KOHO Mastercard Prepaid Card: Overview

In Canada, there are two KOHO Mastercard Prepaid Cards:

- KOHO Mastercard Prepaid Card

- KOHO Extra Mastercard Prepaid Card (no foreign currency conversion fees)

In fact, we’ve named it the Best Prepaid Card in Canada for 2023. Not least because the KOHO Extra Mastercard Prepaid Card offers 1.5% at grocery stores, including Costco and Walmart! It’s one of the only cards to offer this for these stores.

What’s more, it doesn’t charge any conversion fees for foreign currency transactions.

And we’ve named the KOHO Mastercard Prepaid Card the Best Card for Newcomers to Canada in 2024.

This card requires no credit history in Canada, and you can build your credit score. And with this card, you’ll earn at least 3% interest on your entire balance!

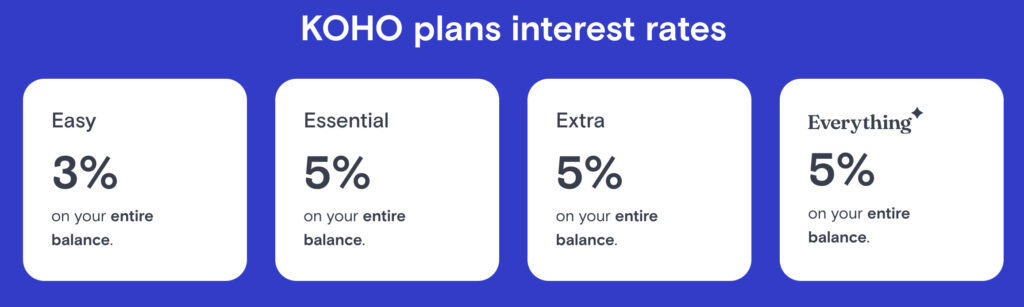

You can choose from 4 different KOHO plans that offer features to suit your needs:

- KOHO Easy (free of charge – this plan will disappear on April 20, 2024)

- KOHO Essential

- KOHO Extra

- KOHO Everything

The KOHO Card is halfway between a debit card and a credit card:

- Like the debit card, the KOHO Mastercard Prepaid Card allows you to spend only what you have in your account

- Like the credit card, the KOHO Mastercard Prepaid Card offers you rewards (in the form of cashback)

This type of card will not affect your credit score: getting one will have no impact. However, it won’t help you improve your credit score either.

KOHO prepaid cards have some things in common:

- Accepted worldwide through the Mastercard network (including at Costco)

- Cash back on some purchases

- Possibility of automatic savings

- Earn 3% to 5% interest on your available balance

- No interest charges on your purchases

- No fees at merchants charging fees to credit cardholders

- Possibility to buy online

- Bill Payments

- Possibility of joint accounts

- Available on Apple Pay

KOHO Mastercard Prepaid Card

Special Offer:

- Enter the code MILESOPEDIA when you apply for your card

- Get $20 in your KOHO account after the first purchase within the first 30 days

The features of the KOHO Mastercard Prepaid card are as follows:

- No annual fee with the Easy Plan (this plan will disappear on April 20, 2024 – get the card before that date)

- 1% cash back on groceries and transportation

- 1.5% FX fee

- $2 to $3 ATM Fee abroad

- Accepted at Costco

KOHO Extra Mastercard Prepaid Card

Special Offer:

- Enter the code MILESOPEDIA when you apply for your card

- Get $20 in your KOHO account after the first purchase within the first 30 days

The features of the KOHO Extra Mastercard Prepaid Card (formerly known as the KOHO Premium Mastercard Prepaid Card) are as follows:

- 1.5% cash back on groceries (including Costco and Walmart), eating & drinking and transportation

- 0.25% cash back on all other purchases

- Accepted at Costco

- No FX fees

- 1 free international ATM withdrawal per month

- Monthly fee of $9 (or $84 per year) with a 30-day free trial

KOHO Prepaid Mastercard - Changes coming on April 20, 2024

Koho has announced that several changes will take place from April 20, 2024.

Withdrawal of KOHO Easy Plan

Bad news: the KOHO Easy Plan will be withdrawn from the market.

KOHO will no longer be offering a no-fee plan. However, if you get the card and opt for this plan by April 19, 2024, you’ll be able to keep it (and its current features).

