TransUnion Credit Report

We’ve been talking regularly about the credit report.

There are two credit scoring agencies in Canada: TransUnion and Equifax. You can request your credit report free of charge each year. You will then get a paper or electronic copy but not your score.

TransUnion offers a paid monthly subscription to access your score and real-time details of your credit report. This subscription is without obligation so you can stop it at any time.

Open an account to get your TransUnion credit report

After opening your account, you will access your scoreboard displaying your score, but also the essential information of your TransUnion credit report.

The first section concerns your subscription and allows you to manually update your score. You can do this at any time, you will also receive an email if it changes.

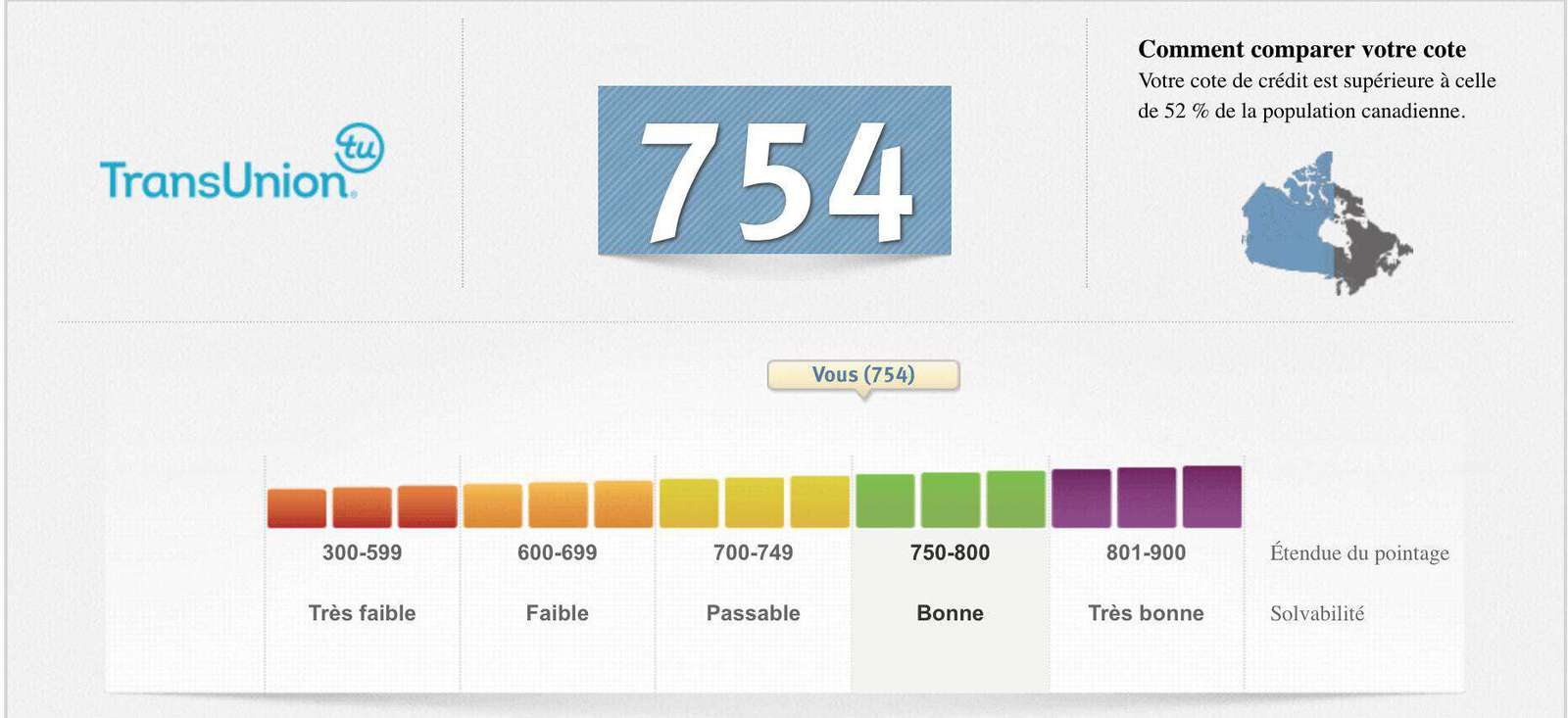

My TransUnion credit rating

It’s the most prominent information. Your score is then compared to the Canadian population. Apoints hunter can sometimes fall below 750. However, the score does not tell the whole story. But if you plan to negotiate a mortgage, it’s best to stay above it.

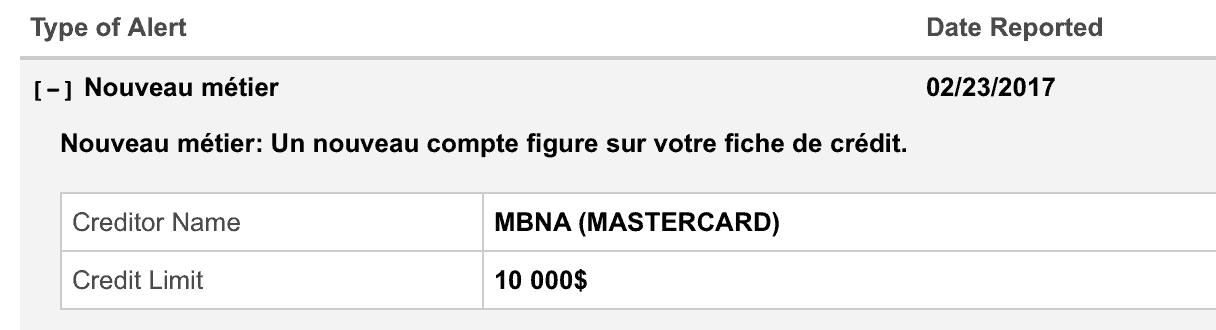

Alerts

You will receive an email when a new history request is made. An alert can be created when your credit card is first charged and the financial institution reports it to TransUnion. Finally, a closed account can also trigger an update.

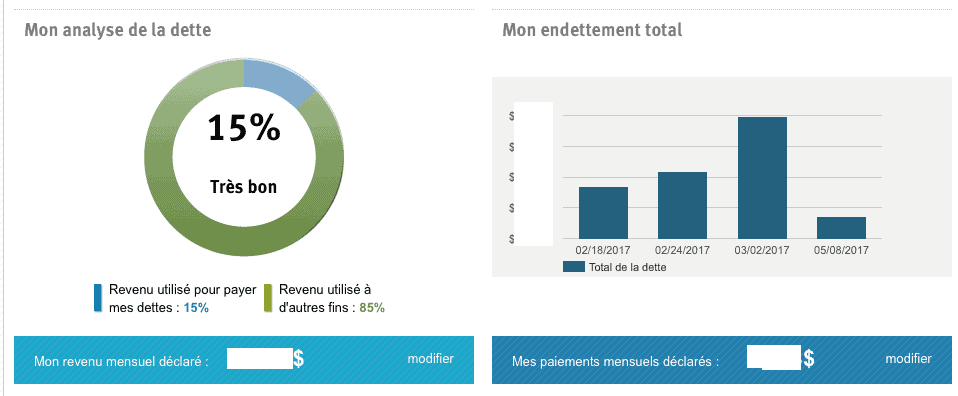

Debt analysis

We can’t say it enough, but the travel hacker must not go into debtto play the points game. So, pay your credit cards on time!

This section allows you to see your debt ratio. This is relative because it is based on the gross monthly income you declare when you register. The high limit considered dangerous is 44%.

Summary

Next comes the “ingredients” of your TransUnion credit score.

There are the :

- Sales (the amount in itself does not say much, because it is rather the”credit mix” that will give a more or less good image)

- Minimum payments to be made

- Requests made on your file (too many requests can be a sign of running away from opening accounts to pay others)

- Number of accounts and accounts opened (it is a shame that TransUnion does not display the average age of your accounts because it is one of the criteria of the score)

- Overdue or overriding accounts (we want to avoid this!)

