Welcome offer

The BMO eclipse Visa Infinite Privilege* Card is a premium metal card! With this card, you can earn up to 120,000 BMO Rewards points:

- 50,000 points when you spend $6,000 in the first 3 months

- 30,000 points after $30,000 in card purchases in the first six months

- 40,000 points at annual card renewal if you have made $75,000 in card purchases in the first 12 months

Plus, you’ll get a $200 annual lifestyle credit – per calendar year – to spend however you want.

As well as a Visa Airport Companion membership with 6 complimentary airport lounge visits per year.

With this Card, you earn 5 BMO Rewards points per dollar of purchases for:

- Groceries

- Gas

- Drugstores

- travel purchases

- Dining

- Food delivery

And 1 BMO Rewards point for every $1 spent on everything else.

You can use BMO Rewards points for all travel purchases made through the agency or website of your choice (flights, hotels, car rentals, all-inclusive resorts, Airbnb, etc.) or for rewards and gift cards on the BMO Rewards platform.

Would you like a Visa credit card earning 5 points per dollar at many stores for a lower annual fee? Check out this offer for the BMO eclipse Visa Infinite Card!

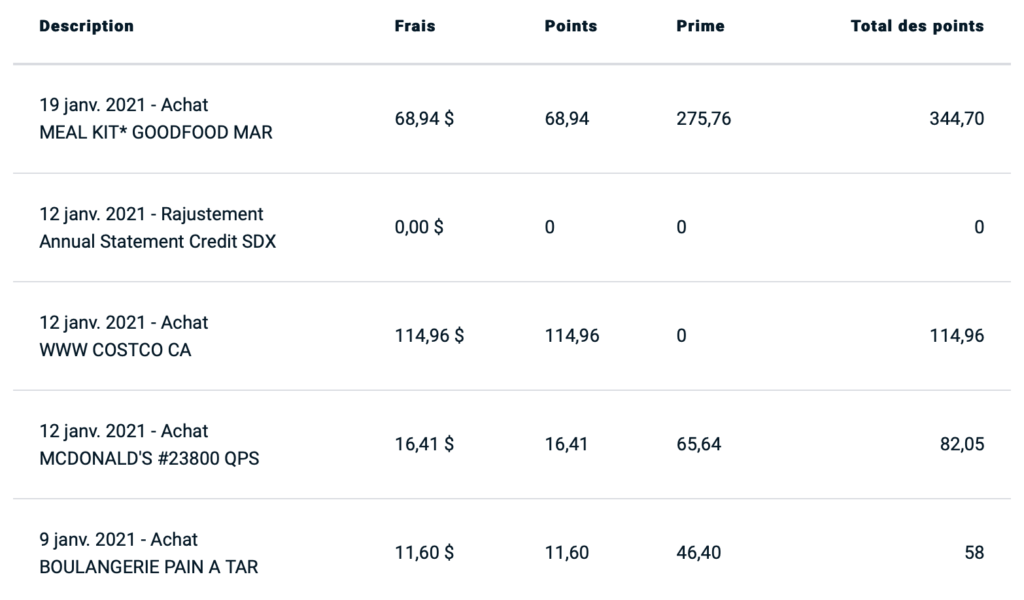

Earning points

With this card , you can earn 5 BMO Rewards points for every $1 in purchases:

- Groceries

- Gas

- Drugstores

- travel purchases

- Dining

- Food delivery

And 1 BMO Rewards point for every $1 spent on everything else.

The BMO eclipse Visa Infinite Privilege* Card is aimed at the more mature traveller!

Note that unlike the BMO eclipse Visa Infinite* Card, the Visa Infinite Privilege version earns 5 points per dollar on travel and drugstore purchases (bypassing the local transportation category).

Grocery, gas, food delivery and dining purchases are kept at 5x the points for every $1 spent. That’s a lot of 5x categories!

So, if you use your points earned through all these purchases for travel, that means a return of 3.33%! It’s very rare that a credit card offers more than 3% for travel or even drugstore purchases!

25% more points with supplemental cardholders

If you add an authorized user to your account, you will earn 25% more points.

So you will earn 6.25 points per dollar in the bonus categories (groceries, gas, drugstores, travel, restaurants, bars, food delivery). That’s a return of 4.17% if you use your points for travel purchases through BMO Rewards.

The additional card fee is $99. Therefore, to break even, you’ll need to spend at least $11,000 per year. And if you spend more, you’ll get more value! And if you spend more, you’ll get more value!

Using points

You can use your BMO Rewards points in many ways:

- Travel

- Pay with your points option for any purchase

- Products or gift cards

- Investment

Let’s analyze the two most common uses of BMO Rewards points.

Redeem your BMO Rewards Points for travel

To use your BMO Rewards points for travel, you can visit the BMO Rewards platform. You can redeem BMO Rewards points for different types of trips:

- flights

- hotel nights

- Car rentals

- Vacation packages

- Cruises

Prices are the same as other travel agencies.

But now you can also book with any travel provider and get the same value for your BMO Rewards points.

Using BMO Rewards points for travel is the best use of your points: 150 points = $1. So 120,000 points are worth $800.

For example, if you spend $3,000 per month in the 5 points per dollar with the BMO eclipse Visa Infinite Privilege* Card (groceries, pharmacy, restaurants and bars, home food delivery, gas, travel), you’ll earn 15,000 points per month, a $100 value for travel.

Over the course of a year, that’s nearly $1,200 you can earn this way! Enough to pay for a flight or several hotel nights!

And 25% more if you add an authorized user to your account.

Redeem BMO Rewards points for all purchases

You can also redeem your BMO Rewards points for any purchase charged to your card for as little as $1!

Here, 200 points = $1. So 40,000 points have a $200 value.

