A friend of mine told me that she didn’t think it was possible to travel as much as I do, because she doesn’t make a lot of money. Yet she makes a better income than I do! What I found funny was that we were having this conversation while she was sipping her Starbucks coffee and eating her pain au chocolat.

So I made some calculations. This little daily treat “only” costs her about $8. She was very surprised when I told her that she spends $2,920 ($8 x 365 days) on grab-and-go breakfast, because she even went on her days off! At an average tax rate of 25% (marginal 37.12%), it takes about $3,900 in gross salary to afford this expense, equivalent to one month’s salary.

Is it worth working a month to have the luxury of breakfast on the go every morning? The answer is personal to her and I’ll never judge her; to each his own.

All of which is to say that it’s essential to make and keep a budget, so that you can be aware of what’s coming in and what’s going out!

Steps to manage your budget

Here are my tips and tricks for taking control of your finances and learning how to manage your budget.

1. Make a budget

Of course, the first thing to do is to write down everything you spend. It doesn’t have to be by the cent, but you do need to know how much you’re spending in each category. It’s the only way to analyze your habits and optimize all those hours spent at work!

It’s often the “phantom expenses” such as morning coffee that can surprise us, as they are very small amounts. These are piling up, and the financial hemorrhage goes unnoticed. Once they’ve been identified, you can decide whether or not to keep them, but it will be a well-informed decision!

The large annual expenditures should not surprise us. After all, it’s the same thing every year: Christmas presents, license plates, dentist appointments, etc.

2. A dynamic budget

Do you know approximately how much money will be in your account four months from now? In seven months?

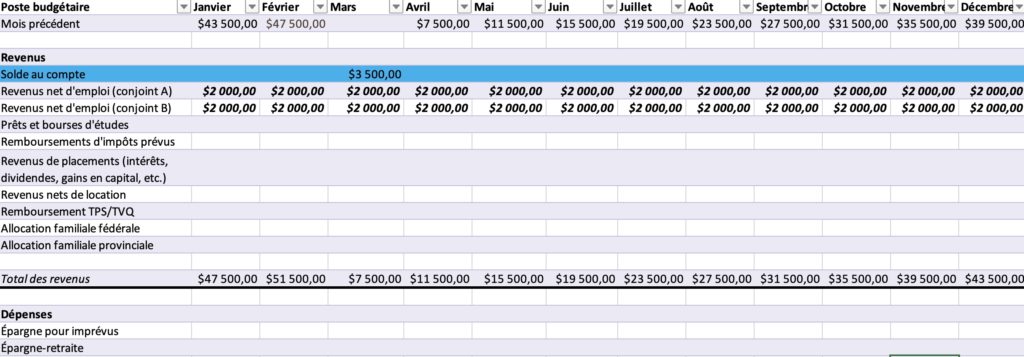

Maybe it’s a personality thing, but I like to know what’s coming so I can readjust. I’m sharing the Excel spreadsheet we use in our family.

Check out the Milesopedia toolbox to download it!

This tool calculates all our cash inflows and outflows over the course of a year.

To use it, simply fill it in with your figures. You can use it as is, or as the basis for your own document.

Maybe there’s an Excel expert in the room who could help us fine-tune our spreadsheet without us having to do this manually, but every month, we have to :

- Update your account balance ;

- Set previous month’s balance to zero on the first line.

Knowing if I will be in a deficit in my account makes me want to decrease my expenses and/or increase my income.

3. Determine the amount to save

This step is very important in my opinion. In addition to points and travel, it’s important to plan for contingencies and retirement. I advocate a balance between carpe diem and retirement; retirement is also my carpe diem…. just later!

In my situation, I have several types of savings:

- Short-term savings for travel

- Short-term savings for contingencies (emergency fund)

- Medium- to long-term savings for my children’s education (RESP)

- Long-term retirement savings (investments, real estate, etc.)

I consider my savings to be an “expense”; in other words, I force myself to put money aside as if I had no choice, just as I have to pay for my groceries because I have no choice. This behavior is called “paying yourself first”. Whether it’s $50 or $500 a paycheck, you need to build up your savings and not underestimate the power of compound interest on investments.