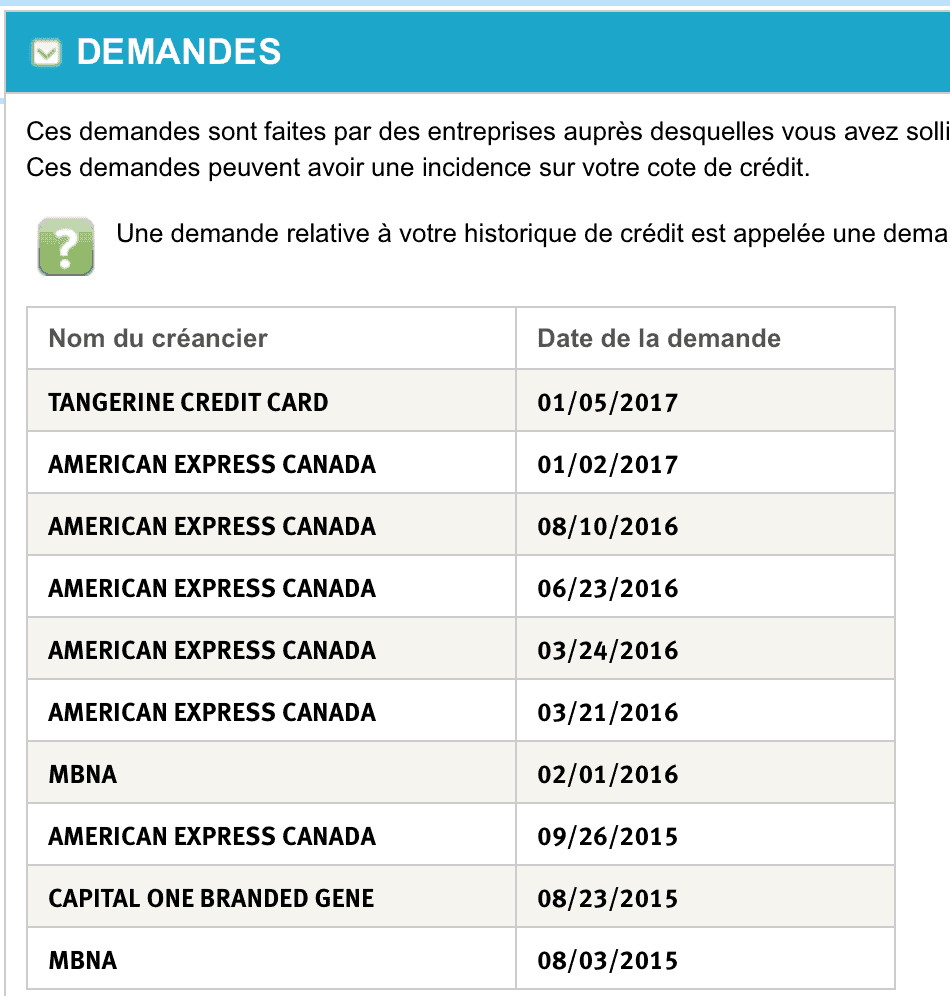

TransUnion credit report requests

This is where your credit history inquiries appear. Some banking institutions such as American Express use TransUnion. Others like CIBC use Equifax. Please note, however, that institutions will declare account over once it is opened at both offices.

Some organizations may refuse you a card because you have done too many applications in a short period of time. This page therefore contains interesting information.