Changes to the KOHO Essential Plan

The KOHO Essentiel Plan will be the new entry-level plan. But here too, changes will affect it:

| Currently | From April 20, 2024 | |

| Base Earn Rate | 0,25 % | 0 % |

| Accelerated Earning Rate | 1 % | 1 % |

| Discount on Credit Building | 30 % | None |

| Monthly fee waived | No ($4) | Yes, subject to conditions $500 monthly deposit on the KOHO Essentiel account or Set up a Direct Deposit |

However, if you get the card and opt for this plan by April 19, 2024, you’ll be able to keep it (and its current features).

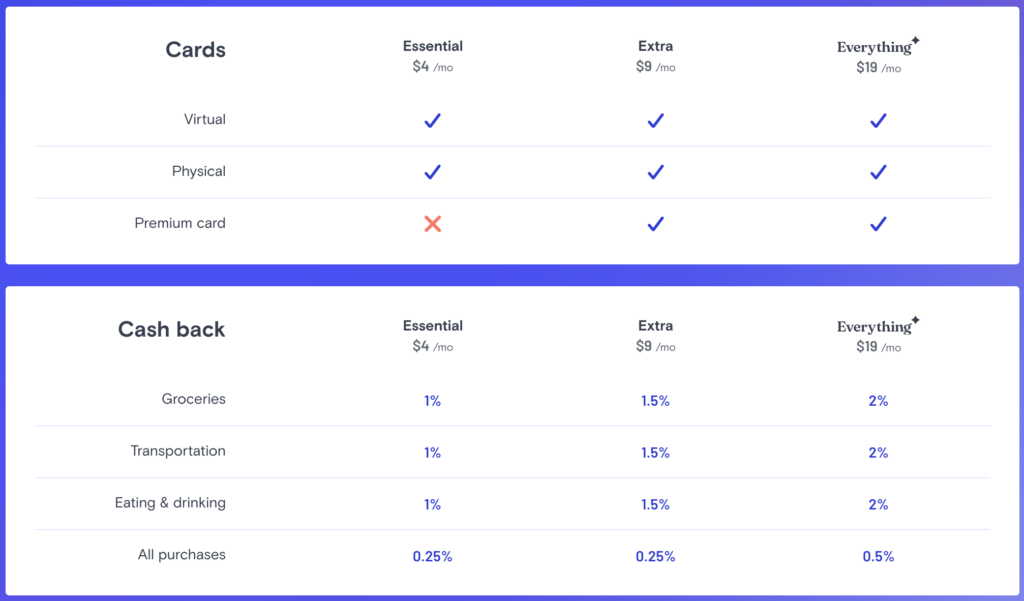

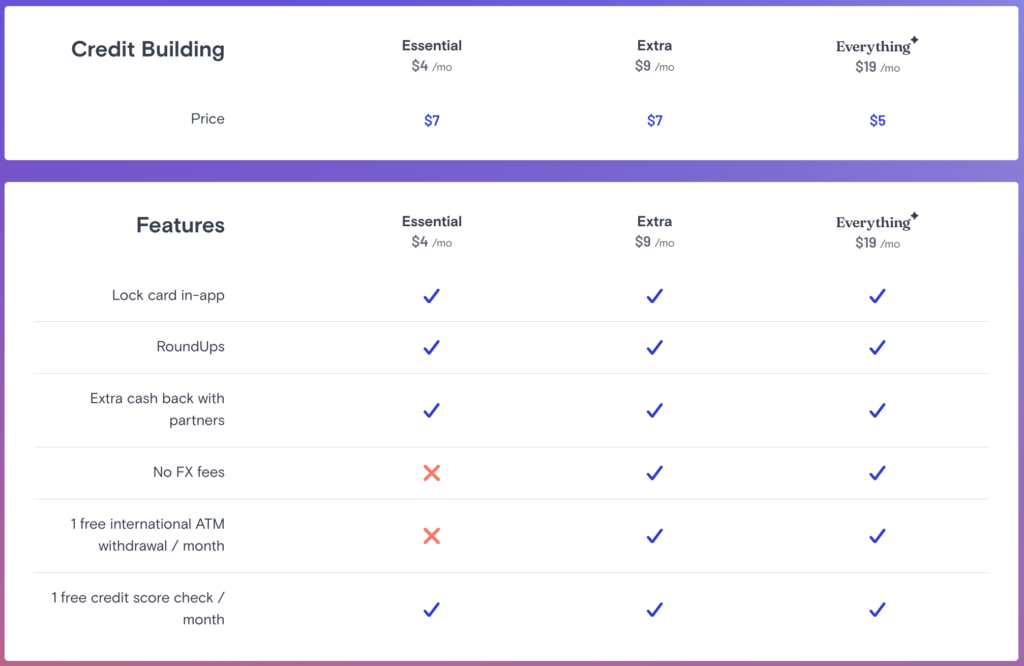

KOHO Prepaid Mastercard - KOHO packages

There are 4 KOHO plans to suit your needs:

