Chalet rental is useful for a group celebrating together or simply for a remote worker looking for inspiration. When the location is found, and the reservation is made, Reward Points come to the rescue to save money.

Using points to reduce the cost of a cottage rental

Before booking in any region of Quebec or abroad, it’s important to know whether Visa, Mastercard and American Express credit cards are accepted as payment. Next, you need to know whether the business you’re dealing with is properly classified as “Travel” or “Tourist accommodation”.

Membership Rewards American Express

American Express Membership Rewards points are flexible. Each 1,000 Membership Rewards points deducts $10 from the credit card balance.

All expenses are accepted. This is convenient if you don’t know if the owner and the cottage rental platform are considered a travel expense.

This is excellent for expenses with :

- Airbnb, VRBO and others;

- WeChalet, ChaletsauQuebec.com, MonsieurChalets.com, etc. ;

Are you dreaming of a stay in the Eastern Townships? The procedure is simple:

- Book your chalet rental on the platform of your choice;

- The expense appears on the credit card;

- You use your credit card points to reduce your expenses.

For example, a cottage rental costs $700.

You have 50,000 Membership Rewards points on the American Express Cobalt Card, which equals $500.

If you take these points to deduct the balance, you will have a net expense of $200.

However, make sure in advance if the platform or the owner accepts American Express cards.

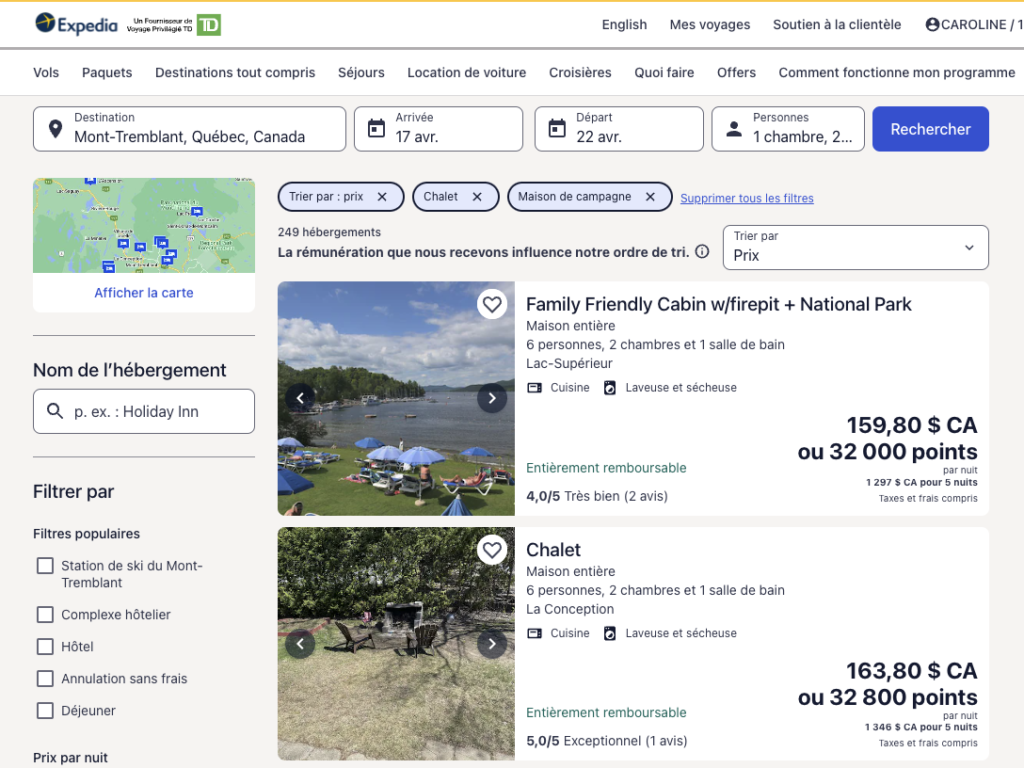

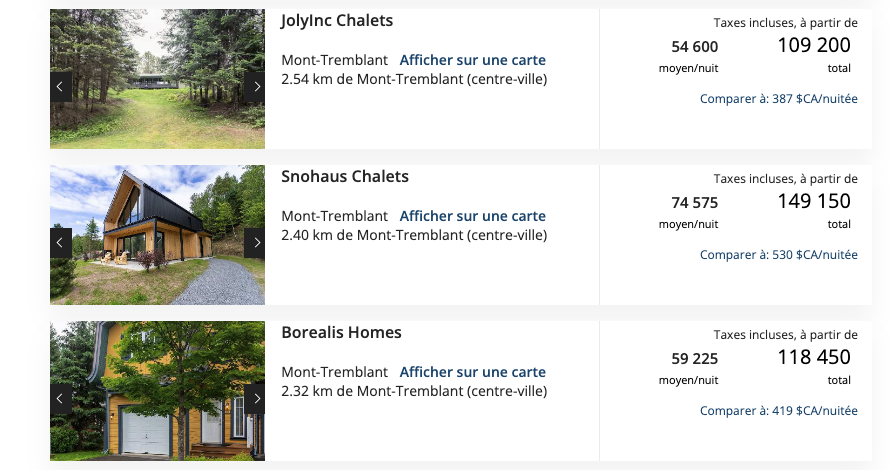

Expedia for TD for a cottage rental

With the TD First Class Travel Visa Infinite Card, TD Rewards points can be used to rent cottages through Expedia for TD.

