For its Aeroplan program, Air Canada partners with three Aeroplan credit cards issuers in Canada:

- American Express

- CIBC

- TD

This page is dedicated to the general features of Aeroplan credit cards. To view the current welcome offers, click here.

Here is the part of my video on this topic:

Aeroplan Credit cards

Since the launch of the new Aeroplan program on November 8, 2020, there are 14 Aeroplan credit cards, spread across the 3 institutions, for all audiences:

- Consumers (3 levels of cards )

- Self-employed, professionals, Small businesses

- Corporation

Aeroplan Credit Card Benefits

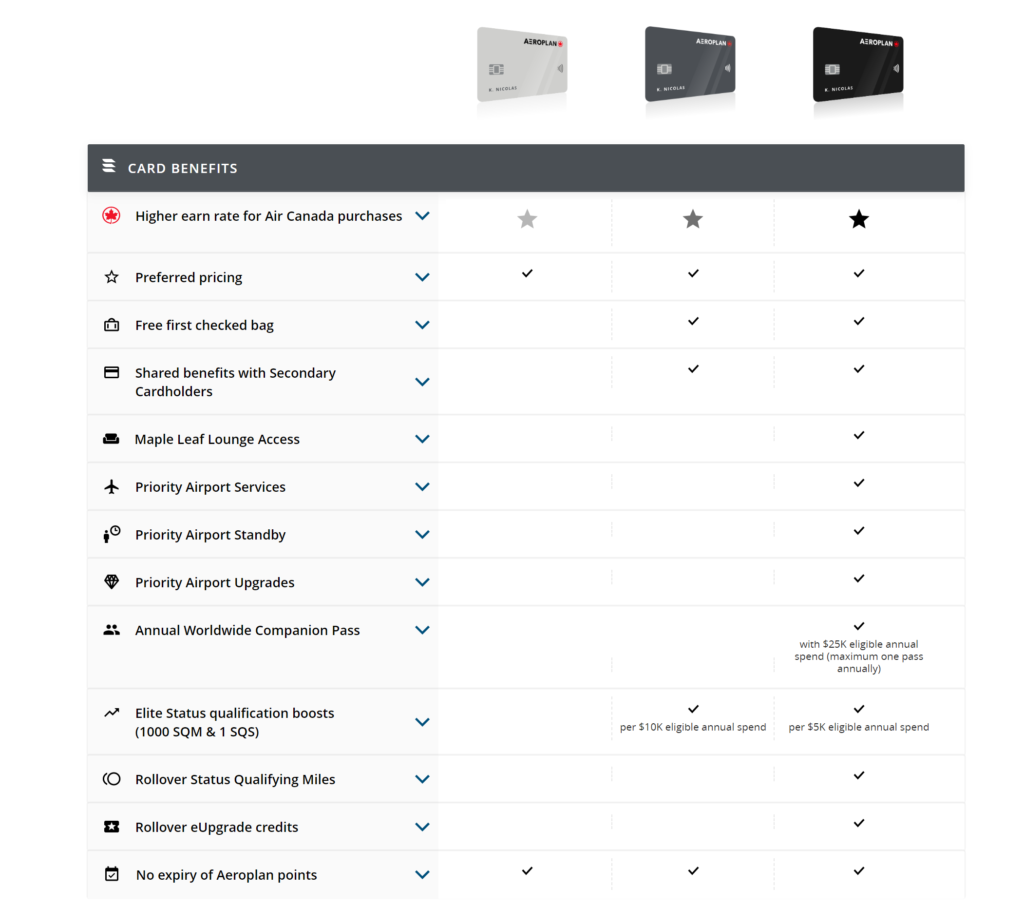

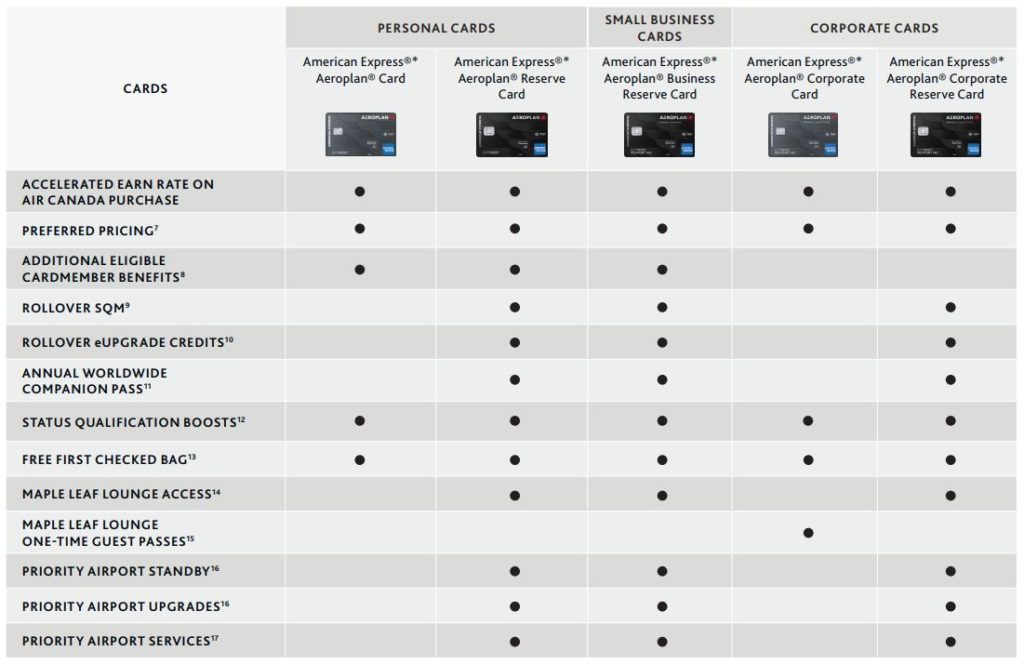

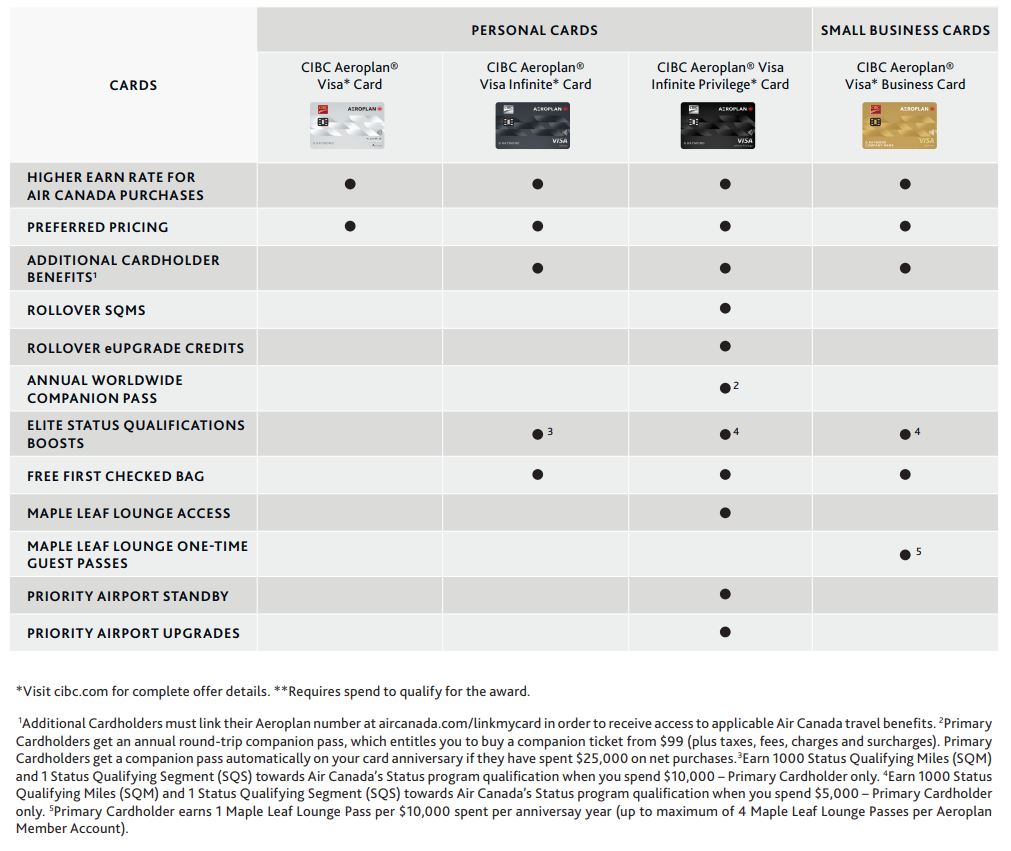

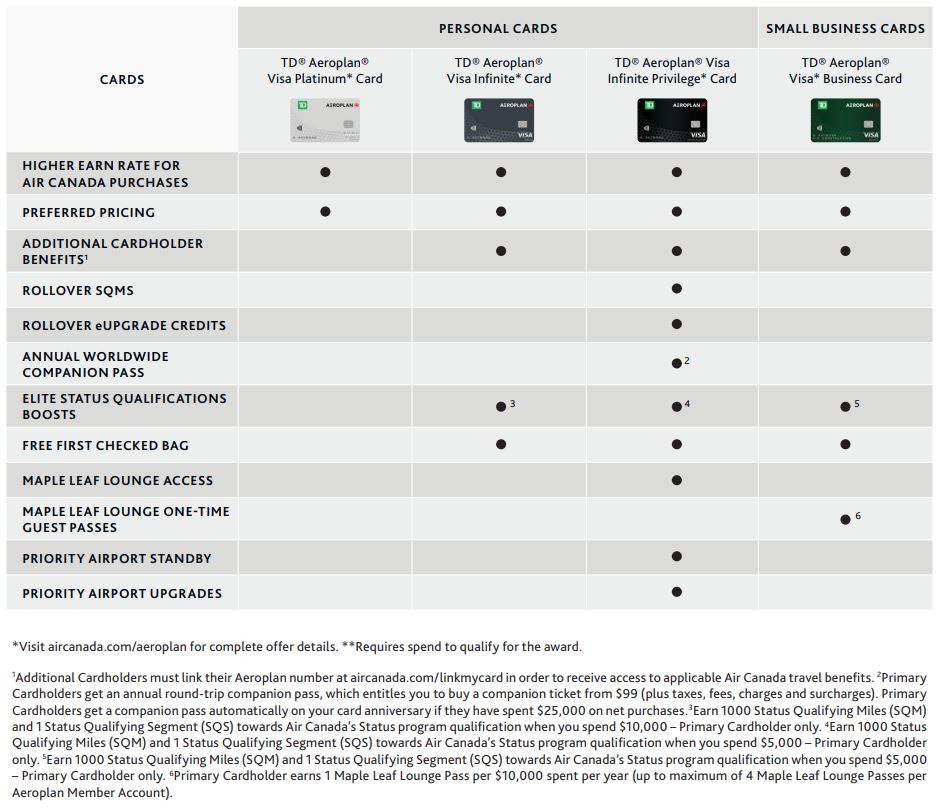

Air Canada has listed in this table the benefits offered to Aeroplan credit cardholders ( find out more about TD Aeroplan Credit Cards at the end of this post ):

Higher earn rate for Air Canada purchases

Aeroplan credit cardholders will receive a higher earn rate for Air Canada purchases.

For some cards, this will apply not only to Air Canada flights, but also Air Canada Vacations packages or onboard purchases.

Preferred pricing

Aeroplan credit cardholders will receive preferred pricing on Aeroplan flight rewards for flights operated by Air Canada.

With a flexible chart on its flights, Air Canada has greater control regarding fares so that it can offer this preferred pricing to Aeroplan credit cardholders.

Air Canada even told us that some preferred fares could go below the minimum chart fare!

No expiry of Aeroplan points

Usually, Aeroplan points expire after 18 months. And there are different ways to keep an active account.

