When I came to Canada more than ten years ago, I was looking for a solution to save on my banking fees, discovering that it is often difficult to avoid them and that they can weigh on the budget.

Used to the principle of online banking with the multiple players on the market in France, I, therefore, naturally turned to ING Direct online banking, which became Tangerine in 2013-2014.

The Tangerine Chequing Account

Tangerine offers a no-fee checking account with multiple benefits:

- No banking fees for all current transactions (debit purchases, bill payments, pre-authorized payments and email money transfers: all free and unlimited)

- Minimal bank fees compared to other banks for your cash withdrawals abroad: $2 per withdrawal + 2.5% conversion fee

- Monthly payment of interest earned on every dollar in the chequing account

- Free access to Scotiabank ABMs

- The first book of cheques (50) free!

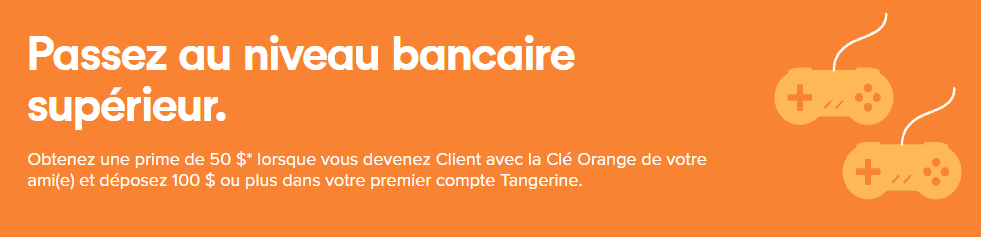

Right now, when you open a Tangerine checking account, you get a $50 welcome bonus!

All you have to do is just:

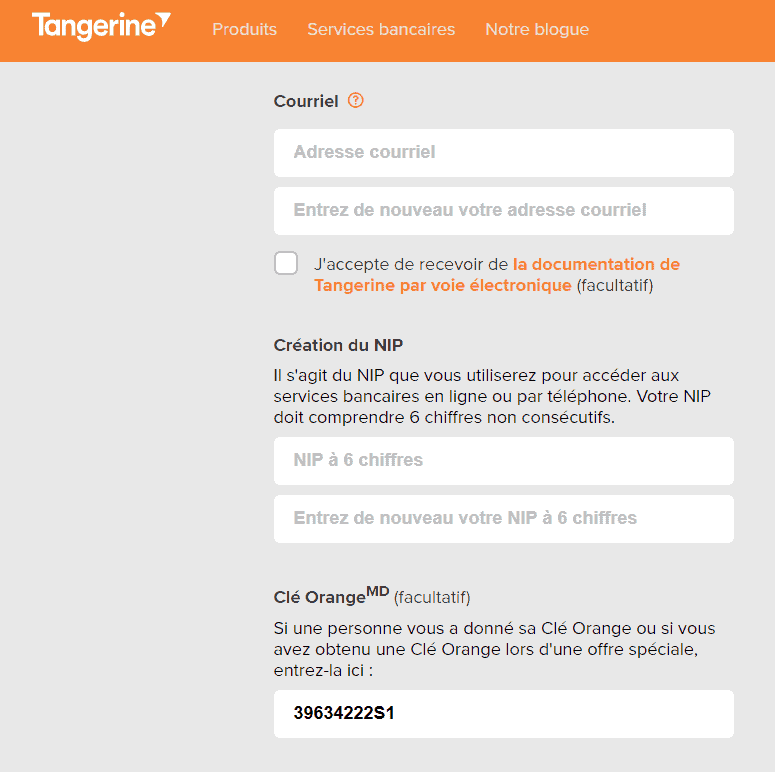

- open an account by indicating our Orange key, a referral from Milesopedia: 39634222S1

- make a $250 deposit

- keep it on the account for 60 days

And you’ll get a $50 bonus!

The Orange key 39634222S1 is to be indicated at the very beginning of your registration

And once you have a chequing account, you too can get an Orange Tangerine key to refer people you know!