- KOHO Easy (free of charge – this plan will disappear on April 20, 2024)

- KOHO Essential

- KOHO Extra

- KOHO Everything

Here are some tables showing the features of these KOHO plans:

KOHO Prepaid Mastercard - Up to 5% interest with a high-interest savings account

KOHO has increased its savings rates to 3% on its free plan and 5% on all its paid plans.

Here’s how to save:

- Choose the KOHO plan that’s right for you;

- Add funds to your new account ;

- Join Earn Interest in the app, then start earning money.

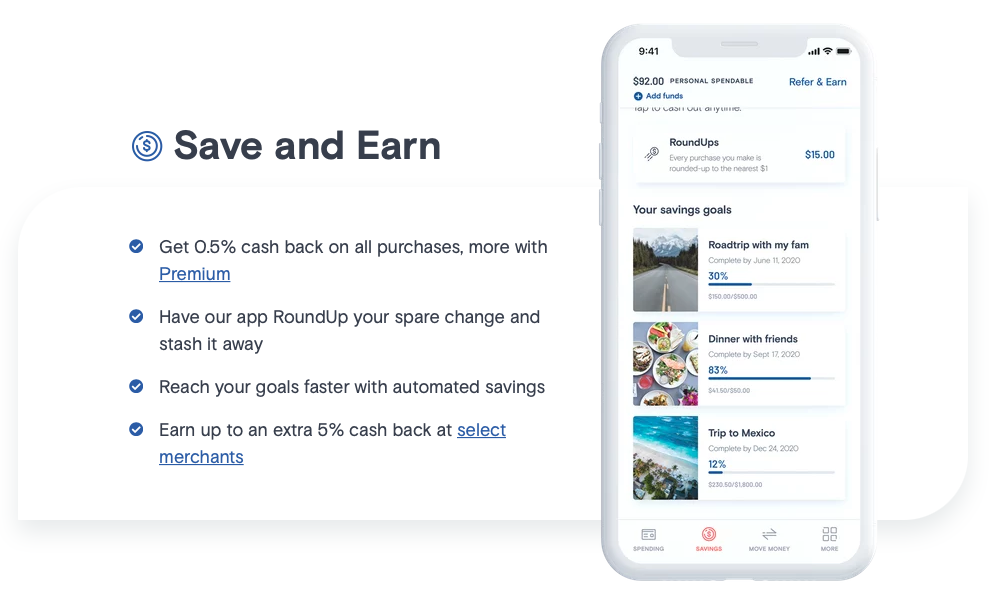

Automatic savings and cash back

The automatic savings program

Both KOHO Mastercard prepaid cards offer an automatic savings program.

Purchases made with your KOHO card are rounded to the nearest $1, $2 or $10 (you choose the amount). For example, if you activate the automatic savings program and purchase $2.25, $0.75, $1.75, $2.75 or $7.75 (whichever you choose), it will automatically be set aside for you!

You can see in your KOHO app how much you have saved at any time. Note that this money can be accessed anytime: if your available balance is less than the amount of the purchase you wish to make, the funds will be withdrawn from your savings account.

The Cash Back Program

KOHO Mastercard prepaid cards offer a cash-back program on your everyday purchases. You’ll see the cash back in your Savings tab within 1-2 business days of the original authorized purchase.

The cash back you earn depends on the KOHO plan you choose.

| Package | Cash Back |

| Easy | 1% cash back on groceries and transportation |

| Essential | 1% cash back on groceries, transportation, food and drink 0.25% cash back on other purchases |

| Extra | 1.5% cash back on groceries, eating & drinking, and transportation 0.25% cash back on other purchases |

| Everything | 2% cash back on groceries, transportation, food and drink 0.5% cash back on other purchases |

