Credit cards insurance reminder

We can’t repeat it enough: keep the documentation sent with your credit card. This includes the insurance coverage booklet.

Various insurance benefits

Ideally, you have to refer to it before deciding to use this card to book your trip!

Indeed, all credit cards have several coverages related to:

- age of the credit card holder

- insured persons

- destinations

- trip duration

- out-of-province absence duration

- type of car rented (even stating excluded car brands)

- flight/baggage delay duration

But for users of rewards programs, the most important section is that relating to theeligibility of the trip covered.

Actually, you’ll find there the coverage conditions of your credit card insurance!

Various insurance coverage conditions

Some credit cards will require that you:

- Charge at least 75% or the full trip costs to your Card (read: without using miles and points)

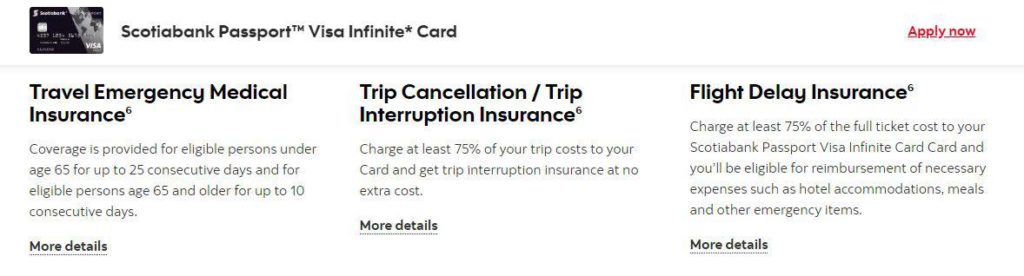

This is the case, for example, with the Scotiabank Passport™ Visa Infinite*:

- Credit Cards Associated Programs

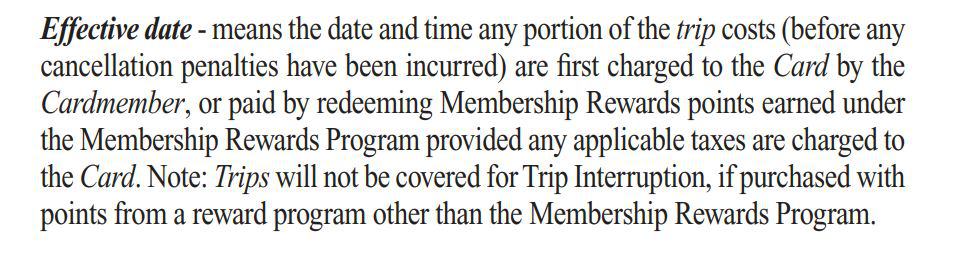

This is the case, for example, with the American Express® Gold Rewards Card: you are covered for a trip paid by redeeming Membership Rewards points earned under the Membership Rewards Program provided any applicable taxes are charged to the Card (but this is not the case when you have redeemed points from another program like Aeroplan or AIR MILES).

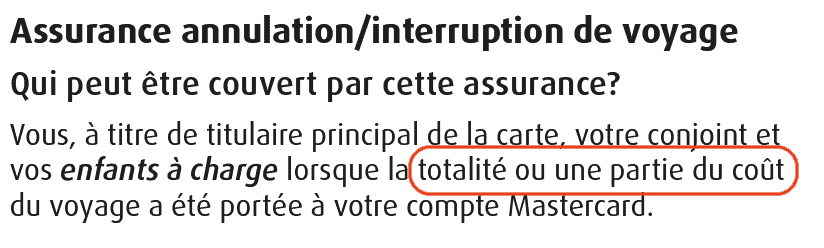

Other cards require only part of the trip to be paid for with the credit card.

For example, here is the insurance note for the BMO Ascend World Elite Mastercardfor trip cancellation and interruption insurance:

It’s very important to read and understand your credit card insurance certificate.

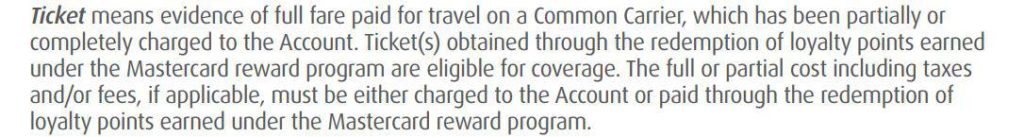

Additional coverage offered by the BMO Ascend World Elite Mastercard is Flight Delay Insurance. It specifies that the entire cost of the plane ticket must be purchased with the same card.

