Tim Hortons - The New Tims Credit Card

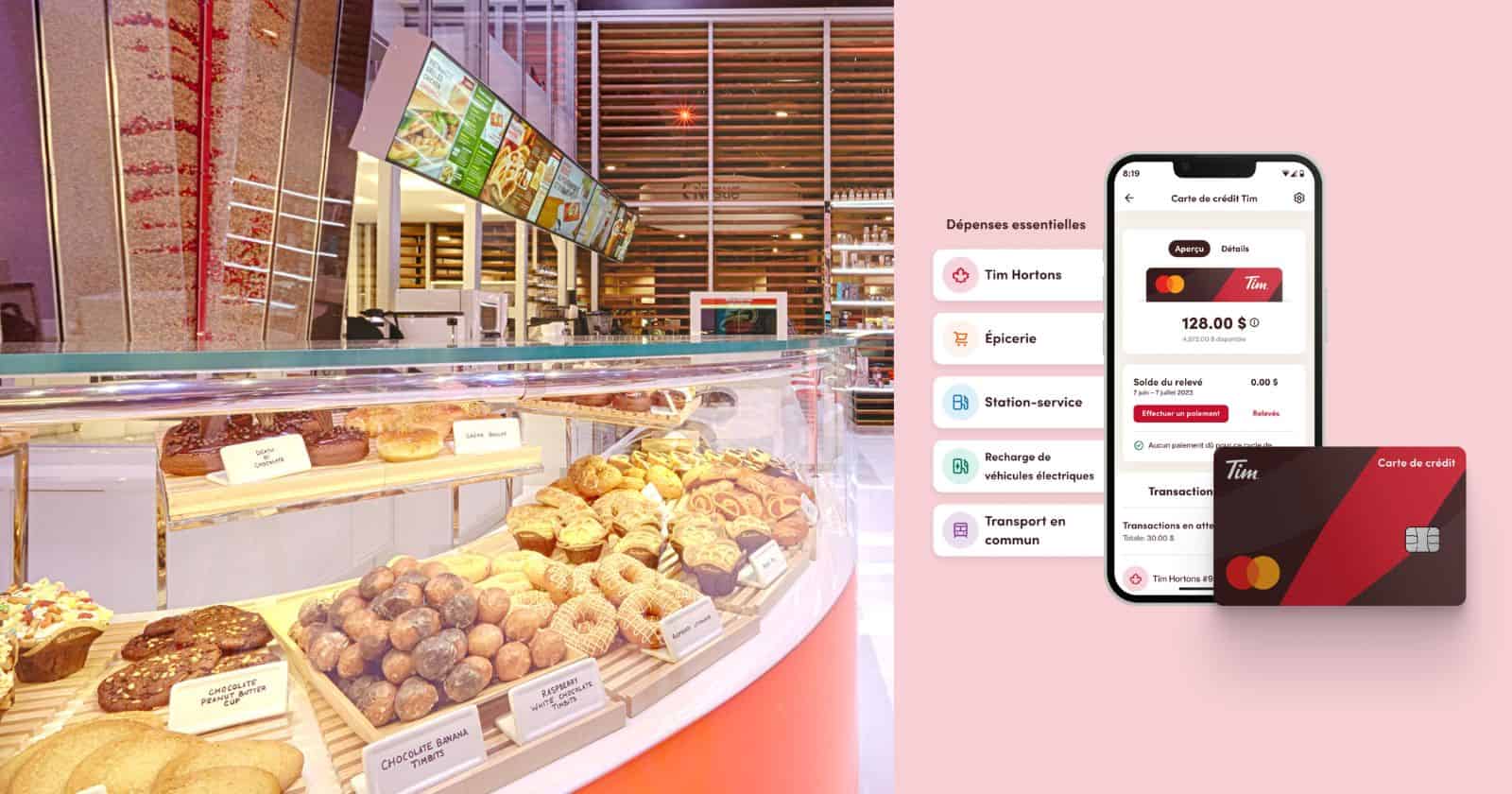

The Tim® Mastercard® Credit Card, announced by Tim Hortons in partnership with Neo Financial, is a Mastercard credit card with no annual fee.