However, Aeroplan credit cardholders don’t have to worry about their Aeroplan points expiring.

Free first checked bag

Some Aeroplan credit cardholders will get a free first checked bag for Air Canada flights (flight rewards or paid tickets)!

This benefit is valid for:

- Primary Cardholder

- Additional Cardholders

- And up to eight travel companions on the same reservation

Also, if an additional card travels without the primary cardholder, it can also be accompanied by 8 travel companions who will benefit from the free first checked bag. The only condition: everyone has to be on the same reservation.

Something to delight groups of friends or sports teams travelling on Air Canada! Or just… families:

Shared benefits with Secondary Cardholders

While in the past, only the primary cardholder enjoyed some benefits with Air Canada, now, additional cardholders too!

However, they must ensure that their Aeroplan number must be linked to a valid credit card. Linking can be done by visiting this page.

Maple Leaf Lounge Access

Aeroplan Visa Infinite Privilege Cardholders and American Express Aeroplan Reserve Cardmembers will receive complimentary access:

- to Maple Leaf Lounges around the world

- to Air Canada Cafés in North America

Also, Aeroplan Visa Infinite Privilege Cardholders will receive six annual visits to Priority Pass airport lounges.

Small business credit cardholders can also get up to 4 annual passes to Maple Leaf Lounges.

You will get one access after every $10,000 in Card purchases (up to 4 annual passes).

Priority Airport Services

Aeroplan Visa Infinite Privilege Cardholders and American Express Aeroplan Reserve Cardmembers will get airport benefits:

- Priority airport services

- Priority Airport Standby

- Priority Airport Upgrades

Annual Worldwide Companion Pass

Aeroplan Visa Infinite Privilege Cardholders and American Express Aeroplan Reserve Cardmembers will be eligible for an annual worldwide companion pass.

To earn it, you need to charge $25,000 to your Card (maximum of one pass per year).

Once earned, you can use your Annual Companion Pass to get a companion flight at a fixed price ($99 in North America, and between $199 and $599 elsewhere around the world ).

Elite Status (1,000 SQM and 1 SQS)

Here’s a new benefit that will be of particular interest to Aeroplan Elite members. Some credit cardholders will be able to get Elite Status qualification boosts.

You can earn 1,000 Status Qualifying Miles (SQM) and 1 Status Qualifying Segment (SQS) per $10,000 eligible annual spend ($5,000 for some premium and business cards).

And there is no limit to the number of SQM and SQS you can earn!

Rollover SQM and eUpgrades

Aeroplan will roll over unused Status Qualifying Miles (SQM) or unused eUpgrade credits for Aeroplan Visa Infinite Privilege Cardholders and American Express Aeroplan Reserve Cardmembers

This will be a great benefit for some Aeroplan Elite members!

Current Aeroplan Credit Cardholders

All new benefits will automatically apply to current cardholders.

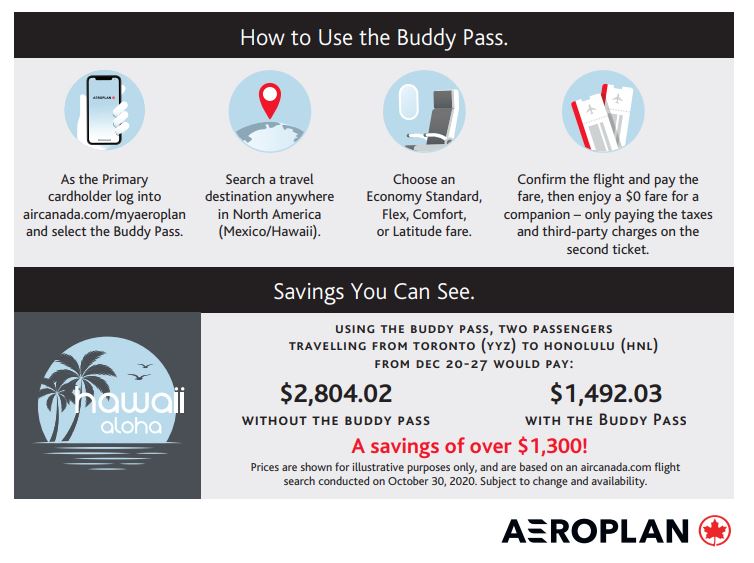

Air Canada Buddy Pass

** Update: This option is no longer included with Aeroplan welcome offers.

The main new feature accompanying some welcome offers is the Air Canada Buddy Pass. You book a flight and pay the fare, then enjoy a $0 fare for a companion – only paying the taxes and third-party charges on the second ticket.

