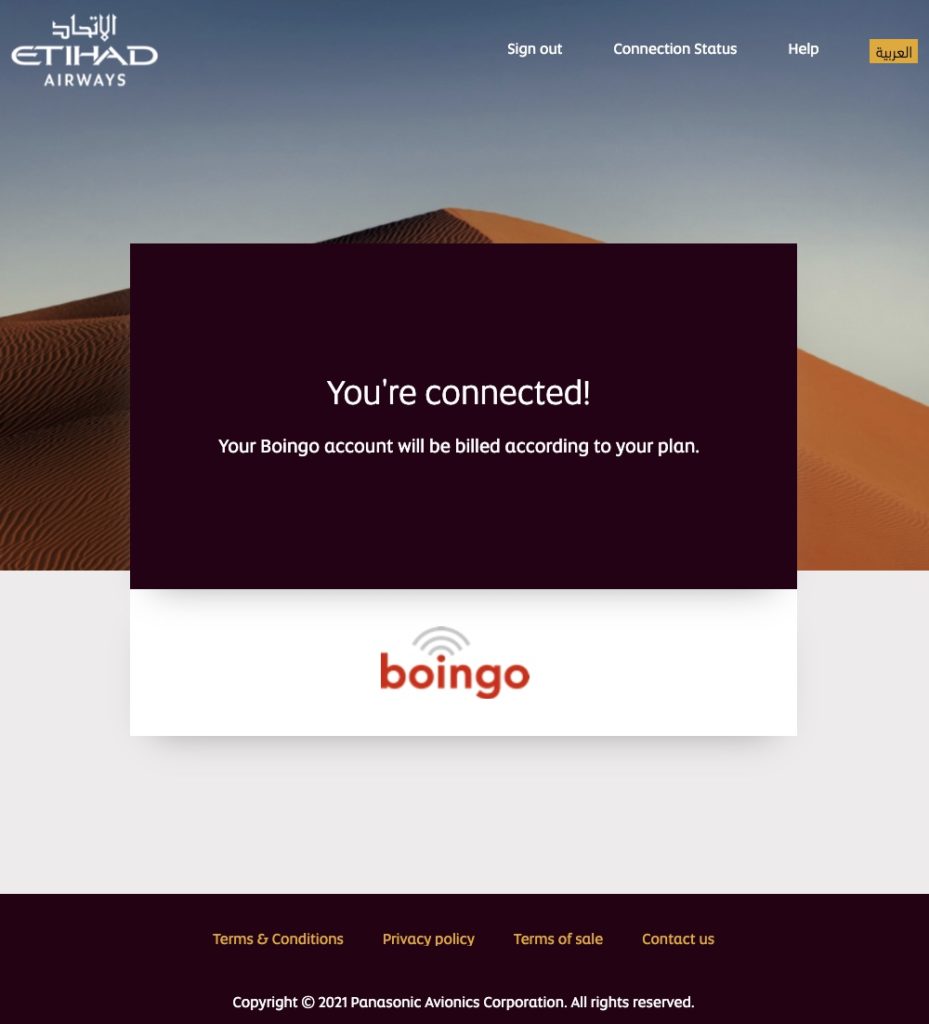

Free Wi-Fi with Boingo

The National Bank World Mastercard® offers 12 free 90-minute annual accesses, with no data limit, to over 1 million Wi-Fi hotspots worldwide via Boingo.

This is particularly useful with some airlines such as WestJet, Lufthansa, Swiss, Austrian, Singapore Airlines, Etihad, etc.

National Bank World Elite Mastercard - Insurance

For most of the insurance coverages included, the National Bank World Mastercard® is one of the only credit cards in Canada to cover you, even if you charge only part of the cost of the trip.

The following expenses will be reimbursed, provided that a portion (…) of the trip was charged to the account.

Banque Nationale du Canada

For travel insurance, only baggage insurance in case of delay and vehicle rental insurance requires that the entire cost was charged to the card.

| Insurance | Coverage |

| Medical/hospital insurance Out-of-province-of-residence |

up to $5,000,000 per person (see details below on age and duration) |

| Flight Cancellation (before departure) |

up to $2,500 per insured person |

| Trip Interruption Insurance (after departure) |

up to $5,000 per insured person |

| Flight delay (over 4 hours) |

$250 per day (up to $500 per person) |

| Baggage insurance in case of delay (over 6 hours) |

up to $500 per person |

| Lost or Stolen Baggage Insurance | up to $1,000 per person |

| Vehicle rental insurance | Vehicle valued up to $65,000 |

| Purchase protection in the event of theft or damage (180 days) |

up to $60,000 |

| Mobile Device Insurance | up to $1,000 |

| Possibility of tripling the manufacturer’s warranty | up to 2 additional years |

| Insurance booklet |

The National Bank World Elite® Mastercard® offers a different kind of protection for emergency medical care when traveling on business:

- the person’s age

- the length of the trip

| Age | Maximum trip time frame |

| 54 and under | 60 days |

| 55 to 64 | 31 days |

| 65 to 74 | 15 days |

| 75 years or older | no coverage |

Bottom Line

The National Bank World Elite® Mastercard® is a credit card to have in your wallet year after year.

With this card, you’ll enjoy up to $150 in annual credit for specific travel purchases and hold the Best Travel Credit Card and Best Credit Card For Insurance in 2024. And you’ll earn up to 5 points per dollar on purchases, including groceries!

Take advantage of this exclusive offer from Milesopedia with National Bank to get this card today!