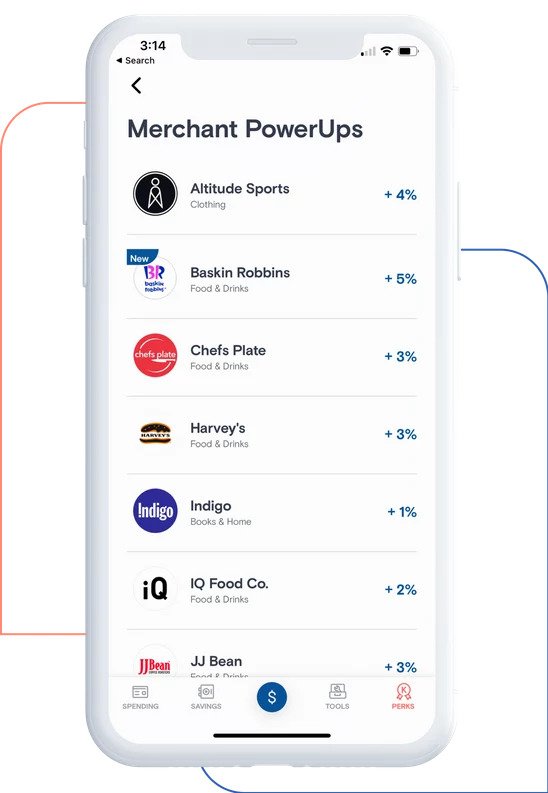

You can earn cash back on more purchases through KOHO partner merchants like:

- Altitude Sports

- Chefs plate

- DashPass/DoorDash

- Harvey’s

- Hudson’s Bay

- Indigo

- Pizza Pizza

- And more!

For example, with Altitude Sports, you can get 4% extra cash back. This is in addition to the base rate, for a total of 4.25% cash back!

And with Harvey’s it’ll be 3% extra cash back. And if you use the KOHO Extra Mastercard Prepaid Card, you’ll get 4.5% at Harvey’s, combining the 1.5% restaurant cash back with it!

KOHO online shopping portal: partner merchants via the app

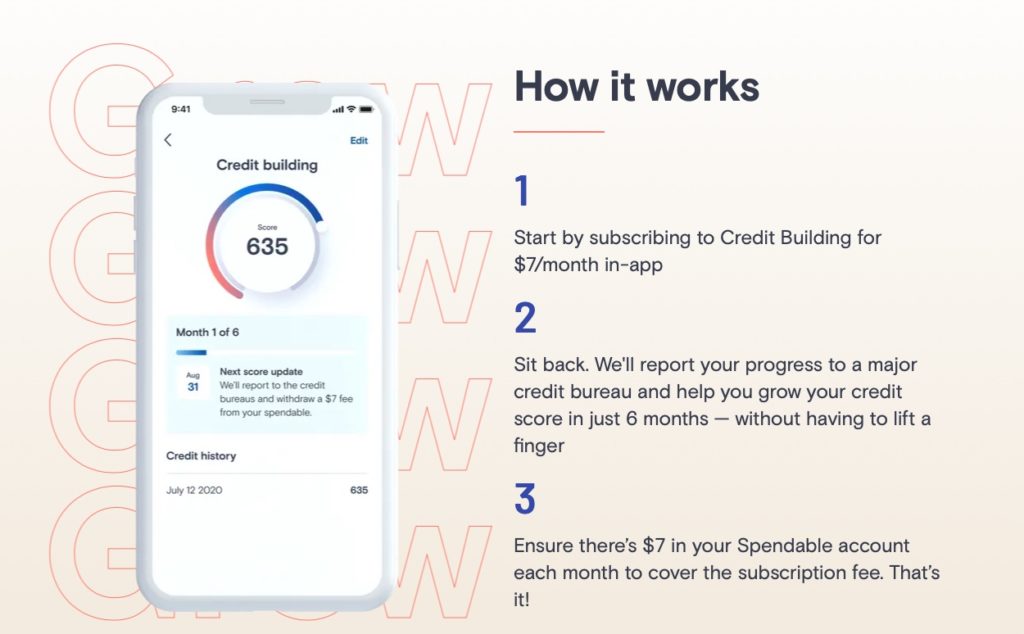

KOHO Prepaid Mastercard - Credit Enhancement / KOHO Credit Building

For $10/month for six months, you can subscribe to KOHO Credit Building.

When you sign up, Koho will deposit $225 of dedicated credit enhancement funds into a separate account from your expenses (so you won’t have access to it). Each month, Koho will recover $75 of these dedicated funds and report it to Transunion as a positive action for your credit score.

For clarity, your total balance on KOHO will not change when KOHO adds the dedicated funds. Your only job is to make sure your Spendable account has $10 in it each month to cover the subscription fee, and KOHO will do the work to build your credit score behind the scenes.