In fact, all savings should be invested in a way that allows the money to grow according to one’s risk tolerance and the purpose of the savings account.

For our family, our short-term savings for travel are in a simple high-interest bank account earning 5%, while our retirement savings consist of investments in a brokerage account and real estate holdings.

Consulting with an advisor is a good place to start.

Just like rewards points and credit cards, mastering investments is the key to getting the most value out of them.

4. Setting our priorities

I’m not judging anyone who decides to spend 3 900 $ of their gross salary on coffee/lunch if that’s what makes them happy, but you have to be able to target expenses that you can reduce or cut if you can’t afford to do something else that’s also important to you.

The main excuse I hear is that people can’t afford _______. Eliminating phantom expenses and setting priorities are the first steps to doing this.

Good for you if you make enough income to pay for each budget item! For the others, we have to make choices and focus on our priorities.

With a clear, concise budget, it’s easier to target where you could cut.

5. Grocery strategies

The grocery budget is often the one we let go, but it’s often the one where we lose the most money in my opinion. I’m not talking about depriving yourself of food – on the contrary, I’m a foodie and I love to eat! In fact, it’s my second passion after travelling!

My main focus is on food waste. I find it absurd to throw food, and therefore money, in the garbage.

For optimal grocery shopping, you need to :

- Take inventory before leaving for the grocery store (fridge, freezer and pantry);

- Consult flyers ;

- Think of recipes according to specials;

- Make a grocery list;

- Before checking out, check the basket in case you’ve consciously or unconsciously added items you don’t really need (don’t go grocery shopping with the kids);

- and, of course, use the best credit card for groceries.

Planning, execution, cross-check.

Think about it, do you know everything that’s in your freezer, or is there a frozen lasagne you’ve forgotten about for 6 months? Did those bananas you bought 2 weeks ago end up in your tummy or in the garbage can?

6. Integrate credit card reward points

These two statements are the real game-changers in my case:

- Credit cards allow me to accumulate travel points or reward points for travel.

- Credit cards allow me to accumulate cash back on my everyday expenses, lowering my cost of living and increasing the funds available for travel.

This has enabled me to travel five to seven times a year over the past decade. In my previous article on credit card management, I said that it’s best to concentrate on one or two programs when you’re a beginner, so that you can master them.

Over time, and depending on the number of programs you master, you’ll build points and rewards into your budget!

Thanks to AIR MILES, many everyday items as well as Christmas gifts for the kids end up being almost free every year.

The same applies to the travel budget. I’ve been collecting Aeroplan points for over 10 years, so I know my average annual accumulation rate.

Since I know how many plane tickets I can afford with my points, I can adjust my travel budget accordingly.

7. With friends, as a couple or with family

United we stand! I’m not telling you anything new when I say that many expenses are reduced when you’re a couple (or sharing with roommates). As far as points are concerned, accumulation and the use of two or more players are the most lucrative.

My parents and I often share expenses, like buying 5 L of ketchup at Costco or buying three packs of paper towels to get a better price (and bonus miles)!

These are savings that can go a long way as they accumulate and everyone’s budget shrinks.

So think of your friends, your parents, your spouse, to help each other save and collect points!

Bottom Line

One thing I’ve often noticed is that people tend to make excuses to justify their problems.

My philosophy is to find solutions and bring them to the forefront. It’s also this kind of effort and mentality that will make life easier. If you’re convinced you’re going to run out of money, this will become your reality.

How to create an Excel spreadsheet to manage your budget?

Create a sectioned spreadsheet for your finances (income, fixed expenses, variable expenses, savings, final balance). Then use the Excel formulas to automatically calculate the totals for each section and the final balance. Finally, adjust the table according to your needs: add or remove categories.

Visit the Milesopedia toolbox to download a dynamic budget template in Excel!

What's the best free budget management app?

Free budget management applications are becoming increasingly rare. These tools generally require a paid subscription. However, some applications are still free, such as EducFinance, Wally and Clarity Money.

How do you manage a 50/30/20 budget?

The 50/30/20 method involves dividing your income into three categories: 50% for essential expenses, 30% for personal desires, and 20% for savings. To succeed, determine your net income, divide it into these percentages and get a clear picture of your expenses by consulting your bank statements.