Together with our authors, we have started to produce travel guides to help you plan your vacation in Canada. Here are some of them:

And we continue to publish our reviews on hotels you can book with points for your vacations in Canada (you can check out this page for a map of 250 hotels across the country):

To help you plan your vacation in Canada, we recommend several credit cards:

- for their welcome bonus

- for points earned with your expenses related to your future vacation in Canada (gas, groceries, etc.)

And we’ve broken it all down by expense item for your holidays in Canada:

Accommodation

There are two ways to stay for a vacation in Canada (putting aside the Van Life concept):

Hotels

In Canada, there are various rewards programs that allow you tosave money on your hotel nights. One of the best is this one:

By applying for credit cards associated with these programs, you can get many free hotel nights across the country. What to lighten your vacation budget in Canada!

With the Marriott Bonvoy™ American Express® Card, you earn 50,000 points after $1,500 in Card purchases. Enough to offer you several free hotel nights during your holidays in Canada.

And if you’re a couple or a friend, you could each sign up for this card and earn a total of over 100,000 bonus points. Then transfer your points from one account to another for free, giving you many free hotel nights!

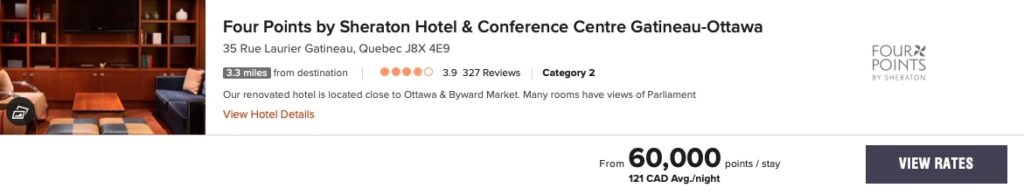

For example, with 60,000 points, you could get 5 nights in Gatineau at the Four Points by Sheraton Hotel & Conference Centre Gatineau-Ottawa :

For 60,000 points, you could get 5 nights at the Delta Hotels Sherbrooke Conference Centre in Sherbrooke:

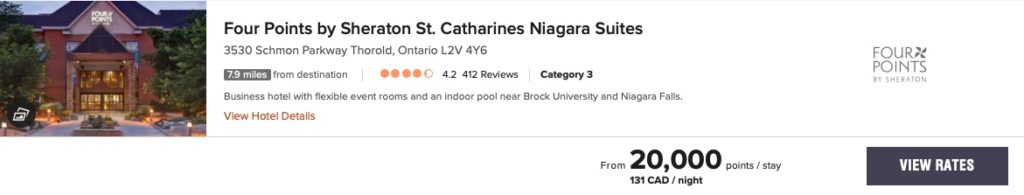

Want to visit Niagara Falls and the local wineries? Stay at the Four Points by Sheraton St. Catharines Niagara Suites for only 20,000 points per night.

Looking for a stopover hotel while visiting British Columbia? How about this Fairfield Inn & Suites Kamloops hotel for only 20,000 points per night:

In short, there are many hotels available with points for a vacation in Canada. Here are the 2 current offers for credit cards with hotel points:

Rentals: apartments, chalets, camping

Hotels are not for you? Do you prefer the comfort of an apartment or a cottage ? Or the proximity to nature offered by campsites or unusual accommodation? There are credit cards allowing you to redeem your points for this type of accommodation.

For example, the American Express Cobalt® Card is the one we recommend to anyone who wants to save money on their vacation rentals.

New American Express Cobalt® Card holders can earn up to 15,000 points as a welcome bonus. This is a generous welcome offer for a credit card that requires no minimum income.

This corresponds to a value of $150 using your points for any purchase made with the Card. See our trick to get 60,000 points in a year!

But there are many credit cards where you can use points on accommodation rentals. Here is a list of the best current offers for a vacation in Canada:

Travel

For your vacation in Canada, there are many ways to get around and save on the “travel” budget:

Car rental and Train

For car rental, you can use travel points from your credit cards.

Here, we suggest:

But you could use specific points like AIR MILES or BMO Rewards points.

Here are the best credit cards for that use:

Gas

Here, we will try to use the best credit card to earn the maximum of points for gas during a vacation in Canada.

A few credit cards stand out in Canada:

| Credit card | Points per dollar | Return |

| CIBC Dividend® Visa Infinite* Card | 4 % | 4 % |

| BMO eclipse Visa Infinite* Card | 5 points | 3,4 % |

| Scotiabank Gold American Express® Card | 3 points | 3 % |

| American Express Business Edge™ Card | 3 points | 3 % |

| Marriott Bonvoy™ Business American Express® Card | 3 points | 2,7 % |

| American Express Cobalt® Card | 2 to 5 points | 2 to 5% |

Avion

Do you want to visit Western Canada? Or do you live in the West and want to discover Quebec and the Maritimes? Flying is the only solution for a short vacation in Canada.

With a low-cost airline like Flair advertising fares never seen in this country, it will be possible to use travel points on your flights.

