Welcome offer

The American Express Business Edge™ Card is an excellent credit card for businesses in Canada. The annual fee is only $99 and this American Express credit card offers up to 67,000 Membership Rewards points in the first year, a value of $670.

You can also transfer your points to airline partners (Aeroplan, British Airways Executive Club, Flying Blue, etc.) and hotel partners (Marriott Bonvoy, Hilton Honors).

With this Card, you can get 3x the points on purchases:

- Office supplies (Staples, etc.)

- Electronic (Apple, Dell, etc.)

- Rides

- Gas

- Eats & Drinks

Besides, you can add up to 99 supplementary cards at no cost.

Like all American Express Canada Cards, there is no minimum income requirement.

Elevated earning rate

This American Express card is accepted by all major gas station banners. You earn 3 points for every $1 spent at gas stations.

With the American Express Business Edge™ Card, you also earn 3 points per dollar on:

- Office supplies (such as Staples or Hamster)

- Electronic items (like Apple or Best Buy)

- Restaurants and bars purchases (such as McDonalds or The Keg)

- Food delivery services (such as Uber Eats or SkipTheDishes)

With the rising cost of gas, you might as well get a very nice return in points!

For the rest of the purchases, the earning rate is 1 point per $1.

For example, see what you can earn monthly in the first year with $3,000 in gas purchases (or a combination of electronics and restaurants) per month:

| Month | Purchases | Category 3X | Bonus | Total |

| #1 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #2 | $3,000 | 9,000 points | 45,000 points + 1,000 points | 55,000 points |

| #3 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #4 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #5 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #6 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #7 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #8 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #9 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #10 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #11 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| #12 | $3,000 | 9,000 points | 1,000 points | 10,000 points |

| Total | 36 000 $ | 108,000 points | 57,000 points | 165,000 points |

What to do with all these points?

With flexible Membership Rewards points and the example in the chart above, you can redeem them for:

- $1,650 in statement credit (1,000 points = $10 credit)

- Redeem points for purchases on Amazon.ca and AirCanada.com

- Use your points to pay for flights, hotels and car rentals booked with American Express Travel Services

- Transfer those 165,000 points to airline and hotel programs that will become :

- 165,000 Aeroplan points

- or 198,000 Marriott Bonvoy points

- or 165,000 Avios miles

- or 165,000 Hilton points

- or exchange them for gift cards and merchandise

To give you some ideas of what to do with Aeroplan or Marriott Bonvoy points, here are plenty of them for different times of the year.

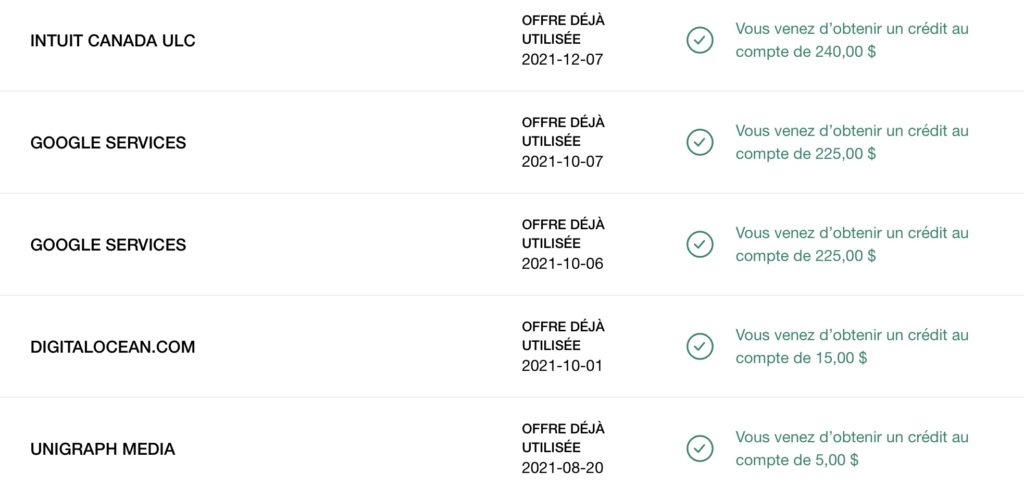

American Express Promotional Offers

American Express regularly runs promotional offers for Cardmembers.

During these offers, depending on purchases from targeted retailers, it will be possible to get:

- a discount (“Spend $100 or more and get a $30 credit”)

- Bonus points (“Spend $50 and get 1,000 bonus points”)

- Higher earning rate (“Earn 4 points per dollar up to 4,000 bonus points”)

For example, I was able to get credits with Google Ads, Quickbooks and Amazon purchases. This will reduce the $99 annual fee (which is already low compared to other business credit cards in Canada).

Additional cards

You can get up to 99 free additional cards attached to your American Express Business Edge™ Card account. All these cards allow you to earn points in your Membership Rewards account.

If an additional Cardmember leaves your business and you terminate their Card within 2 business days, their eligible unauthorized expenses charged to the American Express Business Edge™ Card may be covered.

In fact, you have a special advantage for business owners! You have coverage of up to $100,000 for each additional cardholder employee if they have made unauthorized charges to the card.

Bottom Line

The American Express Business Edge™ Card also provides you with a one-year extended warranty on purchased items. Also, it protects your purchases with a 90-day insurance.

What to have peace of mind to avoid bad surprises to your company! To learn how to apply for an American Express Small Business Card, check out this article.