Travel insurance: the components included in the coverage

Travel insurance generally provides coverage for the following:

- Trip Cancellation or Trip Interruption

- Emergency medical care outside the province of residence

- Delayed flights

- Loss, damage, theft or delay of luggage

Hospitalization and medical expenses

These travel insurances cover everything related to emergency medical care, i.e:

- medical expenses

- professional fees

- hospitalization costs

- surgical fees

- expenses related to convalescence

- ambulance fees

- repatriation costs

In Canada, you don’t see the medical bills roll in because the health care system is public. However, a single broken arm could cost you tens of thousands of dollars in savings. A premature delivery? We can get close to a 7-digit addition if the incident occurs in the United States.

Emergency dental care is generally covered up to $500 depending on your policy; when we talk about emergency dental care, we are referring to an emergency exam, x-rays, drainage of an abscess, temporary dressing, prescription of medication, etc. These procedures are intended to relieve pain while awaiting dental treatment that will permanently fix the problem.

Travel insurance does not cover these; however, dental treatments can be performed if they were caused by a shock or trauma to the mouth.

Cancellation insurance

In the event that you have to cancel your trip for reasons beyond your control,travel insurance will cover the costs up to the limit you set when you purchased your policy. So, if your trip totals $10,000 in non-refundable costs, you should insure accordingly.

Cancellation insurance comes second; that is, you must first recover any amounts that can be reimbursed to you, and thentravel insurance will pay you the difference.

Basically, the reason for cancellation must be beyond your control and most insurers follow this list:

- an illness that prevents you from travelling

- an illness affecting a loved one

- a summons to serve as a juror

- a disaster at the residence

- involuntary loss of employment

- the Government of Canada’s recommendation not to travel (if it occurs after the time of booking)

- the premature birth of his child

- etc.

This travel insurance clause could help you if you suffer a broken arm a few days before your vacation, for example.

Trip Interruption insurance

Unlike travel cancellation insurance, which protects against situations that prevent us from leaving, interruption insurance comes into play after departure.

If your trip doesn’t go as planned, interruption insurance provides protection for incurred and lost expenses. For example, if you suddenly need to return home due to the death of a family member, subsequent non-refundable reservations will be covered. Or, to put you back on another flight so that you can join your cruise.

Luggage insurance

This clause protects you if your luggage is not received on time, is damaged or lost in transit. In the event of a problem, you can purchase new items, up to a maximum amount, and be reimbursed by thetravel insurance.

How do I shop for travel insurance?