But don’t forget about Aeroplan points or AIR MILES Reward Miles, which are two currencies that are particularly well suited for a Canadian vacation. Especially since there are so many credit card offers currently available.

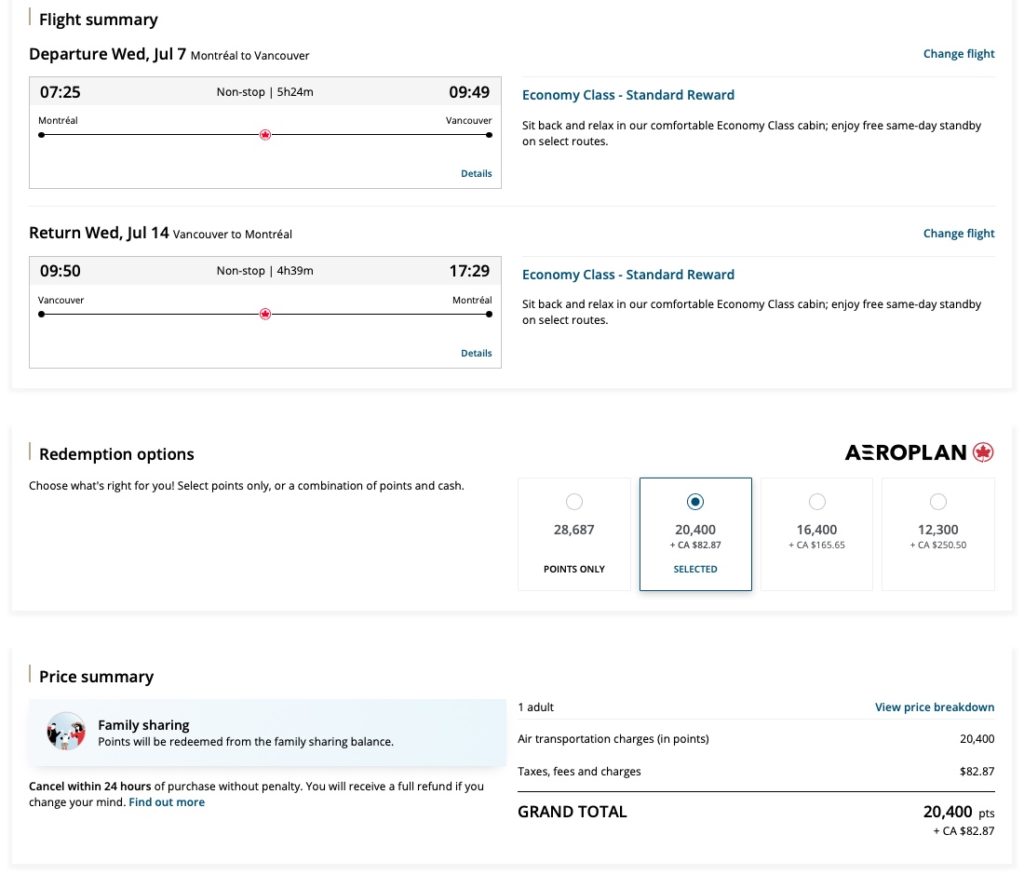

For example, with Aeroplan, you could buy a round-trip ticket from Montreal to Vancouver for 20,400 points and $83:

