Changes announced by Rogers

In a note sent to its customers, Rogers Bank warns of several changes – most of them negative – coming to its credit cards, including the Rogers Red World Elite® Mastercard®.

As you will see in our conclusion, this announcement could be the beginning of a long series.

Cashback devaluation

Rogers Bank has announced a triple change to the rate of discounts granted for purchases made on the Rogers Red World Elite® Mastercard®.

First, a double change: it will now offer a 3% cashback for all purchases made in U.S. dollars ONLY. Whereas previously, it was a 4% cashback on ALL foreign currencies purchases.

This card charges a 2.5% conversion fee, so it is no longer advantageous to use it for foreign currency transactions (outside the U.S. dollar).

Then, the overall cashback rate decreases from 1.75% to 1.5% for all purchases, including Rogers purchases.

Annual minimum amount to charge on the card

Another significant change: Rogers Bank now reserves the right to downgrade customers from a World Elite card if they do not charge $15,000 a year on the card.

Specifically, if you don’t make a minimum of $15,000 in purchases per year (between August 1 and the following July 31) on your Rogers Red World Elite® Mastercard®, Rogers will send you a lower-level(Platinum) card.

This will also end the other benefits of the card including insurance!

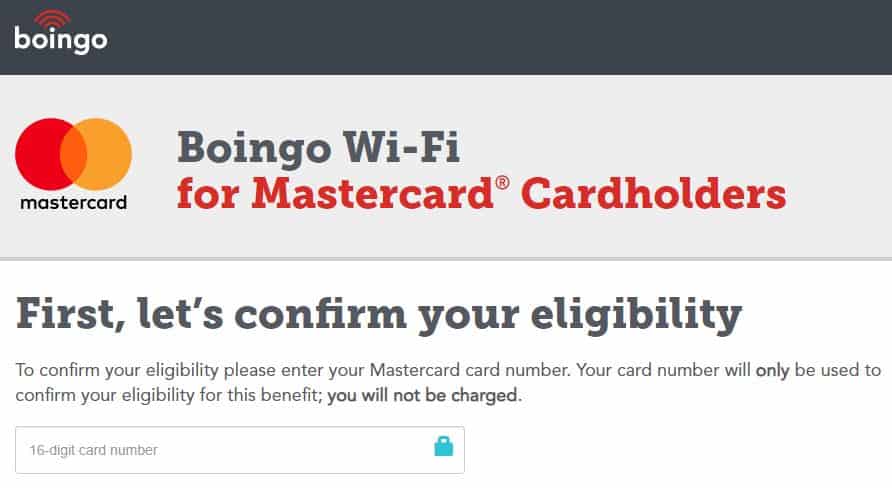

Boingo Wi-Fi Access

As compensation for all these drastic changes, Rogers Red World Elite® Mastercard® cardholders will benefit from access to Boingo, a service providing access to Wi-Fi just about anywhere in the world.

Alternatives to this card

The Rogers Red World Elite® Mastercard® has the merit of being free year after year and offering attractive cash back.

With these changes, this card has become less attractive for travellers, especially compared to alternative credit cards offering travel points (with welcome bonuses and other benefits) rather than cashback.

The 3 best credit cards with no conversion fees

The Rogers Red World Elite® Mastercard® was falsely perceived as a credit card with no foreign currency conversion fees.

As explained above, this credit card charges a 2.5% fee for all foreign currency transactions. On the other hand, its cashback rate was higher for those types of purchases: 4%.

Now, if you use this credit card abroad, apart from purchases in U.S. dollars (3% cashback), you will lose because of a 2.5% conversion fee and the 1.5% only cashback!

Three alternative credit cards in Canada do not charge any conversion fees for foreign currency transactions.

The National Bank World Elite Mastercard®.

Of the three cards shown below, this is the only Mastercard credit card (and therefore accepted at Costco).

This credit card can easily be used for your everyday purchases and provides :

- 5 points per dollar for groceries and restaurants

- 2 points per dollar for gasoline and electric recharges

- 2 points per dollar on recurring bills

- 2 points per dollar on À la carte Travel

- 1 point per dollar on all other purchases

What’s more, you get $150 annual travel credit (for parking, airport lounges or baggage fees, for example), a free unlimited annual access for you and one guest to the National Bank lounge at Montréal-Trudeau airport with unlimited data WiFi access points Boingo and comprehensive travel insurance coverage for up to 60 days of travel.

Scotiabank Gold American Express® Card

Scotiabank Gold American Express® Card is a credit card with no conversion fee for foreign currency purchases, especially for any purchases you make every day in Canada.

You can earn:

- 5 points per dollar for groceries, restaurants, fast food or beverage outlets

- 5 points per dollar for ready-to-cook meal subscriptions and meal delivery services

- 5 points per dollar for entertainment (cinema, theatre, events tickets)

- 3 points per dollar for gas

- 3 points per dollar for public transportation, bus, subway, taxi, carsharing services like Uber

- 3 points per dollar for streaming services like Netflix

- 1 point per dollar everywhere else

It’s a 1% to 5% return on your purchases! Those categories do not normally apply abroad. However, many cardholders reported in our Facebook group that they received 5 points per dollar on restaurants abroad! This is great, especially since this card does not charge any foreign transaction fees. So to be tested;)

Points can easily be used on any travel purchase made with the card (flights, hotels, Airbnb, all-inclusive…).

Check our review about this credit card.

The Scotiabank Passport™ Visa Infinite*

The Scotiabank Passport™ Visa Infinite* Card is an excellent no-conversion-fee credit card for purchases in foreign currencies, with benefits for travellers.

You can earn:

- 2 points per dollar for groceries

- 2 points per dollar for restaurants

- 2 points per dollar for local transport (bus, subway, taxi, carsharing services)

- 1 point per dollar for all other purchases

It’s a 1% to 2% return depending on your purchases! Purchasing categories also work abroad. For example, if you make your groceries in Florida, you’ll earn 2 points per dollar and won’t pay any foreign transaction fees!

You can redeem points for any travel purchase made with the card (flights, hotels, Airbnb, all-inclusive, etc.).

Besides, this card comes with a Priority Pass subscription and six free annual access to airport lounges.

Check our review about this credit card.

Bottom Line

This year, we may see similar changes with other issuers.

The interchange fees charged to merchants will decrease from April 2020:

Rewards given to customers come from these fees, cashback or points accumulation rates, as well as welcome bonuses, are likely to decrease.

Also, Mastercard and Visa have reportedly asked institutions to tighten the criteria for issuing World Elite / Visa Infinite / Visa Infinite Privilege cards (the cards charging the most interchange fees).

It should be noted that issuers should normally ensure that their future customers meet the revenue criteria set by Mastercard and Visa:

| Network | Level | Individual income | Family |

| Visa | Infinite | $60,000 | $100,000 |

| Mastercard | World | $60,000 | $100,000 |

| Mastercard | World Elite | $80,000 | $150,000 |

| Visa | Infinite Privilege | – | $200,000 |

Also, Mastercard is preparing to launch this year a brand new product called Muse, which will be superior to the World Elite, in order to:

- to compete with the Visa Infinite PRIVILEGE

- charge higher interchange fees

It will, therefore, be up to the institutions to respect Mastercard and Visa’s instructions to the letter (which Rogers Bank seems to want to do), or to be a little more accommodating with their future clients (as some institutions still are today. Canadian ones)!