So 200 TD points are used to deduct the $1 of the statement.

In addition, you can also make a reservation at the website of your choice and then deduct 250 TD Rewards points for $1.

Another way to save is to use the annual $100 TD Travel Credit when you book a cottage costing $500 or more throughExpedia for TD.

HSBC Rewards for a cottage by the lake

As of September 29, 2023, HSBC credit cards are no longer available in Canada, following the acquisition of HSBC Canada by RBC. This information is intended for existing cardholders. Hurry up and redeem your points before the end of March, when the transition from HSBC to RBC takes place.

With HSBC Rewards points, you pay :

- A cottage rented from SEPAQ;

- Via Airbnb, VRBO, Expedia;

- On other recognized travel or accommodation platforms.

The use will be done by different levels of points. Then, the deadline for deducting points is within 60 days after the reservation:

- 25,000 points = $125 ;

- 35,000 points = $175 ;

- 45,000 points = $225 and so on.

If you don’t use HSBC Points, the $100 annual HSBC Travel Credit can be used on this cottage rental cost.

NBC awards for your dream waterfront home or cottage

NBC Rewards points are great for a discounted pet carrier!

Among others, eligible purchases are:

- Via Hotels.com, Airbnb, Expedia and similar websites;

- Via Zumper, Belvilla;

- On the reservation of a condominium or cottage for tourism purposes.

Aventura Points for an inexpensive cottage rental

Also, Aventura points have the same principle as the others for a cheap cottage rental.

Normally, 16,000 points are required for a $100 travel expense deduction. But thanks to a promotion, CIBC is allowing you to use 50% fewer Aventura Points, for even more savings!

Scene+ points to rent a cottage like you want

Scotiabank’s Scene+ program has become increasingly popular since its arrival in IGA grocery stores. With the ” Redeem points for a trip ” option, 10,000 points deduct $100 from a cottage rental, which you can easily apply as a statement credit once the transaction is complete.

You can also book your cottage via Scene+ Travel developed by Expedia, for greater flexibility in accumulating and redeeming points on your booking. Renting a chalet in another country? Use the Scotiabank Passport™ Visa Infinite* Card to avoid the 2.5% foreign currency conversion fee.

BONUSDOLLARS Program to reduce the cost of renting a cottage

The BONUSDOLLARS program has the merit of being very simple, but not very rewarding. 1 BONUSDOLLARS is exchanged for a $1 deduction for a cottage rental charged to the account.

Unfortunately, the credit cards in this program do not offer a welcome bonus, unlike most credit cards in Canada.