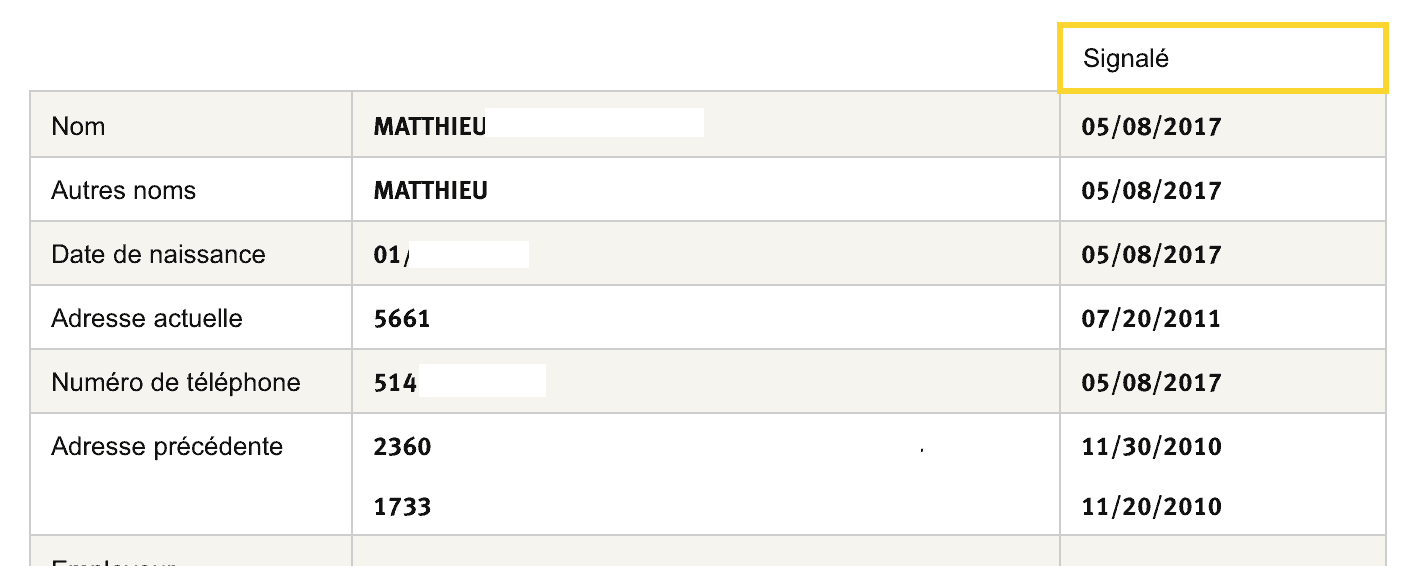

Personal information

This section is less important than the others, but it is important to pay attention if any of the information is wrong. Previous addresses are sometimes used to identify you when applying for a new credit card .