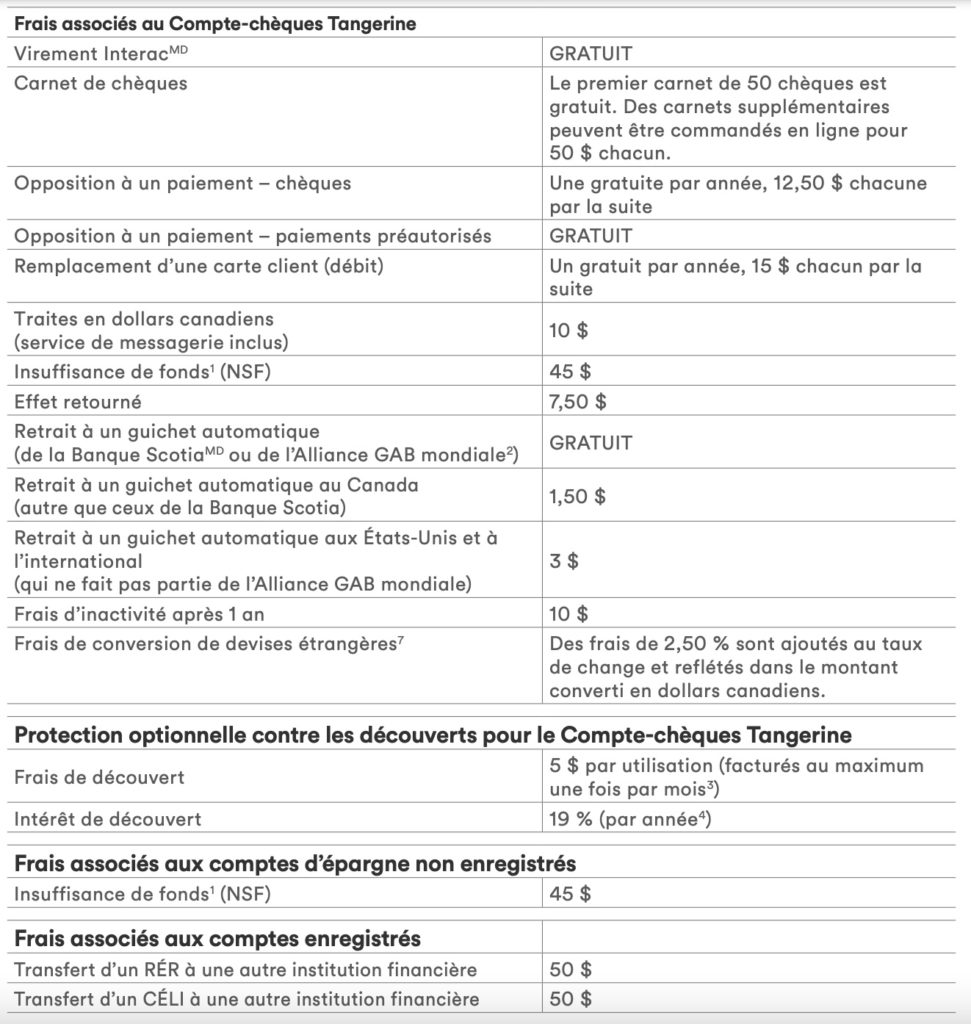

What I like most about the Tangerine checking account is the transparency of the bank fees, and they are not hidden in the fine print of a booklet that no one reads.

The Tangerine Savings Account

Tangerine also offers a savings account. You can open only this type of account without having a Tangerine chequing account.

The Tangerine Savings Account has no bank fees and offers the highest interest rate on the market. In addition, from time to time, you can receive a promotional interest rate on any new dollars deposited into the account.

Right now, by opening a Tangerine savings account you’ll earn 2.75% interest on your savings for 5 months! Plus, you can also get up to $400 cash back when opening a new savings account!

Tangerine Credit Cards

Tangerine Money-Back Credit Card

The Tangerine Money-Back Credit Card has no annual fee and offers cash back.

With this limited-time welcome offer, you can earn an additional 10% cash back (up to $100) when you spend up to $1,000 on everyday purchases during the first 2 months.

You can choose two to three categories that interest you (groceries, gas, furniture, home improvement, recurring bills, pharmacy, etc.) to earn 2% cash back! And there is no annual cash back limit. It is one of the best credit cards for renovations.

In addition, the Tangerine Mastercard offers several insurance coverages for your purchases :

- 90 days purchase insurance

- One year extended warranty

Finally, during your first 30 days, transfer balances and pay only 1.95% interest on the transferred balance for the first 6 months.

Tangerine World Mastercard

If you have an individual income of $60,000 or a family income of $100,000, you may want to consider the World Mastercard Tangerine.

This credit card has no annual fee and offers cashback. With this limited-time welcome offer, you can earn an additional 10% cash back (up to $100) when you spend up to $1,000 on everyday purchases during the first 2 months.

You can choose two to three categories that interest you (groceries, gas, furniture, home improvement, recurring bills, pharmacy, etc.) to earn 2% cash back! And there is no annual cash back limit.

In addition, the Tangerine World Mastercard comes with several insurance coverages for your purchases and travel :

- 90 days purchase insurance

- One year extended warranty

- Mobile Device Insurance

- Rental Car Collision/Loss Damage Insurance

Finally, during your first 30 days, transfer balances and pay only 1.95% interest on the transferred balance for the first 6 months.

Tangerine Services

Tangerine offers several services that go beyond what you might get from your current financial institution:

- a very functional application that was one of the first in Canada to allow instant deposit of cheques by photographing them (“Photocheque” system)

- 24/7 telephone support

- Customizable email alerts (deposits, withdrawals, etc.)

- Free access to Scotiabank ATMs in Canada, and to nearly 50,000 ATMs around the world through the ABM Alliance

Conclusion

Je suis un grand adepte de la Banque Tangerine.

Audrey et moi y détenons chacun :

- un compte-chèques personnel et conjoint,

- un compte-épargne,

- une Carte de crédit Remises Tangerine,

- un compte CELI,

- un compte d’épargne en US $

- un compte-épargne pour chacun de nos enfants