This credit enhancement feature works in 6-month cycles (so you can subscribe once every 6 months). You must already have a KOHO Mastercard Prepaid Card to benefit from it.

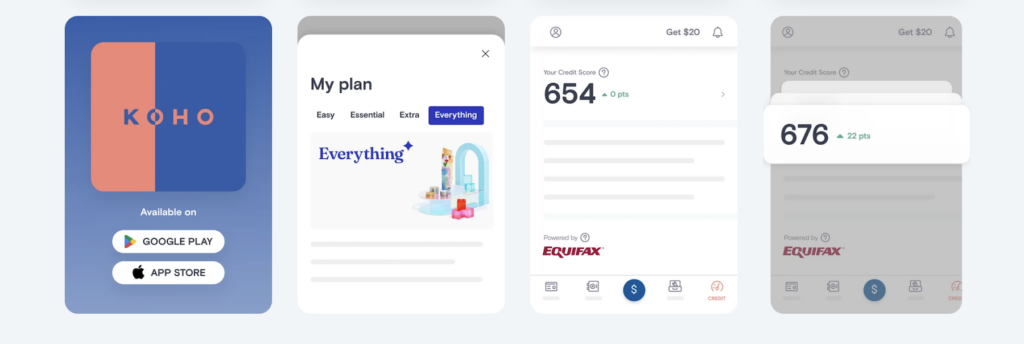

KOHO Prepaid Mastercard - Free credit score

Do you want to check your credit score? KOHO gives you access to this information free of charge. Simply create a KOHO account and take advantage of a 30-day trial period.

Here’s how it works:

- Download the KOHO application, then create an account;

- Choose the Essential, Extra or Everything plan for a free 30-day trial;

- Discover your credit score with Equifax.

Please note that your score will be updated once a month. After the free trial, you’ll need to pay the monthly subscription fee for one of the plans to obtain your credit score.

KOHO Prepaid Mastercard - KOHO / KOHO Card fees

KOHO does not charge a monthly fee for the KOHO Prepaid Mastercard ($4 for the KOHO Prepaid Essential Mastercard and $9 for the KOHO Prepaid Extra Mastercard).

And there are no interest charges, insufficient funds charges or wire transfer fees. The following is a summary table of other fees:

| Package | Monthly fees | Foreign Exchange Fees | International withdrawals |

| Easy | $0 | 1,5 % | – |

| Essential | $4 | 1,5 % | – |

| Extra | $9 | 0 % | 1 per month |

| Everything | $19 | 0 % | 1 per month |

KOHO Prepaid Mastercard - Conclusion

Credit cards offer more rewards – and some have no conversion fees for foreign currency transactions – KOHO is aimed at a different audience.

The KOHO Mastercard Prepaid Card, with no annual fee, can appeal to those who want to control their budget while earning cash back. One thinks, for example, of young people and students. This formula will disappear on April 20, 2024: if you get this card and opt for the Easy Plan (with no annual fee) before this date, you can keep this formula.

The KOHO Extra Mastercard Prepaid Card is designed for those who spend a lot in the 1.5% categories and regularly pay in foreign currencies (to enjoy the no foreign transaction fee benefit). Especially since the 1.5% grocery category also works at Costco and Walmart!

For either of these cards, you can get a $20 welcome bonus by downloading the KOHO application via this link from Milesopedia. And by entering the code MILESOPEDIA when you register.

Otherwise, if you prefer credit cards, you can check our recommendations:

Frequently Asked Questions about KOHO

Has the KOHO Premium Mastercard Prepaid Card become the KOHO Extra Mastercard Prepaid Card?

Yes, the KOHO Extra Mastercard Prepaid Card used to be called the KOHO Premium Mastercard Prepaid Card. It’s still the same card but with a new name and more features.

Is the KOHO Prepaid Card a credit card?

No, as the name suggests, the KOHO Prepaid Card is a prepaid card. There are no credit limits or inquiries made on your credit report.

What is the KOHO card from KOHO Financial?

How do I activate the KOHO Bank KOHO card?

To activate the KOHO Prepaid Card, go to your KOHO mobile application or the KOHO website.

How do I use KOHO?

How can I join KOHO? Who is the KOHO contact?

To join KOHO, go to your KOHO mobile app or the KOHO website. You can also write to KOHO at support@koho.ca.

How to contact KOHO?

To contact KOHO, simply go to your KOHO mobile app or the KOHO website. You can also write to KOHO at support@koho.ca.