Scotiabank Passport Visa Infinite Card - Welcome offer

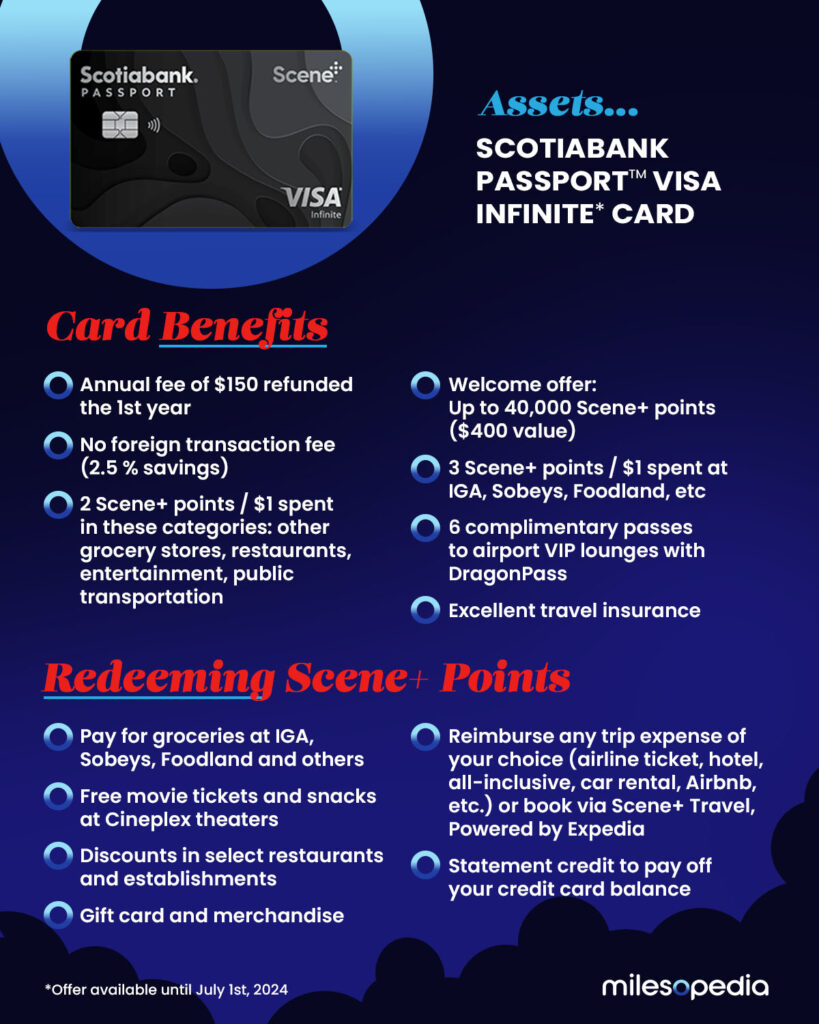

With this welcome offer for the Scotiabank Passport™ Visa Infinite* Card, you earn up to 40,000 welcome bonus points (a $400 value) as well as a first-year annual fee waiver (a $150 value):

- 30,000 points after just $1,000 in purchases

- 10,000 points after $40,000 in annual purchases in the first year

Then, each year, if you make at least $40,000 in purchases on the card, you’ll earn an annual bonus of 10,000 points, a value of $100.

With the Scotiabank Passport™ Visa Infinite* Card, you earn 3 points per dollar spent at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op.

Also, you earn 2 points per dollar for:

- grocery purchases

- dining purchases

- Entertainment

- Transportation

The Scotiabank Passport™ Visa Infinite* Card is an excellent Visa credit card for this type of purchase.

You can redeem your points for any travel purchases (flights, hotels, all-inclusive and even Airbnb). You can also use your points as cash back rewards with Scene+.

The Scotiabank Passport™ Visa Infinite* Card also offers:

- no foreign transaction fee

- 6 complimentary passes to airport VIP lounges

- Premium insurance for your travels or purchases

- Concierge services

We voted this credit card the Best No-FX Fee Credit Card of 2024. Knowing that the annual fee is waived in the first year, there’s never been a better time to get this credit card for your international travels over the next year!

Scotiabank Passport Visa Infinite Card - No foreign currency conversion fees

C’est l’argument majeur de cette carte de crédit: aucuns frais de conversion pour tous vos achats réalisés en devises étrangères. Quasiment toutes les autres cartes de crédit au Canada facturent un frais de conversion de 2,5 % pour tous les achats réalisés en devises étrangères.

Cette Carte Visa Infinite Passeport Banque Scotia fait partie des trois cartes de crédit sans frais de conversion que nous vous conseillons d’avoir dans votre portefeuille.