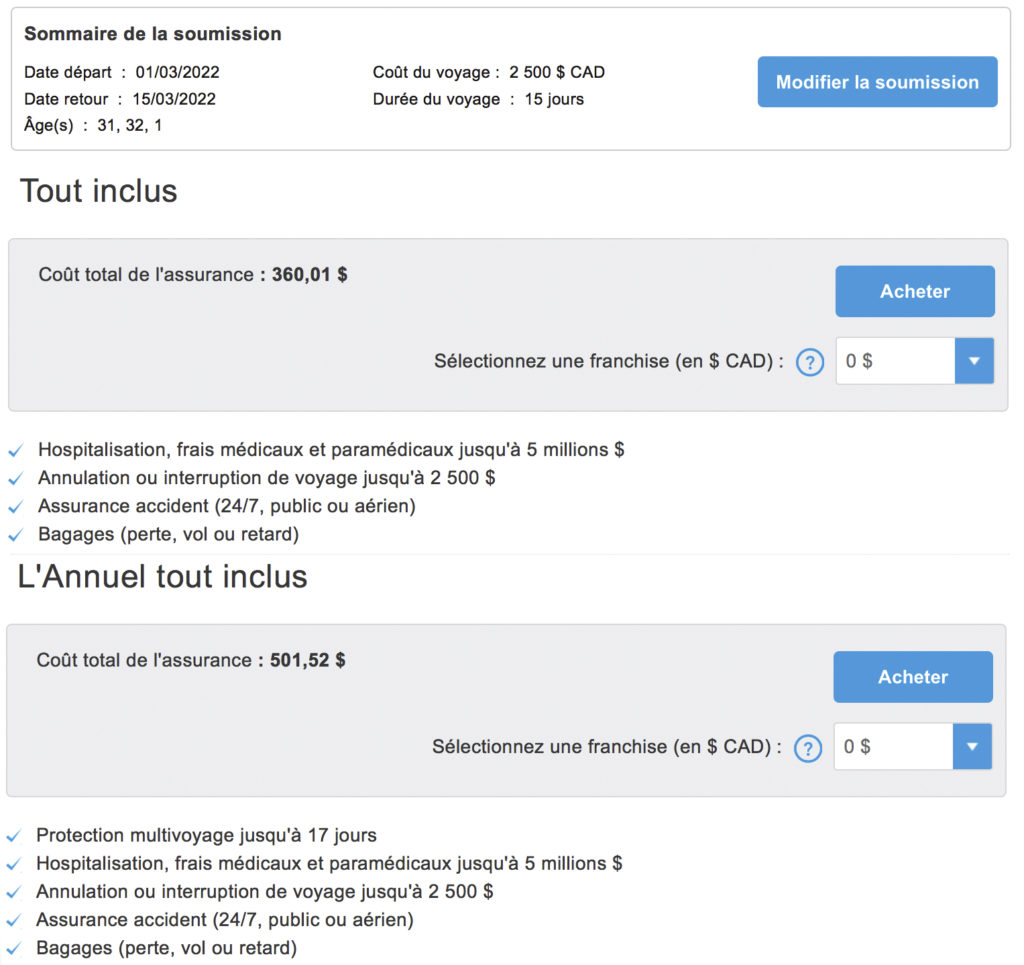

To compare, I did a travel insurance quote with Blue Cross for a trip to Southeast Asia for our family.

The details given on the application were:

| Insurance | Coverage |

| Number of people to be insured | 2 adults and 1 child |

| Flight Cancellation | $2,500 (per person) |

| Trip Interruption Insurance | unlimited |

| Emergency medical care | $5,000,000 (per person) |

| Luggage (theft, loss, damage) | $1,500 (per person) |

| Duration of the trip | 15 days |

The cost of insurance for this 15-day vacation in Asia is $360.01.

For our family (3 people) who go on adventures several times a year, travel insurance costs can go up to $501.52 to have good coverage on multiple trips of 17 days or less.

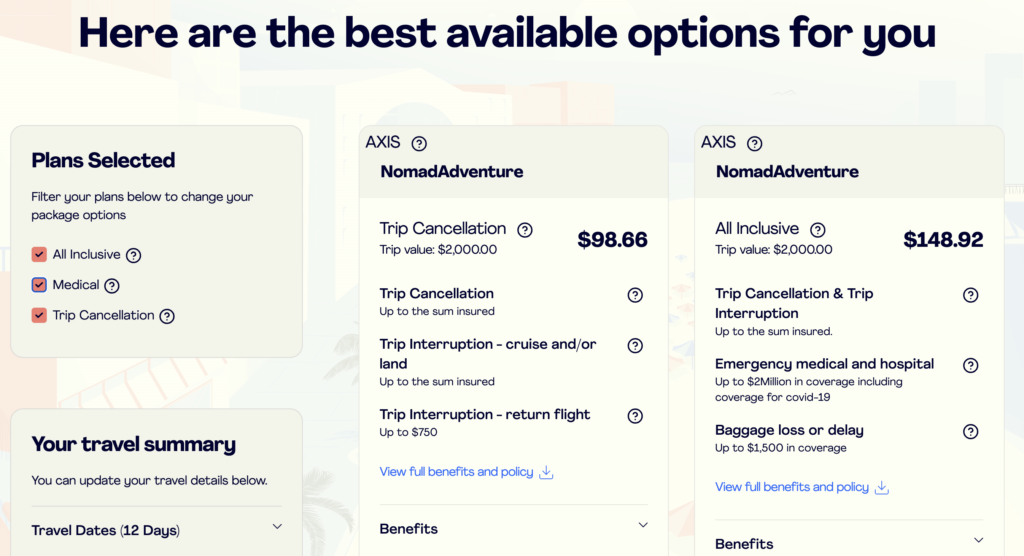

soNomad

An alternative is to take out travel insurance, which costs less than traditional insurance, without going through a broker. This can be useful for people who :

- Don’t have travel insurance with their work benefits

- Spend most of the winter as Snowbirds

- And those with pre-existing medical conditions.

For example, soNomad offers a range of options to ensure that you are well insured and can travel in peace.

- Medical insurance for situations such as these:

- Loss of prescription medication during the trip

- Emergency dental care

- Need for an air ambulance

- Emergency paramedical treatment (chiropractor, podiatrist, physiotherapist, etc.) at destination

- Plane ticket for a relative or friend to come to our hospital bedside

- Bringing children home if a parent is hospitalized

- Glasses replacement

- COVID-19 or other infectious disease coverage

- Pet boarding if the owner is hospitalized while traveling

- Cancellation insurance covering several scenarios that may occur before or during the trip:

- Death of a relative or pet

- Airline bankruptcy

- Fire, vandalism, disaster or burglary at the primary residence

- Uninhabitable destination hotel

- Non-issuance, loss or theft of a passport

- Weather delay

- Loss of job or school exam

- Quarantine coverage if tested positive for COVID-19

- All-inclusive: Medical AND cancellation insurance

- Also includes lost, stolen or delayed baggage

A quick quote can be made directly on the soNomad website. Then you can buy it, and the insurance is valid immediately, if required.

Save on travel insurance costs

However, there is a way to get the same protection for free with credit card travel insurance!