The Tim® Mastercard® credit card is designed to allow Tim Hortons customers to earn Tim Rewards points on all their purchases, which can then be redeemed for more free coffee, drinks and food at Tim Hortons.

Card details

For a limited time, the Tim credit card is offering new cardholders a welcome offer of up to 5,000 Tims Rewards® points. Here are the details:

- Earn 2,000 FideliTimTM points on your first eligible purchase within 30 days of card application approval.

- Earn 1,000 bonus FidelimTM points for every month you spend a minimum of $200 on eligible purchases over the following three months.

With the Tims Credit Card, you can earn Tim Rewards points wherever you shop. Two versions of the card are available: the standard version and the secured version.

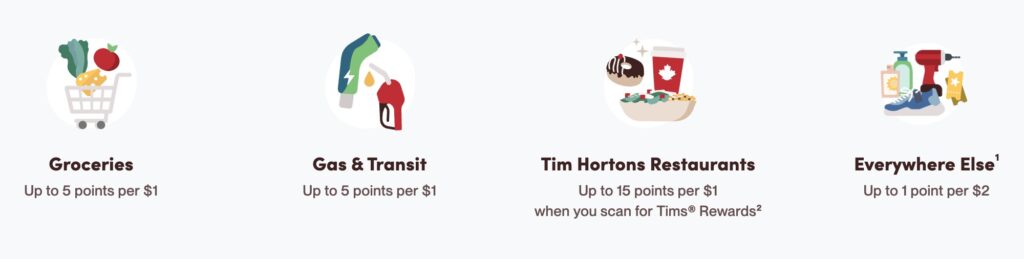

Here are the eraning details for each card by spending category:

| Standard | Secured | |

| At Tim Hortons | 15 points / $ (by scanning your Tims Rewards card) | 15 points / $ (by scanning your Tims Rewards card) |

| Groceries, gas or public transit | 5 points / $ | 2 points / $ |

| Other purchases | 1 point / $2 | 1 point / $4 |

Note that for the first two categories in the table, there is a ceiling of $20,000 per calendar year, after which the earning decreases (to 1 point/$2 for the standard card and 1 point/$4 for the secured card).

The secured version of the Tim credit card is offered to Canadian residents with limited or no credit history, such as students and newcomers. It accumulates points and helps them build their credit history. This version does not require a credit check that could affect the credit score. However, it does require you to pay security funds in order to determine your credit limit. These funds can range from $50 to $10,000.

The standard version of the Tim credit card is more generous in the accumulation of points, but requires a credit check that will have an impact on the credit score (as is the case for most credit cards).

Both versions of the Tim credit card include the same welcome offer.

“Let’s say I spend about $80 at the gas station and use my Tim Credit Card to pay. I’ll get 400 FideliTimTM points for this purchase, and that’s enough points for a free coffee at Tim’s right after I fill up! The Tim Credit Card really lets you maximize your daily spending and earn Tim Hortons rewards faster. We even have a calculator on our website that lets you estimate how quickly you can earn points each month. ” – Markus Sturm, Senior Vice President of Financial Services and Digital at Tim Hortons

Sousrire à la carte

The new Tim Credit Card from Tim Hortons comes in two versions and is integrated with the Tim Hortons app, making it possible to apply for the Tim Credit Card, be approved and check your balance, all from your phone.

Like most credit cards, even those with no annual fee, the Tim Credit Card offers the following advantages:

- Extended warranty up to one year

- Purchase protection against loss, theft and damage

- Mastercard Zero Liability

The Tims Credit Card is offered by Neo Financial, and issued by ATB Financial under license from Mastercard International Incorporated.

Tim Hortons - Our opinion

Before you sign up for a Tim credit card, be sure to read up on the Tim Hortons Tims Rewards loyalty program, including recent changes.

