Personal Finance for Students

Making a monthly budget

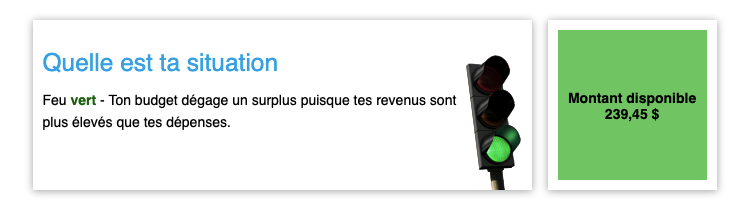

It’s not the sexiest thing to do, but it’s a great habit to get into so you know where your money is going. The Autorité des Marchés Financiers offers a tool to help untangle all this.

This way, your priorities are focused and there are fewer surprises at the end of the month.

ACEF

Contact your local ACEF (Associations coopératives d’économies familiales) for a range of budgeting and financial education services. These non-profit organizations also provide consumer protection information.

Taxes

As a student, you are entitled to tax deductions and credits. The tax return is used not only to declare your income but also to claim expenses you have incurred.

If you’ve moved to school, paid your tuition, or are paying interest on your student loan, you’re eligible to receive more money in your pocket.

Here are some examples from two of the websites concerned:

Chequing account

You can have a youth or student bank account with no monthly fees. Look for financial institutions offering incentives for opening an account.

You can benefit from free tuition throughout your studies until some time after graduation.

Many financial institutions also give you access to your credit rating online. It’s offered free of charge by your financial institution, in collaboration with the two major credit bureaus, TransUnion and Equifax.

Personal Finances

To make the best decisions about your financial situation, it’s important to know as much as possible. You’ll thank yourself later!

- Facebook Group L’Argent ne dort jamais to ask your questions

- Book: La retraite à 40 ans by Jean-Sébastien Pilotte

- Book: Ca coûte cher, être un adulte by Béatrice Poulin

- Book: En as-tu vraiment besoin? and Liberté 45 by Pierre-Yves McSween

- Book: Père riche père pauvre by Robert T Kiyosaki

- McGill University’s free online Personal Finance courses for everyone

- Je m’occupe de mes affaires! by the Autorité des Marchés Financiers

And read our article Spend your money wisely or how to get rich?

Discounts available to students

Use the power of your student card for special offers and discounts at many stores!

ISIC Card

The ISIC (International Student Identity Card) is for students 12 years of age and older as well as for people 30 years of age and younger. For $20 a year, you get discounts at various businesses, museums, Via Rail, hotels, tourist attractions, transportation and ready-to-eat lunch boxes. It is accepted in 130 countries.

For $10 a year, the SPC (Student Price Card) offers discounts mainly in shops and restaurants. You can get the SPC+ card for free with CIBC student credit cards:

Student discount when shopping

Many businesses offer discounts, with the simple gesture of showing your student card.

- Grocery stores, especially those near a college or university.

- Metro (for example, on Mondays 10% off on purchases of $50 or more)

- Provigo (10% off the bill on Mondays)

- Bulk Barn: Every Wednesday at 10

- Adidas: 15% off promotional items and 30% off regular priced items

- DeSerres: 10% off selected items at regular price

- Videotron: For student internet packages

- Yuzu Sushi: 15% off

- Apple: Education section of site offers free AirPods and 20% off AppleCare+

Other stuff

What’s more, you can find a cheaper mobile package by comparing the various products on the Protégez-Vous website.

Don’t hesitate to join loyalty programs to maximize your savings. Use online shopping portals such as AIRMILESSHOPS, the Aeroplan eStore or Rakuten for your purchases.

Student Credit Cards

In Canada, there are several credit cards for students. Getting your first credit card when you turn 18 allows you to build up your credit file and gradually improve your credit score.

Indeed, the notion of history is very important in the calculation of the credit score. The best thing to do is to get a no-fee credit card and keep it for as long as possible: it will be one of the cornerstones of your credit file (along with other financings such as a student loan, a car loan, etc.).

One of Canada’s best credit cards for students, the BMO® CashBack® Mastercard®* for Students, is currently on special offer. You can earn 5% cash back for the first 3 months (up to $100 cash back).

Then you get:

- 3% for grocery store purchases

- 1% cash back on recurring bill payments

- 0.5% on all other purchases

In addition, you get free extended warranty and purchase insurance. Plus, you can get a discount on car rentals at National and Alamo (up to 25% off).

If you prefer rewards points, the CIBC Aventura® Visa* Card for Students is a great no-annual-fee card for travel. Aventura points can be used to pay for travel expenses during school vacations or after studies.

(If you prefer cash back, CIBC also offers the CIBC Dividend® Visa* Card for Students).

Bottom Line

Studying is a stressful time, especially as mid-term or final exams approach. Controlling your personal finances is something you shouldn’t take lightly for later!

And remember that there are things to do to chill out, take it easy and relax. Have a great school year!

Read on with more content for students: