No need to beat around the bush: every time you pay for your purchases with anything other than a premium credit card, you’re paying for other people’s benefits, miles, insurance and cash back. Let us explain why you should use your credit card.

Anatomy of a credit card transaction

Paying by credit card is simple, almost natural, but behind the scenes it is complicated. What really happens when you buy?

- The merchant presents you with his payment terminal displaying the amount of your transaction

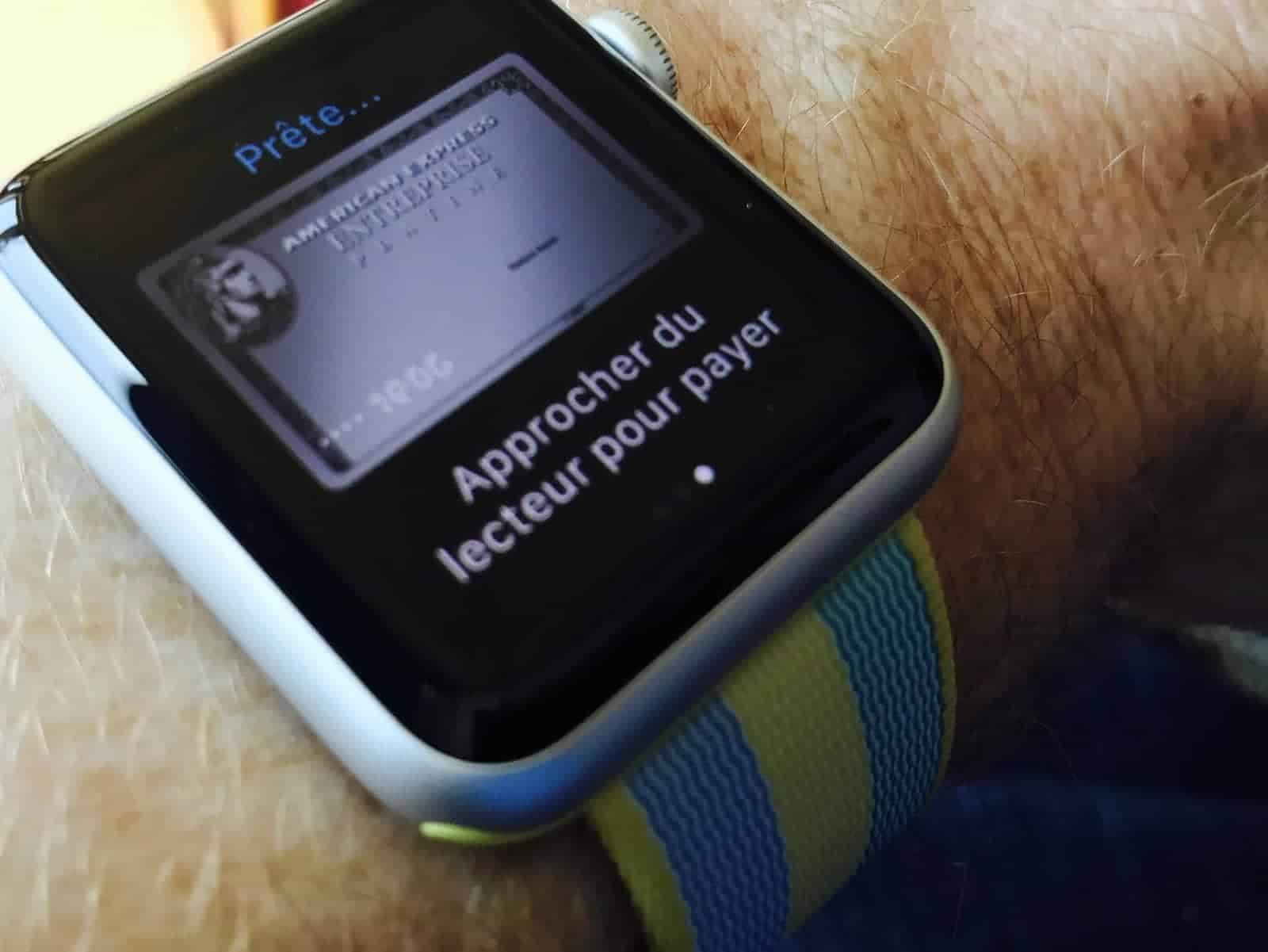

- You insert or tap your card – or your Apple Watch, if you know how to live with the times and prefer a better security of your transactions (tokenization)

- The information is sent to the merchant’s merchant services provider

- The merchant service provider relays the information to the payment network (American Express, Visa or MasterCard)

- The payment network consults with your card issuer to verify your card’s validity, spending limit and security information

- The issuing bank then returns its authorization, which travels by the same route to the merchant’s terminal, which begins to print the transaction receipt – if necessary, your watch will tap your wrist twice to confirm that everything is fine!

Unsurprisingly, all of these operations come at a cost to the merchant, the amount of which is essentially determined by the fees charged by the payment network – the interchange rate – plus various, much smaller ancillary fees, including those charged by the merchant service provider itself.

The interchange rate

This famous interchange rate costs the merchant approximately 2% of all sales paid by credit cards. However, this cost varies depending on the type of business, the amount of purchases and especially the type of card.

For American Express the rate is 1.60 to 2.40% and depends on the type of transaction and its amount – transactions over $200 in restaurants are subject to the highest rates.

For all other cards, the rate depends on the type of card, the volume of transactions and the type of transaction (e.g. card present or not). For Visa, the retail rate ranges from 1.42% for a basic card, to 1.61% for a Visa Infinite and 2.08% for a Visa Infinite Privilege. For MasterCard, the rate ranges from 1.44% to 2.06% for a MasterCard World Elite.

The conclusion is inevitable…

As you can see, merchants have no choice but to absorb these interchange costs by increasing their overall prices for all their customers. This means that a customer who pays cash for his or her purchases pays for the nice Aeroplan rewards of the customer who uses his or her Visa Infinite Privilege card in hand. It’s cruel to the vestals of petty cash and Interac, but that’s just the way it is, so you might as well play the game – and we’re here to help you play it right!

Bonus with Jean-Francois’ testimony on Facebook in reaction to this article:

So true. And then we should rather talk about the management of the credit card as a payment card. Because just because the purchase is paid with a credit card does not mean that you pay interest. The majority of us mileage collectors never pay interest charges. Personally I see my plastic more as a payment card. I don’t have the AppleWatch but I use ApplePay constantly and love it. Plus with the Amex app which is great, I get instant notification of all purchases regardless of the medium (physical, online, monthly pre-authorized payment,…). So convenient that I am notified immediately of any suspicious or fraudulent transactions.

Cash has never brought so many benefits (trouble to get it [guichet automatique], money management,…). And the article doesn’t even mention the other advantages (zero risk in case of theft or loss [protection inexistante avec l’argent comptant], extended warranty [absent avec le comptant]).

For anyone able to manage their credit (avoid debt), the payment card outperforms all other payment methods. All that remains is to assume and pay for everything with even the packets of gum or the $0.50 from the parking meter.