First of all, there is no such thing as the best default-free credit card. You need one or two extra in your wallet to optimize your spending and points earning.

So? Which credit card(s) should I choose from the 200 credit cards available in Canada?

Based on our analysis and personal experiences, Milesopedia readers and our community, the best credit cards for beginners have been chosen based on:

- their ability to get the points quickly

- their ease of use for beginners

- to learn how to manage your monthly expenses

- and to slowly learn how to manage a few credit card accounts

In summary, here are our picks for the best credit cards to start with:

| Card | Why |

| American Express Cobalt® Card | For its very fast earning of points and its great flexibility of redemption |

| National Bank World Elite Mastercard | For its travel insurance, guarantees and benefits |

| TD First Class Travel® Visa Infinite* Card | For its easily redeemable points |

And if you have some experience with points, check out our article dedicated to the intermediate level!

Get started with this American Express credit card

It’s the perfect credit card for those who hesitate between travel points and cash back.

Here are 8 reasons why you should have the American Express CobaltMD Card in your wallet:

- Earn 5X the points at grocery stores, restaurants and Couche-Tard/Circle K

- Flexibility to use points as you wish: cash back for all your expenses (including travel), transfer to other rewards programs such as Marriott Bonvoy or Aeroplan, use American Express fixed chart for flights

- Perfect for learning how reward points work

- Welcome bonus of 1,250 additional points per month

- Regular online promotional offers to recoup a large part of the monthly card fee

- Excellent customer service from American Express

- No minimum income required

- Monthly fee: you can better spread your card fees over your annual budget or cancel your card if it doesn’t suit you without being charged a full annual fee

A few months ago, we surveyed to find out the community’s favourite fast-earning credit card (5X).

Out of 247 votes, 236 chose the American Express CobaltMD Card!

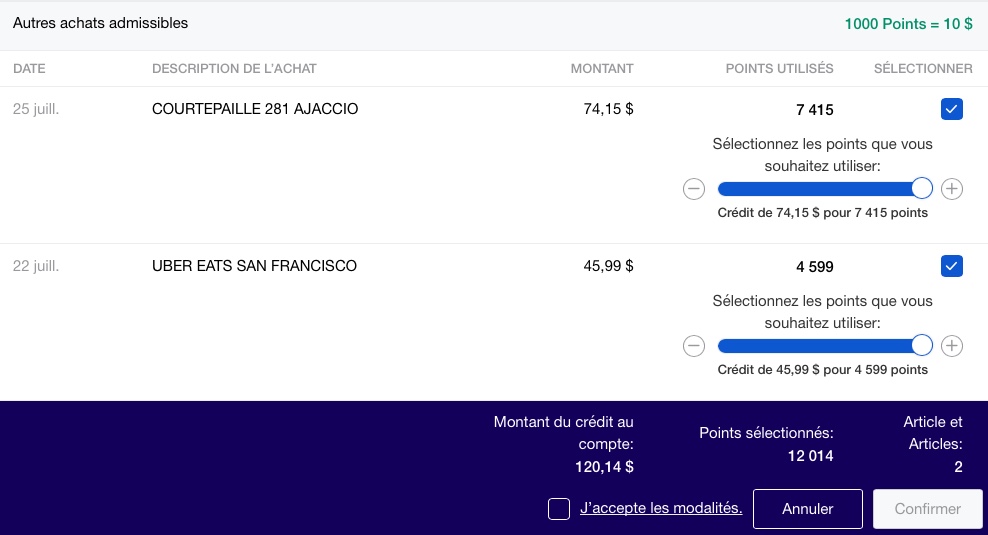

Here is an example of using points to pay off your credit card. Every purchase counts!

- Groceries

- Public transportation ticket

- All travel expenses

- Drugstore, etc.

The myth that American Express credit cards are not accepted in stores is persistent. However, this is not true, and you can check on this site where these cards are accepted. Don’t miss out on significant savings because of an urban legend!

Get started with this National Bank credit card

As a complementary credit card, there is this great Mastercard credit card.

Here are 6 reasons why you should sign up for the National Bank World Elite Mastercard®:

- 5 X the points for groceries and restaurants ;

- Great simplicity in the process of obtaining the refund of $150 of travel credit each year;

- Among the best travel insurances in the industry, offering you peace of mind;

- Extended warranty on items purchased with the card for up to 2 additional years;

- Unlimited access to the National Bank VIP Lounge at Montreal-Trudeau International Airport;

- A Mastercard: perfect for use at Costco ;

- The chance to win 1 of 5 $2,000 Transat travel credits if you sign up through this exclusive link.