Insurance

The BMO eclipse Visa Infinite Privilege* Card includes insurance coverages:

- Travel Emergency Medical Insurance

- Trip Cancellation/Interruption insurance

- Flight delay insurance

- Delayed and Lost Baggage Insurance

- Rental Car Collision Loss/Damage Insurance

- Hotel/Motel Burglary Insurance

- Travel Accident Insurance

- Mobile device insurance

- Purchase security insurance (120 days)

- Extended warranty (up to 2 additional years)

Benefits

$200 Annual Lifestyle Credit

The BMO eclipse Visa Infinite Privilege* Card comes with a $200 annual credit that you can use as you wish.

It’s nearly paying for the $499 first-year annual fee. This card also comes with 6 airport lounge visits per year—about a $200 value per year, in our opinion.

6 complimentary visits to DragonPass VIP lounges

With the BMO eclipse Visa Infinite Privilege* Card, you get six annual visits to DragonPass member VIP lounges.

In Montreal, for example, you can visit the National Bank Lounge or the Air France Lounge.

In Quebec City, at the VIP Club Med Lounge, in Calgary at the WestJet Elevation Lounge, or in one of the many Plaza Premium lounges elsewhere in Canada.

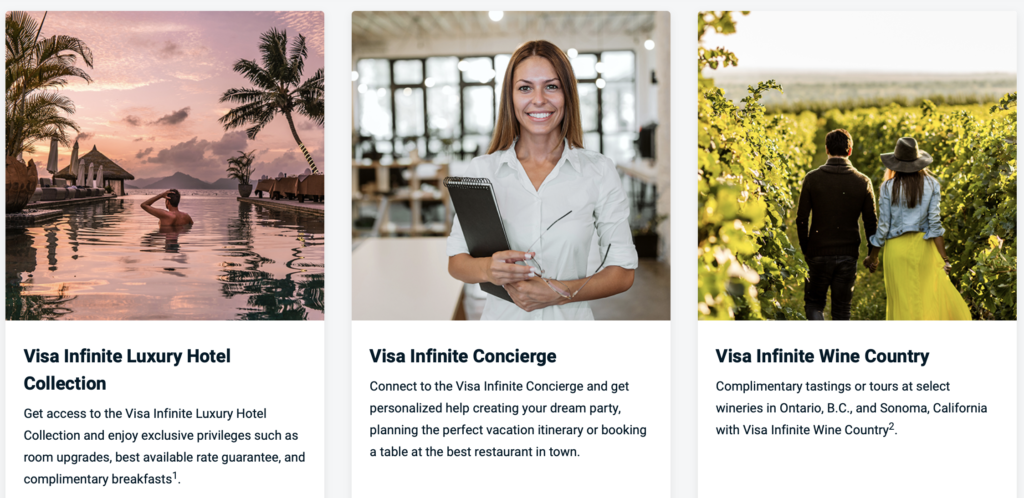

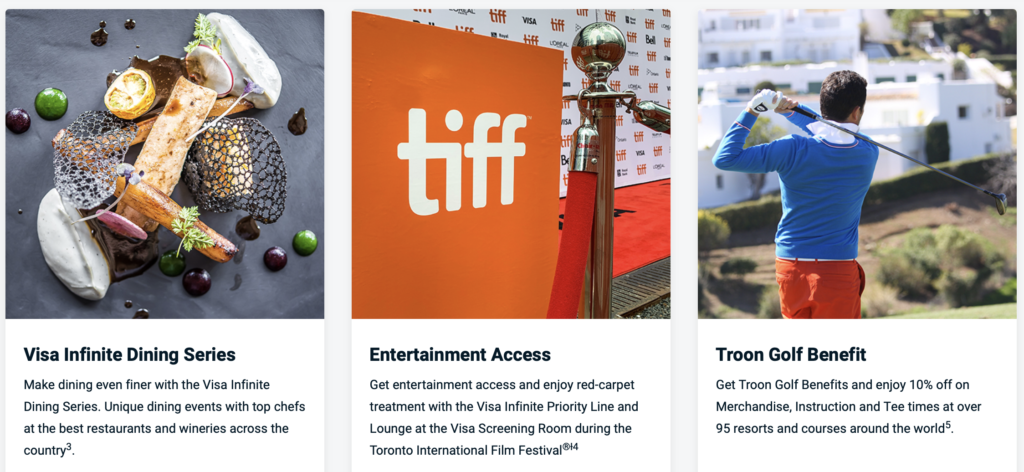

Visa Infinite Benefits

With the BMO eclipse Visa Infinite Privilege* Card, you enjoy a range of benefits reserved for Visa Infinite Privilege credit cardholders:

- Visa Infinite Concierge

- Visa Infinite Dining Series

- Entertainment

- Troon Golf Benefit

And without forgetting other Visa Infinite Privilege benefits such as priority security lane, airport parking and valet service discounts at select Canadian airports, unique dining and wine events, VIP perks in luxury hotels and more.

Bottom Line

The BMO eclipse Visa Infinite Privilege* Card is great for everyday expenses like groceries or food delivery.

In this sense, being able to earn 5 points per dollar on these types of purchases with a Visa card (accepted almost everywhere), for an effective return of more than 3.33%, is particularly interesting.

And thanks to an annual statement credit you can use however you want (and not just travel like other credit cards), it’s a way for BMO to “virtually” lower the annual fee for loyal customers.

During the second year, the annual fee is equal to $299 for the BMO eclipse Visa Infinite Privilege* card (after the $200 annual credit) That way, you can enjoy Visa Infinite Privilege Benefits at a lower cost! That way, you can enjoy Visa Infinite Privilege Benefits at a lower cost!

The BMO eclipse Visa Infinite* Privilege Card requires a minimum individual income of $150,000 or a minimum household income of $200,000.