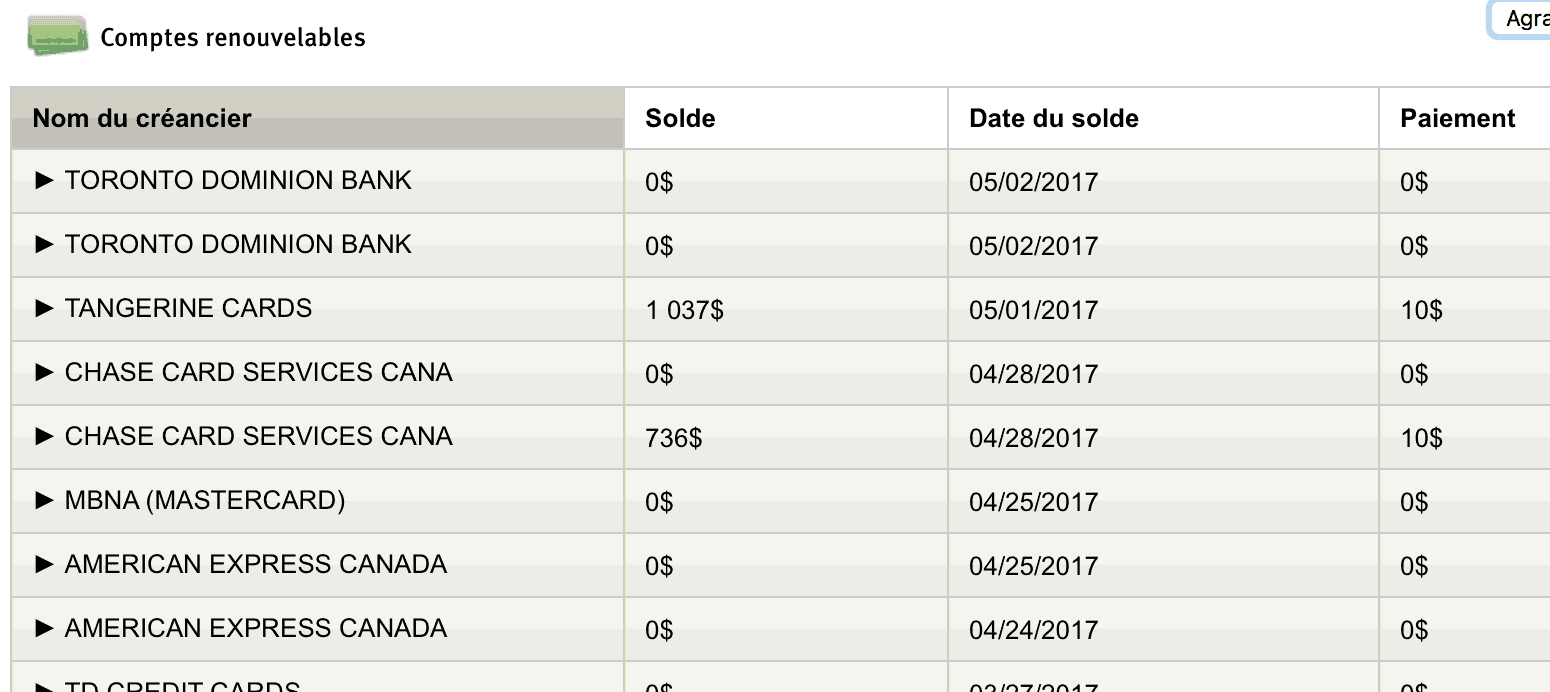

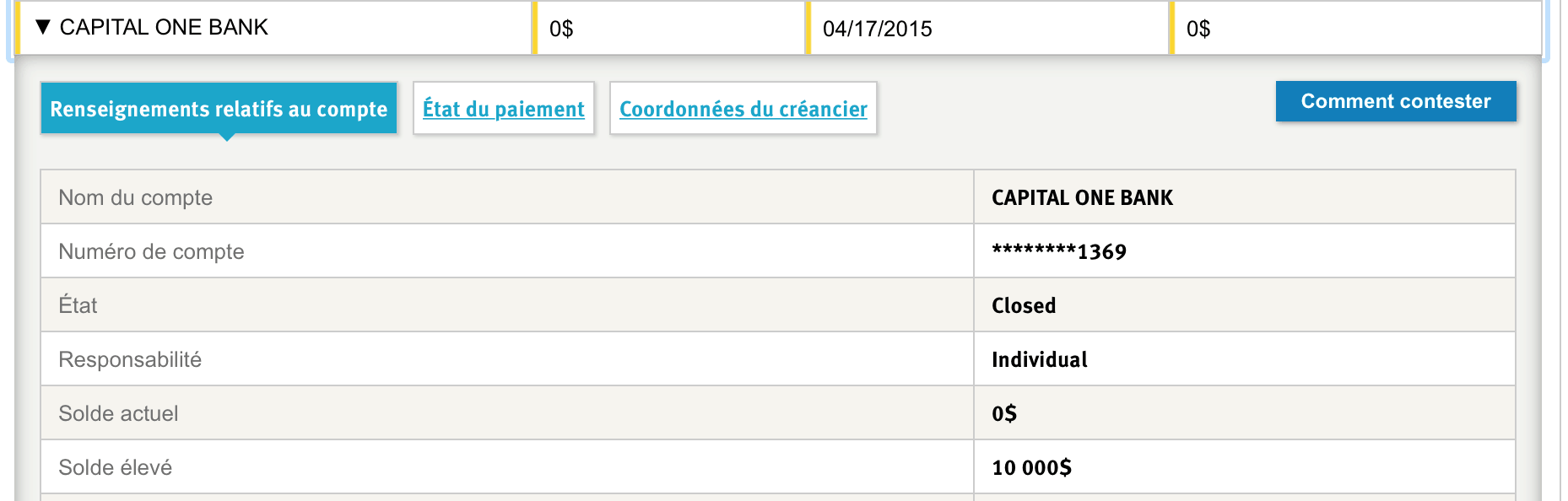

List of accounts

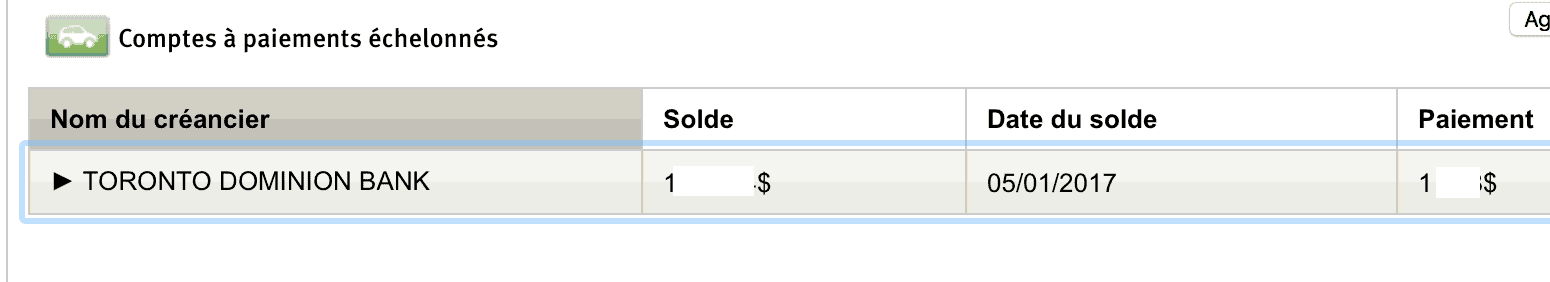

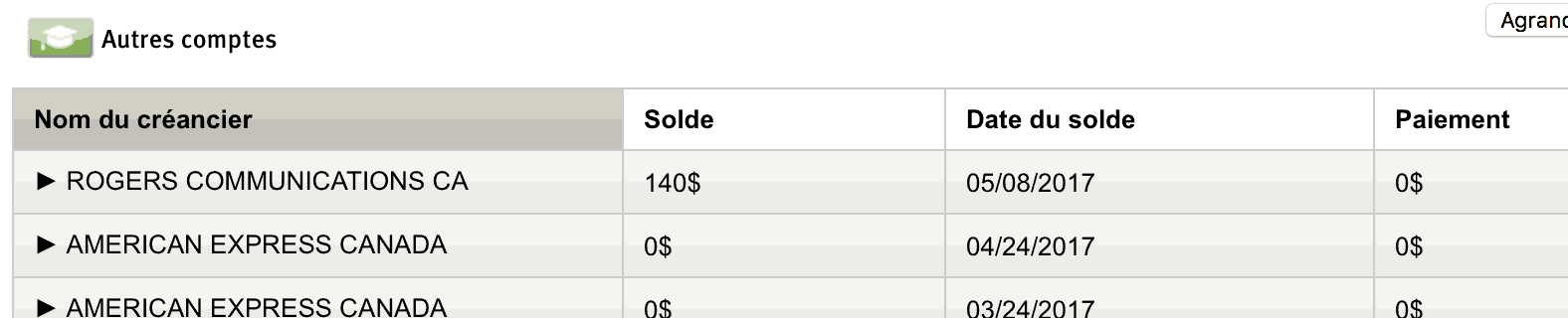

This is where we will find the accounts declared by the banking institutions. There are different types of accounts.

The first one is the most classical: the revolving accounts, re : credit cards. You see a balance column which is the amount on your statement, and the payment which is the minimum amount to pay.

The other type is installment accounts, which means accounts with a deadline. We will find the car loans, the loans of the stores of electric household appliances. Some mortgages may also be included.

Finally, the other accounts include cell phone lines or Internet service providers. It is always important to pay your bills even if you have a dispute with these companies. A prolonged absence of payment, even for a “trivial” amount, can have very bad consequences for your credit score.

In the screen below, we notice thatAmerican Express is present. Some of their cards are payment cards that must be paid in full at each statement.

This table also allows you to check the details of an account to see if it is properly closed.

Conclusion

TransUnion has a nice interface and the information is well presented, so you don’t get lost. It is important to request your TransUnion or Equifax credit report once a year. But if you’re curious to see what’s behind the scenes, your file is just a click away.