Here’s how I used my NBC points so that my hotel room at the Château Frontenac didn’t cost me much.

This card requires a minimum individual income of $80,000 or a $150,000 household income.

If you don’t meet this criterion, here’s another great option: the National Bank Platinum Mastercard®.

Get started with this TD credit card

Here are 8 reasons why you should apply for the TD First Class Travel® Visa Infinite* Card:

- High welcome bonus ;

- Refund of the annual fee for the first year via this welcome offer ;

- Good travel insurance ;

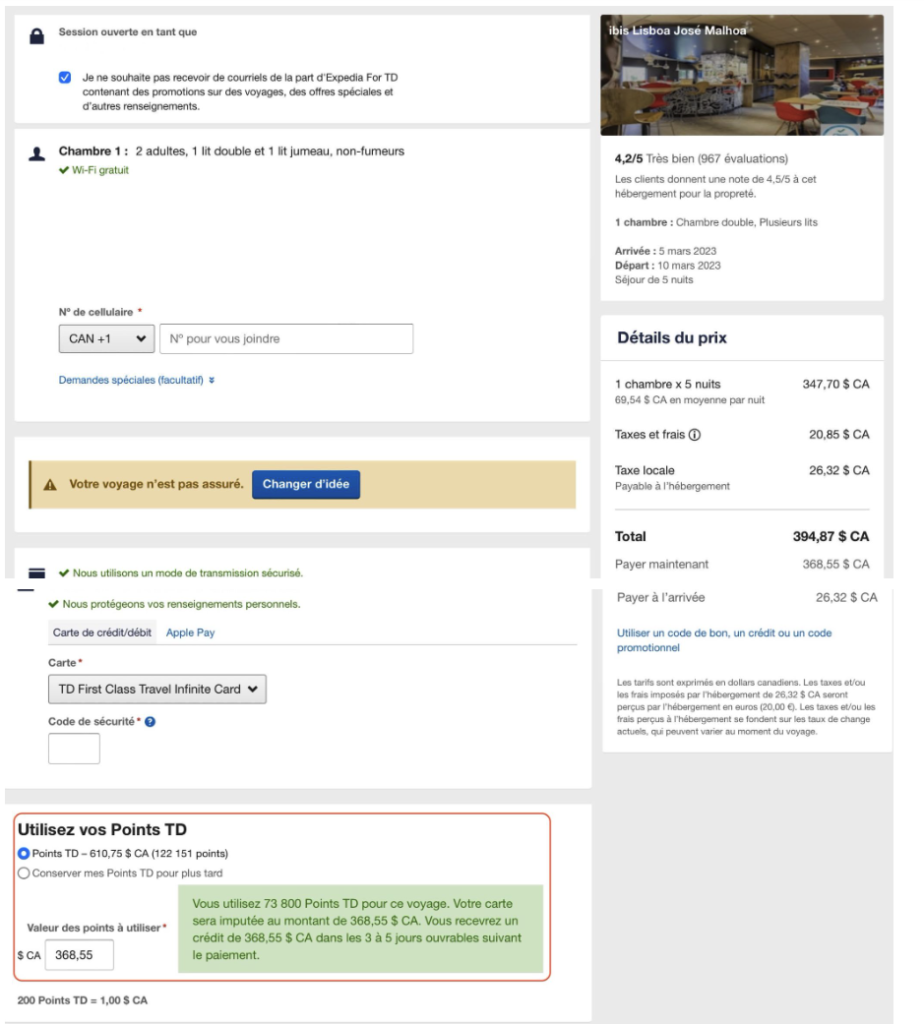

- Points can simply be redeemed for travel credit via ExpediapourTD.com (the best way to purchase hotels, Disney theme park tickets, car rentals, etc.), Amazon purchases, gift cards or cash back;

- 8X points for travel booked via Expedia for TD ;

- 6X points at grocery stores and restaurants ;

- Annual travel credit of $100 for reservations of $500 or more on the Expedia site for TD ;

- Anniversary bonus of up to 10,000 TD Rewards points.

For example, with 100,000 TD points (a $500 value), you could book five free nights in Lisbon. This was during Spring Break 2023 and in an Accor hotel.

This card requires a minimum income of $60,000.

If you don’t meet this criterion, here’s another option available to everyone: the TD Platinum Travel Visa* Card.

Bottom Line

At first, choosing the best credit cards for your needs can be confusing and disorienting. First of all, it is a good idea to read the Beginner’s Guide.

But most importantly, whatever you choose, it is crucial to pay your credit card balances in full every month! Otherwise, all your profits will be wiped out by interest charges.

Also, take screenshots of your application, so you can note the terms of the card offer.

Happy hunting for points!