A single card may have different eligibility criteria for different coverages. These nuances have major consequences in the event of a problem.

General rule: use a card associated with a program

As a general rule, we recommend you to use:

- an AIR MILES credit card to cover an AIR MILES award travel

- an AEROPLAN credit card to cover an AEROPLAN award travel

- a Membership Rewards card to cover a Membership Rewards award travel

- and so on for each program

So, if you use the BMO® AIR MILES® World Elite®* Mastercard®*, you will be covered if there is a problem related to your AIR MILES award travel.

Here is the insurance note of this card regarding award flights booked with miles (AIR MILES in that case):

Special rule: credit cards covering all situations

Only two credit cards allow you to be covered even if you only pay for part of your trip on them!

So you can redeem Aeroplan miles, charge taxes to your credit card and be covered by your credit card insurance!

Two credit cards stand out from the competition in Canada:

For the most part, these two credit cards cover the cost of your trip, whether you have paid for it in full or in part with your card. However, baggage delay insurance requires that the full cost of the flight was charged to the card. The same is true for car rental insurance.

One of the great advantages for people aged 65 to 74 is that out-of-province Hospital Medical Insurance coverage is included, for up to 15 days.

Note that the Desjardins Odyssey® World Elite® Mastercard has similar insurance to the National Bank’s World Elite Mastercard® ones. However, for most of its insurance, Desjardins’ credit card requires that the full cost o has been charged to the card.

It’s up to you to make your choice based on your needs!

To help you, here are two tables listing the main insurance coverages offered by these credit cards.

National Bank Insurance

For most insurance included, the National Bank’s World Elite Mastercard® and the National Bank’s World Mastercard® are among the only credit cards in Canada to cover you even if you only charge to it a part of the cost of the trip.

The following expenses will be reimbursed (…) provided that a portion or the entire cost of the trip was charged to the account

Banque Nationale du Canada

For travel insurance, only baggage insurance in case of delay and vehicle rental insurance requires that the entire cost was charged to the card.

| Insurance | Coverage |

| Medical/hospital insurance Out-of-province-of-residence |

up to $5,000,000 per person (see details below on age and duration) |

| Trip Cancellation Insurance (before departure) |

up to $2,500 per insured person |

| Trip Interruption Insurance (after departure) |

up to $5,000 per insured person |

| Departure flight delay insurance (over 4 hours) |

$250 per day (up to $500 per person) |

| Baggage insurance in case of delay (over 6 hours) |

up to $500 per person |

| Lost or Stolen Baggage Insurance | up to $1,000 per person |

| Vehicle rental insurance |

Vehicle valued up to $65,000 theft of personal effects up to $2,000 |

| Purchase protection in the event of theft or damage (180 days) |

up to $60,000 |

| Possibility of tripling the manufacturer’s warranty | up to 2 additional years |

| Insurance booklet |

The National Bank’s World Elite Mastercard and the National Bank’s World Mastercard® offer different levels of protection for Out-of-province-of-residence medical/hospital insurance according to:

- the person’s age

- the length of the trip

| Age | Maximum trip time frame |

| 54 and under | 60 days |

| 55 to 64 | 31 days |

| 65 to 74 | 15 days |

| 75 years or older | no coverage |

Bottom line

As always, we advise you to carefully read each credit card’s insurance booklet before making a decision. It is your responsibility to contact your credit card issuer for clarification in case of doubt.

Here are posts you can check out about specific credit cards insurance:

- Insurance: The best credit cards for travel insurance with reward points

- 9 reasons to subscribe to the National Bank World Elite Mastercard® in 2024

- What you need to know about travel insurance for people 65 and over

- How does credit cards emergency medical insurance work?

- How to cancel a trip and get a refund?

- Insurance: How to choose and save on travel insurance?

- How do I choose the best credit card to pay for my trip?

- Travel insurance: is COVID-19 a pre-existing condition?

- Insurance: Credit card travel insurance

- Your credit card, luggage and insurance

- Insurance: How Does Credit Card Rental Insurance Work?

- Insurance: How does credit card trip cancellation/interruption insurance work?

- Insurance: How does credit card extended warranty insurance work?

- Insurance: How does credit card flight delay insurance work?