The one-time Buddy Pass will be deposited into your Aeroplan dashboard (aircanada.com/myaeroplan). Once deposited, the pass will be available for one year before it expires, though travel can be booked for a date beyond that year.

The Air Canada Buddy Pass valid for Economy Class bookings anywhere Air Canada flies in North America, including Mexico and Hawaii. The Buddy Pass is valid for travel any time for any economy fare, including fares on sale.

It is even possible to get an upgrade, depending on status level, and if the fare purchased allows for it.

We estimate that this Air Canada Buddy Pass is worth between $200 and $1,000 depending on the flight’s price. So it’s an exciting advantage if you’re looking to travel on Air Canada in North America.

Sign-Up bonuses

This page was dedicated to the general features of Aeroplan credit cards.

To view the current welcome offers, click here.

Earning points

American Express Aeroplan credit cards

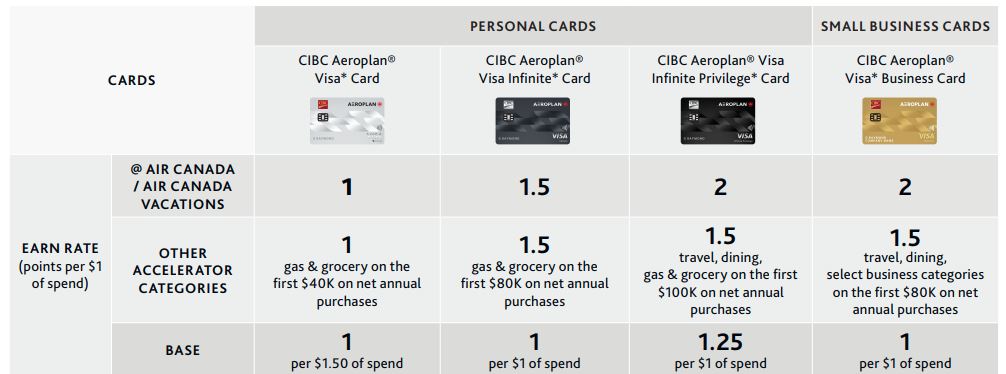

CIBC Aeroplan Credit cards

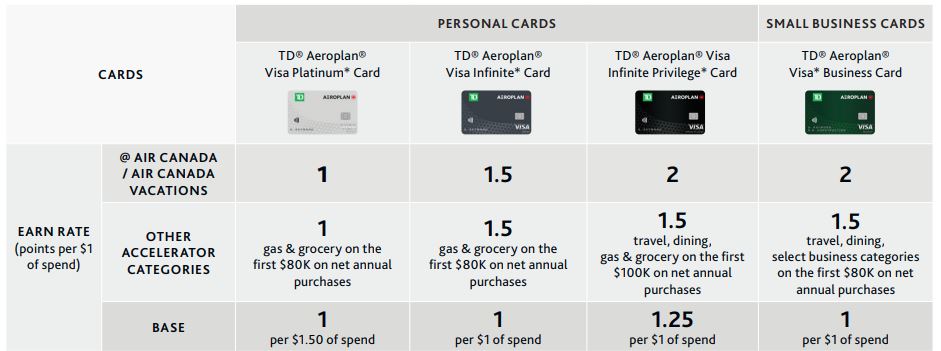

TD Aeroplan credit cards

Benefits

American Express Aeroplan credit cards

CIBC Aeroplan Credit cards

TD Aeroplan credit cards

Conclusion

Now let’s move on to the ways to earn Aeroplan points.