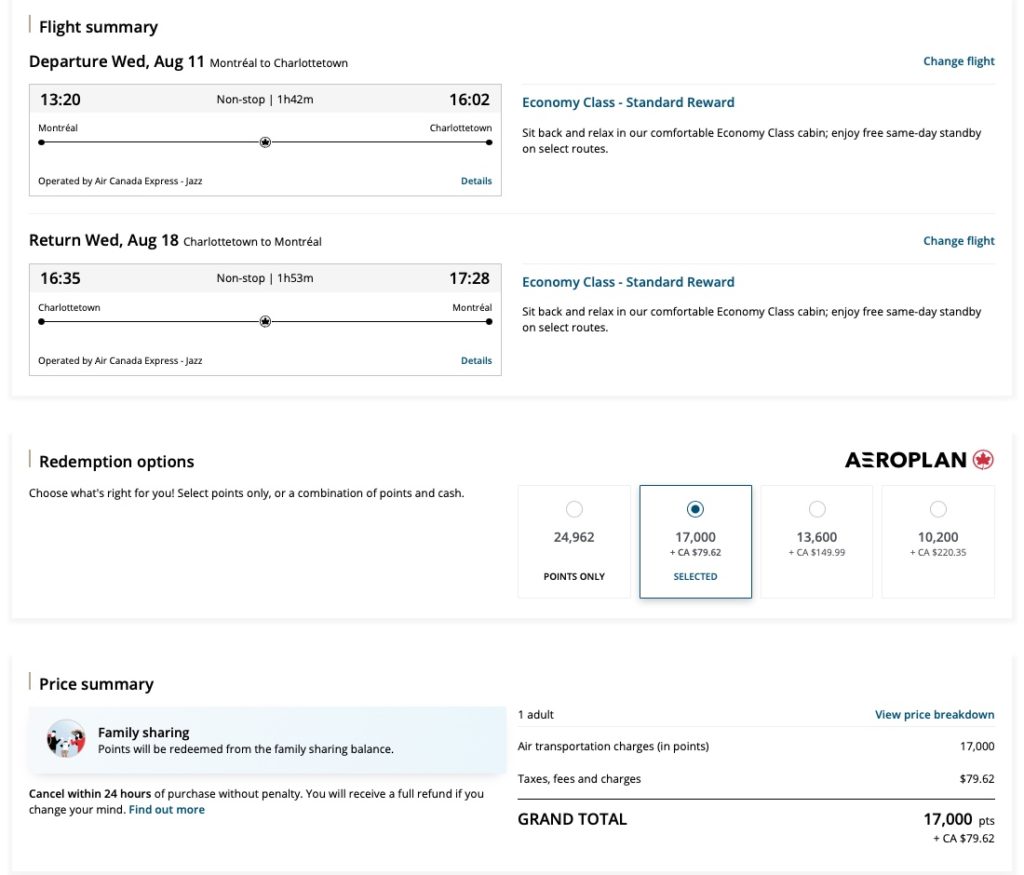

Or 1 return ticket from Montreal to Charlottetown, Prince Edward Island for 17,000 points and $80:

You may also benefit from the Air Canada Companion Pass offered with certain credit cards such as the TDMD Visa Infinite* Card AeroplanMD or the American ExpressMD Card AeroplanMD*.

See these articles for more details on the Air Canada Buddy Pass:

If you are a family of 2 adults and 2 children, the best strategy is to each apply for a credit card with the Buddy Pass. This way, each of your children will travel almost for free!

Here’s a selection of the best Aeroplan credit card offers coming with an Air Canada Buddy Pass:

With AIR MILES, we will focus on short-haul flights with DREAM miles. For example, this round trip flight from Vancouver to Calgary for 1,500 miles and $127:

If you’re a couple, you could get those two round-trip plane tickets with 3,000 miles on your credit card: the BMO® AIR MILES® World Elite®* Mastercard.

Grocery

Are you travelling with your family during your vacation in Canada? Food can get expensive quickly. Stops at the grocery store will be necessary for your meal baskets.

There are several specialized credit cards for grocery stores to earn more points or cash back:

| Credit card | Points per dollar | Return |

| American Express Cobalt® Card | 5 points | 5 % |

| Scotiabank Gold American Express® Card | 5 points | 5 % |

| BMO® CashBack® World Elite®* Mastercard®* | 5 % | 5 % |

| CIBC Dividend® Visa Infinite* Card | 4 % | 4 % |

| Scotia Momentum® VISA Infinite* Card | 4 % | 4 % |

The most interesting credit card for grocery shopping is the American Express Cobalt® Card as you can earn 5 points per dollar (a 5% value against any purchase made on the card or 6 Marriott Bonvoy points if you transfer them to this program for free hotel nights).

Most grocery stores accept this card in Canada, such as Metro, Super C, Sobeys, Safeway, Whole Foods, and many IGA stores.

Another smart way to save on groceries while on vacation in Canada is to use the AIR MILES Cash Miles Program. At IGA or Sobeys, you can use 95 CASH miles for a $10 rebate at the grocery store.

So, if you’ve purchased the BMO Ascend™ AIR MILES® World Elite Mastercard®* through milesopedia’s exclusive offer, you’ll have at least 3,300 Cash Miles in your AIR MILES account (including miles from the required $3,000 spend in the first 3 months).

That’s $346.50 worth of free food!

Restaurants and bars

For restaurants and bars, you could use your American Express Cobalt® Card.

You’ll earn 5 points per dollar for spending at restaurants.

An example for a family

We have presented all the options available to save on your vacation in Canada on several important expenses: accommodation, transportation and food.

Of course, the goal is not to apply to 10 credit cards, but to get the ones that will meet your needs. And to be strategic, if there are two of you planning your vacation to Canada!

If you’ve read this article carefully, you’ll notice that one credit card stands out: the American Express Cobalt® Card. It is one of the best credit cards in Canada because of its versatility:

- You like Airbnb rentals or other accommodations: you can use your points on that

- You prefer Marriott Bonvoy hotels: you can transfer your points (5 points = 6 Marriott Bonvoy points)

- If you have grocery, restaurant or bar expenses: this card offers a 5% cash back

In short, this is the credit card we recommend first.

Then, if you would like to stay in hotels, the Marriott Bonvoy™ American Express® Card is a must, especially with its current elevated welcome bonus!

If you are a couple, I suggest you both apply for this card and transfer your points from one account to another. This is enough to get several free hotel nights during your vacation in Canada.

Finally, you can complete your round of credit card purchases with another card such as the BMO Ascend™ World Elite®* Mastercard and the TD® Aeroplan® Visa Infinite* Card.

Of course, it is up to you to do your calculations carefully to respect the minimum expenses required by all these offers (some of them do not require any minimum for Quebec residents). But planning ahead can save you hundreds or even thousands of dollars on your Canadian vacation with Travel Reward Points.