It will therefore be particularly interesting for Snowbirds and anyone who regularly travels abroad or buys on sites that charge in US dollars, euros, etc.

On each of these transactions, when you pay with your Scotiabank Passport™ Visa Infinite* Card, you save 2.5%, plus earn Scene+ points !

And remember, you’ll also earn 2 points per dollar for purchases made abroad:

- grocery purchases

- dining purchases

- Entertainment

- Transportation

Scotiabank Passport Visa Infinite Card - A Scene+ credit card

The Scene+ program is Scotiabank’s travel points loyalty program.

The other main cards in the Scene+ program are the Scotiabank Gold American Express® Card and the Scotiabank Platinum American Express® Card. This gives you another source of Scene+ points: you can, of course, have a single Scene+ account combining your various credit cards, as explained in this article!

Enough to earn many points both through credit card application bonuses and with your purchases!

Earn Scene+ points with this card

With this card, you earn:

- 3 points per dollar at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op

- 2 points per dollar spent on groceries, restaurants, entertainment or public transportation

- 1 point per dollar everywhere else

The accumulation of Scene+ points is not as high as that of the Scotiabank Gold American Express® Card (5 points per dollar in groceries, restaurants, and entertainment), but since it’s a Visa card, you’ll be able to use it in more places!

For those who spend $40,000 in a year on the Scotiabank Passport™ Visa Infinite* Card, a bonus of 10,000 Scene+ points (or $100) will be credited to the account. After that, a bonus of 2,000 Scene+ points will be added to the account for each additional $10,000.

Using Scene+ points

You can apply your Scene+ points directly to your travel expenses (flights, hotels, Airbnb, car rentals, etc.) charged to the card: 10,000 Scene+ points = $100.

This is one of the cards we recommend in these strategies:

You must redeem at least 5,000 points or $50 (after this threshold, the redemption ratio is 100 points = $1).

By redeeming your Scene+ points for travel expenses, you’re guaranteed a return of between 1% and 3%, depending on the retailer from which you’ve collected them.

See in the article below how easy it is to use your Scene+ points to save on travel, with a real-life example:

Scotiabank Passport Visa Infinite Card - 6 annual airport lounge visits

Scotiabank is likely to want to address the traveller market. This Scotiabank Passport™ Visa Infinite* Card offers six annual airport lounge visits, which partly justifies the cost of the annual card fee.

Thanks to this exceptional welcome offer, you get all this for free the first-year!

This is a very nice perk for casual travellers. An individual traveller will be able to visit the airport lounges 6 times a year, while a couple will be able to access them… 3 times!

After 6 visits in a year, you will have to pay a US$32 entry fee.

In Quebec City, you can access the VIP lounge!

In Montreal, you have 2 options:

- The Air France VIP Lounge (international terminal)

- The National Bank VIP Lounge (international terminal)

Scotiabank Passport Visa Infinite Card - Comprehensive Insurance

The Scotiabank Passport™ Visa Infinite* Card offers a wide range of travel insurance:

Travel Emergency Medical Insurance

Coverage is provided for eligible persons under age 65 for up to 25 consecutive days and for eligible persons age 65 and older for up to 3 consecutive days.

Trip Cancellation / Trip Interruption Insurance

Charge at least 75% of your trip costs to your Card and get trip interruption insurance at no extra cost.

Flight delay insurance

Charge at least 75% of the full ticket cost to your Scotiabank Passport Visa Infinite Card Card and you’ll be eligible for reimbursement of necessary expenses such as hotel accommodations, meals and other emergency items.

Delayed and Lost Baggage Insurance

Charge the full cost of your airplane, train, bus or cruise ship tickets to your Card. If your checked luggage is delayed or lost – you’re covered.

Travel Accident Insurance

Charge at least 75% of your ticket cost to your Card and you’re insured against accidental loss of life or dismemberment.

Rental Car Collision Loss/Damage Insurance

Charge the full cost of your eligible rental car to your Card and you’re automatically insured if your rental is damaged or stolen.

Hotel/Motel Burglary Insurance

Use your Card to pay for your stay at any hotel or motel in Canada or the U.S.

Bottom Line

Scotiabank is the only major Canadian bank to offer a card with no foreign transaction fee. Two other Scotia credit cards also offer this benefit.

This Scotiabank Passport™ Visa Infinite* Card will be of great interest to many profiles:

- Those who regularly pay in foreign currency

- Those who travel regularly abroad

- Those who live part of the year abroad like the Snowbirds

- Those who want a card with solid insurance

- Those who travel at least 1-2 times a year and will use airport VIP lounges

- Those who already have one or more Scene+ cards in their wallet.