Indeed, travel – whether it’s a plane ticket, a hotel reservation, an all-inclusive package or a car rental – is usually paid for with a credit card.

Many credit cards offer a comprehensive travel insurance that applies as soon as a trip has been charged to the card, in part or in full. In the event of a problem that prevents you from starting or continuing your trip, the travel insurance you have will be able to cover the costs incurred.

For example, the National Bank World Elite Mastercard® allows our family to be insured free of charge, under certain conditions, for several trips of up to 60 days!

The people who can be covered by the travel insurance of this card are:

- the primary cardholder

- spouse and dependent children travelling with the primary cardholder

Our trip to Asia would be completely covered under the same Blue Cross conditions, except for a few details.

National Bank World Elite Mastercard

The National Bank World Elite Mastercard® stands out from the crowd when it comes to protection. When you look at the travel insurance certificates, you will notice disparities, and not all contracts are equivalent.

In addition to the excellent insurance, this card currently has a great welcome bonus on top of these usual benefits.

- $150 annual fee refund for the first year

- $ 150 in travel credits (to offset annual fees in subsequent years)

- unlimited access to the NBC World Mastercard Lounge

- access to DragonPass lounges

- free wifi via Boingo

How can I be covered by credit card travel insurance?

Some cards require us to charge the entire expense to the card, while for others, we are covered by travel insurance when you pay part of the trip with the credit card.

For most of the insurances included, the National Bank World Elite Mastercard® is one of the only credit cards in Canada to cover you even if you only carry part of the cost of the trip.

The following expenses will be reimbursed (…) provided that a portion or the entire cost of the trip was charged to the account

National Bank of Canada

In terms of travel, only luggage delay and car rental insurance will require the full cost to be charged to the card.

Then, for emergency medical insurance, simply being a National Bank World Elite Mastercard® cardholder makes you eligible for coverage. This is especially useful during our road trips in the United States, where we stay with friends. Therefore, no travel-related expenses are charged to the credit card!

Finally, it is imperative to have a valid and active account for all the various types of insurance included with credit cards.

Bottom Line

The question is often asked whether it’s worth keeping a credit card with an annual fee after you’ve earned the welcome bonus.

When you put numbers to the benefits offered, you quickly realize that paying the annual fee for a card can be considered a bargain!

Join us in the Milesopedia Facebook community for more money-saving tips and tricks.

Questions

Do I need travel insurance?

Various reasons, sometimes beyond our control, may force us to cancel our trip. A vacation that falls through often represents thousands of dollars that cannot be recovered.

Travel insurance allows you to recover expenses related to the trip that did not take place.

How easy is it to make a travel insurance claim?

Yes, it’s easy to start a claim. The agents will ask you for a series of supporting documents. Therefore, keep all invoices and evidence related to your request.

Do I need travel cancellation insurance?

Travel cancellation insurance protects the financial investment you have made in your trip. In the event of a force majeure that forces you to cancel your vacation, you need travel cancellation insurance if you want your money back.

Without travel cancellation insurance, you run the risk of not seeing that money again if your trip is cancelled.

Can we cancel a trip if we change our mind?

No, the cancellation insurance component oftravel insurance only protects you against events that are beyond your control.

Does travel insurance provide coverage in connection with COVID-19?

The coverage depends on each insurer, but yes, some travel insurances do protect you against COVID-19 related glitches.

How much does travel insurance cost?

The rate will mainly depend on the amount of indemnity as well as the coverages chosen (cancellation, interruption, luggage, emergency medical care, etc.).

On the other hand, many credit cards offer travel insurance (which will suit the vast majority of travelers). The cost of this protection is built into the annual fee of the credit card in question. Those who travel frequently will benefit from these credit cards.

Is the credit card travel insurance sufficient?

Travel insurance agreements vary from card to card. It is necessary to verify if the coverages are appropriate for your case. You can find these details in your card’s certificate of insurance on the bank’s website in PDF format if you have ever misplaced it.

How to choose your travel insurance?

The first step is to determine the total cost of your trip and the coverage you want, i.e. what you will claim in case of a problem.

Then, look first at your credit card and work to determine what you already have as coverage. Travel insurance quotes and purchases can easily be made online.

When to take out travel insurance?

It is preferable to take out travel insurance at the time of purchase, especially if it is the cancellation component that is important. So, if you will be protected from the moment you purchase your trip.

What is the best travel insurance?

Credit card insurance is usually adequate for most people. Plus, you don’t have to pay extra to cover your trip.

For example, National Bank World Elite Mastercard® travel insurance covers all your trips up to $2,500 each. This way, you don’t have to break your head every time you want to fly to the South!

For more expensive trips, you can sometimes supplement your credit card coverage with private insurance. Blue Cross offers preferential rates if you already have travel insurance with the National Bank World Elite Mastercard®.

Can I cancel my travel insurance?

It is necessary to read the respective clauses of your insurance to know if the one you have can be reimbursed or not.