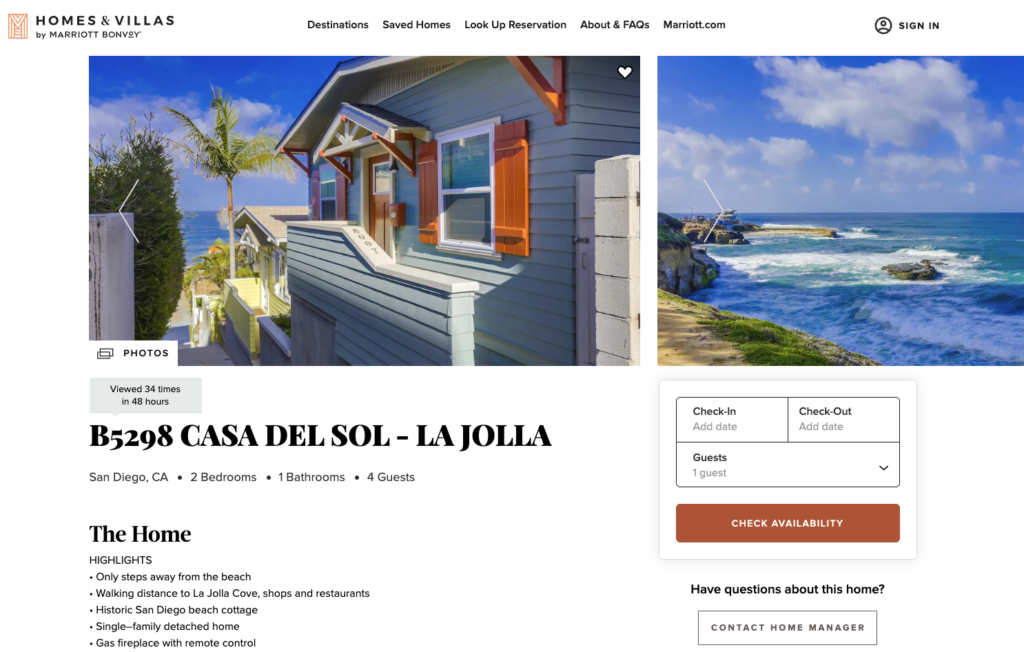

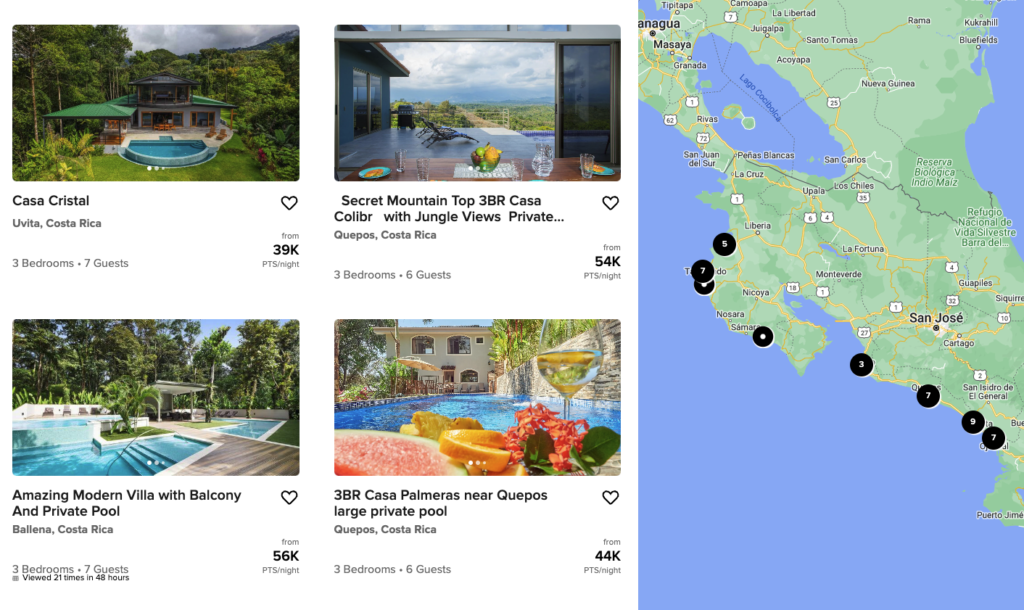

Marriott Bonvoy : Homes & Villas by Marriott Bonvoy

Marriott Bonvoy is not just for hotels. A little-known option is its private home rental platform Homes & Villas by Marriott Bonvoy.

You can pay in dollars as usual, or with Marriott Bonvoy points!Depending on the date of your stay, you could also benefit from bonus points on a stay paid for in cash with this promotionin addition to the 5 points per dollar earned by paying with one of the Marriott Bonvoy co-branded credit cards If you have any questions about the benefits of this program, simply contact their customer service team.

Aeroplan Points

The Aeroplan program allows you to use Aeroplan points to rent cottages. It may or may not be worth it.

We don’t really recommend it. But the option of paying for a cottage with Aeroplan points does exist and can be convenient for some.

Cash Back

Based on the same principle as points redemption, cash-back cards also help you save money.

Among the best is the CIBC Dividend® Visa Infinite* Card.

Its welcome offer gives 10% cash back on all purchases made on the account, during the first four statements. The maximum discount for this promotion is $200.

Then, for the rest of the year, it offers one of the best cash discounts, with 4% back on groceries and gas.

Which websites should I consult to book my vacation cottage?

Whether in the Eastern Townships, other regions of Quebec or abroad, there’s no shortage of cottages to choose from. You may wish to consult the following sites in particular: Hotels.com, Airbnb, VRBO, Expedia, Homes & Villas by Marriott Bonvoy, WeChalet and ChaletsauQuebec.com.

Where to rent a cottage with spa or private pool in Quebec?

There are many cottages with such facilities across the province. To find cottages that match your requirements, most of the time all you have to do is select the “filter” or “category” option on booking sites such as Chaletsalouer.com.

Where to find a mini-cottage with dog in Quebec?

MonsieurChalets.com offers a wide choice of dog-friendly mini-cottages across the province. Several conditions must be met, depending on the location, including the animal’s weight and proof of vaccination.

Is it better to rent a house or a cottage?

The cottage can be more rustic, smaller or by a lake.

Whereas a house is bigger, but further away from a body of water.