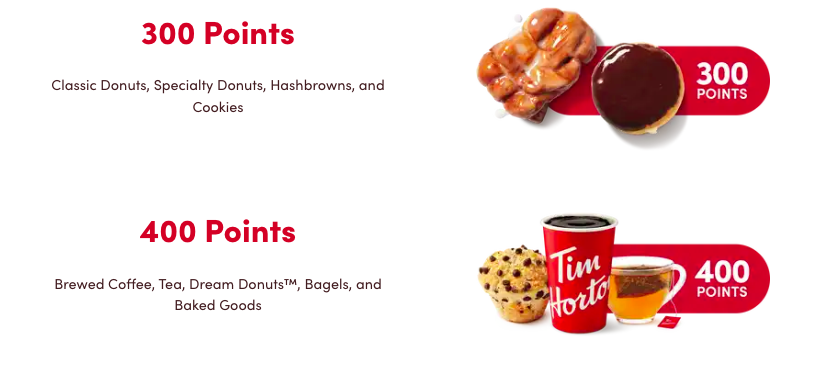

As part of the Tims Rewards program, you can select a reward level to redeem your points. This level can then be changed at any time if you change your mind.

Here are the different levels:

| Reward level | Reward Options |

| 300 points | Classic donut, specialty donut, hashbrowns, cookie |

| 400 points | Brewed coffee, tea, dream donut, bagel, baked goods |

| 600 points | Hot Chocolate, French Vanilla, Iced Coffee, Wedges |

| 800 points | Real Fruit Quenchers, Cold Brew, Classic Iced Capp®, Box of 10 Timbits®, Yogurt, Frozen Beverages and Espresso Drinks |

| 1,100 points | Breakfast Sandwiches and Soups |

| 1,300 points | Farmer’s Wrap, BELT®, Lunch Sandwiches and Chili |

| 1,800 points | Loaded Bowls & Wraps |

Knowing that a donut at Tim Hortons costs about $1.5, that means 1 Tim point equals about 0.5 cents:

Looked at it another way, when the new Tims Credit Card offers 5 points per dollar for groceries, gas or public transit, that’s a return of about 2.5%(which you can only use at Tim Hortons).

For all other purchases, this new Tims Credit Card offers 1 point for every 2 dollars, i.e. a return of 0.25%.

This credit card is aimed at Tim Hortons addicts since cardholders will only be able to redeem their points for products sold by Tim Hortons.

If you prefer a no-annual-fee credit card offering cash back, we recommend these credit cards instead:

And suppose you want even more cashback or rewards. In that case, these credit cards are unbeatable for groceries and restaurants (even with an annual fee – some of which are offered in the first year – you’ll be a winner at the end of the year by making your purchases on these credit cards):

For more choices in specific credit card categories, see our various rankings:

Bottom line

Before you sign up for the Tim® Mastercard® credit card, do your homework: there are better credit cards on the market, even at the no-annual-fee level (and with welcome bonuses in the first year).

Questions

What is Tims Financial?

Tim Financial is a financial services division of Tim Hortons, set up to make it easy and convenient for customers to manage their day-to-day finances while enjoying the rewards of doing so.

With the Tims Credit Card, you’ll earn Tims Rewards points every time you make a purchase, including extra points for spending on groceries, gas, public transit and electric vehicle recharging. Plus, you’ll receive extra points at Tim Hortons restaurants when you scan your Tims Rewards card for rewards.

Tim Financial services have been integrated into the Tim Hortons application to offer easy registration, account management, points tracking and rewards claiming, all from a convenient, centralized location.

Who can apply for a Tims Credit Card?

To apply for the Tims Credit Card, you must be a Canadian resident and have reached the age of majority in your province or territory of residence.

The credit limit granted is determined by taking into account several factors, such as your credit rating, your income, your debts and the length of your credit history.

For individuals with a low credit rating or no credit history, we also offer a secured version of the Tims Credit Card. This option allows you to earn points on all your purchases while building up your credit history.

Quebec residents must first sign up for the standard Tim credit card; they will then be able to sign up for the other version after a credit check with an impact on their credit rating.

What if I have no credit history or a low credit rating?

To apply for the Tims Credit Card, you must be a Canadian resident and have reached the age of majority in your province or territory of residence.

The credit limit granted is determined by taking into account several factors, such as your credit rating, your income, your debts and the length of your credit history.

For individuals with a low credit rating or no credit history, we also offer a secured version of the Tims Credit Card. This option allows you to earn points on all your purchases while building up your credit history.

Do I have to be a member of the Tims Rewards program to apply for the Tims Credit Card?

To apply for the Tims Credit Card, you must first create an account in the Tim Hortons application. When you register on the Tim Hortons application, you will automatically be enrolled in the Tims Rewards program.